Global Cancer Immunotherapy Drug Discovery Outsourcing Market - Key Trends & Drivers Summarized

Why Is Outsourcing Becoming a Critical Component in Cancer Immunotherapy Drug Discovery?

The complexity and high cost of developing cancer immunotherapy drugs have driven pharmaceutical companies and research institutions to increasingly outsource parts of their drug discovery processes. Immunotherapy drug discovery is an intricate process involving target identification, validation, lead optimization, and preclinical testing, all of which require specialized expertise and advanced technologies. By outsourcing these tasks to contract research organizations (CROs) and biotech firms, companies can access state-of-the-art technologies, experienced scientists, and comprehensive infrastructure without bearing the enormous cost of building these capabilities in-house. This outsourcing model accelerates timelines, reduces operational costs, and allows companies to focus their resources on clinical development and commercialization.Additionally, outsourcing has become a critical tool for smaller biotech firms that often lead the way in cancer immunotherapy innovations but may lack the in-house resources to manage the entire drug discovery pipeline. Outsourcing enables these companies to collaborate with specialized firms for high-throughput screening, computational modeling, and biomarker identification, ensuring they remain competitive with larger pharmaceutical players. The rise of partnerships between biotech firms, academic research centers, and CROs has also helped streamline the transition from drug discovery to clinical development, expediting the path to market for groundbreaking cancer immunotherapies.

How Are Technological Advancements Influencing Outsourced Cancer Immunotherapy Drug Discovery?

The rapid advancement of technologies such as artificial intelligence (AI), machine learning, and next-generation sequencing (NGS) is significantly impacting cancer immunotherapy drug discovery, particularly in the realm of outsourcing. AI and machine learning algorithms are being used by outsourced research firms to analyze vast datasets and identify potential therapeutic targets at a faster pace. These technologies can predict how patients will respond to specific immunotherapies, enabling researchers to identify promising drug candidates with higher accuracy and lower failure rates in preclinical testing. This data-driven approach is revolutionizing the discovery phase, reducing the time needed for target validation and optimizing lead compounds for immunotherapy drug development.Next-generation sequencing is another key technology that outsourced firms are using to unlock new insights into cancer's genetic and molecular underpinnings. By leveraging NGS to analyze tumor samples, contract research organizations (CROs) can discover novel cancer biomarkers and potential immunotherapy targets, improving the precision of personalized cancer treatments. Outsourced companies specializing in bioinformatics are also playing a crucial role in integrating multi-omics data, allowing for a comprehensive understanding of tumor immunology. The use of these technologies by outsourced research providers not only accelerates drug discovery timelines but also enhances the potential for developing highly targeted, more effective immunotherapies.

What Role Is Globalization Playing in Cancer Immunotherapy Drug Discovery Outsourcing?

Globalization is a key factor driving the growth of cancer immunotherapy drug discovery outsourcing. As pharmaceutical companies and research organizations seek to access the best talent and technology worldwide, they are increasingly turning to outsourcing partners across various regions. Asia-Pacific, particularly China and India, has emerged as a key hub for outsourcing drug discovery tasks due to the region's lower operational costs, skilled workforce, and growing infrastructure for biotech research. These countries offer a competitive edge in terms of both cost-effectiveness and speed, making them attractive destinations for companies looking to outsource early-stage research, preclinical studies, and biomarker discovery.At the same time, regions like North America and Europe remain pivotal in cancer immunotherapy innovation, housing some of the world's leading CROs and academic research institutions. By forming global partnerships, companies are leveraging the expertise of these advanced research centers while also benefiting from the cost savings offered by outsourcing to emerging markets. Globalization also enables pharmaceutical companies to manage multiple aspects of drug discovery simultaneously across different geographies, significantly accelerating the pace of development. As the cancer immunotherapy sector becomes increasingly competitive, the ability to outsource tasks globally is providing companies with the agility and resources needed to stay ahead in drug discovery.

