Global Virtualization Security Market - Key Trends & Drivers Summarized

What Is Virtualization Security, and Why Is It So Crucial in Modern IT Infrastructure?

Virtualization Security refers to the measures, tools, and protocols designed to protect virtualized environments, including virtual machines (VMs), hypervisors, virtual networks, and cloud infrastructure, from cyber threats, vulnerabilities, and data breaches. In virtualized settings, physical hardware resources are abstracted into virtual environments, allowing multiple systems to run on a single server or across distributed cloud networks. While virtualization enhances scalability, efficiency, and flexibility, it also introduces unique security challenges, such as hypervisor attacks, VM sprawl, and inter-VM traffic vulnerabilities, making specialized security solutions essential.The importance of virtualization security lies in its ability to protect the core of modern IT infrastructure, which increasingly relies on virtualized servers, applications, networks, and cloud services. As organizations adopt virtualization to enable cloud computing, containerization, and digital transformation, robust security becomes crucial to ensure data integrity, regulatory compliance, and protection against evolving threats. Virtualization security solutions include firewalling, intrusion detection/prevention systems (IDPS), micro-segmentation, encryption, and secure access controls tailored to virtual environments. As businesses migrate critical workloads to virtualized data centers and hybrid clouds, virtualization security has become essential to maintaining the resilience, privacy, and performance of digital operations.

How Are Technological Advancements Shaping the Virtualization Security Market?

Technological advancements have significantly enhanced the capabilities, efficiency, and adaptability of Virtualization Security solutions, driving innovation across the sector. One of the major developments is the rise of micro-segmentation, which allows for granular security controls within virtual environments. Micro-segmentation divides virtual networks into smaller, isolated segments, enabling specific security policies for individual workloads, applications, or virtual machines. This minimizes the risk of lateral movement by attackers, effectively containing breaches and protecting sensitive data within cloud or virtual data centers. By applying firewall rules at the VM level, micro-segmentation supports zero-trust security models, enhancing overall network security.The integration of artificial intelligence (AI) and machine learning (ML) has further transformed virtualization security. AI-powered threat detection systems analyze real-time network traffic, user behavior, and application performance to identify unusual patterns and potential vulnerabilities in virtual environments. ML algorithms continuously learn from historical data to improve threat detection accuracy and reduce false positives. This proactive approach enhances intrusion detection, automates response, and helps secure complex virtualized environments that often host dynamic workloads. AI-driven analytics also enable predictive security measures, anticipating potential risks based on past behaviors and current anomalies.

The growth of containerization and cloud-native technologies has reshaped the virtualization security landscape. With the increasing adoption of containers and microservices, security solutions have evolved to protect these ephemeral environments. Container security tools are now integrated into virtualization security frameworks, providing runtime protection, image scanning, and secure orchestration for platforms like Kubernetes and Docker. Additionally, advancements in encryption technologies, such as homomorphic encryption and secure multi-party computation (MPC), have improved data protection in virtualized environments by ensuring data remains encrypted even during processing. These technological innovations not only expand the capabilities of virtualization security but also align with broader trends toward automation, cloud-native security, and AI-driven threat intelligence in modern IT infrastructure.

What Are the Emerging Applications of Virtualization Security Across Different Sectors?

Virtualization Security is finding expanding applications across a wide range of industries, driven by the need to protect critical workloads, sensitive data, and distributed networks. In the financial services sector, virtualization security is essential for safeguarding banking applications, trading platforms, and customer databases hosted in virtualized environments. The sector benefits from micro-segmentation, which isolates sensitive financial transactions and prevents unauthorized access to core systems. Virtualization security also ensures compliance with regulations like GDPR, PCI-DSS, and SOX, making it a fundamental component of risk management in finance.In the healthcare sector, virtualization security protects electronic health records (EHRs), telemedicine applications, and patient management systems. By securing virtualized servers and virtual desktops (VDI), healthcare organizations can ensure the confidentiality of patient data and meet regulatory requirements like HIPAA. Additionally, secure virtual environments support telehealth platforms, enabling safe remote consultations, diagnostics, and data sharing while preventing unauthorized access or data breaches.

