Global Powertrain Sensors Market - Key Trends & Drivers Summarized

What Is Driving The Rising Demand For Powertrain Sensors?

The powertrain sensors market is experiencing significant growth, driven by the increasing demand for more efficient, safe, and environmentally friendly vehicles. Powertrain sensors play a critical role in ensuring optimal engine performance, fuel efficiency, and emissions control, making them essential components in modern vehicles. As automotive manufacturers continue to develop more complex and technologically advanced powertrains, the need for high-precision sensors that monitor various parameters, such as temperature, pressure, speed, and position, is becoming more critical. Additionally, the global push for stricter emission standards and fuel efficiency regulations is compelling automakers to adopt powertrain sensors that help monitor and optimize engine performance, particularly in internal combustion engines (ICE), hybrid, and electric vehicles (EVs). The shift toward electrification and the increasing adoption of electric vehicles (EVs) is also driving the demand for specialized powertrain sensors, particularly for monitoring battery performance, electric motors, and inverters. As consumers and governments place greater emphasis on reducing carbon footprints, the role of powertrain sensors in improving overall vehicle efficiency and reducing emissions has become more pronounced.How Are Technological Innovations Impacting The Powertrain Sensors Market?

Technological advancements are reshaping the powertrain sensors market, enabling the development of more accurate, reliable, and durable sensors capable of withstanding the harsh operating conditions of automotive powertrains. One of the key trends in this market is the increasing adoption of micro-electromechanical systems (MEMS) technology in the design of powertrain sensors. MEMS sensors are highly compact, offer greater precision, and consume less power compared to traditional sensor technologies, making them ideal for modern vehicles that require multiple sensors for various functions. Another significant advancement is the development of wireless powertrain sensors, which eliminate the need for complex wiring systems and reduce overall vehicle weight. Wireless sensors also offer greater flexibility in sensor placement and enable real-time data transmission to vehicle control units, enhancing overall vehicle performance and efficiency.The rise of electric and hybrid vehicles has spurred innovations in powertrain sensor technology, particularly in areas such as battery management systems and electric motor monitoring. For instance, new-generation sensors can monitor battery temperature, voltage, and current in real-time, ensuring optimal battery performance and preventing overheating or failure. In electric vehicles, sensors that monitor the performance of inverters and motors are critical for maintaining the efficiency of the powertrain system. Additionally, advancements in sensor fusion technology, which combines data from multiple sensors, are enabling more accurate and comprehensive monitoring of vehicle powertrains, particularly in autonomous and connected vehicles. These technological innovations are not only enhancing the capabilities of powertrain sensors but are also making them more affordable and accessible for automakers, driving their widespread adoption across various vehicle segments.

How Are Regulatory Standards And Environmental Concerns Shaping The Market?

Stricter environmental regulations and fuel efficiency standards are key drivers of the powertrain sensors market, particularly as governments worldwide intensify their efforts to reduce vehicle emissions and promote cleaner technologies. Regulatory bodies, such as the U.S. Environmental Protection Agency (EPA) and the European Union (EU), have implemented stringent emission standards that require automakers to adopt advanced powertrain technologies to meet lower CO2 emission targets. In response, automakers are increasingly relying on powertrain sensors to optimize fuel combustion, monitor exhaust gas recirculation, and ensure the effective operation of catalytic converters and other emissions control systems. For example, oxygen sensors, which monitor the air-fuel mixture in combustion engines, are crucial for ensuring that engines operate efficiently and within emission limits.In addition to emissions regulations, fuel efficiency mandates are driving the adoption of powertrain sensors that enhance engine performance and reduce fuel consumption. Powertrain sensors, such as temperature, pressure, and position sensors, enable real-time monitoring of engine components, allowing for precise control of fuel injection, ignition timing, and turbocharger performance. The growing emphasis on fuel efficiency and reduced carbon footprints is also evident in the electric and hybrid vehicle market, where sensors play a critical role in managing battery systems, electric motors, and regenerative braking systems.

As consumers become more environmentally conscious, automakers are under increasing pressure to develop greener, more fuel-efficient vehicles, further propelling the demand for powertrain sensors. Moreover, government incentives and subsidies for electric vehicles are encouraging automakers to accelerate the development and adoption of advanced sensor technologies that enhance the efficiency and reliability of electric powertrains. The combination of regulatory pressures, consumer demand, and environmental concerns is shaping the future of the powertrain sensors market and driving innovation in sensor technologies.

What Factors Are Driving Growth In The Powertrain Sensors Market?

