Real-Time Payments (RTP): Transforming Financial Transactions with Instant Settlement

What Are Real-Time Payments, and Why Are They Important?

Real-Time Payments (RTP) refer to financial transactions that are processed and settled almost instantaneously, enabling funds to be transferred between bank accounts within seconds, 24/7. Unlike traditional bank transfers, which can take hours or days to process, RTP systems ensure that payments are available to recipients immediately after they are initiated. This immediacy is beneficial for both individuals and businesses, allowing them to access funds faster and manage cash flow more effectively. RTP systems use advanced digital networks to verify, process, and settle payments securely and instantly, with real-time confirmation of each transaction.RTP is transforming financial transactions by providing greater speed, efficiency, and convenience for various use cases, from personal payments and e-commerce to business-to-business (B2B) transactions. For consumers, RTP simplifies peer-to-peer (P2P) transactions and e-commerce payments, making it easier to send money to friends or pay for goods and services in real time. For businesses, RTP supports faster payroll, vendor payments, and improved cash flow management, which is essential for budgeting and financial planning. With the demand for faster, seamless financial transactions increasing, RTP is becoming a vital part of the global financial ecosystem, meeting consumer and business needs in the digital age.

How Do Real-Time Payment Systems Work?

Real-Time Payment systems rely on advanced digital payment networks that facilitate instant fund transfers between participating financial institutions. When a sender initiates a payment through an RTP platform, the payment details are encrypted and transmitted to the recipient's bank. The recipient's bank verifies the transaction, and if the funds are available, the payment is settled immediately. Both parties receive confirmation of the transaction within seconds, and the recipient can access the funds instantly. This streamlined process is enabled by RTP networks such as The Clearing House's RTP Network in the United States, the U.K.'s Faster Payments Service, and India's Immediate Payment Service (IMPS).RTP systems operate around the clock, ensuring payments can be made any time of day, even on weekends and holidays. Some RTP platforms also provide additional messaging capabilities, allowing businesses to attach invoices or transaction details, making it easier for recipients to understand the context of each payment. By combining instant fund transfer with real-time communication, RTP offers transparency and speed, creating a more efficient payment experience. In many cases, the funds are final and irrevocable, reducing the risk of payment delays or disputes, which adds security and reliability to the RTP process.

What Are the Benefits of Real-Time Payments for Consumers and Businesses?

Real-Time Payments offer numerous benefits for consumers, businesses, and financial institutions alike. For consumers, RTP makes money transfers easier and faster, eliminating the waiting periods associated with traditional bank transfers. RTP enhances P2P payment experiences, making it simple for users to split bills, pay friends or family, or make payments to small businesses instantly. For online shopping and e-commerce, RTP supports immediate payments, streamlining checkout processes and enhancing the customer experience. RTP's around-the-clock availability is especially valuable, as consumers can complete transactions whenever they need, without waiting for banking hours.For businesses, RTP is a game-changer in cash flow management, reducing the need for credit or short-term loans to manage day-to-day finances. Instant payments mean businesses can pay vendors, suppliers, and employees faster, improving operational efficiency. Faster payroll is particularly beneficial for gig economy workers and freelancers who value immediate access to their earnings. RTP also enhances transparency, as businesses can see real-time transaction data and make more informed financial decisions. Additionally, RTP systems reduce the administrative costs and delays associated with traditional payment processing, as funds are available immediately, eliminating the need for reconciliation and manual tracking. This efficiency in B2B transactions is particularly valuable in sectors where timely payments are essential, such as retail, logistics, and supply chain management.

What Challenges Does the Real-Time Payments Market Face?

While RTP offers numerous advantages, it also faces challenges, including infrastructure costs, fraud risk, and regulatory compliance. Infrastructure costs are a significant barrier, as financial institutions need to upgrade their systems to support instant payments and integrate with RTP networks. This investment can be particularly challenging for smaller banks or institutions in regions with less advanced digital infrastructure. Additionally, RTP requires strong cybersecurity and fraud prevention measures, as the instant nature of these transactions leaves little time to detect or prevent fraudulent activity. Financial institutions must implement real-time fraud monitoring and detection systems to protect both customers and themselves from losses.Regulatory compliance

is another challenge, as RTP systems must adhere to various financial and data protection regulations depending on the region. Meeting compliance requirements can be complex, as regulations differ between countries and sometimes conflict with the speed and efficiency goals of RTP. Privacy concerns are also a consideration, as RTP systems involve processing and transmitting sensitive financial data in real time. Balancing speed, security, and compliance is essential to successfully implementing RTP systems and ensuring that consumers and businesses trust these platforms.What Is Driving Growth in the Real-Time Payments Market?