In the government sector, virtualization security is used to protect classified information, secure communications, and manage sensitive virtual workloads. Government agencies rely on virtualization security to enforce access controls, monitor network traffic, and protect virtual infrastructure from advanced persistent threats (APTs) and state-sponsored attacks. For enterprises, virtualization security enables secure cloud adoption, supporting hybrid cloud strategies by ensuring secure data transfer, workload isolation, and compliance with industry-specific regulations. The expanding applications of virtualization security across these industries underscore its critical role in enhancing data protection, operational resilience, and regulatory compliance in virtualized environments.

What Drives Growth in the Virtualization Security Market?

The growth in the Virtualization Security market is driven by several factors, including increasing adoption of virtualization technologies, rising cybersecurity threats, and stringent regulatory requirements. One of the primary growth drivers is the widespread adoption of virtualization, as businesses shift workloads to virtual machines, containers, and cloud environments. As companies migrate to virtualized data centers and hybrid clouds, the need for specialized security solutions becomes critical to protect against vulnerabilities unique to virtual environments, such as VM sprawl, hypervisor attacks, and inter-VM traffic interception.The growing frequency and sophistication of cyberattacks have further fueled demand for virtualization security. As attackers develop advanced techniques to exploit virtual environments, organizations are investing in next-generation security solutions to defend against ransomware, malware, and zero-day exploits targeting virtual infrastructure. Technologies like AI-powered threat detection, micro-segmentation, and automated incident response have become essential to prevent breaches and minimize damage in virtualized networks. This proactive approach to security not only protects data but also ensures business continuity and operational resilience.

Strict regulatory requirements for data protection, such as GDPR, HIPAA, and CCPA, have also contributed to the adoption of virtualization security. Industries like finance, healthcare, and government require robust security measures to ensure compliance, prevent data leaks, and protect sensitive information hosted in virtual environments. Virtualization security solutions offer built-in compliance features, such as encryption, access controls, and audit trails, making them crucial for organizations aiming to meet regulatory standards while maintaining secure operations.

With ongoing innovations in AI-driven threat intelligence, cloud-native security tools, and network segmentation, the virtualization security market is poised for strong growth. These trends, combined with increasing demand for secure, scalable, and compliant virtual environments, make virtualization security a vital component of modern IT strategies focused on enhancing cybersecurity, supporting digital transformation, and ensuring regulatory compliance across various industries.

Report Scope

The report analyzes the Virtualization Security market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Component (Solutions, Services); Deployment (On-Premise, Cloud); End-Use (Service Providers, Enterprises).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Solutions Component segment, which is expected to reach US$3.4 Billion by 2030 with a CAGR of a 14.6%. The Services Component segment is also set to grow at 16.2% CAGR over the analysis period.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Virtualization Security Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Virtualization Security Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Virtualization Security Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as 10zig Technology Inc., CA Technologies, Centrify, Checkpoint, Cisco and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 36 companies featured in this Virtualization Security market report include:

- 10zig Technology Inc.

- CA Technologies

- Centrify

- Checkpoint

- Cisco

- Dell EMC

- ESET

- Fortinet

- Hewlett Packard Enterprise (HPE)

- Huawei

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- 10zig Technology Inc.

- CA Technologies

- Centrify

- Checkpoint

- Cisco

- Dell EMC

- ESET

- Fortinet

- Hewlett Packard Enterprise (HPE)

- Huawei

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 210 |

| Published | January 2026 |

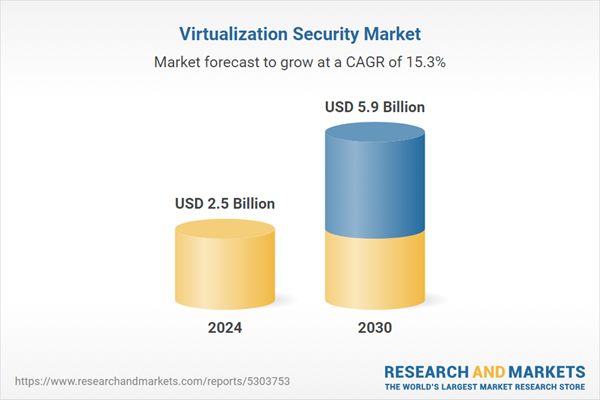

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 2.5 Billion |

| Forecasted Market Value ( USD | $ 5.9 Billion |

| Compound Annual Growth Rate | 15.3% |

| Regions Covered | Global |