Global Pre-Engineered Buildings Market - Key Trends & Drivers Summarized

What Are Pre-Engineered Buildings (PEBs) And How Are They Transforming The Construction Industry?

Pre-engineered buildings (PEBs) are a modern construction solution where structures are fabricated off-site using a pre-determined design, and then assembled at the construction site. This method offers significant advantages over traditional construction techniques, particularly in terms of cost-efficiency, speed, and sustainability. PEBs are typically made of steel and are widely used in the construction of warehouses, factories, commercial complexes, and other industrial structures. The design of PEBs is optimized for efficient use of materials, reducing waste and allowing for quicker assembly once delivered to the site. These structures are customized to meet specific client needs while ensuring compliance with safety standards and local regulations.One of the most transformative aspects of PEBs is their speed of construction. Since components are pre-fabricated and delivered ready for assembly, construction timelines are drastically reduced compared to conventional methods. This makes PEBs an attractive option for projects with tight deadlines, such as industrial plants or large warehouses. Moreover, PEBs offer flexibility in design, allowing architects and engineers to customize layouts and structural features without sacrificing efficiency. As industries seek faster and more sustainable construction solutions, the use of pre-engineered buildings is becoming increasingly widespread across various sectors, helping businesses save on both time and costs.

How Is Technology Enhancing The Growth Of The Pre-Engineered Buildings Market?

Technological advancements are playing a key role in driving the adoption and expansion of the pre-engineered buildings market. Computer-aided design (CAD) and building information modeling (BIM) are revolutionizing the way PEBs are designed, enabling more precise, efficient, and customized building solutions. With the help of CAD software, engineers can design complex structures while optimizing material usage, reducing waste, and ensuring that the building components fit together seamlessly when assembled on-site. BIM further enhances this process by allowing for 3D modeling, which provides a holistic view of the building before it is constructed. These technologies also enable collaboration among architects, engineers, and contractors, ensuring that all aspects of the project are aligned and potential issues are identified early in the design phase.Additionally, advancements in materials technology are expanding the applications of PEBs beyond traditional industrial uses. The development of stronger, more durable steel alloys, for instance, allows PEBs to be used in larger, more complex structures like airports, sports arenas, and multi-story buildings. The integration of sustainable materials and green building technologies, such as energy-efficient insulation and solar panels, is also becoming more prevalent, further boosting the market for PEBs as industries and governments prioritize environmentally friendly construction. Modular construction techniques, where entire sections of the building are pre-fabricated and assembled on-site, are also being incorporated into PEB designs, streamlining construction processes even further.

In addition to design and materials, automation and robotics are becoming integral to the PEB manufacturing and assembly process. In factories, automated systems are used to fabricate steel components with high precision, reducing labor costs and improving production efficiency. Robotics is also increasingly being used on construction sites to assist in the assembly of these pre-fabricated components, making construction faster and safer. These technological advancements are significantly enhancing the overall quality, efficiency, and scalability of pre-engineered building solutions, positioning PEBs as a top choice for modern construction projects.

What Are The Key Applications And Benefits Of Pre-Engineered Buildings Across Various Sectors?

Pre-engineered buildings are used in a wide range of applications across different industries due to their versatility, durability, and cost-effectiveness. In the industrial sector, PEBs are commonly used for warehouses, factories, and manufacturing plants because they offer large, unobstructed spaces that can be customized to meet specific operational requirements. The ability to quickly assemble PEBs makes them ideal for expanding or relocating industrial operations. Additionally, PEBs can be designed to accommodate heavy machinery, loading docks, and specialized equipment, further enhancing their utility in industrial environments.In the commercial sector, PEBs are gaining popularity for the construction of shopping malls, office complexes, and sports facilities. The flexibility of pre-engineered designs allows developers to create aesthetically pleasing structures with open floor plans and customizable layouts. For instance, large retail stores and showrooms benefit from the open-space designs of PEBs, which allow for easy reconfiguration of the interior. Similarly, PEBs are being used for public infrastructure projects, such as airport terminals and railway stations, where speed, durability, and large span requirements are critical.

The agricultural sector also benefits from the use of pre-engineered buildings, particularly in the construction of storage facilities, barns, and cold storage units. PEBs are ideal for agricultural use because they can be quickly constructed to meet seasonal demands, such as crop storage, and they offer customizable temperature control solutions that are essential for preserving perishable goods. Furthermore, PEBs can be designed to be resistant to harsh environmental conditions, making them suitable for use in rural and remote areas.

The benefits of PEBs extend beyond their structural efficiency and rapid construction. They also offer significant cost savings due to the reduced need for manual labor, minimal material waste, and lower maintenance costs. PEBs are designed to be energy-efficient, and with the integration of modern insulation and solar technologies, they can reduce the operational costs associated with heating, cooling, and lighting. The prefabrication process also allows for better quality control since components are manufactured in a controlled environment, ensuring consistency and adherence to design specifications.

What Factors Are Driving Growth In The Pre-Engineered Buildings Market?

