Global Organic Feed Market - Key Trends & Drivers Summarized

Why Has Organic Feed Become Essential for Sustainable Livestock Farming?

Organic feed has become a cornerstone of sustainable livestock farming, providing an eco-friendly and health-focused alternative to conventional animal feed. Unlike conventional feed, organic feed is produced without synthetic pesticides, herbicides, antibiotics, or genetically modified organisms (GMOs), which benefits both animal health and environmental sustainability. This chemical-free approach is particularly important as consumers increasingly demand transparency and traceability in the food supply chain, including the diet of animals that produce meat, milk, eggs, and other animal-derived products. Organic feed ensures that livestock are raised on diets that are aligned with natural and ethical farming standards, leading to healthier animals and, consequently, higher-quality organic products for consumers. This has made organic feed an essential component of certified organic farming practices, where both the feed and the end-products must meet rigorous organic standards to receive certification.The environmental benefits of organic feed production are a major factor driving its adoption, as organic farming practices contribute to biodiversity, reduce pollution, and promote soil health. Organic feed crops are grown using sustainable agricultural practices that avoid chemical fertilizers and pesticides, which helps maintain the ecological balance in farming areas. Crop rotation, cover cropping, and composting are commonly used to enrich soil fertility and prevent erosion, contributing to long-term environmental health. By reducing the need for synthetic inputs, organic feed production also minimizes water contamination and protects beneficial insects and wildlife. As climate change concerns mount, livestock farmers and consumers alike are turning to organic feed as a way to reduce the ecological footprint of livestock production, supporting a more sustainable and eco-friendly food system.

Organic feed has also gained traction due to its perceived health benefits for animals, which can translate into improved product quality for consumers. Animals raised on organic feed are generally healthier, as they are not exposed to the chemical residues commonly found in conventional feed. This results in animal products with fewer contaminants and potentially higher nutritional quality, which is appealing to health-conscious consumers. For example, studies have indicated that organically raised livestock can yield products with higher levels of omega-3 fatty acids and antioxidants. As consumer preferences shift toward natural, high-quality foods, organic feed is increasingly seen as essential to producing products that meet these expectations. This demand for cleaner, ethically produced food continues to propel the organic feed market forward, making it a vital component of sustainable livestock production.

How Are Certifications and Standards Shaping the Organic Feed Market?

Certifications and standards play a crucial role in the organic feed market, ensuring that products meet the stringent requirements needed for organic labeling and providing consumers with confidence in the integrity of organic livestock products. Certifications such as the USDA Organic, EU Organic, and Organic Farmers & Growers (OF&G) specify strict criteria that organic feed must meet, including prohibitions on synthetic chemicals, GMOs, and antibiotics. These certifications are essential in the organic feed supply chain, as they establish credibility and transparency, allowing farmers, processors, and consumers to trust that the feed adheres to environmentally friendly and ethical standards. Compliance with these standards is required for any product labeled as organic, reinforcing the importance of certified organic feed in maintaining the organic status of animal products in the marketplace.The adoption of organic certifications for feed has also fostered trust among consumers, who increasingly value transparency and ethical sourcing. With organic labeling, buyers can be assured that the feed meets established standards for animal welfare and environmental stewardship, attributes that resonate strongly with ethically minded consumers. These standards extend to every aspect of the organic feed production process, from the sourcing of organic grains to the handling and processing stages, ensuring that the entire supply chain is free from prohibited chemicals and genetic modification. As consumer awareness of animal welfare and sustainability issues grows, certification labels have become important indicators that help customers make informed purchasing decisions, and organic feed suppliers benefit from the enhanced credibility that certified products provide in a competitive market.

In addition to established certifications, the organic feed market is increasingly influenced by independent verifications and eco-labels that emphasize animal welfare, sustainable agriculture, and social responsibility. Certifications like Non-GMO Project Verified and Fair Trade are often sought alongside organic certification to offer consumers added assurance of ethical and eco-friendly practices. These additional certifications reinforce the values of organic feed brands, helping them reach broader market segments and respond to diverse consumer preferences. By adhering to these high standards, organic feed producers strengthen their reputation and meet the growing demand for responsible, high-quality feed options that align with evolving consumer priorities around sustainability and health. As the demand for organic and eco-certified feed grows, producers are investing in certifications and transparency to build trust and secure a prominent position in the organic livestock industry.

What Are the Key Benefits of Organic Feed for Livestock Health and Productivity?

Organic feed offers several advantages for livestock health and productivity, which have made it highly desirable among farmers and producers aiming to improve animal welfare and optimize the quality of their products. One of the primary benefits of organic feed is its contribution to better digestion and nutrient absorption, as it is free from synthetic additives and genetically modified ingredients that can disrupt animals' natural digestive processes. Organic feed is typically made from high-quality grains and legumes, such as organic corn, soy, and alfalfa, which provide essential nutrients and energy to support healthy growth and productivity in livestock. This natural diet reduces the risk of digestive issues and enhances nutrient uptake, leading to healthier, more resilient animals. By prioritizing animal health, organic feed also contributes to higher-quality end products, such as milk with improved fatty acid profiles or meat with enhanced flavor, which are attractive to health-conscious consumers.Another advantage of organic feed is its impact on animal immunity and disease resistance. Since organic feed is produced without antibiotics, synthetic hormones, and other chemical additives, animals are less likely to develop resistance to antibiotics, which is a growing concern in conventional livestock farming. Organic livestock are also often raised in conditions that emphasize natural grazing, exercise, and outdoor access, which further enhances their health and minimizes stress. As a result, animals fed on organic diets tend to have stronger immune systems and are less prone to diseases, reducing the need for medical interventions and contributing to overall livestock productivity. This natural approach to animal care aligns with consumer demand for products that are free from antibiotics and artificial additives, positioning organic feed as a vital component of ethical and sustainable livestock management.

