Global Pre-Workout Supplements Market - Key Trends & Drivers Summarized

What Are Pre-Workout Supplements, And Why Are They Gaining Popularity Among Fitness Enthusiasts?

Pre-workout supplements are specialized dietary products designed to enhance physical performance, endurance, and focus during exercise. These supplements are typically consumed before a workout and often contain a combination of ingredients such as caffeine, amino acids (like beta-alanine and L-citrulline), creatine, B-vitamins, and nitric oxide boosters. Each of these components is formulated to improve energy levels, increase blood flow to muscles, reduce fatigue, and enhance focus, giving users a boost in performance during intense exercise sessions. Pre-workout supplements are used by a wide range of individuals, from professional athletes to recreational gym-goers, seeking to maximize their workout effectiveness.The growing popularity of pre-workout supplements is largely driven by the increasing awareness of fitness and wellness. As more people adopt active lifestyles and strive for better health, the demand for products that can enhance workout performance has surged. Fitness influencers, social media, and online fitness communities have also played a significant role in promoting pre-workout supplements, highlighting their potential benefits in terms of boosting energy and improving results in strength training, endurance sports, and high-intensity interval training (HIIT). The convenience of pre-workout supplements, which are typically available in powder, capsule, or liquid form, further adds to their appeal as a quick and easy way to boost performance before hitting the gym or engaging in sports activities.

How Are Technological Innovations And Ingredients Advancements Shaping The Pre-Workout Supplements Market?

Technological advancements in the formulation and delivery of pre-workout supplements have led to the development of more effective, targeted, and safer products. One of the major innovations in this space is the use of scientifically backed ingredients that are tailored to specific performance outcomes. For instance, ingredients like beta-alanine and L-citrulline have been shown to improve muscle endurance and reduce fatigue by buffering lactic acid in the muscles, while creatine monohydrate is widely recognized for its ability to increase strength and power in resistance training. As scientific research continues to validate the effectiveness of certain ingredients, manufacturers are increasingly formulating pre-workout products that provide measurable improvements in performance without the need for high stimulant doses.In addition, there is a growing demand for clean-label and plant-based pre-workout supplements that cater to health-conscious consumers and those with dietary restrictions. Innovations in ingredient sourcing and formulation have enabled manufacturers to create supplements that are free from artificial sweeteners, synthetic additives, and common allergens. Plant-based ingredients, such as beetroot extract, which boosts nitric oxide production, and natural caffeine sources like green tea and yerba mate, are gaining popularity as consumers seek healthier, more natural alternatives. The demand for vegan, organic, and non-GMO pre-workout supplements has led to the creation of products that align with the clean eating and sustainability movements, offering users a way to enhance performance while adhering to their lifestyle choices.

Technological advancements are also improving the delivery mechanisms of pre-workout supplements. For example, time-release formulations are being developed to ensure a sustained release of energy and nutrients throughout the workout, preventing the energy crash that is sometimes associated with high-stimulant products. Additionally, pre-workouts in ready-to-drink (RTD) formats are growing in popularity as they provide convenience for users on the go. These innovations are making pre-workout supplements more accessible and adaptable to the needs of modern consumers, from hardcore athletes to casual gym-goers.

How Are Market Dynamics And Consumer Preferences Shaping The Pre-Workout Supplements Industry?

Consumer preferences are significantly influencing the growth and development of the pre-workout supplements industry, particularly as health and wellness trends continue to evolve. One of the major trends shaping the market is the increasing preference for personalized nutrition. Consumers are no longer seeking one-size-fits-all solutions but are instead looking for supplements that cater to their specific fitness goals, whether it's building muscle, enhancing endurance, or losing weight. This has led to the rise of customizable pre-workout supplements, where users can choose ingredients or formulations based on their individual needs and sensitivities. As a result, manufacturers are offering products with varying levels of stimulants, amino acids, and performance enhancers, allowing consumers to personalize their pre-workout experience.Another key trend is the demand for transparency and clean labels in the pre-workout market. Consumers are increasingly interested in knowing exactly what goes into their supplements, particularly regarding ingredient quality, sourcing, and the absence of artificial additives. Many companies are responding to this demand by providing more detailed labeling, third-party testing certifications, and clear information about ingredient sourcing. Additionally, the focus on clean-label products has led to the rise of supplements that avoid artificial flavors, colors, and sweeteners, appealing to health-conscious consumers who prefer natural and minimally processed products.

The growing popularity of sugar-free and low-calorie options is also shaping the market. As consumers become more aware of the importance of maintaining a balanced diet and managing caloric intake, many are seeking pre-workout supplements that provide performance benefits without added sugars or unnecessary calories. This trend is particularly prominent among fitness enthusiasts who are focused on weight management and lean muscle gains. Manufacturers are increasingly offering pre-workout supplements sweetened with natural alternatives like stevia or monk fruit, which cater to consumers looking for healthier, low-calorie options.

