Global Canned Legumes Market - Key Trends & Drivers Summarized

Why Are Canned Legumes Gaining Popularity Among Health-Conscious Consumers?

Canned legumes are becoming an essential part of modern diets, appealing to health-conscious consumers who value both nutrition and convenience. Legumes, including beans, lentils, chickpeas, and peas, are renowned for their high protein, fiber, and essential nutrient content. They are naturally low in fat and free of cholesterol, making them an ideal food choice for those looking to maintain heart health, manage weight, and regulate blood sugar levels. With the global rise of plant-based diets, canned legumes provide a convenient way for people to incorporate these nutrient-dense foods into their meals without the long cooking times required for dried legumes.In addition to their impressive nutritional profile, canned legumes have gained popularity due to their versatility and long shelf life. They can be easily incorporated into a variety of dishes, such as salads, soups, stews, and side dishes, offering a quick and easy solution for busy consumers who want nutritious meals without spending hours in the kitchen. As awareness of the health benefits of legumes increases, more consumers are turning to canned versions to meet their dietary needs, especially as they offer an affordable source of plant-based protein that fits into modern, fast-paced lifestyles.

How Are Sustainability Trends Driving the Demand for Canned Legumes?

Sustainability has become a major driver of the canned legumes market, as consumers increasingly seek environmentally friendly food choices. Legumes are one of the most sustainable crops, requiring less water, fertilizers, and pesticides compared to animal-based protein sources. Additionally, legumes naturally enrich the soil by fixing nitrogen, reducing the need for synthetic fertilizers. This has made legumes a preferred choice for consumers who are concerned about their environmental footprint and are looking to reduce their consumption of animal products.Canned legumes, with their long shelf life and minimal packaging waste, align well with this growing interest in sustainable food systems. Many companies are responding to this demand by offering organic, non-GMO, and sustainably sourced canned legumes. Furthermore, the use of recyclable packaging and BPA-free cans is becoming more common as brands prioritize eco-friendly packaging solutions. As sustainability continues to influence consumer choices, the demand for canned legumes is expected to rise, especially among younger, environmentally conscious consumers who prioritize the ecological impact of their food.

What Role Does Convenience Play in the Rising Popularity of Canned Legumes?

The convenience of canned legumes is one of the key factors driving their growing popularity. For consumers with busy lifestyles, canned legumes provide a ready-to-eat solution that eliminates the need for soaking and lengthy cooking times associated with dried beans and lentils. With canned legumes, consumers can simply open the can and add them directly to their dishes, making meal preparation quicker and more efficient. This convenience has made canned legumes a staple in households where time-saving solutions are prioritized, particularly for working professionals, students, and families.Moreover, the affordability of canned legumes compared to other protein sources makes them an attractive option for budget-conscious shoppers. With rising food prices, legumes offer a cost-effective way to incorporate protein and essential nutrients into daily meals. Additionally, canned legumes come in a variety of options, from low-sodium to organic, catering to a wide range of dietary preferences and needs. Their versatility also adds to their appeal, as they can be used in a multitude of cuisines, from Mediterranean salads to Latin American stews, making them a convenient and adaptable ingredient in global kitchens.

Growth in the Canned Legumes Market Is Driven by Several Factors

Growth in the canned legumes market is driven by several factors, including the increasing adoption of plant-based diets, the rising awareness of the health benefits of legumes, and the demand for convenient, sustainable food products. As more consumers move toward vegetarian, vegan, and flexitarian diets, legumes have become a key component of their meals, providing a valuable source of plant-based protein and fiber. The growing popularity of clean-label, non-GMO, and organic products has also fueled the demand for canned legumes, as consumers seek out healthier, more transparent food options. In addition, the demand for eco-friendly and sustainable food sources is a significant driver of market growth. Legumes' low environmental impact makes them an appealing choice for environmentally conscious consumers, and canned legumes offer a practical solution with minimal packaging waste and long shelf life. The convenience factor cannot be overstated, as the ready-to-eat nature of canned legumes fits seamlessly into the busy lives of modern consumers who are looking for quick, nutritious meal options. With innovations in packaging and product offerings, including low-sodium and organic varieties, the canned legumes market is expected to continue its robust growth trajectory, driven by changing dietary trends and a focus on sustainability.Report Scope

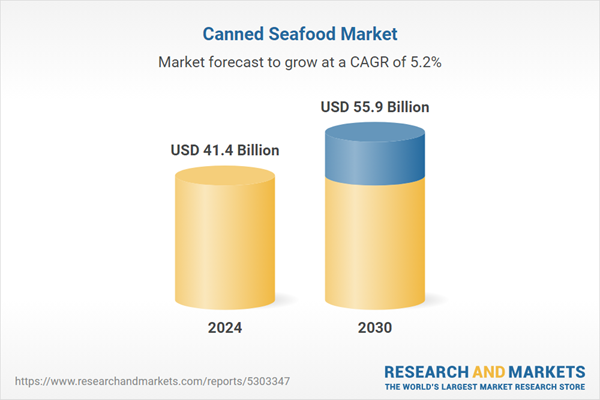

The report analyzes the Canned Seafood market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Product (Tuna, Sardines, Salmon, Prawns, Shrimps, Other Products).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Tuna segment, which is expected to reach US$17.5 Billion by 2030 with a CAGR of a 4.8%. The Sardines segment is also set to grow at 5.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $10.8 Billion in 2024, and China, forecasted to grow at an impressive 7.7% CAGR to reach $12.2 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Canned Seafood Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Canned Seafood Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Canned Seafood Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as American Tuna, Inc., Aquachile, Brunswick Seafood, Bumble Bee Seafoods, Connors Bros. Ltd. (Brunswick Seafoods) and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 52 companies featured in this Canned Seafood market report include:

- American Tuna, Inc.

- Aquachile

- Brunswick Seafood

- Bumble Bee Seafoods

- Connors Bros. Ltd. (Brunswick Seafoods)

- Icicle Seafoods Inc.

- LDH (La Doria) Ltd.

- Marine Harvest

- Maruha Nichiro Corporation

- Mogster Group

- Nippon Suisan Kaisha, Ltd.

- StarKist Co.

- Thai Union Frozen Products

- Tri Marine Group

- Trident Seafoods Corporation

- Universal Canning, Inc.

- Wild Planet Foods

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- American Tuna, Inc.

- Aquachile

- Brunswick Seafood

- Bumble Bee Seafoods

- Connors Bros. Ltd. (Brunswick Seafoods)

- Icicle Seafoods Inc.

- LDH (La Doria) Ltd.

- Marine Harvest

- Maruha Nichiro Corporation

- Mogster Group

- Nippon Suisan Kaisha, Ltd.

- StarKist Co.

- Thai Union Frozen Products

- Tri Marine Group

- Trident Seafoods Corporation

- Universal Canning, Inc.

- Wild Planet Foods

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 202 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 41.4 Billion |

| Forecasted Market Value ( USD | $ 55.9 Billion |

| Compound Annual Growth Rate | 5.2% |

| Regions Covered | Global |