Global Pharmaceutical Processing Seals Market - Key Trends & Drivers Summarized

What Are Pharmaceutical Processing Seals and How Are They Used?

Pharmaceutical processing seals are critical components used in pharmaceutical manufacturing equipment to prevent leakage, contamination, and ensure the integrity of drug production processes. These seals are designed to withstand the stringent demands of pharmaceutical processing, which often involves exposure to extreme temperatures, aggressive chemicals, high pressures, and strict hygiene requirements. The role of seals in pharmaceutical processing is paramount, as even minor leaks or contamination could compromise the safety and efficacy of drug products. Seals are used in a variety of equipment, including mixers, reactors, centrifuges, pumps, and valves, ensuring that all production phases - from raw material handling to final product packaging - meet the highest safety and regulatory standards.The importance of pharmaceutical processing seals has grown significantly with the increasing complexity of drug formulations, particularly in the development of biologics, vaccines, and other sensitive drugs. These seals must meet the strictest regulatory requirements to ensure product purity and prevent contamination by external particles or microbes. Additionally, seals used in pharmaceutical manufacturing must be compatible with various sterilization methods, including steam sterilization and chemical cleaning processes. As a result, the demand for high-quality, FDA-compliant seals has surged, with manufacturers focusing on developing materials that offer enhanced durability, chemical resistance, and biocompatibility.

How Are Technological Advancements Shaping the Pharmaceutical Processing Seals Market?

Technological advancements have had a transformative impact on the pharmaceutical processing seals market, improving the performance, durability, and safety of seals used in drug manufacturing processes. One of the most significant innovations is the development of advanced sealing materials, such as perfluoroelastomers (FFKM), fluoroelastomers (FKM), and silicone-based seals, which offer superior resistance to aggressive chemicals, extreme temperatures, and sterilization processes. These high-performance materials are essential in pharmaceutical applications where standard materials may degrade under harsh conditions, leading to potential contamination or equipment failure. These materials ensure long-term performance and maintain the purity of pharmaceutical products, reducing the risk of costly recalls or production downtime. Another critical technological advancement is the rise of elastomeric coatings and surface treatments that enhance the chemical resistance, biocompatibility, and cleanliness of seals. These coatings prevent the buildup of product residues, facilitate easy cleaning, and improve the overall hygiene of manufacturing environments. Moreover, digitalization and automation are playing an increasingly important role in pharmaceutical processing, enabling real-time monitoring and predictive maintenance of seals and other critical components. Seals equipped with sensors and IoT capabilities can monitor the status of equipment in real-time, providing early warnings of wear or failure, thus preventing unplanned downtime and ensuring continuous manufacturing processes.What Are the Emerging Trends in the Pharmaceutical Processing Seals Market?

Several emerging trends are shaping the future of the pharmaceutical processing seals market, driven by advancements in drug development and the evolving demands of pharmaceutical manufacturers. One of the key trends is the increasing focus on biopharmaceuticals, including biologics, vaccines, and gene therapies. These highly complex and sensitive drug products require sterile processing environments, and any compromise in the sealing systems could result in contamination or loss of product efficacy. As a result, there is growing demand for seals that offer superior sterility, chemical resistance, and biocompatibility to meet the stringent requirements of biopharmaceutical production. Manufacturers are increasingly investing in the development of seals that can withstand the rigorous cleaning, sterilization, and operating conditions of biopharma manufacturing processes. Another significant trend is the shift toward single-use technologies (SUTs) in pharmaceutical processing. Single-use systems, which are designed for one-time use and then discarded, reduce the risk of cross-contamination and eliminate the need for complex cleaning validation processes. Seals used in these systems must meet the same high standards of performance and safety as traditional processing seals, but they must also be cost-effective and easy to install and replace. This trend is particularly important in the production of personalized medicines and small-batch biologics, where flexibility and fast turnaround times are critical. Sustainability is also becoming a key consideration in the pharmaceutical processing seals market. As pharmaceutical manufacturers strive to reduce their environmental footprint, there is growing interest in seals made from recyclable or biodegradable materials. Additionally, the push for more energy-efficient production processes is driving the development of seals that reduce energy consumption and improve the overall efficiency of pharmaceutical manufacturing equipment. This focus on sustainability is expected to shape the future of seal design, with manufacturers exploring new materials and production methods that align with global sustainability goals.What Is Driving Growth in the Pharmaceutical Processing Seals Market?

