Global Physical Vapor Deposition (PVD) Market - Key Trends & Drivers Summarized

How Does Physical Vapor Deposition (PVD) Technology Enhance Product Coating Solutions?

Physical Vapor Deposition (PVD) is a cutting-edge thin-film coating process used to enhance the surface properties of various materials by applying a durable, functional, and often decorative layer. PVD technology involves vaporizing a solid material into a plasma state and then depositing it onto a target surface in a controlled environment, typically inside a vacuum chamber. This process results in a thin film with improved hardness, wear resistance, corrosion protection, and, in some cases, aesthetic appeal. The PVD method is versatile and is commonly used in industries such as electronics, automotive, medical devices, aerospace, and cutting tools.One of the primary advantages of PVD over traditional coating techniques is its environmentally friendly nature. The process does not involve harmful chemicals or produce hazardous waste, making it an eco-conscious solution. Additionally, PVD coatings are highly durable and resistant to extreme temperatures, oxidation, and corrosion, extending the lifespan of coated products. In industries like automotive and aerospace, PVD coatings are critical for components exposed to harsh environments, where performance reliability is essential. Furthermore, in electronics, PVD coatings are used to improve the conductivity and durability of components like semiconductors, enhancing the performance and longevity of electronic devices.

What Are the Latest Technological Advancements in PVD Coatings?

The PVD market has witnessed rapid technological advancements that have significantly enhanced the capabilities and applications of PVD coatings. Innovations such as high-power impulse magnetron sputtering (HiPIMS), ion plating, and pulsed laser deposition are pushing the boundaries of what PVD coatings can achieve in terms of thickness, adhesion, and functional performance. HiPIMS, for example, allows for higher ionization rates during deposition, resulting in coatings with superior density and adhesion, making it ideal for applications requiring extreme wear resistance, such as cutting tools and engine components.Another major advancement in PVD technology is the use of multi-layer coatings that combine several thin films with different properties to create a composite coating that offers enhanced performance. For instance, combining hard ceramic coatings with lubricating layers can significantly reduce friction and wear in mechanical components. Additionally, nanostructured PVD coatings are gaining traction in sectors like healthcare and electronics, where ultra-thin coatings are required for precision components like microelectromechanical systems (MEMS), sensors, and medical implants.

The PVD process has also become more adaptable and precise thanks to advancements in automation and robotics. Modern PVD systems equipped with automated control panels and AI-driven data analytics can precisely monitor the deposition process in real-time, ensuring consistent quality and reducing human error. These innovations have expanded the range of applications for PVD coatings and made the process more efficient, cost-effective, and scalable for mass production.

How Are End-Use Industries Driving the Demand for PVD Coatings?

PVD technology's versatility has made it indispensable across several end-use industries, each of which drives demand in unique ways. In the automotive industry, the need for lightweight, wear-resistant, and corrosion-resistant components has increased the demand for PVD-coated engine parts, gear systems, and decorative trim. Automakers are focused on improving fuel efficiency and reducing emissions, and the use of lightweight materials with PVD coatings enhances durability while reducing overall vehicle weight. PVD coatings are also used for aesthetic purposes in luxury vehicles, where high-quality, scratch-resistant finishes are preferred for interior and exterior trim components.In the electronics sector, PVD is critical for the miniaturization of electronic components. With devices like smartphones, tablets, and wearables becoming more compact, PVD coatings are used to protect sensitive components such as semiconductors, sensors, and display screens from environmental damage and wear. The ability of PVD to create ultra-thin, highly durable films makes it ideal for electronics where space and precision are paramount.

The medical industry is another key driver of the PVD market, particularly for applications such as surgical instruments, implants, and medical devices. PVD coatings provide biocompatibility, improved wear resistance, and reduced friction for implants like hip joints, pacemakers, and stents. These coatings also enhance the durability and sharpness of surgical tools, leading to improved performance in medical procedures. As healthcare technologies continue to evolve, particularly in areas like minimally invasive surgery and wearable medical devices, the demand for PVD coatings is expected to grow.

What Factors Are Driving Growth in the PVD Market?

The growth in the physical vapor deposition (PVD) market is driven by several factors, including technological advancements, rising demand in key end-use industries, and a growing focus on sustainability. One of the primary drivers is the expansion of the electronics industry, where the demand for miniaturized, high-performance components has surged. The ongoing trend toward smaller, more powerful electronic devices has increased the need for precise, thin-film coatings that offer superior protection and performance, making PVD coatings indispensable in this sector.The automotive industry's shift toward electric vehicles (EVs) is another significant driver of market growth. EV manufacturers are increasingly adopting lightweight materials, such as aluminum and composites, to improve fuel efficiency and extend battery range. PVD coatings play a critical role in enhancing the durability and functionality of these lightweight components, particularly in high-stress environments like engines and drivetrains. As the global EV market continues to expand, the demand for advanced PVD coatings is expected to grow in tandem.

