Global Polycarbonate Diols Market - Key Trends & Drivers Summarized

What Are Polycarbonate Diols and Why Are They Critical for High-Performance Applications?

Polycarbonate diols (PCDs) are specialty polyols with repeating carbonate groups in their structure, making them an essential component in the production of high-performance polyurethane (PU) products. Known for their excellent durability, hydrolysis resistance, and superior flexibility, PCDs are widely used in applications requiring enhanced mechanical properties, chemical resistance, and long-term durability. These diols are typically employed in the manufacturing of coatings, adhesives, sealants, and elastomers, particularly in sectors where harsh environmental conditions and mechanical wear are common. The unique molecular structure of polycarbonate diols offers exceptional oxidative and thermal stability, which significantly extends the lifespan of the materials made from them. Furthermore, PCDs improve the soft segment of polyurethanes, enhancing properties like resistance to hydrolysis, weathering, and abrasion, which are particularly important in high-end applications like automotive coatings, construction materials, and industrial goods. The versatility of polycarbonate diols in customizing the properties of polyurethanes to meet specific performance criteria makes them indispensable in industries requiring long-lasting, durable products.How Are Polycarbonate Diols Driving Innovation in Coatings, Adhesives, and Elastomers?

Polycarbonate diols are playing a pivotal role in driving innovation in coatings, adhesives, and elastomers, particularly in industries where superior durability and resistance to environmental stressors are required. In the coatings sector, PCD-based polyurethanes offer outstanding chemical resistance, UV stability, and flexibility, making them ideal for automotive and industrial coatings that must withstand harsh conditions such as extreme temperatures, moisture, and chemical exposure. The use of polycarbonate diols in polyurethane dispersions (PUDs) has grown significantly, allowing manufacturers to produce eco-friendly, waterborne coatings with enhanced performance attributes, such as increased scratch resistance and longer service life. In adhesives and sealants, PCDs improve flexibility, adhesion strength, and resistance to hydrolysis, making them ideal for demanding applications in the construction, electronics, and automotive industries, where long-term reliability is critical. Moreover, elastomers made from polycarbonate diols exhibit superior abrasion resistance, mechanical strength, and elasticity, which is essential for applications such as footwear, gaskets, and industrial belts. As manufacturers seek to create products with enhanced longevity, flexibility, and resistance to degradation, the use of polycarbonate diols is becoming increasingly important in formulating advanced polyurethanes for a wide range of high-performance applications.What Technological Advancements Are Expanding the Applications of Polycarbonate Diols?

Technological advancements in the production and modification of polycarbonate diols are expanding their application scope, especially in high-performance and environmentally friendly solutions. One notable development is the increased focus on eco-friendly and sustainable production methods, with the use of bio-based carbonates and renewable feedstocks gaining traction. As sustainability becomes a growing concern across industries, polycarbonate diols derived from renewable resources are being developed to reduce the environmental footprint of polyurethane production. Additionally, advancements in polymerization techniques are enabling the production of polycarbonate diols with tailored molecular weights and functionalities, allowing manufacturers to customize polyurethane properties for specific end-use applications. This has proven particularly useful in high-demand sectors like aerospace, electronics, and medical devices, where precise material properties such as elasticity, chemical resistance, and thermal stability are critical. Moreover, the development of high-purity polycarbonate diols with fewer impurities has improved the performance of polyurethane systems, resulting in coatings, adhesives, and elastomers that offer even better resistance to hydrolysis, UV radiation, and environmental degradation. As technology continues to advance, the customization of polycarbonate diols for niche applications is expected to grow, leading to new opportunities in sectors such as renewable energy, electronics, and biomedicine.What Factors Are Driving the Growth of the Polycarbonate Diols Market?

