PXI Source Measure Units (SMU): Precision Measurement and Control in a Modular Platform

What Are PXI Source Measure Units and Why Are They Essential in Test and Measurement?

PXI (PCI eXtensions for Instrumentation) Source Measure Units (SMUs) are precision instruments designed to source and measure voltage and current with high accuracy, making them indispensable in applications that require precise control over electrical parameters. A PXI SMU integrates both a power source and measurement capabilities into a single module within the PXI platform, allowing users to seamlessly switch between sourcing and measuring in a compact and modular form factor. This dual functionality is particularly valuable in testing semiconductors, sensors, LEDs, and batteries, where both the applied stimulus and the response need to be accurately controlled and measured. By combining these capabilities, PXI SMUs streamline testing setups, eliminate the need for multiple instruments, and reduce overall system complexity, which is critical in high-density testing environments like semiconductor labs and production lines.The modular nature of PXI SMUs allows for flexible, scalable test configurations, as multiple SMU modules can be added or removed within the same PXI chassis based on testing requirements. This flexibility enables engineers to build and modify test systems tailored to specific needs, from single-device testing to large-scale automated test setups. The PXI platform's high-speed backplane further enhances the performance of PXI SMUs, allowing them to perform fast measurements and high-speed data transfer. This combination of precision, speed, and flexibility makes PXI SMUs ideal for research, product development, and automated testing, where consistency and reliability are paramount.

How Do PXI SMUs Operate and What Are Their Key Features?

PXI SMUs operate by providing a highly controlled voltage or current to a device under test (DUT) while simultaneously measuring the response with high accuracy. This dual functionality allows for various measurement techniques, including IV (current-voltage) characterization, pulsed measurements, and low-current measurements for sensitive electronic components. Most PXI SMUs offer programmable voltage and current ranges, enabling users to fine-tune the output parameters based on the specific requirements of the DUT. Additionally, PXI SMUs are typically equipped with fast measurement sampling rates, allowing them to capture rapid changes in electrical parameters, which is particularly useful for testing transient responses in semiconductors and other fast-switching devices.One of the distinguishing features of PXI SMUs is their four-quadrant operation capability, meaning they can source and sink both current and voltage, which allows for more complex testing scenarios. In the first and third quadrants, PXI SMUs operate as a source (providing positive or negative voltage/current), while in the second and fourth quadrants, they act as a load, sinking current while measuring voltage. This functionality is essential for testing energy-storing components like batteries and supercapacitors, as well as for simulating load conditions in power electronics. Additionally, many PXI SMUs offer advanced programming options, allowing users to configure parameters such as compliance limits, protection settings, and triggering options, enabling precise control and automation in test sequences. Together, these features make PXI SMUs an invaluable tool for any application that requires accurate sourcing, measurement, and data collection.

What Applications Benefit Most from PXI SMUs?

PXI SMUs are widely used in industries that require high precision, reliability, and efficiency in testing electrical components. The semiconductor industry, for example, relies on PXI SMUs for IV characterization, which involves measuring current and voltage behavior across a range of values to understand a device's electrical characteristics. PXI SMUs can handle the fine measurement and control requirements of transistor and diode testing, as well as more complex components like microcontrollers and integrated circuits. Additionally, in LED and optoelectronic testing, PXI SMUs offer precise control of the current supplied to LEDs, helping manufacturers assess characteristics such as brightness, color, and efficiency.Battery and energy storage testing is another area where PXI SMUs are invaluable. Their four-quadrant operation allows them to simulate both charging and discharging cycles in batteries, supercapacitors, and other storage devices, providing insights into charge efficiency, cycle life, and stability. PXI SMUs are also commonly used in testing solar cells and other photovoltaic materials, where they measure the output current under different voltage and light conditions to determine the energy conversion efficiency. Additionally, research and development in emerging technologies, such as IoT sensors, MEMS (Micro-Electro-Mechanical Systems), and bioelectronics, also benefit from PXI SMUs, as these devices require sensitive and accurate electrical measurements. Across these applications, PXI SMUs are essential for delivering the precision and flexibility needed to ensure performance and reliability in a wide range of electronic components and systems.

