Global Residue Testing Market - Key Trends & Drivers Summarized

Why Is Residue Testing Essential in Modern Food and Agricultural Practices?

Residue testing is a critical process that ensures the safety and compliance of food and agricultural products by detecting traces of pesticides, veterinary drugs, heavy metals, and other chemical residues. This testing plays a crucial role in safeguarding public health and meeting the stringent regulatory standards set by governments and international bodies. With growing concerns around food safety, residue testing helps prevent contamination and ensures that food products reaching consumers are within safe limits for chemical exposure. Given the global nature of the food supply chain, residue testing has become indispensable, as it enables producers, suppliers, and regulatory agencies to maintain consumer trust and prevent health risks associated with chemical residues.The importance of residue testing has heightened as consumer awareness of food safety increases. Today's consumers are more informed and often demand transparency regarding the chemicals used in the production and preservation of their food. To meet these demands, food manufacturers and agricultural producers are increasingly adopting rigorous residue testing protocols. Additionally, major import markets, such as the European Union, the United States, and Japan, have established stringent residue testing regulations for imported goods. As a result, producers and exporters are now under greater pressure to ensure their products are compliant with these international standards. This increased demand for food transparency and safety underscores the growing relevance of residue testing in ensuring both consumer protection and regulatory compliance on a global scale.

How Are Technological Innovations Enhancing Residue Testing Capabilities?

Technological advancements have significantly improved the accuracy, speed, and efficiency of residue testing. Sophisticated techniques such as liquid chromatography-mass spectrometry (LC-MS) and gas chromatography-mass spectrometry (GC-MS) have revolutionized residue analysis by enabling the detection of minute quantities of contaminants with high precision. These technologies allow laboratories to identify multiple residues within a single test, drastically improving throughput and providing more comprehensive insights into potential contaminants. Furthermore, these advanced testing methods can detect a broader range of chemicals, including those with low detection limits, which helps meet stringent regulatory standards. Automation in testing procedures has further enhanced efficiency, reducing manual errors and enabling high-throughput analysis that is essential for large-scale food production and export compliance.Additionally, innovations in portable residue testing devices are expanding the accessibility of on-site testing in fields, farms, and food processing facilities. These handheld devices allow for rapid preliminary testing, enabling producers to monitor contamination risks earlier in the supply chain and address issues before products reach consumers. Another advancement shaping the industry is data analytics, which is helping laboratories and producers manage, interpret, and track large volumes of testing data more effectively. Through these technologies, residue testing is becoming not only faster and more accurate but also more adaptable, meeting the diverse needs of stakeholders throughout the supply chain. As technology continues to advance, residue testing will likely become even more integral to ensuring food safety and compliance in the global market.

What Challenges and Opportunities Exist in the Residue Testing Market?

Despite its importance, residue testing faces a number of challenges, primarily related to regulatory variability, high costs, and testing complexity. Different countries and regions have varying Maximum Residue Limits (MRLs) and testing requirements, which can complicate compliance for producers and exporters. The lack of standardization across regulatory frameworks makes it challenging for international producers to ensure that their products meet diverse requirements. Additionally, the costs associated with advanced testing methods, as well as the need for highly specialized equipment and trained personnel, can be prohibitive for smaller producers and suppliers, limiting their ability to compete in international markets. This challenge is particularly relevant for emerging economies, where resources for advanced residue testing may be scarce.However, these challenges also create opportunities for growth and innovation in the market. For example, there is increasing demand for third-party testing laboratories and contract research organizations (CROs) that can offer standardized, high-quality testing services to producers around the world. By outsourcing testing to specialized providers, companies can ensure compliance with multiple regulatory standards while managing costs more effectively. Additionally, as consumer and regulatory demand for transparency in food production grows, there is potential for the development of more cost-effective and portable testing technologies. Companies that can provide reliable, accessible, and scalable testing solutions are well-positioned to capture a share of the expanding market for residue testing, particularly as food safety standards continue to evolve globally.

What Are the Key Drivers Accelerating the Residue Testing Market?