The growth in the global polycarbonate diols market is driven by several factors, closely linked to advancements in high-performance materials, rising demand for durable and long-lasting polyurethane products, and increasing environmental concerns. One of the primary growth drivers is the expanding application of PCDs in the automotive industry, where demand for high-performance coatings and elastomers is rising as manufacturers strive to produce vehicles with improved durability, fuel efficiency, and environmental resistance. The shift towards waterborne and eco-friendly coatings is also driving demand for polycarbonate diols, as these materials enable the production of low-VOC (volatile organic compound) and sustainable coatings without sacrificing performance. Additionally, the rising demand for advanced adhesives and sealants in industries like construction, electronics, and packaging is contributing to market growth, as PCDs improve the adhesion properties, flexibility, and longevity of polyurethane-based formulations. The growing importance of sustainability and recyclability in material production is another major driver, with polycarbonate diols gaining favor for their ability to produce recyclable and environmentally friendly products. Lastly, the increasing focus on innovation and customization, supported by advancements in polymerization and the development of bio-based PCDs, is propelling market growth as industries seek to meet specific performance criteria while minimizing their environmental impact. These factors reflect the increasing reliance on polycarbonate diols for the development of advanced, sustainable, and high-performance polyurethane products across a wide range of industries.Report Scope

The report analyzes the Polycarbonate Diols market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Form (Solid, Liquid); Application (Synthetic Leather, Paints & Coatings, Adhesives & Sealants, Elastomers, Other Applications).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Solid Form segment, which is expected to reach US$352.2 Million by 2030 with a CAGR of a 6.3%. The Liquid Form segment is also set to grow at 5% CAGR over the analysis period.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Polycarbonate Diols Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Polycarbonate Diols Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Polycarbonate Diols Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

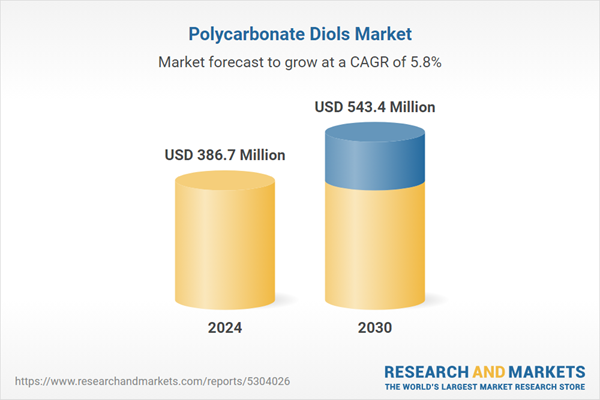

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Asahi Kasei Corporation, Chemwill Asia Co. Ltd., Covestro Ag, Daicel Corporation, GRR Fine Chem Pvt. Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 43 companies featured in this Polycarbonate Diols market report include:

- Asahi Kasei Corporation

- Chemwill Asia Co. Ltd.

- Covestro Ag

- Daicel Corporation

- GRR Fine Chem Pvt. Ltd.

- Haiyan Huashuaite Plastics Electric Appliances Co.

- Hangzhou Dayangchem Co., Ltd.

- ICC Industries, Inc.

- Ishii Chemicals Co., Ltd.

- Jinan Haohua Industry Co., Ltd.

- Mitsubishi Chemical Corporation

- Perstorp Group

- Saudi Arabian Oil Co.

- Tosoh Corporation

- Ube Industries Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Asahi Kasei Corporation

- Chemwill Asia Co. Ltd.

- Covestro Ag

- Daicel Corporation

- GRR Fine Chem Pvt. Ltd.

- Haiyan Huashuaite Plastics Electric Appliances Co.

- Hangzhou Dayangchem Co., Ltd.

- ICC Industries, Inc.

- Ishii Chemicals Co., Ltd.

- Jinan Haohua Industry Co., Ltd.

- Mitsubishi Chemical Corporation

- Perstorp Group

- Saudi Arabian Oil Co.

- Tosoh Corporation

- Ube Industries Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 145 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 386.7 Million |

| Forecasted Market Value ( USD | $ 543.4 Million |

| Compound Annual Growth Rate | 5.8% |

| Regions Covered | Global |