Global Polyurethane (PU) Sealants Market - Key Trends & Drivers Summarized

What Are Polyurethane Sealants and Why Are They Vital in Construction and Industrial Applications?

Polyurethane (PU) sealants are a type of adhesive material designed to create durable, flexible, and watertight seals between various substrates. These sealants are valued for their excellent adhesion, flexibility, durability, and resistance to environmental factors such as moisture, UV radiation, and temperature fluctuations. They are used extensively in industries such as construction, automotive, aerospace, and packaging, where long-lasting bonds and effective sealing are required to prevent air, water, or chemical penetration. The unique properties of PU sealants make them suitable for both interior and exterior applications, as they can accommodate the natural movement of materials without cracking or losing adhesion over time.In the construction industry, polyurethane sealants are critical for sealing joints in buildings, bridges, roads, and other infrastructure projects. They are used in applications such as expansion joints, window and door frames, roofing, and concrete surfaces, where their flexibility allows them to absorb movement caused by thermal expansion, contraction, and structural settling. This ability to maintain a strong, watertight seal while flexing with the building materials is essential in preventing water infiltration and ensuring the long-term durability of structures.

Additionally, PU sealants are highly resistant to chemicals, oils, and solvents, making them ideal for industrial applications where exposure to harsh environments is common. In sectors such as automotive, aerospace, and marine, PU sealants are used to seal and bond components that are exposed to high stress, vibration, and extreme environmental conditions. Their ability to create a weatherproof and durable seal ensures the safety, efficiency, and longevity of critical systems and components, such as fuel tanks, windows, doors, and seams in vehicles and aircraft.

How Are Technological Advancements Shaping the Polyurethane Sealants Market?

Technological advancements are driving innovation in the polyurethane sealants market, enabling the development of new formulations with improved performance, sustainability, and ease of application. One of the most notable trends is the increasing focus on low-VOC and eco-friendly polyurethane sealants. As industries move toward reducing their environmental footprint and complying with stricter regulations, there is a growing demand for sealants that emit fewer volatile organic compounds (VOCs) during application and curing. Low-VOC PU sealants offer the same high-performance characteristics as traditional sealants while minimizing harmful emissions, making them suitable for indoor use and environmentally conscious projects. These formulations are particularly important in sectors such as construction and automotive, where sustainability and air quality are becoming top priorities.Another key advancement is the development of fast-curing PU sealants. In applications such as construction and automotive assembly, where time is a critical factor, fast-curing sealants allow for quicker installation and faster turnaround times. These sealants are designed to cure rapidly without sacrificing strength or flexibility, enabling manufacturers and contractors to complete projects more efficiently. Fast-curing polyurethane sealants are especially valuable in large-scale infrastructure projects and in industries where minimizing downtime is essential, such as transportation and industrial manufacturing.

The emergence of hybrid polyurethane sealants, which combine polyurethane chemistry with other polymers such as silane-modified polyethers (SMPs) or silicones, is also gaining traction. These hybrid sealants offer the best of both worlds, combining the flexibility, adhesion, and durability of polyurethane with the weatherability, UV resistance, and ease of use of silicone-based sealants. Hybrid PU sealants are particularly useful in outdoor applications where exposure to harsh environmental conditions such as sunlight, rain, and temperature fluctuations is common. They are increasingly used in construction, marine, and automotive industries for applications requiring long-term resistance to UV radiation, moisture, and extreme weather.

Advances in application technology are also shaping the polyurethane sealants market. Modern application tools and automated dispensing systems make it easier to apply PU sealants with precision, improving efficiency and reducing waste. For example, robotic systems are increasingly being used in automotive assembly lines to apply sealants with high precision, ensuring consistent and reliable seals in critical areas. Additionally, spray-applied polyurethane sealants are gaining popularity in the construction industry for waterproofing large areas such as roofs and basements, where traditional application methods may be time-consuming and labor-intensive.

What Are the Key Applications and End-Use Sectors for Polyurethane Sealants?