The growth in the residue testing market is driven by several key factors that reflect the increasing importance of food safety and regulatory compliance. One of the primary drivers is the rise in global food trade, which has led to stricter regulations on imported goods in major markets such as the EU, the U.S., and Japan. As food products move across borders, residue testing is necessary to ensure that they meet the safety standards of the destination country, helping to prevent contamination and protect consumers. This increase in trade has made residue testing essential for producers who want to expand their market reach and comply with international safety requirements.Another major driver is the rising consumer demand for transparency and safety in food production. Modern consumers are more health-conscious and often seek information about the chemicals and practices used in producing their food. This shift in consumer behavior has prompted food producers to adopt residue testing as a standard practice to reassure customers about product safety. Additionally, the growing concerns around environmental contamination from pesticides, heavy metals, and antibiotics in the food chain are driving the adoption of advanced residue testing solutions. The presence of stricter governmental policies regarding environmental and food safety regulations further supports the need for routine and reliable testing. These factors collectively fuel the expansion of the residue testing market, reinforcing its role in promoting global food safety, regulatory compliance, and consumer trust.

Report Scope

The report analyzes the Residue Testing market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Pesticide Residues, Toxins, Heavy Metals, Food Allergens, Other Types); Technology (Chromatography, Spectroscopy, Immunoassay, Other Technologies).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Pesticide Residues Testing segment, which is expected to reach US$3.4 Billion by 2030 with a CAGR of a 7%. The Toxins Testing segment is also set to grow at 5.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.4 Billion in 2024, and China, forecasted to grow at an impressive 9.2% CAGR to reach $1.8 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Residue Testing Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Residue Testing Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Residue Testing Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AB Sciex, Agriculture and Food Laboratory, ALS Limited, Arbro Pharmaceuticals Private Limited, Bureau Veritas and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 34 companies featured in this Residue Testing market report include:

- AB Sciex

- Agriculture and Food Laboratory

- ALS Limited

- Arbro Pharmaceuticals Private Limited

- Bureau Veritas

- Eurofins Scientific

- Fera Science Limited

- Intertek Group plc

- Meth Residue Testing

- Microbac Laboratories, Inc.

- Neogen Corporation

- NSF International

- QTS Analytical

- SciCorp Laboratories (Pty) Ltd

- Scientific Certification Systems, Inc.

- SGS SA

- Sophisticated Industrial Material Analytic Labs Private Limited

- Symbio Laboratories

- Trilogy Analytical Laboratory

- Waters Agricultural Laboratories, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AB Sciex

- Agriculture and Food Laboratory

- ALS Limited

- Arbro Pharmaceuticals Private Limited

- Bureau Veritas

- Eurofins Scientific

- Fera Science Limited

- Intertek Group plc

- Meth Residue Testing

- Microbac Laboratories, Inc.

- Neogen Corporation

- NSF International

- QTS Analytical

- SciCorp Laboratories (Pty) Ltd

- Scientific Certification Systems, Inc.

- SGS SA

- Sophisticated Industrial Material Analytic Labs Private Limited

- Symbio Laboratories

- Trilogy Analytical Laboratory

- Waters Agricultural Laboratories, Inc.

Table Information

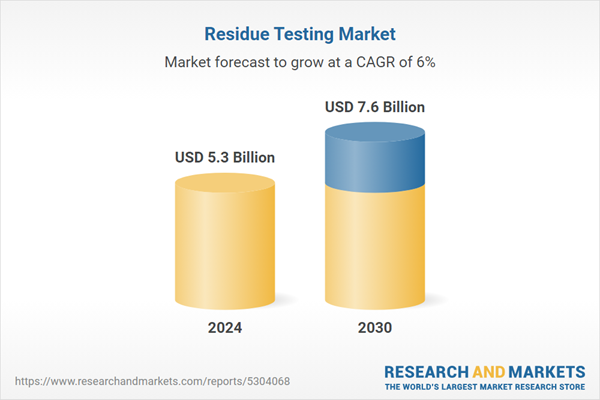

| Report Attribute | Details |

|---|---|

| No. of Pages | 280 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 5.3 Billion |

| Forecasted Market Value ( USD | $ 7.6 Billion |

| Compound Annual Growth Rate | 6.0% |

| Regions Covered | Global |