The growth in the powertrain sensors market is driven by several key factors, including the increasing complexity of vehicle powertrains, the rise of electric and hybrid vehicles, and the growing focus on vehicle safety and performance. One of the primary drivers is the automotive industry's shift toward electrification and the increasing adoption of electric vehicles (EVs). As the powertrain architecture of EVs differs significantly from traditional internal combustion engines, new types of sensors are required to monitor critical components such as batteries, electric motors, and inverters. For instance, powertrain sensors that monitor battery temperature and voltage are essential for maintaining battery health and performance, while sensors that track electric motor speed and position are crucial for optimizing energy efficiency in EV powertrains.Another key driver is the increasing adoption of advanced driver assistance systems (ADAS) and autonomous driving technologies, which require highly accurate and reliable powertrain sensors to ensure safe and efficient vehicle operation. Sensors that monitor engine speed, torque, and transmission performance are integral to the functioning of ADAS systems, which rely on real-time data to make critical decisions regarding vehicle control and navigation. The demand for powertrain sensors is also being fueled by the rising trend of vehicle connectivity, as automakers increasingly adopt telematics and connected car technologies that require continuous monitoring of powertrain performance to provide real-time diagnostics and predictive maintenance services.

Moreover, the growing consumer demand for vehicles with enhanced fuel efficiency, lower emissions, and better performance is pushing automakers to invest in advanced sensor technologies that can optimize powertrain operation. The increasing use of turbocharged engines, direct fuel injection systems, and hybrid powertrains is creating a need for more sophisticated sensors that can monitor and control complex engine and transmission systems. Finally, the development of smart sensors that offer real-time data analytics and predictive maintenance capabilities is further driving the growth of the powertrain sensors market, as automakers and fleet operators seek to reduce downtime, improve vehicle reliability, and enhance overall performance. These factors, combined with the ongoing technological advancements and regulatory pressures, are expected to propel the powertrain sensors market forward in the coming years.

Report Scope

The report analyzes the Powertrain Sensors market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Propulsion Type (ICE, EV); Subsystem (Engine, Drivetrain, Exhaust); Vehicle Type (Light-Duty, Heavy-Duty).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Regional Analysis

Gain insights into the U.S. market, valued at $6.1 Billion in 2024, and China, forecasted to grow at an impressive 4.9% CAGR to reach $5.5 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Powertrain Sensors Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Powertrain Sensors Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Powertrain Sensors Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Allegro Microsystems, Amphenol Technologies, AMS AG, Continental, Cts Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 36 companies featured in this Powertrain Sensors market report include:

- Allegro Microsystems

- Amphenol Technologies

- AMS AG

- Continental

- Cts Corporation

- Denso

- Hella

- Hyundai Kefico

- Infineon Technologies

- Littlefuse

- Melexis

- Mitsubishi Electric Corporation

- NXP Semiconductors

- Robert Bosch

- Semitec Electronics

- Sensata Technologies

- Tdk-Micronas

- TE Connectivity

- Texas Instruments

- Valeo

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Allegro Microsystems

- Amphenol Technologies

- AMS AG

- Continental

- Cts Corporation

- Denso

- Hella

- Hyundai Kefico

- Infineon Technologies

- Littlefuse

- Melexis

- Mitsubishi Electric Corporation

- NXP Semiconductors

- Robert Bosch

- Semitec Electronics

- Sensata Technologies

- Tdk–Micronas

- TE Connectivity

- Texas Instruments

- Valeo

Table Information

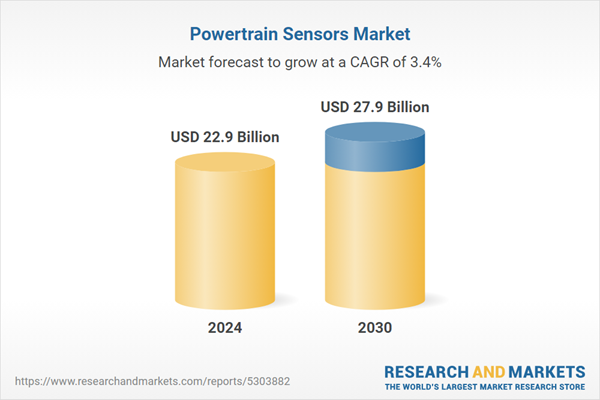

| Report Attribute | Details |

|---|---|

| No. of Pages | 363 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 22.9 Billion |

| Forecasted Market Value ( USD | $ 27.9 Billion |

| Compound Annual Growth Rate | 3.4% |

| Regions Covered | Global |