How Has the Pet Food Processing Market Evolved Over the Years?

The pet food processing market has evolved significantly in response to the growing demand for high-quality, nutritionally rich, and specialized pet foods. Initially, pet food production was focused on basic kibble manufacturing, using simple processes that combined protein, grains, and fillers into dry food for convenience. However, with the increasing trend of pet humanization and rising awareness of pet nutrition, the pet food market has shifted toward more diverse, premium, and health-focused offerings. This has led to the integration of advanced food processing technologies aimed at preserving the nutritional content, enhancing flavors, and improving the texture of pet food products.The shift toward grain-free, organic, and functional foods that support specific health conditions such as joint care, skin health, and digestion has pushed manufacturers to adopt more sophisticated processing methods. These methods include extrusion, baking, and freeze-drying to retain nutrients while offering different formats like wet food, semi-moist products, and treats. The increasing focus on pet health and wellness has prompted manufacturers to innovate with new ingredients, such as plant-based proteins, superfoods, and novel animal proteins, to cater to the evolving preferences of pet owners.

How Are Technological Advancements Shaping the Pet Food Processing Market?

Technological advancements are driving significant improvements in the pet food processing industry, enabling manufacturers to enhance product quality, increase production efficiency, and meet consumer demands for specialized diets. Extrusion technology is one of the most widely used processes in the pet food industry, allowing manufacturers to produce consistent, high-quality dry food (kibble) while incorporating diverse ingredients, such as alternative proteins and health-promoting additives. Modern extrusion technology has also evolved to create products with varying textures and moisture levels, such as semi-moist food and high-protein treats.Freeze-drying and dehydration techniques

have gained popularity, especially in the production of premium and raw pet food products. These processes help retain the nutritional value of ingredients, such as vitamins, minerals, and enzymes, while extending the product's shelf life without the need for preservatives. This is particularly important in raw or minimally processed pet food, which appeals to pet owners looking for more natural and nutritious options for their pets.Automation and robotics

are transforming pet food processing plants by improving operational efficiency, reducing labor costs, and ensuring consistent product quality. These technologies help streamline production, from ingredient mixing and cooking to packaging, ensuring that pet food products meet safety and quality standards. Additionally, sustainability-focused innovations in processing, such as energy-efficient machinery and reduced water consumption, are becoming more prominent as manufacturers seek to reduce their environmental impact and cater to eco-conscious consumers.How Is Changing Consumer Behavior Impacting the Pet Food Processing Market?

The increasing awareness of pet health and wellness is significantly impacting the pet food processing market. As pet owners become more concerned with the quality and origin of the ingredients in their pets' food, there is a growing demand for products that are natural, organic, and free from artificial preservatives. This has pushed manufacturers to adopt cleaner processing techniques that maintain the nutritional integrity of the ingredients while avoiding synthetic additives.Pet owners are also seeking personalized nutrition for their pets, mirroring trends in human food. This has led to increased demand for specialized pet food products tailored to specific breeds, life stages, and health conditions. For example, pet food designed for puppies may focus on growth and development, while senior pets might require food enriched with ingredients that support joint health and digestion. These personalized nutritional needs are driving pet food processors to innovate with diverse ingredient blends and precise nutrient formulations.

The trend toward alternative proteins has also emerged in the pet food market, driven by consumers' interest in sustainability and the environmental impact of traditional meat production. Plant-based proteins, insect protein, and novel animal proteins (like venison and duck) are gaining popularity, and manufacturers are adapting their processing methods to handle these ingredients while maintaining the flavor and texture that pets enjoy.

What Factors Are Driving Growth in the Pet Food Processing Market?

