Global Molecular Breeding Market - Key Trends and Drivers Summarized

Why Is Molecular Breeding Revolutionizing Agriculture?

Molecular breeding is a method used to enhance crop quality and yield through the manipulation of genes at the molecular level. This approach involves using molecular markers and genetic engineering techniques to identify desirable traits in plants and incorporate them into new crop varieties. Molecular breeding has transformed traditional agricultural practices by enabling the development of crops that are resistant to pests, diseases, and environmental stresses, as well as crops with improved nutritional content and growth rates. This technology is critical for meeting the increasing global demand for food, driven by population growth and changing dietary preferences. The adoption of molecular breeding is rapidly expanding in the agricultural industry due to its ability to accelerate crop improvement processes. Compared to traditional breeding methods, molecular breeding allows for more precise and targeted manipulation of genetic material, resulting in faster development of high-yield and stress-resistant crop varieties. This technology is being used to improve a wide range of crops, including cereals, fruits, vegetables, and oilseeds, enhancing their quality and resilience.What Are the Key Trends in Molecular Breeding?

Several trends are shaping the molecular breeding market, including the growing focus on sustainable agriculture, advancements in genetic engineering technologies, and increasing government support for agricultural research. The push towards sustainable farming practices is driving the adoption of molecular breeding to develop crops that require fewer inputs such as water, pesticides, and fertilizers. This is essential for reducing the environmental impact of agriculture and improving food security. Advancements in genetic engineering, such as CRISPR/Cas9 gene editing, are enabling more precise and efficient crop improvement, expanding the possibilities for molecular breeding. Government initiatives and funding for agricultural biotechnology research are also accelerating the development and adoption of molecular breeding technologies. These trends are creating a favorable environment for the growth of the molecular breeding market.How Do Market Segments Influence Molecular Breeding?

Techniques include marker-assisted selection, marker-assisted backcrossing, genomic selection, and genetic engineering, each serving different purposes based on the desired crop traits. In terms of application, molecular breeding is used for yield improvement, disease resistance, and quality enhancement of crops. The major crop types benefiting from molecular breeding include cereals, oilseeds, fruits, and vegetables. Geographically, the market is dominated by North America, driven by advanced agricultural practices, significant investments in biotechnology research, and favorable regulatory policies. Europe also represents a significant market, with increasing adoption of molecular breeding for sustainable agriculture. The Asia-Pacific region is experiencing rapid growth due to rising food demand, expanding agricultural biotechnology initiatives, and government support for crop improvement programs.What Factors Are Driving the Growth in the Molecular Breeding Market?

The growth in the molecular breeding market is driven by several factors, including the increasing global demand for food, advancements in genetic engineering technologies, and the need for sustainable agriculture practices. The rising population and changing dietary patterns are boosting the demand for high-yield and stress-resistant crops. Technological innovations in molecular breeding are enhancing the efficiency of crop improvement processes. Additionally, the growing focus on sustainable agriculture and government support for biotechnology research are further driving the adoption of molecular breeding in the agricultural sector.Report Scope

The report analyzes the Molecular Breeding market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Process (Marker-Assisted Selection (MAS), QTL Mapping, Marker-Assisted Backcrossing (MABC), Genomic Selection, Other Processes); Marker (Single Nucleotide Polymorphism (SNP), Simple Sequence Repeats (SSR)); Application (Crop Breeding, Livestock).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Marker-Assisted Selection (MAS) Process segment, which is expected to reach US$11.7 Billion by 2030 with a CAGR of a 18.1%. The QTL Mapping Process segment is also set to grow at 17.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $3.3 Billion in 2024, and China, forecasted to grow at an impressive 16.5% CAGR to reach $4.7 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Molecular Breeding Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Molecular Breeding Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Molecular Breeding Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Eurofins Scientific, Illumina, LGC Limited, Thermo Fisher Scientific, Inc., SGS SA and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 32 companies featured in this Molecular Breeding market report include:

- Eurofins Scientific

- Illumina

- LGC Limited

- Thermo Fisher Scientific, Inc.

- SGS SA

- DanBred

- Intertek Group Plc

- LemnaTec GmbH

- Charles River Laboratories

- Slipstream Automation

- Fruitbreedomics

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Eurofins Scientific

- Illumina

- LGC Limited

- Thermo Fisher Scientific, Inc.

- SGS SA

- DanBred

- Intertek Group Plc

- LemnaTec GmbH

- Charles River Laboratories

- Slipstream Automation

- Fruitbreedomics

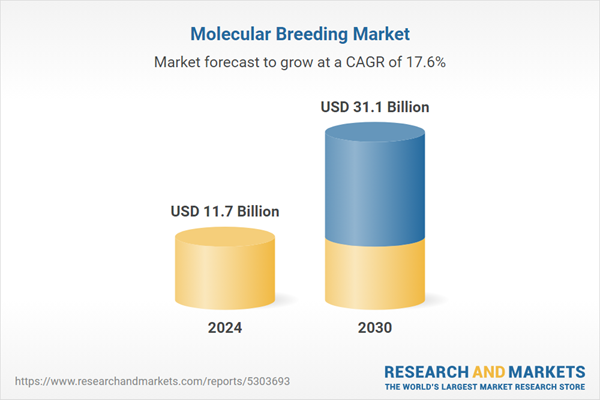

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 215 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 11.7 Billion |

| Forecasted Market Value ( USD | $ 31.1 Billion |

| Compound Annual Growth Rate | 17.6% |

| Regions Covered | Global |