Global Vaccine Contract Manufacturing Market - Key Trends & Drivers Summarized

What Is Vaccine Contract Manufacturing, and Why Is It So Crucial in Modern Healthcare?

Vaccine Contract Manufacturing involves outsourcing vaccine production to specialized contract development and manufacturing organizations (CDMOs). These CDMOs provide end-to-end services, including process development, scale-up, bulk production, formulation, fill-finish, packaging, and quality control. Vaccine manufacturers partner with CDMOs to leverage their expertise, technology, and facilities, allowing for faster, more cost-effective production. This approach is particularly beneficial for large pharmaceutical companies looking to expand capacity and for biotech startups that need to accelerate vaccine development without building their own infrastructure.The importance of vaccine contract manufacturing lies in its ability to rapidly scale up production, enhance flexibility, and ensure global access to vaccines, particularly in times of high demand, such as during pandemics or disease outbreaks. By enabling large-scale production, CDMOs help ensure that vaccines reach markets more quickly and at a lower cost, supporting public health initiatives worldwide. The COVID-19 pandemic underscored the critical role of contract manufacturing in meeting unprecedented global demand, with CDMOs helping pharmaceutical companies achieve faster approvals and large-scale vaccine distribution. As vaccine pipelines continue to expand and diversify - including vaccines for infectious diseases, cancer, and emerging pathogens - contract manufacturing has become indispensable in supporting efficient, reliable, and scalable vaccine production.

How Are Technological Advancements Shaping the Vaccine Contract Manufacturing Market?

Technological advancements have significantly improved the efficiency, scalability, and quality of Vaccine Contract Manufacturing, driving innovation in vaccine development and production. One of the major developments is the adoption of single-use bioreactor technology, which offers flexibility, faster turnaround times, and reduced contamination risks compared to traditional stainless-steel bioreactors. Single-use systems are particularly advantageous for producing viral vector vaccines, mRNA vaccines, and recombinant protein vaccines, allowing CDMOs to switch between different vaccine types quickly and cost-effectively.Advancements in mRNA vaccine production have also reshaped contract manufacturing, with CDMOs investing heavily in specialized mRNA synthesis, encapsulation, and lipid nanoparticle (LNP) technologies. These innovations allow for rapid scale-up and higher yields, supporting the development of mRNA vaccines not only for COVID-19 but also for other diseases like influenza, RSV, and cancer. Automation and digitalization are transforming vaccine production lines, improving process control, reducing human error, and enabling real-time monitoring. AI and machine learning tools are being integrated into vaccine manufacturing workflows to optimize production processes, enhance batch consistency, and accelerate quality control.

Another key advancement is in fill-finish technology, where automated aseptic filling systems, lyophilization (freeze-drying), and advanced packaging solutions have improved vaccine stability, shelf life, and distribution. These innovations ensure that vaccines are produced and packaged safely and efficiently, meeting stringent regulatory standards. CDMOs are also incorporating continuous manufacturing processes, which enable uninterrupted production and real-time quality assurance, improving efficiency and reducing costs. These technological innovations not only enhance the capacity and speed of vaccine production but also align with global demands for faster, more adaptable, and scalable manufacturing solutions.

What Are the Emerging Applications of Vaccine Contract Manufacturing Across Different Vaccine Types?

Vaccine Contract Manufacturing is finding expanding applications across a diverse range of vaccine types, driven by increasing demand for specialized production capabilities. For traditional vaccines like live-attenuated, inactivated, and subunit vaccines, CDMOs provide large-scale production facilities that meet Good Manufacturing Practice (GMP) standards, ensuring high-quality and reliable output. These vaccines remain critical for routine immunization programs, targeting diseases like polio, hepatitis, and measles. Contract manufacturers play a crucial role in scaling up production to meet global immunization needs, particularly in low - and middle-income countries where vaccine access is vital for public health.The production of next-generation vaccines, such as mRNA vaccines, DNA vaccines, and viral vector vaccines, has become a significant focus for contract manufacturing. CDMOs have rapidly adapted to support these innovative platforms, providing capabilities for mRNA synthesis, vector production, and viral encapsulation. For example, mRNA vaccines, which demonstrated rapid development and scalability during the COVID-19 pandemic, require specialized manufacturing processes that CDMOs are uniquely equipped to handle. The increasing focus on personalized cancer vaccines, which involve small-batch, patient-specific production, is also driving demand for CDMOs with flexible manufacturing setups that can accommodate small-scale, precision-focused production.

In addition to infectious disease vaccines, contract manufacturing is expanding into therapeutic vaccines targeting cancer, autoimmune diseases, and allergies. These vaccines often require complex production methods, including cell-based platforms, recombinant proteins, and novel adjuvant formulations. CDMOs are collaborating with biotech companies to develop and manufacture these therapeutic vaccines, ensuring efficient production and adherence to regulatory standards. The expanding applications of contract manufacturing across these vaccine types reflect its critical role in meeting diverse production needs, accelerating development timelines, and enabling broader access to life-saving vaccines.

