Global Predictive Genetic Testing and Consumer Genomics Market - Key Trends & Drivers Summarized

How Is Predictive Genetic Testing and Consumer Genomics Revolutionizing Personalized Healthcare?

Predictive genetic testing and consumer genomics are transforming healthcare by providing individuals with insights into their genetic makeup, enabling them to make more informed decisions about their health, disease risks, and lifestyle choices. Predictive genetic testing involves analyzing an individual's DNA to assess their susceptibility to certain diseases or conditions, such as cancer, cardiovascular disease, or diabetes. This form of testing empowers individuals and healthcare providers to implement proactive measures, such as lifestyle changes, early screenings, or preventive treatments, before the onset of symptoms. With the rise of personalized medicine, predictive genetic testing has become a vital tool in tailoring medical interventions to a person's genetic predisposition, enhancing treatment efficacy and minimizing adverse effects.In parallel, the consumer genomics industry has exploded in popularity, fueled by the availability of direct-to-consumer (DTC) genetic tests that offer insights into ancestry, health, and wellness traits. Companies like 23andMe, AncestryDNA, and others allow consumers to explore their genetic heritage, identify potential health risks, and even learn about traits such as physical attributes, food sensitivities, and athletic abilities. Consumer genomics has democratized access to genetic information, shifting genetic testing from the clinical environment into the hands of consumers. As the demand for personalized healthcare grows, both predictive genetic testing and consumer genomics are becoming central to modern healthcare, helping individuals take control of their health and promoting a more preventive approach to medicine.

What Technological Advancements Are Driving The Growth of Predictive Genetic Testing and Consumer Genomics?

Technological advancements, particularly in next-generation sequencing (NGS), bioinformatics, and data analytics, are propelling the growth of the predictive genetic testing and consumer genomics market. NGS technology has revolutionized the speed and cost of genetic sequencing, making it feasible to analyze large portions of the human genome rapidly and affordably. This technological leap has allowed companies and healthcare providers to offer more comprehensive genetic testing panels that can assess an individual's risk for a wide range of conditions. For example, hereditary cancer panels now analyze multiple genes related to breast, ovarian, and colorectal cancer risk, providing a more detailed and accurate assessment than earlier tests.Artificial intelligence (AI) and machine learning are also playing a crucial role in the interpretation of complex genetic data. AI algorithms are being used to analyze large genomic datasets, identify patterns, and predict disease risk with greater accuracy. These tools help clinicians and genetic counselors interpret the results of genetic tests more effectively, improving patient outcomes by providing personalized treatment and prevention plans. Additionally, advancements in bioinformatics are enabling researchers to uncover the links between specific genetic variants and diseases, paving the way for new diagnostics and therapies.

Moreover, consumer genomics is benefiting from innovations in digital platforms and mobile applications that allow consumers to easily access, interpret, and share their genetic data. Many companies now offer personalized health insights and recommendations through user-friendly apps, which provide consumers with actionable information related to diet, exercise, and wellness based on their genetic profiles. The integration of digital health tools with genomics is making it easier for individuals to manage their health in real time, further boosting the demand for genetic testing.

How Are Privacy Concerns And Regulatory Changes Impacting The Market?

The rapid growth of predictive genetic testing and consumer genomics has raised significant concerns about data privacy and security. As consumers share more of their genetic information with testing companies, questions around how this data is stored, used, and shared have come to the forefront. Genetic data is highly sensitive, as it contains detailed information about an individual's health, ancestry, and biological traits. The potential misuse of this data by third parties, such as insurance companies, employers, or marketers, is a major concern for consumers. In response, regulatory bodies in several countries have implemented or are considering legislation to protect genetic data.In the United States, the Genetic Information Nondiscrimination Act (GINA) prohibits health insurers and employers from using genetic information to make decisions about coverage or employment. However, GINA does not cover life insurance, disability insurance, or long-term care insurance, which leaves gaps in genetic privacy protection. The European Union's General Data Protection Regulation (GDPR) includes stringent rules on data privacy and the handling of personal information, including genetic data. These regulations require companies to obtain explicit consent from consumers before collecting or sharing genetic information and provide consumers with the right to access, correct, or delete their data.

As regulatory frameworks evolve, genetic testing companies must prioritize data security and transparency in how they handle consumer information. Leading companies are increasingly adopting encryption, anonymization, and strict data access controls to safeguard genetic data from breaches. Additionally, many companies offer customers the option to control how their data is used, such as participating in research or sharing their data with third-party partners. Privacy concerns, while valid, have not significantly slowed the growth of the industry, as consumers continue to seek the benefits of genetic testing. However, the implementation of robust regulatory standards and data protection practices will be key to maintaining consumer trust and ensuring the long-term success of the market.

What Are The Key Growth Drivers In The Predictive Genetic Testing And Consumer Genomics Market?

The growth in the predictive genetic testing and consumer genomics market is driven by several factors, including advancements in technology, rising consumer demand for personalized healthcare, and increased awareness of genetic health risks. One of the primary growth drivers is the decreasing cost of genetic sequencing, which has made genetic testing more accessible to a broader population. As the cost of sequencing a genome continues to fall, more consumers are able to afford tests that provide personalized insights into their health and ancestry, driving the demand for consumer genomics services. The development of more affordable and comprehensive testing panels for conditions like cancer, cardiovascular diseases, and rare genetic disorders is also expanding the clinical applications of predictive genetic testing.Rising awareness of the benefits of preventive healthcare is another key factor driving the market. Consumers are increasingly recognizing the value of understanding their genetic risks for diseases, enabling them to take proactive steps to manage their health. Healthcare providers are also embracing predictive genetic testing as a tool to guide personalized treatment plans and improve patient outcomes, particularly in oncology and cardiology. This trend is supported by an increasing number of insurance companies that are beginning to cover certain genetic tests, further promoting their adoption.

