Global Carbon Steel Market - Key Trends & Drivers Summarized

What Is Carbon Steel, and Why Is It Vital Across Industries?

Carbon steel, a widely used metal alloy composed primarily of iron and carbon, is one of the most versatile and essential materials across various industries. Known for its strength, durability, and affordability, carbon steel is categorized into low, medium, and high-carbon types, each with different properties suited to specific applications. Low-carbon steel, with a lower percentage of carbon, is malleable and used in structural applications like buildings, pipelines, and car bodies. Medium-carbon steel balances ductility and strength, making it ideal for manufacturing automotive parts, machinery, and railways, while high-carbon steel is hard and resistant to wear, commonly used in cutting tools, springs, and high-strength wires.The widespread use of carbon steel is due to its cost-effectiveness compared to alternatives like stainless steel or aluminum, and its ability to withstand heavy loads and harsh environments. This makes it indispensable in industries such as construction, automotive, manufacturing, and energy. Additionally, carbon steel's adaptability to different forms and heat treatments allows for customization based on specific needs, contributing to its popularity in industrial machinery, bridges, and transportation infrastructure. As infrastructure development and industrial growth continue globally, carbon steel remains a cornerstone material for a variety of sectors.

How Are Technological Advancements Influencing the Carbon Steel Market?

Technological advancements are significantly impacting the carbon steel market, enhancing the material's quality, efficiency of production, and application range. Continuous casting technologies, for instance, have revolutionized the production process, allowing steel manufacturers to produce large volumes of high-quality carbon steel more efficiently and with less waste. Innovations in rolling processes, such as hot and cold rolling techniques, have improved the strength and surface finish of carbon steel products, making them more suitable for precise applications in automotive, construction, and energy sectors.In addition to production techniques, advancements in heat treatment and alloying methods are improving the properties of carbon steel. Modern heat treatment technologies allow for better control of the steel's hardness, flexibility, and tensile strength, making it possible to produce high-performance carbon steel for specialized applications. Furthermore, the integration of automation and artificial intelligence (AI) in steel manufacturing is optimizing production lines, reducing human error, and lowering operational costs, making carbon steel more competitive in the global market. These technological developments are enhancing the material's usability, cost-efficiency, and quality, driving its adoption in industries that require both strength and precision.

What Market and Consumer Trends Are Shaping the Demand for Carbon Steel?

Several trends are shaping the demand for carbon steel, including the rising focus on infrastructure development, the automotive industry's shift toward lighter and more durable materials, and the increasing investments in renewable energy. As governments across the globe commit to large-scale infrastructure projects - such as roads, bridges, and railways - the demand for carbon steel in construction is expected to surge. Its ability to provide structural strength while remaining affordable makes carbon steel the material of choice for these projects. Moreover, the growing urbanization in emerging economies is driving investments in real estate and public infrastructure, further increasing the need for carbon steel in building materials and frameworks.In the automotive industry, the push for fuel efficiency and reduced emissions is leading to a higher demand for lightweight yet strong materials. While aluminum and advanced high-strength steel are gaining ground, carbon steel remains critical for manufacturing components like chassis, body frames, and engine parts. Carbon steel's adaptability to lightweight designs makes it an ideal solution for producing cost-effective yet durable automotive components. Additionally, the expanding renewable energy sector, particularly wind and solar energy, is fueling demand for carbon steel in energy infrastructure, such as wind turbines, transmission towers, and pipelines for natural gas and hydrogen, driving further growth in the market.

Growth in the Carbon Steel Market Is Driven by Several Factors

Growth in the carbon steel market is driven by several factors, including infrastructure expansion, technological advancements in steel production, and the growing need for sustainable materials in key industries like automotive and energy. One of the primary growth drivers is the global focus on infrastructure development. Governments are investing heavily in large-scale construction projects to meet the demands of expanding urban populations and to upgrade aging infrastructure. Carbon steel, being cost-effective and structurally strong, is essential for constructing buildings, bridges, railways, and highways, making it a vital material in these projects.In addition to infrastructure growth, technological innovations in carbon steel production - such as improved casting, rolling, and heat treatment processes - are enhancing the material's performance, making it more attractive to industries that require high strength and durability. The automotive industry's shift toward lighter vehicles that meet fuel efficiency standards is also boosting demand for carbon steel, as it remains a key material in vehicle manufacturing. The rise in electric vehicle (EV) production, which relies on lightweight and durable components, is further driving the demand for carbon steel. Furthermore, the global push toward renewable energy sources is expanding the market for carbon steel in energy infrastructure. Wind turbines, pipelines for hydrogen storage, and solar panel frameworks all require durable and cost-efficient materials, positioning carbon steel as a key player in the energy transition. These factors, combined with rising industrialization and technological advancements, are expected to sustain the growth of the carbon steel market in the coming years.

Report Scope

The report analyzes the Carbon Steel market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Low Carbon Steel, Medium Carbon Steel, High Carbon Steel); Application (Construction, Automotive, Shipbuilding, Other Applications).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

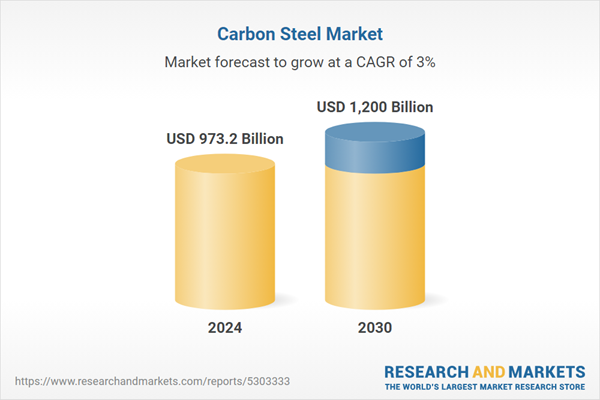

- Market Growth: Understand the significant growth trajectory of the Low Carbon Steel segment, which is expected to reach US$1.1 Trillion by 2030 with a CAGR of a 3.1%. The Medium Carbon Steel segment is also set to grow at 2.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $262.2 Billion in 2024, and China, forecasted to grow at an impressive 5.2% CAGR to reach $230.4 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Carbon Steel Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Carbon Steel Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Carbon Steel Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Afarak Group, AK Steel Corporation, ArcelorMittal SA, Baosteel Group, Bushwick Metals LLC and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Carbon Steel market report include:

- Afarak Group

- AK Steel Corporation

- ArcelorMittal SA

- Baosteel Group

- Bushwick Metals LLC

- Curtis Steel Co., Inc

- Evraz plc

- HBIS Group

- JFE Steel Corporation

- Nippon Steel Corporation

- NLMK

- Omega Steel Company

- POSCO

- United States Steel

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Afarak Group

- AK Steel Corporation

- ArcelorMittal SA

- Baosteel Group

- Bushwick Metals LLC

- Curtis Steel Co., Inc

- Evraz plc

- HBIS Group

- JFE Steel Corporation

- Nippon Steel Corporation

- NLMK

- Omega Steel Company

- POSCO

- United States Steel

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 282 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 973.2 Billion |

| Forecasted Market Value ( USD | $ 1200 Billion |

| Compound Annual Growth Rate | 3.0% |

| Regions Covered | Global |