Global Truck Racks Market - Key Trends & Drivers Summarized

What Are Truck Racks, and Why Are They So Vital for Modern Utility?

Truck racks are essential vehicle accessories designed to expand the cargo-carrying capacity of trucks. They serve as durable frameworks mounted on the bed or roof of trucks, allowing users to transport bulky items such as ladders, kayaks, construction materials, and other heavy-duty equipment. Available in various materials like aluminum, steel, and stainless steel, truck racks are designed to enhance the versatility of trucks by enabling the secure transportation of diverse loads. They are popular among contractors, outdoor enthusiasts, logistics providers, and other professionals who need reliable solutions for carrying tools, equipment, or recreational gear. Truck racks not only maximize load capacity but also help in maintaining organized cargo space, making them indispensable for industries that rely heavily on vehicle-based transportation. Their ability to withstand tough environmental conditions while providing secure loading solutions makes them a must-have for various end-users.The growing popularity of utility vehicles and off-road adventures has also contributed to the rising demand for truck racks. As more consumers and businesses embrace the utility of trucks for both professional and recreational purposes, the need for truck racks that provide safety, durability, and flexibility has grown significantly. In industries like construction and logistics, truck racks enhance productivity by enabling workers to carry tools and materials efficiently, often reducing the number of trips needed. Meanwhile, the recreational sector benefits from truck racks that allow the transportation of sports equipment such as bikes, canoes, and camping gear. This versatility across different user needs highlights the fundamental role of truck racks in modern transport solutions, cementing their importance in today's market.

How Are Technological Advancements Impacting the Truck Racks Market?

Technological advancements have significantly shaped the evolution of truck racks, leading to the development of more versatile, durable, and lightweight models. Innovations in materials have introduced high-strength, corrosion-resistant aluminum and composite racks, making them both strong and lightweight. This not only improves the vehicle's fuel efficiency but also enhances the payload capacity without compromising safety or performance. Additionally, new designs feature modular components, allowing users to customize racks based on their specific needs. Features like adjustable crossbars, sliding brackets, and quick-release clamps offer increased flexibility and ease of use, making truck racks more adaptable to a variety of load requirements. Furthermore, manufacturers are increasingly incorporating aerodynamic designs to reduce wind resistance, which improves fuel efficiency and minimizes noise during transportation. These innovations reflect the industry's response to evolving consumer needs, where efficiency and adaptability are prioritized.Moreover, the integration of smart technologies is beginning to make its way into the truck racks market. Some modern racks are equipped with IoT-enabled sensors that monitor load capacity, detect vibrations, and even provide GPS-based tracking for theft prevention. These advancements not only enhance the utility of truck racks but also align them with broader trends in vehicle automation and fleet management. Manufacturers are also investing in quick-installation designs that reduce the time and effort needed to mount or dismount racks, catering to both individual consumers and commercial fleet operators. In addition, sustainable manufacturing practices, such as using recycled materials and energy-efficient production techniques, are becoming more prevalent, aligning the industry with global sustainability goals. These technological innovations not only improve the functionality of truck racks but also drive growth by making them more user-friendly and eco-friendly.

What Are the Emerging Applications of Truck Racks Across Different Sectors?

The applications of truck racks have expanded beyond traditional uses, finding new relevance across a range of industries. In the construction sector, truck racks are vital for transporting heavy materials like pipes, lumber, and scaffolding, making it easier for workers to transport tools and building supplies efficiently. Similarly, in agriculture, truck racks are used to carry farming equipment, animal feed, and other supplies across fields and farms. The logistics and delivery sectors also rely heavily on truck racks, particularly for last-mile deliveries that require fast loading and unloading of goods. The racks provide additional space for transporting oversized packages and goods, which is crucial for courier and delivery services operating in urban and suburban environments. As e-commerce continues to grow, truck racks are becoming an indispensable part of last-mile delivery solutions, providing companies with the versatility needed to handle diverse package sizes and quantities.In the recreational segment, truck racks have become popular among outdoor enthusiasts, including campers, kayakers, cyclists, and hunters, who need to transport equipment safely and efficiently. Truck racks allow for secure mounting of gear like bikes, canoes, tents, and fishing rods, making them essential for outdoor adventures. Additionally, the rise of overlanding - a form of self-reliant, off-road travel that requires carrying extensive camping and survival gear - has driven demand for robust truck racks that can handle rough terrains and heavy loads. The racks' versatility and durability make them suitable for use in harsh environments, expanding their appeal among adventure-seekers and professionals alike. As consumers increasingly seek out vehicles that offer a blend of utility and recreation, truck racks are positioned as key accessories that enhance the functionality of trucks across a broad spectrum of uses.