The growth in the pharmaceutical processing seals market is driven by several factors, including the increasing complexity of drug manufacturing, stringent regulatory requirements, and advancements in drug delivery systems. One of the key drivers is the growing demand for biologics and biosimilars, which require highly specialized manufacturing environments. The need for sterility, chemical resistance, and compliance with regulatory standards in biopharmaceutical production has fueled the demand for high-quality seals that can withstand the unique challenges posed by these complex drug products. As the biologics market continues to expand, the demand for advanced pharmaceutical processing seals is expected to grow accordingly. Another important factor driving market growth is the rising focus on compliance with Good Manufacturing Practices (GMP) and other regulatory guidelines. Regulatory agencies such as the FDA and EMA have stringent requirements regarding the materials used in pharmaceutical processing equipment, including seals. Pharmaceutical companies must ensure that their equipment meets these requirements to avoid product recalls, regulatory penalties, and potential harm to patients. As a result, there is increased investment in high-quality, FDA-compliant seals that can ensure product safety and integrity throughout the manufacturing process. Technological innovations in sealing materials and manufacturing processes are also contributing to market growth. The development of advanced elastomers and coatings that offer enhanced performance in aggressive chemical and sterilization environments has opened new opportunities for pharmaceutical seal manufacturers. These innovations are helping companies reduce downtime, improve operational efficiency, and maintain compliance with regulatory standards, further driving demand for advanced seals. Additionally, the shift toward single-use systems in pharmaceutical manufacturing is driving demand for seals that can be easily integrated into these disposable systems. Single-use technologies offer significant advantages in terms of reducing contamination risks and simplifying cleaning processes, making them increasingly popular in biopharmaceutical and small-batch drug production. The growing focus on sustainability and the development of eco-friendly seals are also shaping the market, as manufacturers seek solutions that align with global efforts to reduce waste and minimize environmental impact. These factors, combined with the expansion of the global pharmaceutical industry, are expected to continue driving growth in the pharmaceutical processing seals market.Report Scope

The report analyzes the Pharmaceutical Processing Seals market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (O-Rings, Gaskets, Lip Seals, D-Seals, Other Types); Material (Metals, PTFE, Silicone, Nitrile Rubber, EPDM, Other Materials); Application (Manufacturing Equipment, Other Applications).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the O-Rings segment, which is expected to reach US$2.8 Billion by 2030 with a CAGR of a 9.4%. The Gaskets segment is also set to grow at 7.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $789.8 Million in 2024, and China, forecasted to grow at an impressive 12.3% CAGR to reach $1.3 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Pharmaceutical Processing Seals Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Pharmaceutical Processing Seals Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Pharmaceutical Processing Seals Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Flowserve Corporation, Freudenberg Group, Garlock, IDEX Corporation, James Walker and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Pharmaceutical Processing Seals market report include:

- Flowserve Corporation

- Freudenberg Group

- Garlock

- IDEX Corporation

- James Walker

- John Crane

- Marco Rubber & Plastic Products Inc.

- Morgan Advanced Materials PLC

- Parker Hannifin Corporation

- Saint-Gobain S.A.

- Smiths Group Plc

- Technetics Group

- Trelleborg AB

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Flowserve Corporation

- Freudenberg Group

- Garlock

- IDEX Corporation

- James Walker

- John Crane

- Marco Rubber & Plastic Products Inc.

- Morgan Advanced Materials PLC

- Parker Hannifin Corporation

- Saint-Gobain S.A.

- Smiths Group Plc

- Technetics Group

- Trelleborg AB

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 387 |

| Published | January 2026 |

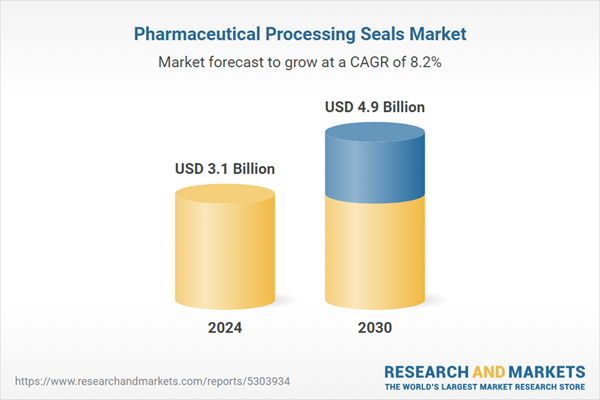

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 3.1 Billion |

| Forecasted Market Value ( USD | $ 4.9 Billion |

| Compound Annual Growth Rate | 8.2% |

| Regions Covered | Global |