What Drives Growth in the Vaccine Contract Manufacturing Market?

The growth in the Vaccine Contract Manufacturing market is driven by several factors, including the increasing demand for vaccines, the expansion of vaccine pipelines, and the need for scalable production solutions. One of the primary growth drivers is the rising global demand for vaccines, fueled by emerging infectious diseases, seasonal epidemics (e.g., influenza), and the need for mass immunization campaigns. The COVID-19 pandemic highlighted the urgency of scalable, rapid vaccine production, demonstrating the vital role of contract manufacturing in achieving global vaccination goals. As pharmaceutical companies and governments invest in pandemic preparedness and vaccine stockpiling, the reliance on CDMOs for surge capacity has increased, driving market growth.The diversification of vaccine pipelines, with the development of mRNA, DNA, viral vector, and protein-based vaccines for both infectious diseases and therapeutic applications, has also fueled the demand for contract manufacturing. Biotech companies, startups, and academic institutions often lack the infrastructure to produce vaccines at commercial scale, making CDMOs essential partners in bringing these innovative vaccines to market. The rapid growth of mRNA vaccines beyond COVID-19 - targeting conditions like influenza, RSV, Zika virus, and personalized cancer vaccines - has further driven the need for specialized contract manufacturing capabilities, including mRNA synthesis, lipid nanoparticle encapsulation, and fill-finish services.

Regulatory support and government initiatives aimed at expanding vaccine manufacturing capacity, particularly in low - and middle-income countries, have also contributed to market growth. Governments are investing in infrastructure, partnerships, and technology transfer agreements with CDMOs to ensure local production capacity and improve access to vaccines. The push for more resilient global supply chains, driven by the need to mitigate supply disruptions and improve vaccine equity, has further accelerated demand for contract manufacturing. With ongoing innovations in vaccine technologies, production methods, and digitalization, the Vaccine Contract Manufacturing market is poised for robust growth, supported by global efforts to improve public health, pandemic preparedness, and vaccine accessibility.

Report Scope

The report analyzes the Vaccine Contract Manufacturing market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Vaccine Type (Attenuated, Inactivated, Subunit-based, Toxoid-based, DNA-based); Application (Human, Veterinary).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Attenuated Vaccine segment, which is expected to reach US$2.6 Billion by 2030 with a CAGR of a 7.2%. The Inactivated Vaccine segment is also set to grow at 6.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.2 Billion in 2024, and China, forecasted to grow at an impressive 11.4% CAGR to reach $1.8 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Vaccine Contract Manufacturing Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Vaccine Contract Manufacturing Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Vaccine Contract Manufacturing Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Ajinomoto Althea, Inc., Albany Molecular Research, Inc., Catalent, Inc., Cobra Bio, Cytovance Biologics and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 34 companies featured in this Vaccine Contract Manufacturing market report include:

- Ajinomoto Althea, Inc.

- Albany Molecular Research, Inc.

- Catalent, Inc.

- Cobra Bio

- Cytovance Biologics

- Fujifilm Diosynth Biotechnologies U.S.A., Inc.

- Icon plc

- IDT Biologika

- KBI Biopharma

- Lonza

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Ajinomoto Althea, Inc.

- Albany Molecular Research, Inc.

- Catalent, Inc.

- Cobra Bio

- Cytovance Biologics

- Fujifilm Diosynth Biotechnologies U.S.A., Inc.

- Icon plc

- IDT Biologika

- KBI Biopharma

- Lonza

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 274 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

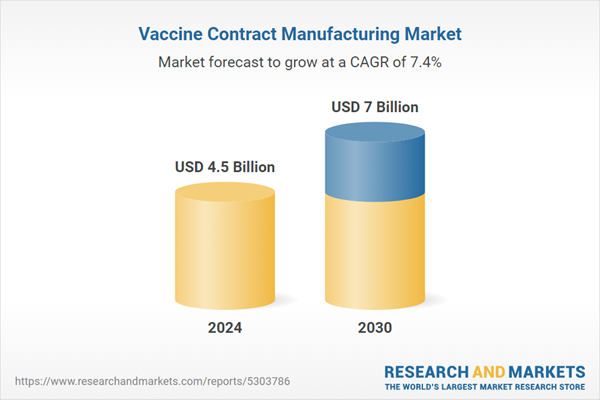

| Estimated Market Value ( USD | $ 4.5 Billion |

| Forecasted Market Value ( USD | $ 7 Billion |

| Compound Annual Growth Rate | 7.4% |

| Regions Covered | Global |