Global Canned Wines Market - Key Trends & Drivers Summarized

Why Are Canned Wines Gaining Popularity Among Modern Consumers?

Canned wines are increasingly gaining popularity, particularly among younger and on-the-go consumers, due to their convenience, portability, and sustainability. Unlike traditional glass bottles, canned wines are lightweight, easily transportable, and ideal for outdoor events such as picnics, concerts, and beach outings. Their compact and resealable nature appeals to consumers seeking single-serve portions or smaller quantities, allowing for easy enjoyment without the need for corkscrews or glassware. As lifestyles become more fast-paced, canned wines provide a hassle-free solution for casual drinking, aligning perfectly with modern consumption habits.Additionally, the rise of informal and spontaneous socializing has contributed to the growing demand for canned wines. The casual, no-fuss packaging appeals to consumers who prioritize experiences over formality, making it a popular choice for millennials and Gen Z. The packaging not only appeals aesthetically but also meets the needs of consumers who want to enjoy quality wine in a variety of settings. The convenience of canned wines also makes them a suitable option for single-serving consumption, reducing waste compared to traditional bottles that may not be finished once opened.

How Are Sustainability Trends Shaping the Canned Wines Market?

Sustainability is a key driver behind the growing demand for canned wines, as eco-conscious consumers increasingly favor environmentally friendly packaging options. Cans, which are made from aluminum, are highly recyclable and have a smaller carbon footprint compared to glass bottles. Aluminum cans are lightweight and require less energy to transport, making them a more sustainable option in terms of logistics and reducing emissions throughout the supply chain. This shift toward sustainability resonates with younger consumers, many of whom are motivated by a desire to reduce their environmental impact through their purchasing choices.Moreover, the durability and recyclability of aluminum cans provide wineries with an opportunity to market their products as eco-friendly, aligning with the growing global trend toward sustainable living. The widespread adoption of sustainable practices within the wine industry, including packaging innovations, has opened up new opportunities for canned wines to cater to eco-conscious consumers. As environmental concerns continue to shape consumer preferences, wineries that embrace sustainable packaging solutions like cans are likely to gain a competitive edge in the market.

What Role Does Consumer Behavior Play in the Success of Canned Wines?

Consumer behavior, particularly the shift toward more casual and spontaneous drinking occasions, is driving the success of canned wines. As drinking patterns change, with consumers increasingly seeking convenience, portability, and flexibility in their beverage choices, canned wines offer an ideal solution. Single-serve cans eliminate the need to open a full bottle, making it easier to manage portions and enjoy wine in moderation. This appeals to health-conscious consumers who want to control their alcohol intake without compromising on quality or experience.Additionally, the rise of outdoor and on-the-go activities has fueled the demand for more portable alcohol options. Whether at festivals, camping trips, or tailgating events, canned wines provide a practical alternative to traditional bottles. The aesthetic appeal of canned wines also plays a role in their success, as modern, sleek designs attract millennial and Gen Z consumers, who are often influenced by packaging design and social media trends. The ease of sharing and portability enhances the social aspect of wine consumption, aligning with the broader trend of experiential and shareable consumer goods.

Growth in the Canned Wines Market Is Driven by Several Factors

Growth in the canned wines market is driven by several factors, including increasing consumer demand for convenience, portability, and sustainability, as well as the rising interest in alternative packaging formats. As consumers look for more convenient ways to enjoy wine, especially during outdoor activities, canned wines offer an ideal solution. The compact, lightweight, and durable nature of cans makes them easy to transport and consume, catering to modern, on-the-go lifestyles. This shift is particularly significant among younger consumers, who value experiences and flexibility, leading to a growing preference for casual and portable wine options.Another key driver is the global shift toward more sustainable and eco-friendly packaging. As environmental concerns become more central to consumer decision-making, the recyclable and energy-efficient nature of aluminum cans positions them as a favorable alternative to traditional glass bottles. Wineries are capitalizing on this trend by marketing their canned wine products as both convenient and environmentally responsible. Furthermore, the growth of the single-serve alcohol market, which emphasizes portion control and individual consumption, has created a strong demand for canned wines. The combination of changing lifestyles, environmental awareness, and the desire for on-demand consumption has made canned wines a rapidly expanding segment in the global wine industry. As this trend continues, the market for canned wines is expected to experience sustained growth, driven by evolving consumer preferences and innovative product offerings.

Report Scope

The report analyzes the Canned Wines market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Product (Sparkling Wine, Fortified Wine, Other Products); Distribution Channel (Supermarket & Hypermarket, Online Stores, Other Distribution Channels).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Sparkling Wine segment, which is expected to reach US$525.3 Million by 2030 with a CAGR of a 11.5%. The Fortified Wine segment is also set to grow at 12.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $107.5 Million in 2024, and China, forecasted to grow at an impressive 15.7% CAGR to reach $197.9 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Canned Wines Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Canned Wines Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Canned Wines Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Beach Juice, Constellation Brands, Inc., E & J Gallo Winery, Field Recordings, IBG Wines and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 34 companies featured in this Canned Wines market report include:

- Beach Juice

- Constellation Brands, Inc.

- E & J Gallo Winery

- Field Recordings

- IBG Wines

- Integrated Beverage Group LLC

- MANCAN WINE

- Old Westminster Winery

- Precept Wine, LLC

- Sans Wine Co.

- Shamps Beverage, LLC

- Sula Vineyards Pvt. Ltd.

- The Family Coppola

- Union Wine Company

- Winesellers, Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Beach Juice

- Constellation Brands, Inc.

- E & J Gallo Winery

- Field Recordings

- IBG Wines

- Integrated Beverage Group LLC

- MANCAN WINE

- Old Westminster Winery

- Precept Wine, LLC

- Sans Wine Co.

- Shamps Beverage, LLC

- Sula Vineyards Pvt. Ltd.

- The Family Coppola

- Union Wine Company

- Winesellers, Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 271 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

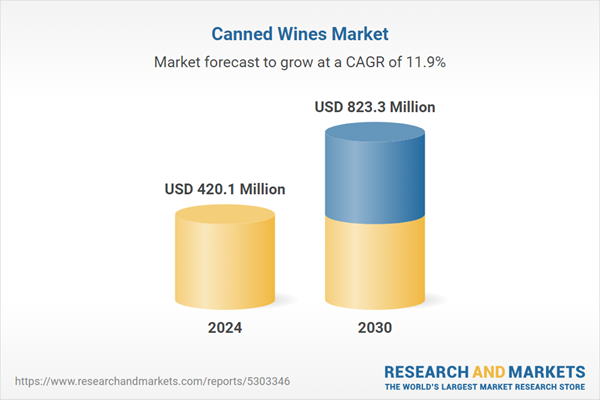

| Estimated Market Value ( USD | $ 420.1 Million |

| Forecasted Market Value ( USD | $ 823.3 Million |

| Compound Annual Growth Rate | 11.9% |

| Regions Covered | Global |