Additionally, the increasing emphasis on mental focus and cognitive enhancement in workouts has led to the incorporation of nootropics (cognitive enhancers) in pre-workout formulas. Ingredients like L-theanine, tyrosine, and alpha-GPC are being added to supplements to improve mental clarity, focus, and mood during exercise. This shift reflects the growing recognition that a successful workout requires not just physical energy but also mental sharpness, especially in activities that demand coordination and concentration, such as weightlifting or endurance sports.

What Factors Are Driving Growth In The Pre-Workout Supplements Market?

The growth in the pre-workout supplements market is driven by several factors, including rising fitness awareness, changing consumer preferences, and innovations in product formulation. One of the primary growth drivers is the global increase in health and fitness consciousness, as more individuals incorporate physical exercise into their daily routines to improve health, manage stress, and achieve aesthetic goals. As people seek to maximize the efficiency and outcomes of their workouts, pre-workout supplements have become an essential tool for boosting energy, endurance, and performance.The expansion of the fitness industry, including the growth of gyms, fitness centers, and group training programs, is also contributing to the increased demand for pre-workout supplements. As more people join fitness communities and invest in their health, the need for performance-enhancing products like pre-workouts is growing. This trend is particularly notable in emerging markets, where increasing disposable incomes and a growing focus on wellness are driving demand for dietary supplements, including pre-workout products.

In addition to fitness trends, the rise of e-commerce and digital marketing has played a crucial role in expanding the reach of pre-workout supplements. The availability of these products online allows consumers to access a wide variety of pre-workout formulas, compare reviews, and make informed purchasing decisions from the comfort of their homes. Social media influencers, fitness bloggers, and online communities have also played a significant role in promoting pre-workout supplements, driving consumer interest and adoption through testimonials, reviews, and workout tips.

Lastly, product innovation is fueling growth in the pre-workout supplements market. Manufacturers are continuously developing new formulations that cater to specific fitness goals, dietary preferences, and health concerns. The introduction of sugar-free, low-calorie, vegan, and gluten-free pre-workout supplements is attracting a broader audience, including health-conscious consumers and those with dietary restrictions. Additionally, advancements in flavor technology are improving the taste profiles of pre-workout supplements, making them more appealing to consumers who prioritize taste alongside performance. These factors, combined with the rising interest in fitness and wellness, are expected to drive continued growth in the pre-workout supplements market.

Report Scope

The report analyzes the Pre-Workout Supplements market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Form (Powder, Ready to Drink, Capsules / Tablets); Distribution Channel (Offline, Online).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Powder Form segment, which is expected to reach US$25.7 Billion by 2030 with a CAGR of a 7%. The Ready to Drink Form segment is also set to grow at 7.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $5.4 Billion in 2024, and China, forecasted to grow at an impressive 10.7% CAGR to reach $7.7 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Pre-Workout Supplements Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Pre-Workout Supplements Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Pre-Workout Supplements Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ALLMAX Nutrition, Inc., Beast Sports Nutrition, BPI Sports, LLC, eFlow Nutrition LLC, EFX Sports and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 36 companies featured in this Pre-Workout Supplements market report include:

- ALLMAX Nutrition, Inc.

- Beast Sports Nutrition

- BPI Sports, LLC

- eFlow Nutrition LLC

- EFX Sports

- Finaflex

- GAT Sport

- Magnum Nutraceuticals

- MusclePharm Corporation

- Nutrabolt Corporation

- Nutrex Research, Inc.

- SAN

- SynTech Nutrition (Medix Laboratories NV)

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ALLMAX Nutrition, Inc.

- Beast Sports Nutrition

- BPI Sports, LLC

- eFlow Nutrition LLC

- EFX Sports

- Finaflex

- GAT Sport

- Magnum Nutraceuticals

- MusclePharm Corporation

- Nutrabolt Corporation

- Nutrex Research, Inc.

- SAN

- SynTech Nutrition (Medix Laboratories NV)

Table Information

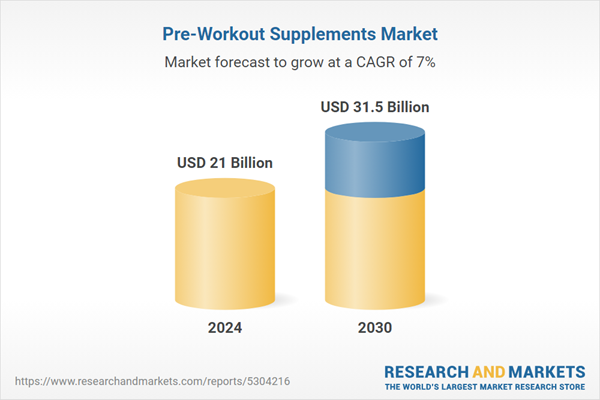

| Report Attribute | Details |

|---|---|

| No. of Pages | 270 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 21 Billion |

| Forecasted Market Value ( USD | $ 31.5 Billion |

| Compound Annual Growth Rate | 7.0% |

| Regions Covered | Global |