Recovered Carbon Black (rCB): A Sustainable Solution in the Circular Economy of Tire Recycling

What Is Recovered Carbon Black and Why Is It Important for Sustainability?

Recovered carbon black (rCB) is a sustainable material produced from end-of-life tires (ELTs) through a process known as pyrolysis, where tires are thermally decomposed in the absence of oxygen to recover valuable compounds, including carbon black. Carbon black, a fine black powder primarily used as a reinforcing filler in tires, is traditionally manufactured from fossil fuels. The production of rCB offers an eco-friendly alternative to virgin carbon black by reducing reliance on petroleum, lowering carbon emissions, and helping divert used tires from landfills. By recycling and reusing carbon black in applications such as rubber, plastics, coatings, and inks, rCB supports the circular economy model, where waste materials are repurposed into valuable products, reducing environmental impact and conserving natural resources.The significance of rCB extends beyond waste reduction, as it plays an essential role in reducing the tire industry's carbon footprint. With over one billion tires reaching the end of their life every year, the potential environmental harm of improper disposal is vast. Recovered carbon black helps address this challenge by providing a practical recycling pathway, minimizing greenhouse gas emissions, and reducing energy consumption associated with the production of virgin carbon black. As industries become more committed to sustainability goals, rCB offers a promising solution for companies looking to improve their environmental credentials and meet consumer demand for sustainable products.

How Is Recovered Carbon Black Produced and What Are Its Key Characteristics?

Recovered carbon black is produced through a process called pyrolysis, which involves heating shredded end-of-life tires in a controlled, oxygen-free environment. This process thermally decomposes the tires into rCB, synthetic gases, and oils, all of which can be repurposed. The recovered carbon black is then processed, purified, and refined to meet industry-specific standards. Depending on the pyrolysis conditions, rCB can vary in particle size, surface area, and structure, all of which impact its reinforcement properties. While rCB is chemically distinct from virgin carbon black due to the presence of residual ash and other minor impurities, it still retains a high carbon content and reinforcing ability, making it suitable for many applications.The quality and performance of rCB depend on several factors, including the type of tire feedstock, pyrolysis conditions, and post-processing techniques. Modern technologies have made it possible to refine rCB to produce grades with tailored properties that match the performance of certain types of virgin carbon black. For instance, rCB can be modified for specific applications in rubber compounding, plastics, and industrial coatings, where it provides durability, conductivity, and tinting properties. Additionally, rCB's lower carbon footprint and energy requirements give it an edge in applications where sustainability is a priority. By balancing performance with environmental benefits, rCB is emerging as a valuable alternative in the production of sustainable materials across multiple industries.

What Are the Applications and Benefits of Recovered Carbon Black?

Recovered carbon black has broad applications in industries that use traditional carbon black, particularly in rubber manufacturing, plastics, and inks. Rubber and tire manufacturing represent the largest market for rCB, where it is used as a reinforcing filler in tire compounds and other rubber products like hoses, belts, and footwear. Although rCB cannot fully replace virgin carbon black in high-performance tire applications, it is highly effective in non-tread components such as sidewalls and inner liners, where mechanical requirements are less stringent. By incorporating rCB, tire manufacturers can reduce their reliance on fossil-derived carbon black, leading to more sustainable production practices and cost savings.In plastics and polymer composites, rCB provides pigmentation, UV protection, and conductivity, making it useful in products like plastic containers, automotive parts, and construction materials. The ink and coatings industries also utilize rCB as a sustainable pigment alternative, especially in applications like printing inks, paints, and industrial coatings, where color and durability are critical. rCB offers additional benefits, including reduced environmental impact, cost savings, and compliance with environmental regulations that restrict landfill use and promote recycling. For manufacturers and consumers alike, rCB provides an appealing sustainable option without compromising on performance, enabling a more responsible approach to resource utilization and waste management.

What Is Driving Growth in the Recovered Carbon Black Market?

The growth in the recovered carbon black market is driven by several factors, including increasing environmental awareness, regulatory support, and advancements in recycling technologies. With rising global emphasis on sustainability and resource efficiency, industries are seeking alternatives to virgin materials that align with their environmental goals. Recovered carbon black appeals to companies committed to reducing their carbon footprint, waste, and reliance on fossil-derived materials. Regulations aimed at reducing tire waste and promoting the circular economy, such as the European Union's End-of-Life Vehicle Directive and Extended Producer Responsibility laws, are further encouraging the adoption of rCB. These policies require manufacturers to manage the disposal and recycling of end-of-life products, creating a favorable environment for rCB production and use.Technological advancements in pyrolysis and refining processes have also improved the quality and consistency of rCB, making it more competitive with virgin carbon black. Innovations in process optimization and quality control enable rCB manufacturers to meet industry specifications, expand rCB's applicability, and achieve performance comparable to traditional carbon black. Consumer demand for sustainable products is further driving the market, with end-users increasingly prioritizing eco-friendly alternatives in their purchasing decisions. Companies across sectors are responding to this trend by integrating rCB into their products, from automotive components and electronics to packaging and textiles. Together, these factors highlight the potential of recovered carbon black as a key material in the transition toward sustainable manufacturing and waste management, positioning it as a vital component in the future of environmentally responsible production.

Report Scope

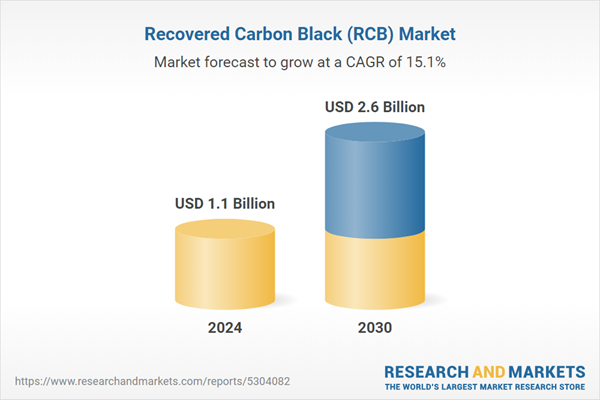

The report analyzes the Recovered Carbon Black (rCB) market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Application (Tires, Rubber, High Performance Coating, Plastic, Other Applications).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Tires Application segment, which is expected to reach US$1.9 Billion by 2030 with a CAGR of a 15.3%. The Rubber Application segment is also set to grow at 17.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $323.1 Million in 2024, and China, forecasted to grow at an impressive 13.8% CAGR to reach $384.4 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Recovered Carbon Black (rCB) Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Recovered Carbon Black (rCB) Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Recovered Carbon Black (rCB) Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Alpha Carbone, Black Bear Carbon, Bolder Industries, Delta-Energy Group, DRON Industries and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Recovered Carbon Black (rCB) market report include:

- Alpha Carbone

- Black Bear Carbon

- Bolder Industries

- Delta-Energy Group

- DRON Industries

- DVA Renewable Energy JSC

- Enrestec

- Integrated Resource Recovery

- Klean Industries

- Pyrolyx

- Radhe Group of Energy

- Scandinavian Enviro Systems AB

- SR2O Holdings

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Alpha Carbone

- Black Bear Carbon

- Bolder Industries

- Delta-Energy Group

- DRON Industries

- DVA Renewable Energy JSC

- Enrestec

- Integrated Resource Recovery

- Klean Industries

- Pyrolyx

- Radhe Group of Energy

- Scandinavian Enviro Systems AB

- SR2O Holdings

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 114 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.1 Billion |

| Forecasted Market Value ( USD | $ 2.6 Billion |

| Compound Annual Growth Rate | 15.1% |

| Regions Covered | Global |