Additionally, the medical device and healthcare sector is seeing rapid growth due to the increasing need for biocompatible, durable coatings for implants, surgical tools, and diagnostic devices. PVD's ability to create coatings that are both functional and biocompatible makes it a popular choice for manufacturers in this sector. With the aging population and rising healthcare demands, the need for PVD-coated medical devices is projected to continue rising. Finally, the push for environmentally friendly manufacturing processes is driving the adoption of PVD technology across industries. Unlike traditional coating methods that rely on chemical solutions, PVD is a clean and environmentally safe process that does not produce harmful by-products or hazardous waste. As industries strive to reduce their environmental footprint, PVD offers a sustainable alternative that meets both regulatory requirements and consumer expectations. These factors, combined with ongoing innovations in coating technology, are expected to propel the PVD market forward over the coming years.

Report Scope

The report analyzes the Physical Vapor Deposition market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Category (PVD Equipment, PVD Materials, PVD Services); Application (Microelectronics, Data Storage, Solar Products, Cutting Tools, Medical Equipment, Other Applications).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the PVD Equipment segment, which is expected to reach US$16.4 Billion by 2030 with a CAGR of a 4.9%. The PVD Materials segment is also set to grow at 5.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $5.6 Billion in 2024, and China, forecasted to grow at an impressive 8.5% CAGR to reach $6.1 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Physical Vapor Deposition Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Physical Vapor Deposition Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Physical Vapor Deposition Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Advanced Energy Industries, Inc., AJA International, Inc., Angstrom Engineering, Inc., Applied Materials, Inc., CHA Industries and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 36 companies featured in this Physical Vapor Deposition market report include:

- Advanced Energy Industries, Inc.

- AJA International, Inc.

- Angstrom Engineering, Inc.

- Applied Materials, Inc.

- CHA Industries

- Denton Vacuum

- IHI HAUZER B.V.

- Impact Coatings AB

- Intevac, Inc.

- Johnsen Ultravac

- Kurt J. Lesker Co.

- Kurt J. Lesker Company

- Novellus Systems

- Penta Technology

- Plasma Quest Limited

- Platit AG

- PVD Products, Inc.

- Richter Precision, Inc.

- Semicore Equipment, Inc.

- Singulus Technologies AG

- Sulzer Metaplas

- Suzhou) Co. Ltd.

- ULVAC, Inc.

- Veeco Instruments

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Advanced Energy Industries, Inc.

- AJA International, Inc.

- Angstrom Engineering, Inc.

- Applied Materials, Inc.

- CHA Industries

- Denton Vacuum

- IHI HAUZER B.V.

- Impact Coatings AB

- Intevac, Inc.

- Johnsen Ultravac

- Kurt J. Lesker Co.

- Kurt J. Lesker Company

- Novellus Systems

- Penta Technology

- Plasma Quest Limited

- Platit AG

- PVD Products, Inc.

- Richter Precision, Inc.

- Semicore Equipment, Inc.

- Singulus Technologies AG

- Sulzer Metaplas

- Suzhou) Co. Ltd.

- ULVAC, Inc.

- Veeco Instruments

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 282 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

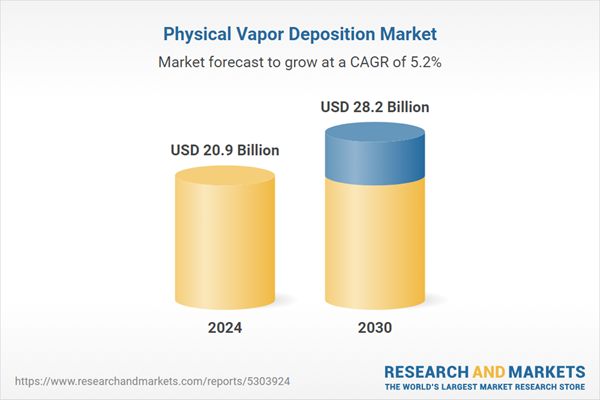

| Estimated Market Value ( USD | $ 20.9 Billion |

| Forecasted Market Value ( USD | $ 28.2 Billion |

| Compound Annual Growth Rate | 5.2% |

| Regions Covered | Global |