What Is Driving the Growth in the PXI SMU Market?

The growth in the PXI SMU market is driven by several factors, including the demand for high-precision testing in the semiconductor industry, the rise of IoT and wearable technologies, and the need for automated test solutions. As semiconductor technology continues to evolve with more complex, miniaturized, and power-efficient devices, the need for precise and reliable testing has intensified, making PXI SMUs a preferred choice for semiconductor characterization and validation. The global shift towards IoT, where devices like sensors, microcontrollers, and wireless modules require rigorous testing for functionality and reliability, further supports the adoption of PXI SMUs due to their ability to perform accurate low-current and low-voltage measurements crucial for these components.Additionally, the growing adoption of automation in testing processes, especially in large-scale production environments, has accelerated the demand for PXI SMUs. Their modular and programmable nature fits well within automated test setups, enabling faster and more efficient testing cycles. Emerging technologies, such as 5G, electric vehicles, and renewable energy systems, are also key drivers as they demand precise testing for power management and energy storage components, areas where PXI SMUs excel. As these technologies continue to expand, the PXI SMU market is set to grow, reflecting an ongoing need for reliable, high-performance measurement solutions in the fast-evolving electronics landscape.

Report Scope

The report analyzes the PXI Source Measure Units (SMU) market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Channel (1 Channel, 2 Channel, 4 Channel, Above 4 Channel); Application (Semiconductors, LEDs, Sensors, Green Energy Products, Nanomaterials, Organic & Printed Electronics, Other Applications); End-Use (IT & Telecom, Consumer Electronics, Automotive, Energy, Medical Equipment, Other End-Uses).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the 1 Channel SMU segment, which is expected to reach US$367.1 Million by 2030 with a CAGR of a 15.4%. The 2 Channel SMU segment is also set to grow at 16.4% CAGR over the analysis period.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global PXI Source Measure Units (SMU) Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global PXI Source Measure Units (SMU) Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global PXI Source Measure Units (SMU) Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

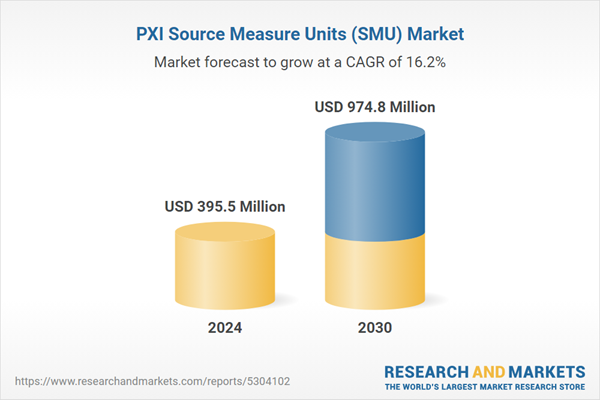

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Acquitek, Chroma ATE, Keysight Technologies Inc., Litepoint, A Teradyne Company, Marvin Test Solutions and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 33 companies featured in this PXI Source Measure Units (SMU) market report include:

- Acquitek

- Chroma ATE

- Keysight Technologies Inc.

- Litepoint, A Teradyne Company

- Marvin Test Solutions

- National Instruments Inc.

- Pickering Interfaces Ltd.

- Rohde & Schwarz GmbH & Co KG

- Virginia Panel Corporation

- VX Instruments GmbH

- Yokogawa Electric Corporation

- Yotta Volt Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Acquitek

- Chroma ATE

- Keysight Technologies Inc.

- Litepoint, A Teradyne Company

- Marvin Test Solutions

- National Instruments Inc.

- Pickering Interfaces Ltd.

- Rohde & Schwarz GmbH & Co KG

- Virginia Panel Corporation

- VX Instruments GmbH

- Yokogawa Electric Corporation

- Yotta Volt Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 240 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 395.5 Million |

| Forecasted Market Value ( USD | $ 974.8 Million |

| Compound Annual Growth Rate | 16.2% |

| Regions Covered | Global |