Polyurethane sealants are used in a wide range of applications across diverse industries due to their superior adhesion, flexibility, and resistance to environmental stressors. One of the largest application sectors for PU sealants is the construction industry, where they are essential for sealing joints, cracks, and gaps in buildings and infrastructure. PU sealants are commonly used in expansion joints, concrete repair, roofing, and waterproofing applications, as they provide durable, flexible seals that can withstand movement and prevent water infiltration. Their ability to bond to a variety of substrates such as concrete, wood, metal, and glass makes them versatile solutions for both new construction and renovation projects.In the automotive industry, PU sealants are used extensively in vehicle assembly and maintenance. They are applied to seal body seams, windows, doors, and windshields, providing protection against moisture, dust, and air leakage. PU sealants are also used in vibration damping and noise reduction, helping improve vehicle comfort and performance. Their resistance to high temperatures, chemicals, and UV radiation ensures long-term durability in harsh environments, making them a preferred choice for automotive manufacturers looking to improve vehicle safety and efficiency.

The aerospace industry also relies on PU sealants for sealing and bonding critical components in aircraft and spacecraft. PU sealants are used to seal fuel tanks, cabin windows, and structural joints, where they provide resistance to pressure changes, temperature extremes, and chemical exposure. The lightweight nature of PU sealants, combined with their strong bonding properties, makes them ideal for use in weight-sensitive applications where maintaining the integrity of seals is essential for safety and performance.

In the marine and shipbuilding sectors, PU sealants are used to seal decks, hulls, and underwater components, where resistance to saltwater, moisture, and UV exposure is critical. These sealants are also used to bond components such as windows, doors, and hatches, ensuring water and weatherproof seals in harsh marine environments. Their flexibility and durability make PU sealants suitable for use in applications that are exposed to constant movement, impact, and environmental stress.

The packaging industry is another significant market for polyurethane sealants, particularly in flexible packaging applications. PU sealants are used to bond and seal layers of plastic films in food packaging, medical packaging, and industrial packaging. Their ability to provide strong, flexible seals while maintaining barrier properties against moisture, air, and contaminants ensures the integrity and shelf life of packaged goods. Additionally, PU sealants are used in the packaging of electronic components, where their insulating properties help protect sensitive devices from damage.

What Factors Are Driving Growth in the Polyurethane Sealants Market?

The growth of the polyurethane sealants market is driven by several factors, including increasing demand from key industries such as construction, automotive, and aerospace, as well as technological advancements and the growing emphasis on sustainability. One of the primary growth drivers is the expansion of the construction industry, particularly in emerging markets. As urbanization accelerates and infrastructure development intensifies in regions such as Asia-Pacific, Latin America, and the Middle East, the demand for durable, flexible sealants in building and infrastructure projects is rising. PU sealants, with their ability to withstand movement, environmental exposure, and long-term stress, are increasingly being used in large-scale construction projects to ensure the structural integrity and longevity of buildings.The automotive industry's focus on vehicle lightweighting and improved performance is another significant factor driving market growth. As automakers look to reduce vehicle weight to improve fuel efficiency and reduce emissions, PU sealants are increasingly being used as substitutes for traditional, heavier materials. Their lightweight, durable, and flexible properties make them ideal for sealing and bonding components in modern vehicles, where high performance and reduced weight are critical for improving overall efficiency and compliance with environmental regulations.

The growing emphasis on sustainability and eco-friendly materials is also influencing the polyurethane sealants market. With increasing consumer demand for green building materials and stricter environmental regulations, manufacturers are developing low-VOC and recyclable PU sealants that reduce harmful emissions during application and provide environmentally friendly solutions. The shift toward green construction practices and sustainable packaging is driving the demand for these eco-friendly sealants, particularly in regions such as Europe and North America, where sustainability goals are becoming increasingly important.