The growth in the Pre-Engineered Buildings (PEBs) market is driven by several factors, including increasing demand for cost-effective, time-efficient construction solutions, advancements in technology, and the rising emphasis on sustainability. One of the primary growth drivers is the need for faster construction methods across industries such as logistics, manufacturing, and commercial real estate. As businesses seek to reduce downtime and accelerate project timelines, PEBs offer a solution that allows for rapid construction without compromising on structural integrity or design flexibility. The ability to assemble these structures quickly makes them particularly attractive for industries that require large-scale facilities, such as warehouses, factories, and distribution centers.The push for sustainable construction practices is also playing a significant role in the growth of the PEB market. Governments and regulatory bodies around the world are implementing stricter building codes and environmental regulations, prompting developers to adopt construction methods that minimize waste and reduce carbon emissions. PEBs align with these goals, as they are typically made from recyclable materials like steel, and their efficient design reduces the overall energy consumption of buildings. Moreover, PEBs can be easily integrated with green technologies such as solar panels, rainwater harvesting systems, and energy-efficient insulation, making them a preferred choice for eco-conscious developers.

The expansion of infrastructure projects in developing economies is another key driver of the PEB market. Rapid urbanization, particularly in Asia-Pacific, the Middle East, and Latin America, has led to an increased demand for affordable, scalable construction solutions. Governments and private developers are turning to PEBs for the construction of schools, hospitals, airports, and other public infrastructure, as these structures can be built quickly and cost-effectively. In addition, the increasing adoption of PEBs in the residential sector, particularly for affordable housing projects, is creating new growth opportunities in the market.

Finally, advancements in material science and design technologies are expanding the range of applications for PEBs, further driving market growth. As the strength and durability of steel alloys improve, and as design software becomes more sophisticated, PEBs are being used for larger, more complex projects, including multi-story buildings and commercial hubs. The combination of these factors - speed, cost-efficiency, sustainability, and technological innovation - is expected to fuel continued growth in the pre-engineered buildings market in the coming years.

Report Scope

The report analyzes the Pre-Engineered Buildings market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Structure (Single-Storey, Multi-Storey); Application (Warehouses & Industrial, Commercial, Infrastructure, Other Applications).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Single-Storey Structure segment, which is expected to reach US$47.3 Billion by 2030 with a CAGR of a 13.3%. The Multi-Storey Structure segment is also set to grow at 10.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $7.6 Billion in 2024, and China, forecasted to grow at an impressive 16.3% CAGR to reach $14.3 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Pre-Engineered Buildings Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Pre-Engineered Buildings Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Pre-Engineered Buildings Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Allied Steel Buildings, Atad Steel Structure Corporation, ATCO, Bluescope, Emirates Building Systems and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 48 companies featured in this Pre-Engineered Buildings market report include:

- Allied Steel Buildings

- Atad Steel Structure Corporation

- ATCO

- Bluescope

- Emirates Building Systems

- Everest Industries

- Jindal Buildsys

- John Reid & Sons (Strucsteel)

- Kirby Building Systems

- Lindab Group

- Mabani Steel

- Memaar Building Systems

- Metal Building Manufacturers Inc.

- NCI Building Systems

- Norsteel Buildings

- Nucor Corporation

- Octamec Group

- PEB Steel

- PEBS Pennar

- Phenix Construction Technologies

- Rigid Global Buildings

- SML Group

- Steelway Building Systems

- Tiger Steel Engineering India (Tseil)

- Zamil Steel Holding Company

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Allied Steel Buildings

- Atad Steel Structure Corporation

- ATCO

- Bluescope

- Emirates Building Systems

- Everest Industries

- Jindal Buildsys

- John Reid & Sons (Strucsteel)

- Kirby Building Systems

- Lindab Group

- Mabani Steel

- Memaar Building Systems

- Metal Building Manufacturers Inc.

- NCI Building Systems

- Norsteel Buildings

- Nucor Corporation

- Octamec Group

- PEB Steel

- PEBS Pennar

- Phenix Construction Technologies

- Rigid Global Buildings

- SML Group

- Steelway Building Systems

- Tiger Steel Engineering India (Tseil)

- Zamil Steel Holding Company

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 285 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

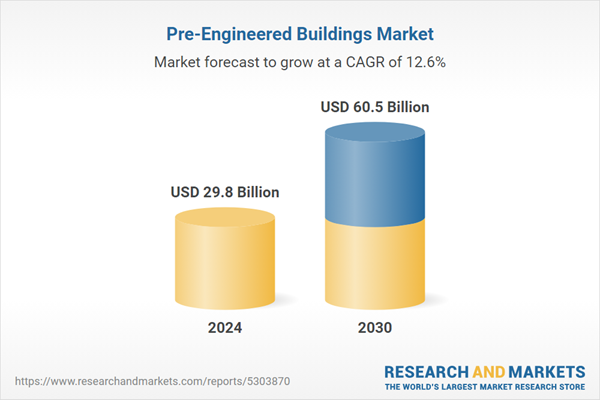

| Estimated Market Value ( USD | $ 29.8 Billion |

| Forecasted Market Value ( USD | $ 60.5 Billion |

| Compound Annual Growth Rate | 12.6% |

| Regions Covered | Global |