Growth in the Cancer Immunotherapy Drug Discovery Outsourcing Market Is Driven by Several Factors

The growth in the cancer immunotherapy drug discovery outsourcing market is driven by several factors, including the increasing complexity of drug discovery, rising R&D costs, and the growing need for specialized expertise. As immunotherapies become more personalized and complex, pharmaceutical companies are recognizing the benefits of outsourcing certain phases of drug discovery to CROs that have advanced technological capabilities and a deep understanding of cancer immunology. Outsourcing allows companies to reduce operational expenses, access cutting-edge research platforms, and streamline the discovery process by focusing on core competencies like clinical development.Another major growth driver is the rise of small biotech firms leading innovation in the cancer immunotherapy space. These companies often lack the internal infrastructure needed to carry out all stages of drug discovery but can leverage outsourcing to access the resources of larger, more established CROs. Additionally, technological advancements such as AI, high-throughput screening, and next-generation sequencing are enabling outsourced firms to accelerate the drug discovery process, improving the chances of success. The expansion of global outsourcing networks, particularly in Asia-Pacific, is providing cost-effective solutions for pharmaceutical companies while maintaining high research standards. As companies continue to pursue innovative and targeted cancer treatments, outsourcing will remain a vital strategy for reducing time-to-market and enhancing the precision of cancer immunotherapy drug discovery.

Report Scope

The report analyzes the Cancer Immunotherapy Drug Discovery Outsourcing market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Drug Type (Monoclonal Antibodies, Immunomodulators, Oncolytic Viral Therapies & Cancer Vaccines, Other Drug Types); Service Type (Target Identification & Validation, Lead Screening & Characterization, Cell-Based Assays); Cancer Type (Lung, Breast, Prostate, Melanoma, Pancreatic, Colorectal, Other Cancer Types).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Monoclonal Antibodies segment, which is expected to reach US$1.5 Billion by 2030 with a CAGR of a 13.4%. The Immunomodulators segment is also set to grow at 15% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $469.8 Million in 2024, and China, forecasted to grow at an impressive 17.8% CAGR to reach $963.3 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Cancer Immunotherapy Drug Discovery Outsourcing Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Cancer Immunotherapy Drug Discovery Outsourcing Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Cancer Immunotherapy Drug Discovery Outsourcing Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Aquila Biomedical, BPS Biosciences Inc., Celentyx Ltd., Covance, Inc., Crown Bioscience Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 34 companies featured in this Cancer Immunotherapy Drug Discovery Outsourcing market report include:

- Aquila Biomedical

- BPS Biosciences Inc.

- Celentyx Ltd.

- Covance, Inc.

- Crown Bioscience Inc.

- DiscoverX Corporation

- Explicit Immuno-Oncology

- Explicyte

- Gen script Biotech Corporation

- HD Biosciences Co. Ltd.

- Horizon Discovery Group PLC

- ImmunXperts SA

- Molecular Imaging Inc. (MI Bioresearch Inc.)

- Personalis, Inc.

- Promega Corporation

- STC Biologics

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Aquila Biomedical

- BPS Biosciences Inc.

- Celentyx Ltd.

- Covance, Inc.

- Crown Bioscience Inc.

- DiscoverX Corporation

- Explicit Immuno-Oncology

- Explicyte

- Gen script Biotech Corporation

- HD Biosciences Co. Ltd.

- Horizon Discovery Group PLC

- ImmunXperts SA

- Molecular Imaging Inc. (MI Bioresearch Inc.)

- Personalis, Inc.

- Promega Corporation

- STC Biologics

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 382 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

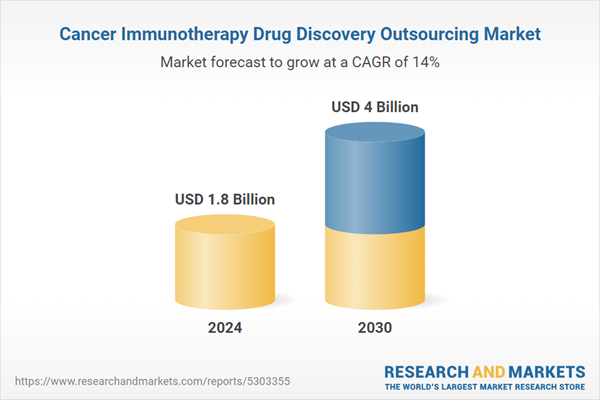

| Estimated Market Value ( USD | $ 1.8 Billion |

| Forecasted Market Value ( USD | $ 4 Billion |

| Compound Annual Growth Rate | 14.0% |

| Regions Covered | Global |