Global Industrial Wastewater Treatment Services Market - Key Trends and Drivers Summarized

Why Are Industrial Wastewater Treatment Services Crucial for Environmental Sustainability?

Industrial wastewater treatment services play a pivotal role in ensuring that industries adhere to environmental regulations by treating wastewater before it is discharged into water bodies or reused. These services are vital in preventing the contamination of ecosystems and reducing the industrial sector's environmental footprint. Wastewater treatment services encompass a range of processes, including physical, chemical, and biological treatments designed to remove pollutants, such as heavy metals, organic compounds, and suspended solids. Industries such as oil & gas, pharmaceuticals, chemicals, and food & beverage are some of the largest producers of wastewater, and without proper treatment, these industries can cause severe environmental degradation. Wastewater treatment services help industries meet stringent regulatory standards, ensuring that water discharged into the environment is safe.How Are Technological Innovations Shaping the Industrial Wastewater Treatment Services Market?

Technological advancements are significantly improving the efficiency and effectiveness of industrial wastewater treatment services. New treatment technologies such as membrane filtration, advanced oxidation processes (AOP), and electrochemical treatment are enabling more efficient pollutant removal. Membrane bioreactors (MBRs), for instance, combine biological treatment with membrane filtration, enhancing water purification efficiency. In addition, the rise of Internet of Things (IoT) integration into wastewater treatment plants allows for real-time monitoring of water quality, predictive maintenance, and optimization of chemical dosing, leading to cost reductions and improved performance. Furthermore, the growing trend of water reuse is spurring the development of innovative water treatment solutions that allow industries to recycle treated wastewater, reducing freshwater consumption and operational costs.How Do Market Segments Define the Growth of Industrial Wastewater Treatment Services?

Key treatment processes include physical, chemical, and biological treatment, with chemical treatment leading the market due to its wide application in various industries. Service types include consulting, installation, and maintenance, with consulting and maintenance services seeing strong demand as industries seek to comply with evolving environmental regulations. End-use industries include oil & gas, chemicals, pharmaceuticals, food & beverage, and power generation, with the oil & gas sector being the largest consumer of wastewater treatment services due to the large volumes of wastewater generated in extraction and refining processes. Geographically, North America and Europe lead the market in terms of regulatory enforcement and wastewater treatment capacity, while Asia-Pacific is rapidly expanding due to increasing industrialization.What Factors Are Driving the Growth in the Industrial Wastewater Treatment Services Market?

The growth in the industrial wastewater treatment services market is driven by several factors, including increasing environmental regulations, water scarcity, and advancements in treatment technologies. As governments around the world tighten regulations on wastewater discharge, industries are compelled to invest in treatment services to avoid hefty fines and meet compliance standards. Water scarcity, particularly in regions such as the Middle East and parts of Asia, is also pushing industries to adopt water reuse practices, further boosting demand for advanced wastewater treatment services. Technological advancements that improve the efficiency of treatment processes and reduce operational costs are contributing to the market's expansion. The growing awareness of environmental sustainability among industries and consumers is another key driver.Report Scope

The report analyzes the Industrial Wastewater Treatment Services market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Biocides & Disinfectants, Coagulants, Flocculants); End-Use (Power Generation, Oil & Gas, Chemical).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Biocides & Disinfectants segment, which is expected to reach US$12.8 Billion by 2030 with a CAGR of a 6.6%. The Coagulants segment is also set to grow at 5.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $4.5 Billion in 2024, and China, forecasted to grow at an impressive 8.9% CAGR to reach $5.6 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Industrial Wastewater Treatment Services Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Industrial Wastewater Treatment Services Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Industrial Wastewater Treatment Services Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Aries Chemical, Ecolab, Evoqua Water Technologies, Golder Associates, Pentair and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 36 companies featured in this Industrial Wastewater Treatment Services market report include:

- Aries Chemical

- Ecolab

- Evoqua Water Technologies

- Golder Associates

- Pentair

- SUEZ

- SWA Water Holdings

- Terrapure Environmental

- Thermax Group

- Veolia

- WOG Group

- Xylem

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Aries Chemical

- Ecolab

- Evoqua Water Technologies

- Golder Associates

- Pentair

- SUEZ

- SWA Water Holdings

- Terrapure Environmental

- Thermax Group

- Veolia

- WOG Group

- Xylem

Table Information

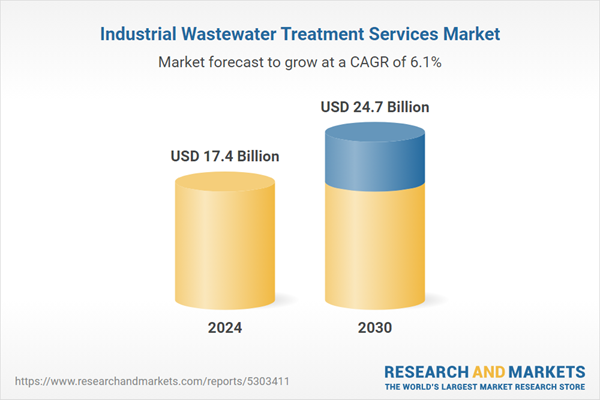

| Report Attribute | Details |

|---|---|

| No. of Pages | 273 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 17.4 Billion |

| Forecasted Market Value ( USD | $ 24.7 Billion |

| Compound Annual Growth Rate | 6.1% |

| Regions Covered | Global |