Global Pressure Sensitive Adhesives Market - Key Trends & Drivers Summarized

What Are Pressure Sensitive Adhesives, And How Are They Shaping The Modern Adhesives Industry?

Pressure sensitive adhesives (PSAs) are versatile materials that bond to surfaces when light pressure is applied, without the need for heat, water, or solvent activation. PSAs are commonly found in tapes, labels, stickers, and protective films across a wide range of industries, including packaging, automotive, electronics, healthcare, and construction. These adhesives are formulated using various polymers and can be designed for temporary or permanent bonding, depending on the application. Their ability to bond instantly with minimal effort, coupled with flexibility in formulation, makes them an essential component in modern manufacturing and consumer goods industries.PSAs are prized for their ease of use, durability, and ability to adhere to a wide variety of surfaces, including paper, plastic, metal, and glass. The adhesives are available in different forms, including water-based, solvent-based, and hot-melt systems, each offering distinct performance characteristics to meet the specific needs of end-users. For example, water-based PSAs are valued for their eco-friendly properties, while solvent-based PSAs are chosen for their superior adhesion in harsh environments. These adhesives are indispensable in many everyday applications, from sealing food packages to providing reliable performance in automotive parts and electronic devices. As industries continue to innovate and streamline production processes, the demand for high-performance pressure sensitive adhesives is expected to grow.

How Are Technological Advancements Driving The Evolution Of Pressure Sensitive Adhesives?

Technological advancements in the formulation and production of pressure sensitive adhesives are driving significant improvements in performance, sustainability, and customization. One of the most notable innovations is the development of high-performance polymer technologies that enhance the adhesive properties of PSAs, making them more durable and adaptable to extreme conditions. These advancements have enabled the creation of adhesives that can withstand high temperatures, UV exposure, moisture, and chemical contact, making them ideal for applications in industries such as automotive, electronics, and construction. For example, PSAs used in the automotive industry must endure extreme weather conditions and continuous wear, and advancements in polymer chemistry have improved their resilience and longevity.Another major trend is the move toward sustainable and eco-friendly PSAs, driven by both consumer demand and environmental regulations. Manufacturers are focusing on developing adhesives with reduced volatile organic compounds (VOCs), recyclable or biodegradable materials, and renewable sources. Water-based PSAs, in particular, are gaining popularity due to their lower environmental impact compared to solvent-based systems. These adhesives eliminate the need for harmful chemicals, reduce energy consumption during production, and provide safer options for end-users, making them a preferred choice for industries with sustainability targets. Bio-based PSAs, which use natural materials such as starch or cellulose, are also gaining traction as more companies strive to reduce their carbon footprints.

In addition to improvements in performance and sustainability, smart adhesives are emerging as a new frontier in the PSA market. These materials can respond to external stimuli such as temperature, light, or humidity, allowing for reversible adhesion or self-healing properties. Smart PSAs are particularly valuable in high-tech industries like electronics and healthcare, where precise control over bonding and debonding processes is essential. Furthermore, advancements in nanotechnology are enhancing the structural integrity of PSAs at the molecular level, resulting in stronger adhesion, better thermal stability, and enhanced flexibility. These innovations are positioning pressure sensitive adhesives as an increasingly sophisticated and essential material in a variety of high-performance applications.

How Are Market Dynamics And Consumer Trends Shaping The Pressure Sensitive Adhesives Industry?

Market dynamics and evolving consumer preferences are playing a key role in shaping the demand for pressure sensitive adhesives across different sectors. One of the most prominent trends driving growth in the PSA market is the increasing demand for lightweight and flexible materials in the automotive and electronics industries. As automotive manufacturers focus on improving fuel efficiency and reducing vehicle weight, PSAs are being used as an alternative to traditional mechanical fasteners and welds. They provide strong bonds without adding significant weight, making them ideal for bonding trim, interior components, and electronic systems within vehicles. Similarly, the rise of compact, lightweight electronics such as smartphones and wearables has led to increased demand for PSAs that can securely bond delicate components without affecting device performance.The e-commerce boom has also contributed to the expansion of the PSA market, particularly in the packaging sector. With the surge in online shopping, there is a growing need for reliable, tamper-evident packaging solutions that ensure product integrity during shipping and handling. PSAs are widely used in sealing tapes, labels, and packaging films, providing the flexibility and durability needed to secure packages while allowing for easy opening by consumers. Additionally, the demand for sustainable packaging materials has led to the development of recyclable and biodegradable PSAs that meet the environmental requirements of both businesses and regulatory agencies.

Healthcare applications are another significant driver of PSA market growth. Medical-grade PSAs are used in wound care products, medical tapes, and transdermal drug delivery systems, where hypoallergenic and skin-friendly adhesives are critical. With the rise of home healthcare and an aging population, there is increasing demand for comfortable, long-wearing adhesives that can securely adhere to the skin without causing irritation. Innovations in medical adhesives, including antimicrobial coatings and breathable materials, are addressing these needs and expanding the use of PSAs in the healthcare industry.

