Global Pipeline and Process Services Market - Key Trends & Drivers Summarized

What Are Pipeline and Process Services and How Are They Used in the Energy Industry?

Pipeline and Process Services (PPS) refer to the range of services provided to ensure the safe, efficient, and reliable operation of pipelines and associated infrastructure in the oil & gas, petrochemical, and power generation industries. These services include the commissioning, maintenance, testing, and decommissioning of pipelines and process facilities. The goal is to optimize the performance of these critical assets while minimizing downtime and ensuring compliance with safety and environmental regulations. PPS encompasses a wide range of activities such as pipeline cleaning, pigging, hydrostatic testing, nitrogen purging, leak detection, and drying.In the oil & gas sector, pipelines are the lifelines of energy distribution, transporting crude oil, natural gas, and refined products across vast distances. Ensuring the integrity and performance of these pipelines is crucial to avoiding leaks, spills, and disruptions in supply. PPS companies provide specialized expertise and equipment to clean pipelines, remove contaminants, inspect for damage or corrosion, and ensure that the pipeline operates within its design parameters. These services are also vital in process facilities, such as refineries and chemical plants, where process lines and equipment must be cleaned, tested, and maintained to ensure safe and efficient operations.

How Are Technological Advancements Impacting the Pipeline and Process Services Market?

Technological advancements are playing a significant role in enhancing the efficiency and accuracy of pipeline and process services, particularly in areas such as inspection, testing, and maintenance. One of the key advancements is the development of smart pigging technology. Smart pigs are inspection devices equipped with sensors that can detect defects, corrosion, and irregularities within pipelines while traveling through them. These devices provide real-time data on the internal condition of the pipeline, allowing operators to identify potential issues before they lead to costly leaks or failures. Advances in smart pigging technology have improved the accuracy and resolution of inspections, making it easier to detect even minor defects that could compromise pipeline integrity.Another important advancement is the use of robotics and drones for pipeline inspections and maintenance tasks. Drones equipped with high-resolution cameras and thermal imaging sensors are being used to inspect pipelines in remote or hazardous locations, reducing the need for manual inspections and improving safety. Similarly, robots designed for internal pipeline inspections can navigate tight spaces and harsh environments, providing detailed visual and sensor-based data that helps operators assess the condition of the pipeline.

Data analytics and digital twin technology are also having a significant impact on the PPS market. Digital twins are virtual models of physical pipelines or process facilities that can simulate real-time conditions and predict potential issues based on data collected from sensors. By analyzing data from pipeline operations, digital twins allow operators to optimize maintenance schedules, improve efficiency, and reduce the risk of failures. These advancements are helping pipeline operators move from reactive to predictive maintenance strategies, minimizing downtime and extending the lifespan of assets.

What Are the Emerging Trends in the Pipeline and Process Services Market?

Several emerging trends are shaping the future of the pipeline and process services market, driven by technological advancements, regulatory pressures, and the evolving needs of the energy industry. One significant trend is the increasing focus on pipeline integrity management. With the aging of pipeline infrastructure in many regions, particularly in North America and Europe, maintaining the integrity of pipelines has become a top priority. Operators are investing in advanced inspection technologies, corrosion prevention techniques, and pipeline monitoring systems to ensure the safety and reliability of their assets. Integrity management programs are being implemented to comply with stricter regulatory requirements and to prevent accidents that could result in environmental damage and financial losses.Another key trend is the rise of environmentally friendly services in response to growing concerns about the environmental impact of the energy sector. PPS companies are developing greener solutions for pipeline cleaning and maintenance, using non-toxic chemicals, biodegradable cleaning agents, and innovative techniques to reduce waste and emissions. Additionally, the shift toward natural gas and renewable energy sources is driving demand for services that support the transition to cleaner energy, such as nitrogen purging and drying services for natural gas pipelines.

Automation and remote monitoring technologies are also becoming more prevalent in the PPS market. Automated systems for pipeline monitoring, including leak detection and flow control, are enabling operators to manage pipelines more efficiently and respond quickly to potential issues. Remote monitoring technologies, combined with artificial intelligence (AI) and machine learning, are enhancing the ability to predict pipeline failures and optimize maintenance schedules.

What Is Driving the Growth of the Pipeline and Process Services Market?

The growth in the pipeline and process services market is driven by several factors, including the increasing demand for energy, the need to maintain and upgrade aging pipeline infrastructure, and advancements in pipeline inspection and maintenance technologies. One of the primary drivers is the global demand for oil and gas, which continues to grow despite the push for renewable energy. As the oil & gas industry expands, the need for efficient and reliable pipeline infrastructure becomes even more critical. Pipeline and process services are essential to ensuring that pipelines operate safely and efficiently, reducing the risk of leaks, spills, and operational downtime.Another important factor is the aging of pipeline infrastructure in key regions such as North America and Europe. Many pipelines in these regions were installed decades ago and require regular maintenance, inspection, and upgrades to remain operational. As governments and regulatory agencies impose stricter safety and environmental regulations, pipeline operators are turning to PPS companies to help them meet these requirements while maintaining the integrity of their assets.

Technological innovations in pipeline inspection, cleaning, and monitoring are also contributing to market growth. The development of smart pigging, robotics, drones, and digital twin technology is making it easier for pipeline operators to monitor and maintain their infrastructure, improving operational efficiency and reducing the risk of failures. These advancements, combined with the growing demand for cleaner energy and sustainable solutions, are expected to drive continued growth in the pipeline and process services market in the coming years.

Report Scope

The report analyzes the Pipeline and Process Services market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Asset Type (Pipeline, Process); Operation (Maintenance, Pre-Commissioning & Commissioning, Decommissioning).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Pipeline Asset segment, which is expected to reach US$3.5 Billion by 2030 with a CAGR of a 6%. The Process Asset segment is also set to grow at 7% CAGR over the analysis period.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Pipeline and Process Services Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Pipeline and Process Services Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Pipeline and Process Services Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Altus Intervention, BHGE, Bluefin Group, Chenergy, EnerMech and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 38 companies featured in this Pipeline and Process Services market report include:

- Altus Intervention

- BHGE

- Bluefin Group

- Chenergy

- EnerMech

- Halliburton

- Hydratight

- IKM

- IPEC

- Techfem

- Trans Asia Pipelines

- Tucker Energy Services

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Altus Intervention

- BHGE

- Bluefin Group

- Chenergy

- EnerMech

- Halliburton

- Hydratight

- IKM

- IPEC

- Techfem

- Trans Asia Pipelines

- Tucker Energy Services

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 272 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

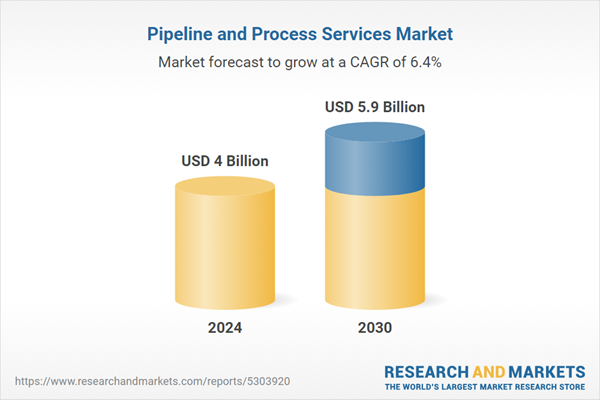

| Estimated Market Value ( USD | $ 4 Billion |

| Forecasted Market Value ( USD | $ 5.9 Billion |

| Compound Annual Growth Rate | 6.4% |

| Regions Covered | Global |