Global Polyurethane (PU) Elastomers Market - Key Trends & Drivers Summarized

What Are Polyurethane Elastomers and Why Are They Essential in High-Performance Applications?

Polyurethane (PU) elastomers are a class of versatile materials known for their outstanding flexibility, abrasion resistance, toughness, and durability. These elastomers are formed through the reaction of diisocyanates with polyols, resulting in a polymer structure that exhibits both elastomeric and thermoplastic properties. Depending on the formulation, PU elastomers can be either thermosetting or thermoplastic, which determines their ability to be re-melted or re-shaped. They offer a balance between mechanical properties, chemical resistance, and elasticity, making them suitable for use in a wide range of applications that demand resilience and performance under stress.PU elastomers are widely used in industries such as automotive, construction, footwear, mining, and machinery due to their excellent abrasion and impact resistance. For example, in the automotive sector, they are used for suspension bushings, seals, and gaskets, where durability, resistance to wear, and flexibility are critical for maintaining performance under constant movement and vibration. In industrial applications, PU elastomers are favored for producing rollers, belts, and gears, as they can withstand extreme pressure and wear over extended periods. Their ability to endure harsh working conditions without losing elasticity makes them highly valuable in applications where mechanical strength and flexibility are required simultaneously.

Additionally, PU elastomers offer excellent resistance to oils, solvents, and chemicals, further broadening their utility in environments where exposure to chemicals is common, such as in chemical processing plants, oil and gas, and mining operations. Unlike many other elastomers, polyurethanes can be tailored to meet specific mechanical and thermal requirements, making them highly customizable. Their ability to perform consistently under dynamic loads, extreme temperatures, and abrasive conditions makes PU elastomers an indispensable material in numerous high-performance applications.

How Are Technological Advancements Shaping the Polyurethane Elastomers Market?

Technological advancements are significantly transforming the polyurethane elastomers market, driving the development of new formulations and expanding the range of applications. One of the major trends in recent years is the growing focus on bio-based PU elastomers. As industries move toward sustainability, bio-based PU elastomers derived from renewable resources such as plant-based polyols are gaining traction. These elastomers offer the same mechanical properties as traditional petrochemical-based elastomers but with a reduced carbon footprint. Bio-based PU elastomers are increasingly being used in the automotive and footwear industries, where companies are looking for greener alternatives to meet both regulatory demands and consumer preferences for eco-friendly products.Another key technological advancement is the development of high-performance thermoplastic polyurethane (TPU) elastomers, which are increasingly being used in applications requiring enhanced mechanical properties, such as higher wear resistance, better flexibility, and superior elongation. TPU elastomers can be re-melted and re-formed, providing manufacturers with greater flexibility in processing and recycling. This property is driving the adoption of TPU elastomers in industries such as footwear, electronics, and consumer goods, where recyclability and production efficiency are key priorities. TPUs are also being developed with improved resistance to UV light and harsh environmental conditions, allowing for expanded use in outdoor and industrial applications where long-term exposure to the elements is a concern.

In addition to bio-based and TPU advancements, nanotechnology is playing an increasingly important role in enhancing the performance of PU elastomers. By incorporating nanoparticles such as silica, carbon nanotubes, or graphene into PU elastomer formulations, manufacturers can significantly improve the material's mechanical strength, abrasion resistance, and thermal conductivity. These nanocomposites are finding applications in industries where enhanced durability and performance are critical, such as aerospace, automotive, and industrial machinery. Nanotechnology is also being leveraged to create PU elastomers with self-healing properties, which allow the material to repair minor damage autonomously, extending the lifespan of products and reducing maintenance costs.

Furthermore, 3D printing technology is expanding the potential applications of PU elastomers. 3D printing with PU elastomers is allowing for the production of complex, customized parts with excellent flexibility and durability. This technology is particularly valuable in industries such as healthcare, automotive, and sports equipment, where bespoke designs and precise geometries are required. As additive manufacturing continues to evolve, the use of PU elastomers in 3D-printed components is expected to grow, providing designers with more flexibility in developing innovative, high-performance products.