What Drives Growth in the Truck Racks Market?

The growth in the Truck Racks market is driven by several factors, including increasing demand for utility vehicles, growing outdoor and adventure activities, and expanding logistics and delivery services. One of the most significant drivers is the rising popularity of pickup trucks, SUVs, and off-road vehicles, which has spurred demand for accessories like truck racks that enhance the functionality and versatility of these vehicles. In the construction and logistics industries, the need for efficient cargo solutions is critical, making truck racks an essential accessory for professionals who require organized and reliable transportation of materials and equipment. The ongoing growth in e-commerce and last-mile delivery services has also contributed to increased demand, as truck racks provide additional cargo space for oversized and heavy parcels, helping delivery companies optimize load capacity and improve operational efficiency.Furthermore, the surge in recreational activities, including camping, kayaking, and biking, has fueled the demand for truck racks among outdoor enthusiasts. Consumers are increasingly investing in accessories that support their active lifestyles, and truck racks offer a practical solution for safely transporting sports equipment and camping gear. The rise of overlanding, where off-road enthusiasts require heavy-duty gear for long-distance travel, has also contributed to market growth. Additionally, the growing focus on sustainability and fuel efficiency has prompted manufacturers to develop lightweight, aerodynamically designed racks that not only reduce vehicle load but also minimize fuel consumption. As industries and consumers alike prioritize efficient, flexible, and sustainable transportation solutions, the truck racks market is expected to maintain robust growth in the coming years.

Report Scope

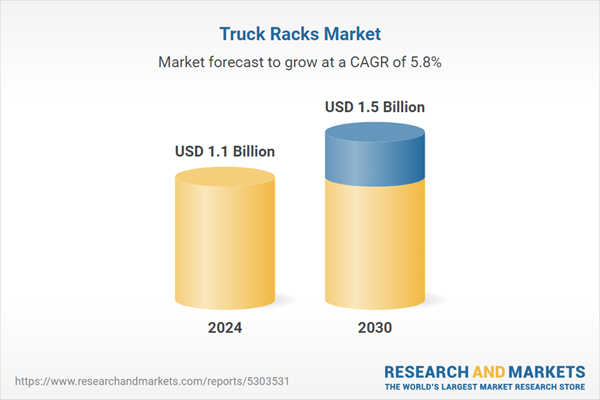

The report analyzes the Truck Racks market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Product Segment (Aluminum, Steel); Application (Aftermarket, OEM).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Aluminum Racks segment, which is expected to reach US$929.3 Million by 2030 with a CAGR of a 6.3%. The Steel Racks segment is also set to grow at 5.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $273.9 Million in 2024, and China, forecasted to grow at an impressive 8.7% CAGR to reach $334.4 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Truck Racks Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Truck Racks Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Truck Racks Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Cross Tread Industries Inc., Hauler Racks, Inc., Kargo Master, Inc., Magnum Manufacturing, Inc., ProTech Industries and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Truck Racks market report include:

- Cross Tread Industries Inc.

- Hauler Racks, Inc.

- Kargo Master, Inc.

- Magnum Manufacturing, Inc.

- ProTech Industries

- Rackit Truck Racks

- Texas Truck Racks

- The Thule Group

- Topper Manufacturing Company, Inc.

- U.S. Rack Inc.

- Vanguard Manufacturing, Inc.

- Yakima Products Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Cross Tread Industries Inc.

- Hauler Racks, Inc.

- Kargo Master, Inc.

- Magnum Manufacturing, Inc.

- ProTech Industries

- Rackit Truck Racks

- Texas Truck Racks

- The Thule Group

- Topper Manufacturing Company, Inc.

- U.S. Rack Inc.

- Vanguard Manufacturing, Inc.

- Yakima Products Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 273 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.1 Billion |

| Forecasted Market Value ( USD | $ 1.5 Billion |

| Compound Annual Growth Rate | 5.8% |

| Regions Covered | Global |