Global Specialty Oilfield Chemicals Market - Key Trends and Drivers Summarized

How Are Specialty Oilfield Chemicals Optimizing Oil and Gas Operations?

Specialty oilfield chemicals are advanced chemical solutions designed to enhance oil and gas exploration, drilling, production, and refining processes. These chemicals include corrosion inhibitors, scale inhibitors, demulsifiers, surfactants, and biocides, each serving specific functions such as improving oil recovery, controlling scaling, preventing corrosion, and managing emulsions. By optimizing operational efficiency and safety, specialty oilfield chemicals are crucial for maintaining production levels, reducing equipment damage, and ensuring environmental compliance. As the oil and gas industry faces increasing complexity, these chemicals play a vital role in improving extraction techniques and extending the lifespan of oilfields.What Are the Key Segments in the Specialty Oilfield Chemicals Market?

Key types include corrosion inhibitors, demulsifiers, friction reducers, surfactants, and scale inhibitors, with corrosion inhibitors holding the largest market share due to their extensive use in protecting pipelines, drilling equipment, and production facilities. Applications span drilling, production, enhanced oil recovery (EOR), and well stimulation, with drilling representing a significant segment driven by the need for effective fluid management and borehole stabilization. End-users include upstream, midstream, and downstream operators, with upstream operations leading the market as they require high-performance chemicals for efficient exploration and extraction.How Are Specialty Oilfield Chemicals Integrated Across Oilfield Operations?

In drilling operations, specialty chemicals like drilling mud additives, viscosifiers, and fluid loss agents improve drilling efficiency, prevent wellbore instability, and enhance fluid management. In production, demulsifiers and scale inhibitors are used to separate oil from water, maintain flow rates, and prevent scaling in pipelines and production facilities. Enhanced oil recovery (EOR) techniques utilize surfactants, polymers, and gas treatments to maximize crude oil recovery from mature fields, extending their productive lifespan. In well stimulation, acidizing and hydraulic fracturing chemicals increase permeability, allowing for greater oil and gas extraction from tight formations. Additionally, biocides are used throughout the supply chain to prevent microbial growth that can cause corrosion and blockages.What Factors Are Driving the Growth in the Specialty Oilfield Chemicals Market?

The growth in the Specialty Oilfield Chemicals market is driven by several factors, including increasing demand for improved oil recovery techniques and effective well stimulation methods to enhance production efficiency. Advancements in chemical formulations, which offer better compatibility with different crude types and drilling environments, have supported broader adoption across oilfield operations. The focus on reducing operational costs and extending the productive life of oilfields has further fueled demand, as specialty chemicals enable better resource management and extraction processes. Additionally, rising exploration and production activities in unconventional oil and gas fields, coupled with stricter environmental regulations, have contributed to market growth by promoting the use of eco-friendly and high-performance oilfield chemicals.Report Scope

The report analyzes the Specialty Oilfield Chemicals market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Demulsifiers, Inhibitors & Scavengers, Rheology Modifiers, Friction Reducers, Specialty Biocides, Specialty Surfactants, Other Types); Application (Production, Well Stimulation, Drilling Fluids, Enhanced Oil Recovery, Other Applications).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Demulsifiers segment, which is expected to reach US$6.2 Billion by 2030 with a CAGR of a 6.4%. The Inhibitors & Scavengers segment is also set to grow at 5.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $3.6 Billion in 2024, and China, forecasted to grow at an impressive 5.5% CAGR to reach $2.9 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Specialty Oilfield Chemicals Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Specialty Oilfield Chemicals Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Specialty Oilfield Chemicals Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AkzoNobel NV, Albemarle Corporation, Basf SE, Clariant, Ecolab and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 43 companies featured in this Specialty Oilfield Chemicals market report include:

- AkzoNobel NV

- Albemarle Corporation

- Basf SE

- Clariant

- Ecolab

- Halliburton Company

- Kemira OYJ

- Schlumberger Limited

- Solvay S.A.

- Stepan Company

- The Dow Chemical Company

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AkzoNobel NV

- Albemarle Corporation

- Basf SE

- Clariant

- Ecolab

- Halliburton Company

- Kemira OYJ

- Schlumberger Limited

- Solvay S.A.

- Stepan Company

- The Dow Chemical Company

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 196 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

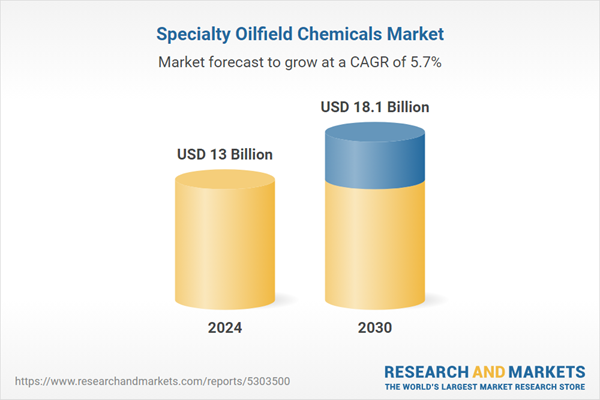

| Estimated Market Value ( USD | $ 13 Billion |

| Forecasted Market Value ( USD | $ 18.1 Billion |

| Compound Annual Growth Rate | 5.7% |

| Regions Covered | Global |