What Factors Are Driving Growth In The Pressure Sensitive Adhesives Market?

The growth in the Pressure Sensitive Adhesives (PSAs) market is driven by several factors, including advancements in adhesive technology, increasing demand from end-use industries, and the rising importance of sustainability. One of the primary growth drivers is the expansion of the packaging industry, particularly in response to the growth of e-commerce and the demand for sustainable packaging solutions. PSAs are widely used in packaging applications for sealing, labeling, and tamper-evidence, and as online shopping becomes more prevalent, the need for flexible, durable, and eco-friendly adhesives is increasing. Packaging manufacturers are turning to PSAs that meet regulatory requirements for recyclability and environmental responsibility, further boosting demand for innovative adhesive solutions.

Another significant factor driving growth is the increased adoption of PSAs in the automotive and electronics sectors. These industries are moving toward lightweight materials and design flexibility, creating more opportunities for PSAs to replace traditional mechanical fasteners. In automotive manufacturing, PSAs offer advantages such as reducing vehicle weight, improving assembly efficiency, and providing long-lasting bonds in high-stress environments. Similarly, the electronics industry is leveraging PSAs in the production of smaller, lighter devices that require precision bonding without compromising performance.

The medical and healthcare industry is another critical driver of PSA market growth, particularly with the rise of home healthcare products and medical wearables. PSAs are essential for creating comfortable, skin-safe adhesives that can be used in medical tapes, wound dressings, and transdermal drug delivery systems. As the healthcare industry continues to evolve, the demand for PSAs that are hypoallergenic, long-lasting, and capable of maintaining adhesion on human skin is expected to increase.

Finally, the focus on sustainability and eco-friendly materials is playing a pivotal role in driving demand for water-based and bio-based PSAs. With increasing pressure to reduce environmental impact, manufacturers are seeking adhesives that minimize VOC emissions and can be recycled or biodegraded. This shift toward sustainable production practices is prompting manufacturers to innovate, leading to the development of new adhesive formulations that are not only high-performing but also environmentally responsible. These factors, combined with the growing applications of PSAs across various industries, are expected to drive significant growth in the global PSA market in the coming years.

Report Scope

The report analyzes the Pressure Sensitive Adhesives market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Chemistry Type (Acrylic, Rubber, Silicone, Other Chemistry Types); Technology (Water-Based, Solvent-Based, Hot-Melt, Radiation); End-Use (Packaging, Electrical, Electronics & Telecommunications, Automotive & Transportation, Building & Construction, Medical & Healthcare, Other End-Uses).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Acrylic Adhesives segment, which is expected to reach US$7.8 Billion by 2030 with a CAGR of a 7.2%. The Rubber Adhesives segment is also set to grow at 7.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $3.3 Billion in 2024, and China, forecasted to grow at an impressive 11% CAGR to reach $4.7 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Pressure Sensitive Adhesives Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Pressure Sensitive Adhesives Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Pressure Sensitive Adhesives Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as 3M Company, Aekyung Chemical Co., Ltd., Alliant Label (USA), American Adhesives, Arkema Group and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 34 companies featured in this Pressure Sensitive Adhesives market report include:

- 3M Company

- Aekyung Chemical Co., Ltd.

- Alliant Label (USA)

- American Adhesives

- Arkema Group

- ASTORPLAST Klebetechnik GmbH

- Avery Dennison Corporation

- Beardow & Adams (Adhesives) Ltd.

- Bond Chemicals Co., Ltd.

- Cattie Adhesives

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- 3M Company

- Aekyung Chemical Co., Ltd.

- Alliant Label (USA)

- American Adhesives

- Arkema Group

- ASTORPLAST Klebetechnik GmbH

- Avery Dennison Corporation

- Beardow & Adams (Adhesives) Ltd.

- Bond Chemicals Co., Ltd.

- Cattie Adhesives

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 382 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

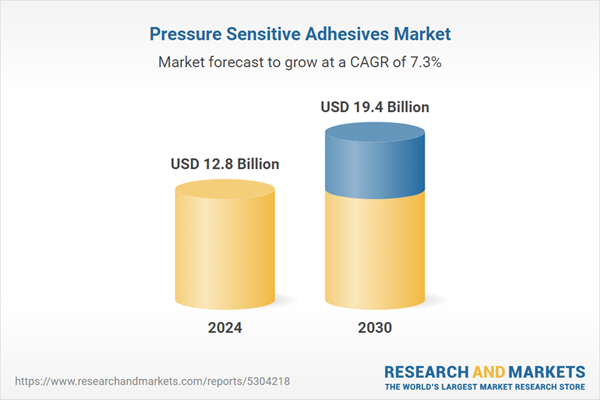

| Estimated Market Value ( USD | $ 12.8 Billion |

| Forecasted Market Value ( USD | $ 19.4 Billion |

| Compound Annual Growth Rate | 7.3% |

| Regions Covered | Global |