Global Carbon Capture and Sequestration (CCS) Market - Key Trends & Drivers Summarized

Why Is Carbon Capture and Sequestration (CCS) Gaining Global Importance?

Carbon capture and sequestration (CCS) has become a critical strategy in the global effort to combat climate change, driven by the urgent need to reduce greenhouse gas emissions from industrial processes and energy production. CCS involves capturing carbon dioxide (CO2) emissions from sources such as power plants and industrial facilities, transporting the captured CO2, and storing it underground in geological formations or utilizing it in other industrial applications. As the world intensifies its focus on reducing carbon footprints and meeting climate targets, particularly those outlined in the Paris Agreement, CCS is emerging as a pivotal technology for mitigating emissions from sectors that are hard to decarbonize, such as heavy industries and fossil-fuel-based power generation.The increasing adoption of CCS is fueled by its potential to significantly reduce CO2 emissions while allowing industries to continue operations during the transition to cleaner energy. It is particularly relevant for energy-intensive sectors like cement, steel, and chemical production, where the carbon intensity is high, and alternative solutions like electrification or renewable energy integration may not be immediately viable. Governments and organizations around the world are realizing the importance of CCS in achieving net-zero emissions, with several countries committing to large-scale CCS projects to offset their industrial carbon emissions and transition toward greener economies.

How Are Technological Advancements Driving the Carbon Capture and Sequestration Market?

Technological advancements are playing a crucial role in accelerating the adoption and effectiveness of CCS. Over the past few years, significant progress has been made in improving the efficiency of CO2 capture technologies, reducing the cost of implementation, and scaling up projects for commercial use. One of the key advancements has been in post-combustion capture technologies, where CO2 is extracted from the exhaust gases of power plants and industrial facilities. New chemical solvents, membranes, and adsorbent materials have been developed to enhance the selectivity and capacity for CO2 capture, reducing energy consumption and making the process more cost-effective.In addition to capture improvements, innovations in carbon utilization are creating new opportunities for sequestered CO2. Researchers and industries are exploring ways to use captured carbon for the production of materials such as fuels, chemicals, and building materials, transforming CO2 from a waste product into a valuable resource. Enhanced oil recovery (EOR), where CO2 is injected into oil fields to improve oil extraction, is also a common use for captured carbon. Furthermore, advancements in geological storage techniques are ensuring that CO2 can be safely and permanently stored in depleted oil and gas reservoirs or deep saline formations, further increasing confidence in the long-term viability of CCS.

What Role Do Policy and Regulatory Support Play in the Growth of CCS?

Policy and regulatory support are key factors driving the growth of carbon capture and sequestration, as governments and international organizations seek to meet their climate commitments and reduce carbon emissions. Many countries have introduced incentives, carbon pricing mechanisms, and financial support for CCS projects to promote their deployment. For instance, the U.S. introduced the 45Q tax credit, which provides financial incentives for industries to capture and store CO2, making CCS projects more economically viable. Similarly, Europe's Green Deal and various national carbon trading systems are fostering investment in CCS by providing funding and creating a market for carbon credits.Additionally, governments are developing regulatory frameworks to ensure that CO2 storage sites are managed responsibly and safely, minimizing environmental risks. International cooperation is also facilitating CCS growth, with cross-border projects that allow captured CO2 to be transported and stored in countries with suitable geological formations. These regulatory efforts are being complemented by public-private partnerships, where governments collaborate with industry leaders to develop large-scale CCS infrastructure. The alignment of policy, regulatory support, and industry innovation is essential to overcoming the financial and technical challenges associated with scaling up CCS technology.

Growth in the Carbon Capture and Sequestration Market Is Driven by Several Factors

Growth in the carbon capture and sequestration (CCS) market is driven by several factors, including the increasing pressure to meet global emissions reduction targets, technological innovations, and supportive government policies. One of the key drivers is the growing recognition that CCS is necessary for achieving net-zero emissions, particularly in industries that are difficult to decarbonize, such as cement, steel, and fossil-fuel power generation. As countries commit to stringent emissions reduction goals, CCS is seen as a critical tool for reducing carbon output while maintaining industrial productivity.Technological advancements are also driving the market, making CCS more efficient and cost-effective. Innovations in CO2 capture processes, such as more efficient solvents and membranes, are reducing the energy and financial costs associated with capturing carbon. Furthermore, the development of new storage and utilization technologies, including carbon-to-products and enhanced oil recovery, is creating additional value streams for captured CO2, increasing the economic attractiveness of CCS projects. The integration of CCS with other low-carbon technologies, such as hydrogen production, is also expanding the market potential for CCS.

Lastly, the expansion of supportive policies and regulatory frameworks is a key growth driver. Governments are offering tax incentives, grants, and carbon pricing mechanisms to encourage the deployment of CCS, while also establishing regulations that ensure safe and effective CO2 storage. This combination of regulatory support and technological innovation is helping to overcome the challenges of scaling up CCS projects, paving the way for the market's continued growth and its role in the global transition to a low-carbon future.

Report Scope

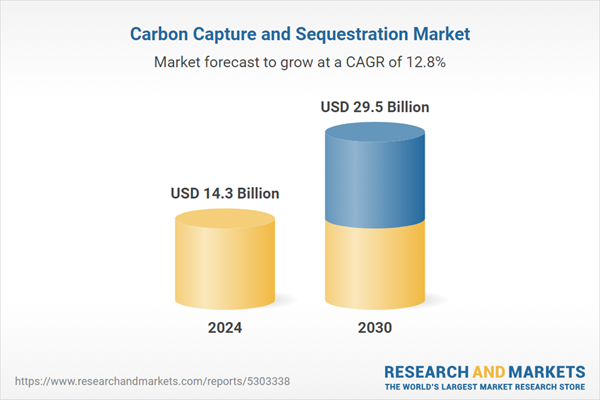

The report analyzes the Carbon Capture and Sequestration market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Service (Capture, Transport, Sequestration); Application (EOR Process, Industrial, Agricultural, Other Applications).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Regional Analysis

Gain insights into the U.S. market, valued at $3.6 Billion in 2024, and China, forecasted to grow at an impressive 16.9% CAGR to reach $7.3 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Carbon Capture and Sequestration Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Carbon Capture and Sequestration Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Carbon Capture and Sequestration Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ADNOC Group, Aker Solutions, BP, Carbon Engineering Ltd, Chevron and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 54 companies featured in this Carbon Capture and Sequestration market report include:

- ADNOC Group

- Aker Solutions

- BP

- Carbon Engineering Ltd

- Chevron

- China National Petroleum Corporation

- Dakota Gasification Company

- Equinor

- Exxonmobil Corporation

- Fluor Corporation

- General Electric

- Halliburton

- Hitachi, Ltd.

- Honeywell International Inc.

- Linde AG

- Mitsubishi Heavy Industries, Ltd.

- NRG Energy

- Schlumberger Limited

- Shell Global

- Siemens AG

- Total

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ADNOC Group

- Aker Solutions

- BP

- Carbon Engineering Ltd

- Chevron

- China National Petroleum Corporation

- Dakota Gasification Company

- Equinor

- Exxonmobil Corporation

- Fluor Corporation

- General Electric

- Halliburton

- Hitachi, Ltd.

- Honeywell International Inc.

- Linde AG

- Mitsubishi Heavy Industries, Ltd.

- NRG Energy

- Schlumberger Limited

- Shell Global

- Siemens AG

- Total

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 294 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 14.3 Billion |

| Forecasted Market Value ( USD | $ 29.5 Billion |

| Compound Annual Growth Rate | 12.8% |

| Regions Covered | Global |