The growth of the pet food processing market is driven by several key factors, including the rising trend of pet humanization, technological advancements in food processing, and increasing consumer demand for premium and specialized pet food products. As pets are increasingly treated as family members, pet owners are willing to invest in higher-quality foods that offer better nutrition and health benefits. This has led to an increase in demand for premium, organic, and functional pet foods that target specific dietary needs, such as weight management, skin and coat health, or digestive support.Technological innovations in processing techniques, such as extrusion, freeze-drying, and high-pressure processing, have enabled manufacturers to produce a wider variety of pet food products with enhanced textures, flavors, and nutritional content. These technologies allow for the inclusion of diverse ingredients, such as superfoods, probiotics, and plant-based proteins, catering to the growing demand for clean-label and functional pet foods.

The rise in pet ownership and growing awareness of pet health and wellness, particularly in developing markets, are also fueling the demand for high-quality pet food. As disposable incomes rise and pet owners become more educated about the benefits of proper nutrition, the pet food processing market is expected to continue its upward trajectory.

Report Scope

The report analyzes the Pet Food Processing market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Form (Dry, Wet); Type (Forming, Mixing & Blending, Baking & Drying, Coating, Cooling, Other Types); Application (Dog Food, Cat Food, Fish Food, Other Applications).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Dry Form segment, which is expected to reach US$5.4 Billion by 2030 with a CAGR of a 5.2%. The Wet Form segment is also set to grow at 6.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.5 Billion in 2024, and China, forecasted to grow at an impressive 8.6% CAGR to reach $1.8 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Pet Food Processing Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Pet Food Processing Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Pet Food Processing Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Andritz Group, Baker Perkins Ltd., Big Heart Pet Brands, Blue Buffalo Co., Ltd., Buhler Holding AG and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Pet Food Processing market report include:

- Andritz Group

- Baker Perkins Ltd.

- Big Heart Pet Brands

- Blue Buffalo Co., Ltd.

- Buhler Holding AG

- Clextral SAS

- Coperion GMBH

- Diamond Pet Foods

- F.N. Smith Corporation

- GEA Group

- Heristo Aktiengesellschaft

- Hill's Pet Nutrition

- Mars Petcare US Inc.

- Mepaco Group

- Nestle Purina PetCare

- Precision Food Innovations

- Procter & Gamble Company

- Reading Bakery Systems

- Selo

- The Middleby Corporation

- Tiernahrung Deuerer GmbH

- WellPet LLC

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Andritz Group

- Baker Perkins Ltd.

- Big Heart Pet Brands

- Blue Buffalo Co., Ltd.

- Buhler Holding AG

- Clextral SAS

- Coperion GMBH

- Diamond Pet Foods

- F.N. Smith Corporation

- GEA Group

- Heristo Aktiengesellschaft

- Hill's Pet Nutrition

- Mars Petcare US Inc.

- Mepaco Group

- Nestle Purina PetCare

- Precision Food Innovations

- Procter & Gamble Company

- Reading Bakery Systems

- Selo

- The Middleby Corporation

- Tiernahrung Deuerer GmbH

- WellPet LLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 384 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

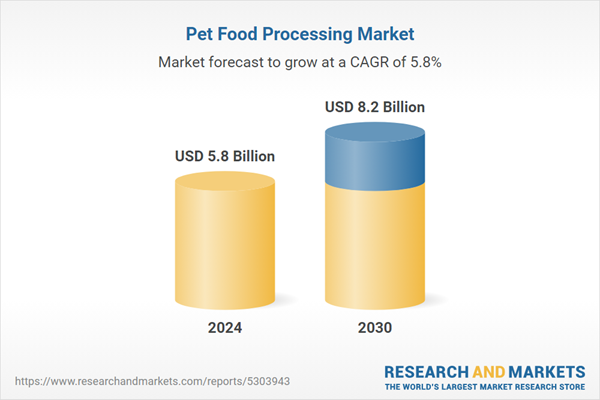

| Estimated Market Value ( USD | $ 5.8 Billion |

| Forecasted Market Value ( USD | $ 8.2 Billion |

| Compound Annual Growth Rate | 5.8% |

| Regions Covered | Global |