What Are the Key Applications and End-Use Sectors for Polyurethane Elastomers?

Polyurethane elastomers are used across a broad range of industries due to their exceptional flexibility, toughness, and resistance to wear, chemicals, and environmental stressors. In the automotive industry, PU elastomers are critical for applications such as suspension bushings, engine mounts, seals, gaskets, and shock absorbers. The elastomers' ability to withstand vibration, impact, and abrasion makes them ideal for use in parts that must endure constant movement and high stress. Additionally, their lightweight properties contribute to the overall reduction of vehicle weight, which improves fuel efficiency - a key goal for automotive manufacturers.In the industrial and mining sectors, polyurethane elastomers are widely used in the production of wheels, rollers, and belts that operate in highly abrasive environments. These elastomers offer superior abrasion resistance compared to traditional rubber and plastic materials, making them ideal for applications where heavy loads and continuous operation lead to significant wear. PU elastomers are also used in conveyor belts, mining screens, and chute liners, where their ability to resist cutting, tearing, and chemical exposure is critical for ensuring long service life and reducing downtime.

The footwear industry is another major market for polyurethane elastomers, particularly in the production of shoe soles and midsoles. PU elastomers provide excellent cushioning, flexibility, and durability, making them ideal for high-performance footwear, including athletic shoes and work boots. Additionally, their lightweight properties enhance comfort and reduce fatigue, which is especially important in applications such as hiking, running, and industrial footwear. With growing demand for sustainable and recyclable materials in footwear, bio-based PU elastomers are gaining popularity among manufacturers looking to offer environmentally friendly products.

In the construction industry, PU elastomers are used in sealants, gaskets, and insulation materials that require flexibility, durability, and resistance to environmental factors such as moisture, UV radiation, and temperature extremes. Polyurethane elastomers are also used in concrete molding and construction equipment parts, where their abrasion resistance and toughness ensure long-lasting performance under heavy use. Additionally, PU elastomers are employed in protective coatings and linings for construction equipment and building components, providing protection against wear, corrosion, and impact.

Healthcare is an emerging application area for polyurethane elastomers, where their biocompatibility, flexibility, and durability make them suitable for use in medical devices, prosthetics, and implants. PU elastomers are used in wound care products, catheters, and surgical instruments due to their ability to withstand sterilization processes and maintain their performance in harsh bodily environments. With advancements in medical technology, the demand for high-performance elastomers in healthcare applications is expected to grow, particularly in wearable medical devices and implants.

What Factors Are Driving Growth in the Polyurethane Elastomers Market?

The growth of the polyurethane elastomers market is driven by several key factors, including rising demand for high-performance materials in industrial, automotive, and consumer applications, as well as increasing focus on sustainability and technological advancements. One of the primary growth drivers is the expansion of the automotive industry, particularly the shift toward lightweight materials that improve fuel efficiency and reduce emissions. PU elastomers are increasingly being used as replacements for heavier materials in automotive components such as bushings, mounts, and seals, where their strength, flexibility, and durability are critical. Additionally, the rise of electric vehicles (EVs) is driving demand for lightweight and durable materials that improve battery efficiency and overall vehicle performance.The industrial sector's growing focus on efficiency and durability is also contributing to market growth. As industries such as mining, manufacturing, and logistics seek to minimize downtime and maintenance costs, the demand for wear-resistant and high-performance elastomers is increasing. PU elastomers are favored for their ability to withstand heavy loads, harsh environmental conditions, and continuous operation, making them a preferred choice for industrial wheels, rollers, and conveyor belts.

