Global Polyols Market - Key Trends & Drivers Summarized

What Are Polyols and Why Are They Integral to Industrial Applications?

Polyols, also known as polyhydric alcohols, are a category of organic compounds characterized by the presence of multiple hydroxyl (OH) groups attached to their carbon backbone. These compounds play a crucial role in various industrial applications, particularly in the production of polyurethanes and other polymers. Polyols are broadly classified into two types: polyether polyols and polyester polyols. Polyether polyols are primarily used in flexible and rigid foams, coatings, and adhesives, while polyester polyols are typically employed in applications requiring greater mechanical strength, such as elastomers and high-performance coatings.Polyols are indispensable in the production of polyurethane foams, which find extensive use across a wide range of industries. Flexible polyurethane foams, for instance, are commonly used in furniture, mattresses, automotive seating, and packaging, while rigid foams are essential for thermal insulation in construction, refrigeration, and appliance manufacturing. Additionally, polyols serve as critical ingredients in the production of coatings, adhesives, sealants, and elastomers (CASE applications), where they impart flexibility, durability, and water resistance. Polyols are also gaining popularity in the food and beverage sector, where sugar alcohols (such as sorbitol and xylitol) are used as sugar substitutes in low-calorie and diabetic-friendly products. The versatility of polyols, combined with their ability to enhance the physical properties of end products, makes them an essential ingredient in numerous industries.

How Are Technological Advancements Shaping the Polyols Market?

Technological advancements are having a profound impact on the polyols market, particularly in the areas of sustainability, performance enhancement, and the development of bio-based alternatives. One of the most notable trends is the growing focus on bio-based polyols, which are derived from renewable sources such as vegetable oils, sugars, and waste biomass. Traditional polyols are typically derived from petrochemical feedstocks, but the push towards greener alternatives has led to significant innovations in bio-based polyol production. These bio-polyols offer comparable or even superior performance characteristics while reducing the carbon footprint of the final products. For example, soy-based polyols are being increasingly used in the production of flexible foams, coatings, and adhesives as part of an industry-wide effort to reduce reliance on fossil fuels.Another significant advancement is the improvement in polyol formulations to enhance specific properties, such as fire resistance, thermal stability, and mechanical strength. These advancements are particularly valuable in high-performance applications such as automotive, aerospace, and construction, where materials must meet stringent safety and performance standards. For example, innovations in flame-retardant polyols have led to the development of polyurethane foams and coatings that provide enhanced fire protection, a critical requirement in building insulation and automotive interiors. Similarly, polyols with improved UV resistance and hydrophobic properties are gaining traction in outdoor and marine applications, where exposure to harsh environmental conditions is a concern.

The ongoing development of circular economy solutions is also influencing the polyols market. As part of efforts to reduce waste and improve sustainability, chemical recycling technologies are being developed to recover and recycle polyols from end-of-life polyurethane products. These recycled polyols can be reintegrated into the production process, reducing the demand for virgin materials and minimizing environmental impact. This trend is gaining momentum, particularly in regions with stringent environmental regulations, where manufacturers are increasingly seeking ways to reduce waste and improve resource efficiency.

What Are the Main Applications and End-Use Sectors for Polyols?

Polyols are used across a wide array of industries, with their largest application being in the production of polyurethanes. Polyurethane foams, both rigid and flexible, account for a substantial portion of global polyol demand. In the furniture and bedding industry, flexible polyurethane foams are extensively used for cushioning materials, offering comfort, durability, and cost-effectiveness. Similarly, in the automotive sector, polyols are used to produce flexible foams for seating and interior components, where they provide cushioning and noise reduction. In the construction industry, rigid polyurethane foams are essential for thermal insulation in walls, roofs, and flooring systems, contributing to energy efficiency in buildings.Polyols are also widely used in CASE (coatings, adhesives, sealants, and elastomers) applications. Polyurethane coatings made from polyols provide excellent abrasion resistance, flexibility, and protection against corrosion, making them ideal for industrial and automotive applications. Adhesives and sealants produced from polyols offer strong bonding properties and durability, making them essential in industries such as construction, packaging, and automotive assembly. Additionally, polyols are integral to the production of elastomers, which are used in a variety of applications, including footwear, gaskets, and conveyor belts, where elasticity and wear resistance are crucial.

In the food and beverage industry, sugar alcohols like sorbitol, xylitol, and erythritol, which are types of polyols, are increasingly being used as low-calorie sweeteners. These sugar substitutes provide the sweetness of sugar without the associated calories, making them popular in products aimed at diabetic and health-conscious consumers. Beyond their role as sweeteners, polyols are used as humectants and stabilizers in food formulations, where they help maintain moisture and improve the texture of baked goods, confectionery, and dairy products.

Another emerging application for polyols is in the production of biodegradable plastics. As demand for sustainable materials grows, polyols are being incorporated into biodegradable polymer formulations, particularly in the packaging industry. This is part of a broader trend toward developing materials that not only perform well but also have a reduced environmental impact, reflecting the increasing consumer and regulatory pressure to minimize plastic waste.

What Is Driving Growth in the Polyols Market?