The benefits of organic feed extend to product consistency and quality, as animals on a natural diet produce more uniform and reliable products. Organic feed is carefully formulated to meet the dietary needs of specific livestock, ensuring balanced nutrition that supports optimal growth, reproduction, and yield. For example, organic feed blends designed for dairy cows are tailored to promote milk production, while poultry feed is optimized to support egg-laying efficiency. By aligning feed composition with animals' biological needs, organic feed supports steady production rates and consistent quality, reducing fluctuations that can occur with conventional feeds that contain artificial growth enhancers. This predictability is essential for producers, as it helps them maintain high standards and meet market demands. The enhanced health, immunity, and productivity offered by organic feed make it an invaluable resource for livestock farmers focused on both animal welfare and product excellence.

What Is Fueling the Growth in the Organic Feed Market?

The growth in the organic feed market is driven by several factors, including rising consumer demand for organic animal products, increased awareness of animal welfare, and stricter environmental regulations. As more consumers prioritize organic and natural foods, they are also seeking animal-derived products that meet organic standards, which has increased the demand for organic feed. Organic feed is essential for maintaining the organic certification of meat, dairy, and eggs, making it a fundamental component of organic food production. This demand from the consumer side has encouraged livestock farmers to adopt organic feed, driving growth across the supply chain and creating opportunities for feed producers to meet the needs of the expanding organic market.Increasing awareness of animal welfare is another key driver of organic feed adoption, as consumers and producers recognize the importance of providing animals with a healthy, natural diet. Organic feed supports ethical farming practices by eliminating the use of synthetic additives, antibiotics, and GMOs, which contribute to healthier and more humane livestock management. Animal welfare organizations and advocacy groups have also promoted the benefits of organic feed, which aligns with the ethical priorities of many consumers and contributes to its growing popularity. As animal welfare continues to gain traction as a critical aspect of sustainable farming, the demand for organic feed is expected to rise, supported by consumers who value transparency and ethical production in animal agriculture.

The adoption of organic feed is further fueled by regulatory and environmental pressures that encourage sustainable farming practices. Governments and regulatory bodies are increasingly introducing policies to reduce the environmental impact of agriculture, including restrictions on pesticide use and incentives for organic farming. Organic feed production, which avoids synthetic chemicals and supports biodiversity, is aligned with these goals, making it an attractive option for farmers looking to meet environmental standards and avoid potential penalties. Additionally, as climate change concerns grow, organic feed's lower environmental footprint and support for regenerative agriculture are appealing to both producers and policymakers seeking sustainable agricultural solutions. Together, these factors highlight the expanding role of organic feed in modern agriculture, reinforcing its position in a market that values sustainability, health, and ethical practices.

Report Scope

The report analyzes the Organic Feed market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Cereals & Grains, Oilseeds, Other Types); Livestock (Poultry, Ruminants, Swine, Aquatic Animals, Other Livestocks); Form (Pellets, Crumbles, Other Forms).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Cereals & Grains segment, which is expected to reach US$9.9 Billion by 2030 with a CAGR of a 6%. The Oilseeds segment is also set to grow at 5.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $2.9 Billion in 2024, and China, forecasted to grow at an impressive 5.2% CAGR to reach $2.3 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Organic Feed Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Organic Feed Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Organic Feed Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Aller Aqua, B&W Feeds, BernAqua, Cargill, Country Heritage Feeds and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 52 companies featured in this Organic Feed market report include:

- Aller Aqua

- B&W Feeds

- BernAqua

- Cargill

- Country Heritage Feeds

- Country Junction feed

- Feedex Companies

- ForFarmers

- Green Mountian Feeds

- K-Much Feed Industry Co. Ltd.

- Kreamer Feed

- Peak Feeds

- Purina Animal Nutrition LLC

- Ranch-Way Feeds

- Scratch and Peck Feeds

- SunOpta

- The Organic Feed Company

- Unique Organic

- Yorktown Organics LLC

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Aller Aqua

- B&W Feeds

- BernAqua

- Cargill

- Country Heritage Feeds

- Country Junction feed

- Feedex Companies

- ForFarmers

- Green Mountian Feeds

- K-Much Feed Industry Co. Ltd.

- Kreamer Feed

- Peak Feeds

- Purina Animal Nutrition LLC

- Ranch-Way Feeds

- Scratch and Peck Feeds

- SunOpta

- The Organic Feed Company

- Unique Organic

- Yorktown Organics LLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 241 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

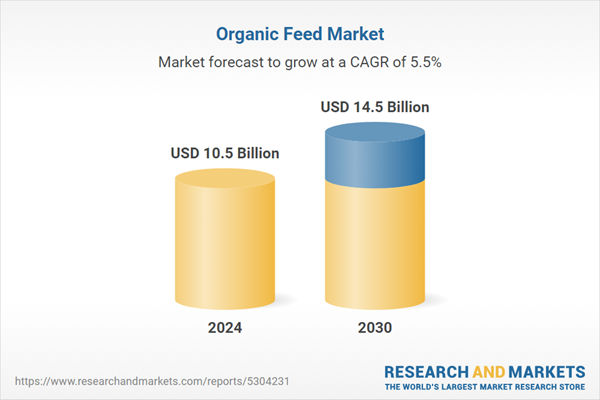

| Estimated Market Value ( USD | $ 10.5 Billion |

| Forecasted Market Value ( USD | $ 14.5 Billion |

| Compound Annual Growth Rate | 5.5% |

| Regions Covered | Global |