Technological advancements in fast-curing and hybrid sealant formulations are further boosting market growth. The development of high-performance hybrid polyurethane sealants that offer superior UV resistance, flexibility, and adhesion is opening up new opportunities in industries such as construction, marine, and automotive. As industries seek faster, more efficient, and long-lasting sealing solutions, the demand for technologically advanced PU sealants is expected to grow. Finally, the rising demand for waterproofing solutions in construction and infrastructure projects is contributing to the growth of the PU sealants market. PU sealants are widely used in waterproofing applications such as roofing, basements, and underground structures, where preventing water infiltration is critical for maintaining the integrity of buildings and infrastructure. As climate change leads to more extreme weather events, the need for effective waterproofing solutions is becoming increasingly important, further driving the demand for PU sealants.

Report Scope

The report analyzes the Polyurethane (PU) Sealants market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (One-Component, Two-Component); Application (Building & Construction, Automotive, Industrial, Marine, Other Applications).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

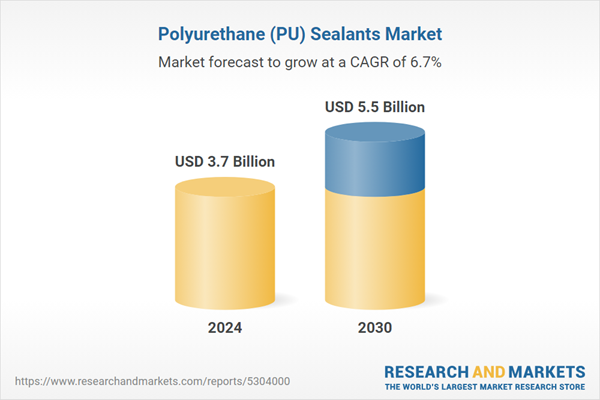

- Market Growth: Understand the significant growth trajectory of the One-Component PU Sealants segment, which is expected to reach US$3.7 Billion by 2030 with a CAGR of a 7%. The Two-Component PU Sealants segment is also set to grow at 6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $956.8 Million in 2024, and China, forecasted to grow at an impressive 9.9% CAGR to reach $1.3 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Polyurethane (PU) Sealants Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Polyurethane (PU) Sealants Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Polyurethane (PU) Sealants Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as 3M, Akfix, Arkema S.A., Asian Paints Limited, BASF SE and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 34 companies featured in this Polyurethane (PU) Sealants market report include:

- 3M

- Akfix

- Arkema S.A.

- Asian Paints Limited

- BASF SE

- EMS-Chemie Holding AG

- H.B. Fuller

- Henkel AG & Company KGaA

- Hodgson Sealants (Holdings) Ltd.

- Itw Polymer Sealants North America, Inc.

- KCC Corporation

- Kömmerling Chemische Fabrik Kg

- Konishi Co. Ltd.

- Mapei S.P.A.

- PCI Augsburg GmbH

- Pidilite Industries Limited

- RPM International Inc.

- Sel Dis Ticaret Ve Kimya Sanayi A.S.

- Selena SA

- Sika AG

- Soudal N.V.

- Splendor Industry Company Limited

- Sunstar Engineering, Inc.

- The DOW Chemical Company

- The Yokohama Rubber Co. Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- 3M

- Akfix

- Arkema S.A.

- Asian Paints Limited

- BASF SE

- EMS-Chemie Holding AG

- H.B. Fuller

- Henkel AG & Company KGaA

- Hodgson Sealants (Holdings) Ltd.

- Itw Polymer Sealants North America, Inc.

- KCC Corporation

- Kömmerling Chemische Fabrik Kg

- Konishi Co. Ltd.

- Mapei S.P.A.

- PCI Augsburg GmbH

- Pidilite Industries Limited

- RPM International Inc.

- Sel Dis Ticaret Ve Kimya Sanayi A.S.

- Selena SA

- Sika AG

- Soudal N.V.

- Splendor Industry Company Limited

- Sunstar Engineering, Inc.

- The DOW Chemical Company

- The Yokohama Rubber Co. Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 274 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 3.7 Billion |

| Forecasted Market Value ( USD | $ 5.5 Billion |

| Compound Annual Growth Rate | 6.7% |

| Regions Covered | Global |