The growth in the Real-Time Payments market is fueled by rising consumer demand for instant financial transactions, increased adoption of digital banking, and the expansion of e-commerce and gig economy services. Consumers and businesses expect seamless, fast payment solutions that match the speed of modern digital services, making RTP systems highly appealing. The surge in digital banking has also contributed to RTP adoption, as financial institutions seek to differentiate themselves with innovative payment options that attract tech-savvy customers. Additionally, the expansion of e-commerce and the gig economy - where quick payment is critical for customer satisfaction and worker engagement - has amplified the demand for RTP solutions.Governments and financial regulators are also playing a role in driving RTP growth, as they see the potential for instant payments to stimulate economic activity and improve financial inclusion. In many regions, governments are investing in RTP infrastructure and encouraging financial institutions to adopt RTP systems to enhance the accessibility and efficiency of financial services. For example, in the U.S., The Federal Reserve's upcoming FedNow Service aims to provide a national, real-time payment infrastructure by 2023, making RTP available to more financial institutions and consumers. As digital payment preferences and financial technologies continue to evolve, RTP systems are set to become a foundational element of the modern financial landscape, offering speed, convenience, and flexibility that meets the needs of today's consumers and businesses.

Report Scope

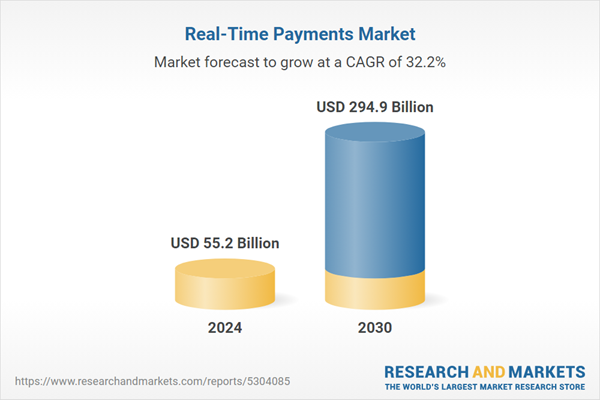

The report analyzes the Real-Time Payments market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Component (Solutions, Services); Payment Type (Person-to-Business (P2B), Person-to-Person (P2P), Business-to-Person (B2P), Other Payment Types); Vertical (Retail & eCommerce, BFSI, IT & Telecom, Travel & Tourism, Government, Healthcare, Other End-Uses).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Solutions Component segment, which is expected to reach US$216.6 Billion by 2030 with a CAGR of a 31.6%. The Services Component segment is also set to grow at 34.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $13.6 Billion in 2024, and China, forecasted to grow at an impressive 39.8% CAGR to reach $88.8 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Real-Time Payments Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Real-Time Payments Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Real-Time Payments Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ACI Worldwide, Alipay (Ant Financial), Apple, Capegemini, Finastra and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 23 companies featured in this Real-Time Payments market report include:

- ACI Worldwide

- Alipay (Ant Financial)

- Apple

- Capegemini

- Finastra

- FIS

- Fiserv

- FSS

- Global Payments

- Icon Solutions

- IntegraPay

- Intelligent Payments

- Mastercard

- Montran

- Nets

- Obopay

- PayPal

- Pelican

- REPAY

- Ripple

- SIA

- Temenos

- Visa

- Wirecard

- Worldline

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ACI Worldwide

- Alipay (Ant Financial)

- Apple

- Capegemini

- Finastra

- FIS

- Fiserv

- FSS

- Global Payments

- Icon Solutions

- IntegraPay

- Intelligent Payments

- Mastercard

- Montran

- Nets

- Obopay

- PayPal

- Pelican

- REPAY

- Ripple

- SIA

- Temenos

- Visa

- Wirecard

- Worldline

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 368 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 55.2 Billion |

| Forecasted Market Value ( USD | $ 294.9 Billion |

| Compound Annual Growth Rate | 32.2% |

| Regions Covered | Global |