Technological advancements are playing a key role in expanding the potential applications of polyurethane elastomers. Innovations in bio-based PU elastomers, nanocomposites, and 3D printing are creating new opportunities for manufacturers to develop high-performance, sustainable products that meet the needs of modern industries. The growing emphasis on sustainability is also driving demand for recyclable and bio-based elastomers, as industries increasingly prioritize reducing their environmental impact and complying with stricter environmental regulations. Finally, the construction industry's growth, particularly in emerging markets, is contributing to increased demand for polyurethane elastomers. As urbanization and infrastructure development accelerate in regions such as Asia-Pacific and Latin America, the need for durable, flexible, and weather-resistant materials in construction is growing. PU elastomers, with their ability to withstand harsh environmental conditions, are being widely adopted in construction sealants, gaskets, and protective coatings, further driving market growth.

Report Scope

The report analyzes the Polyurethane (PU) Elastomers market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Thermoset PU Elastomers, Thermoplastic PU Elastomers); End-Use (Transportation, Industrial, Mining Equipment, Building & Construction, Medical, Other End-Uses).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Thermoset PU Elastomers segment, which is expected to reach US$9.9 Billion by 2030 with a CAGR of a 6.7%. The Thermoplastic PU Elastomers segment is also set to grow at 5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $2.6 Billion in 2024, and China, forecasted to grow at an impressive 9.1% CAGR to reach $3.3 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Polyurethane (PU) Elastomers Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Polyurethane (PU) Elastomers Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Polyurethane (PU) Elastomers Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Accella Polyurethane Systems, Asahi Kasei Corporation, BASF, Blackwell Plastics, Cellular Mouldings and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 43 companies featured in this Polyurethane (PU) Elastomers market report include:

- Accella Polyurethane Systems

- Asahi Kasei Corporation

- BASF

- Blackwell Plastics

- Cellular Mouldings

- Chemtura Corporation

- Coim Group

- Covestro

- ERA Polymers

- Headway Group

- Herikon

- Huntsman

- Inoac Corporation

- Kasodur Polyurethane

- Lubrizol

- Mitsui Chemicals

- P+S Polyurethan-Elastomere

- Perstorp

- Reckli

- RTP Company

- The Dow Chemical Company

- Tosoh

- Trelleborg

- VCM Polyurethanes

- Wanhua Chemical

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Accella Polyurethane Systems

- Asahi Kasei Corporation

- BASF

- Blackwell Plastics

- Cellular Mouldings

- Chemtura Corporation

- Coim Group

- Covestro

- ERA Polymers

- Headway Group

- Herikon

- Huntsman

- Inoac Corporation

- Kasodur Polyurethane

- Lubrizol

- Mitsui Chemicals

- P+S Polyurethan-Elastomere

- Perstorp

- Reckli

- RTP Company

- The Dow Chemical Company

- Tosoh

- Trelleborg

- VCM Polyurethanes

- Wanhua Chemical

Table Information

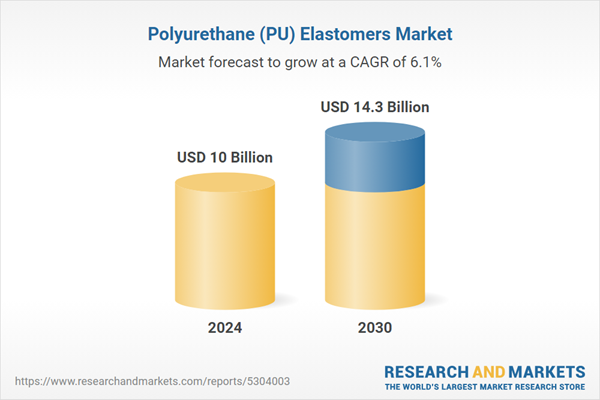

| Report Attribute | Details |

|---|---|

| No. of Pages | 286 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 10 Billion |

| Forecasted Market Value ( USD | $ 14.3 Billion |

| Compound Annual Growth Rate | 6.1% |

| Regions Covered | Global |