Additionally, the expansion of direct-to-consumer (DTC) genetic testing is a significant growth driver. Consumer genomics companies have successfully tapped into the growing interest in ancestry, wellness, and personalized health insights. By offering convenient, at-home genetic testing kits, these companies have made it easy for consumers to access genetic information without needing to visit a healthcare provider. As more consumers become interested in understanding their genetics, the DTC genomics market continues to expand, with companies introducing new features, such as diet and exercise recommendations based on genetic profiles.

Finally, the increasing integration of genomics into healthcare systems is expected to further boost the growth of the market. Governments and healthcare organizations are investing in genomics research and personalized medicine initiatives, such as the U.S. Precision Medicine Initiative and the UK's 100,000 Genomes Project. These efforts are driving innovation in the development of new diagnostics, treatments, and preventive strategies based on genetic information. The combination of consumer demand, technological advancements, and support from the healthcare industry is expected to propel the predictive genetic testing and consumer genomics market forward in the coming years.

Report Scope

The report analyzes the Predictive Genetic Testing and Consumer Genomics market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Test Type (Predictive Testing, Consumer Genomics, Wellness Genomics); Setting Type (DTC, Professional).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Predictive Genetic Testing and Consumer Genomics Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Predictive Genetic Testing and Consumer Genomics Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

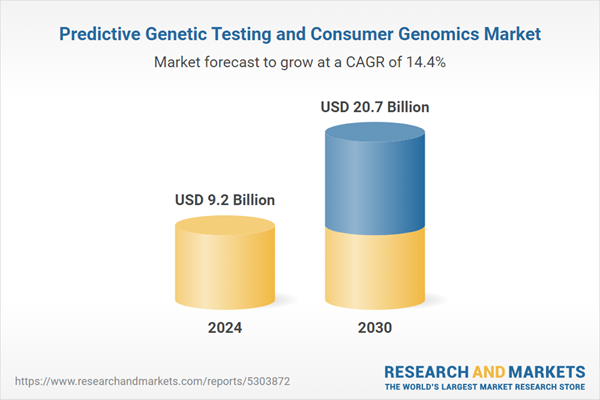

- How is the Global Predictive Genetic Testing and Consumer Genomics Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as 23andMe, Inc., 454 Life Sciences Corporation, Abbott Laboratories, Advanced Genomic Solutions (AGS) Ltd., Affymetrix, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 33 companies featured in this Predictive Genetic Testing and Consumer Genomics market report include:

- 23andMe, Inc.

- 454 Life Sciences Corporation

- Abbott Laboratories

- Advanced Genomic Solutions (AGS) Ltd.

- Affymetrix, Inc.

- Agilent Technologies, Inc.

- Amgen, Inc.

- Applied Biosystems

- ARUP Laboratories

- BGI

- Bio-Rad Laboratories, Inc.

- Cepheid

- Color Genomics, Inc.

- Cooper Surgical, Inc.

- Danaher Corporation

- EasyDNA

- F. Hoffmann-La Roche Ltd.

- Gene by Gene

- Guardant Health, Inc.

- Hologic, Inc. (Gen-Probe Incorporated)

- Illumina, Inc.

- Konica Minolta, Inc. (Ambry Genetics Corporation)

- Laboratory Corporation of America Holdings

- Mapmygenome

- Myriad Genetics, Inc.

- Myriad Genetics, Inc. (Counsyl, Inc.)

- Orig3n (Interleukin Genetics Inc.)

- Pathway Genomics

- Positive Biosciences, Ltd.

- QIAGEN

- Quest Diagnostics Incorporated

- Siemens

- Thermo Fisher Scientific, Inc.

- Xcode Life

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- 23andMe, Inc.

- 454 Life Sciences Corporation

- Abbott Laboratories

- Advanced Genomic Solutions (AGS) Ltd.

- Affymetrix, Inc.

- Agilent Technologies, Inc.

- Amgen, Inc.

- Applied Biosystems

- ARUP Laboratories

- BGI

- Bio-Rad Laboratories, Inc.

- Cepheid

- Color Genomics, Inc.

- Cooper Surgical, Inc.

- Danaher Corporation

- EasyDNA

- F. Hoffmann-La Roche Ltd.

- Gene by Gene

- Guardant Health, Inc.

- Hologic, Inc. (Gen-Probe Incorporated)

- Illumina, Inc.

- Konica Minolta, Inc. (Ambry Genetics Corporation)

- Laboratory Corporation of America Holdings

- Mapmygenome

- Myriad Genetics, Inc.

- Myriad Genetics, Inc. (Counsyl, Inc.)

- Orig3n (Interleukin Genetics Inc.)

- Pathway Genomics

- Positive Biosciences, Ltd.

- QIAGEN

- Quest Diagnostics Incorporated

- Siemens

- Thermo Fisher Scientific, Inc.

- Xcode Life

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 267 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 9.2 Billion |

| Forecasted Market Value ( USD | $ 20.7 Billion |

| Compound Annual Growth Rate | 14.4% |

| Regions Covered | Global |