The growth in the polyols market is driven by several factors, including rising demand from end-use industries, advancements in bio-based polyols, and the growing focus on energy efficiency and sustainability. One of the primary growth drivers is the expanding construction industry, particularly in emerging markets. As urbanization continues to accelerate, the need for energy-efficient buildings is increasing, driving demand for rigid polyurethane foams for insulation purposes. These foams offer superior thermal insulation properties, helping reduce energy consumption in buildings and contributing to global efforts to combat climate change. In regions like Asia-Pacific, Latin America, and the Middle East, the rapid growth of infrastructure projects is further boosting the demand for polyols in construction applications. The automotive industry is another key driver of the polyols market. As the industry shifts towards lightweight materials to improve fuel efficiency and reduce emissions, the use of polyurethanes, produced from polyols, in automotive components is rising. Flexible polyurethane foams are widely used in car seats, armrests, and headliners due to their comfort, resilience, and lightweight properties. Additionally, polyurethanes are used in coatings, adhesives, and elastomers for various automotive applications, further driving demand for polyols in this sector.Another significant growth driver is the increasing consumer preference for sustainable and eco-friendly products. Bio-based polyols, which are derived from renewable resources, are gaining traction as an environmentally friendly alternative to conventional petrochemical-based polyols. This shift is driven by rising consumer awareness of environmental issues, coupled with stricter regulations on the use of fossil fuels and non-biodegradable plastics. Governments and regulatory bodies in regions such as Europe and North America are pushing for the adoption of bio-based and recyclable materials, creating new opportunities for the development and commercialization of bio-polyols. Finally, the growing demand for healthcare and personal care products is also contributing to the expansion of the polyols market. Sugar alcohols, such as sorbitol and xylitol, are increasingly being used as ingredients in a variety of personal care products, including toothpaste, chewing gum, and skincare formulations, due to their moisturizing and sweetening properties. As consumers become more health-conscious, the demand for low-calorie sweeteners and sugar-free alternatives is rising, further driving the market for polyols in the food and beverage industry. Overall, the combination of industrial growth, technological advancements, and evolving consumer preferences is expected to fuel the growth of the polyols market in the years to come.

Report Scope

The report analyzes the Polyols market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Polyether Polyols, Polyester Polyols); Application (Flexible Foam, Rigid Foam, Elastomers, Coatings, Adhesives & Sealants, Other Applications).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Polyether Polyols segment, which is expected to reach US$36.3 Billion by 2030 with a CAGR of a 7.1%. The Polyester Polyols segment is also set to grow at 6.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $9.2 Billion in 2024, and China, forecasted to grow at an impressive 10.2% CAGR to reach $12.6 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Polyols Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Polyols Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Polyols Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Arkema, BASF SE, Cargill, Incorporated, Coim Spa, Covestro AG and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 43 companies featured in this Polyols market report include:

- Arkema

- BASF SE

- Cargill, Incorporated

- Coim Spa

- Covestro AG

- Dic Corporation

- Dow

- Emery Oleochemicals

- Huntsman Corporation

- Jayant Agro-Organics Pvt. Ltd.

- Lanxess AG

- Manali Petrochemicals Limited

- Mitsui Chemicals

- PCC SE

- Perstorp Polyols Inc.

- Polygreen Chemicals

- Polylabs

- Repsol SA

- Royal Dutch Shell Plc

- Saudi Aramco

- Sinopec Corporation

- Solvay

- Stepan Company

- Tosoh Corporation

- Wanhua Chemical Group

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Arkema

- BASF SE

- Cargill, Incorporated

- Coim Spa

- Covestro AG

- Dic Corporation

- Dow

- Emery Oleochemicals

- Huntsman Corporation

- Jayant Agro-Organics Pvt. Ltd.

- Lanxess AG

- Manali Petrochemicals Limited

- Mitsui Chemicals

- PCC SE

- Perstorp Polyols Inc.

- Polygreen Chemicals

- Polylabs

- Repsol SA

- Royal Dutch Shell Plc

- Saudi Aramco

- Sinopec Corporation

- Solvay

- Stepan Company

- Tosoh Corporation

- Wanhua Chemical Group

Table Information

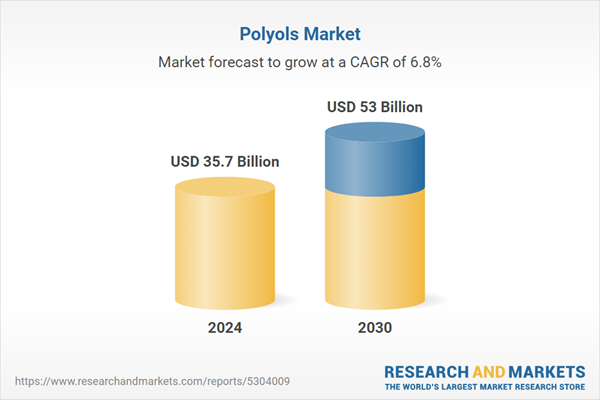

| Report Attribute | Details |

|---|---|

| No. of Pages | 286 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 35.7 Billion |

| Forecasted Market Value ( USD | $ 53 Billion |

| Compound Annual Growth Rate | 6.8% |

| Regions Covered | Global |