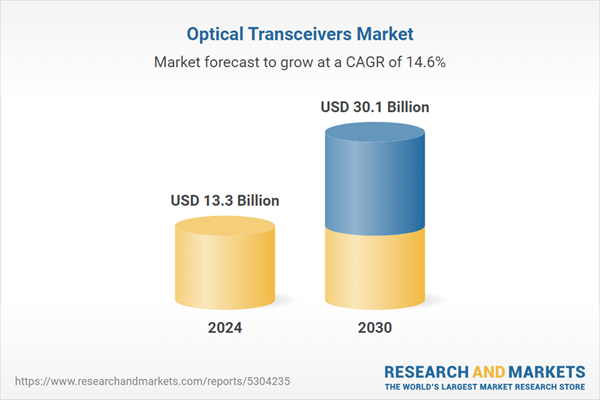

Global Optical Transceivers Market - Key Trends & Drivers Summarized

Why Are Optical Transceivers Vital for Modern Communication Networks?

Optical transceivers have become foundational components in modern communication networks, enabling the high-speed data transmission required to support today's data-intensive applications. These devices convert electrical signals to optical signals and vice versa, allowing data to travel long distances over fiber optic cables with minimal loss, interference, and latency. As data consumption grows exponentially due to cloud computing, streaming services, and the proliferation of connected devices, the demand for optical transceivers has surged. Telecommunications providers, data centers, and enterprises rely heavily on optical transceivers to enhance their network capacity and meet user expectations for fast and reliable connectivity. The migration to 5G networks has further intensified the need for advanced transceiver technologies, as 5G requires substantial backhaul capacity to handle the massive data traffic generated by high-bandwidth services like video streaming, gaming, and IoT applications. Optical transceivers play a critical role in making this high-speed, high-capacity data transmission possible, supporting the backbone of modern digital communication infrastructure.The need for high-performance optical transceivers is particularly pronounced in data centers, where they enable the fast, efficient data transfer required for cloud computing and storage services. Data centers house vast amounts of data and process enormous volumes of traffic, necessitating rapid, low-latency connectivity solutions. Optical transceivers provide the scalability needed to connect racks, rows, and clusters of servers while minimizing energy consumption, which is crucial for managing the operational costs and environmental impact of these facilities. With the rise of edge computing, where data is processed closer to the source to reduce latency, optical transceivers are also essential in enabling high-speed data transmission in distributed data centers, effectively linking central data hubs with peripheral sites. This scalability and adaptability make optical transceivers indispensable in the cloud and data center industry, facilitating rapid data exchange and enabling efficient management of increasingly complex networks.

Additionally, the increasing focus on network virtualization and software-defined networking (SDN) in both telecommunications and enterprise networks has highlighted the importance of optical transceivers in supporting dynamic, flexible infrastructure. Virtualized networks allow for rapid provisioning and reconfiguration, but they rely on robust underlying hardware that can handle substantial data loads. Optical transceivers enable these virtualized and SDN environments by providing flexible and modular connectivity options that support various data rates, distances, and interfaces. As industries continue to adopt virtualized network models to improve scalability and agility, the demand for adaptable optical transceivers grows, underscoring their critical role in enabling future-ready network infrastructure.

How Is the Shift to Higher Data Rates Shaping the Optical Transceiver Market?

The shift toward higher data rates in network infrastructure is a significant driver in the optical transceiver market, with growing demand for 100G, 400G, and even 800G transceivers to support increasing data traffic. The push for higher data rates is fueled by rising consumer expectations for faster internet speeds, as well as by technological advancements that require substantial bandwidth, such as artificial intelligence (AI), machine learning (ML), and the Internet of Things (IoT). The 100G transceivers, once the industry standard, are now being rapidly augmented by 400G and higher-speed transceivers to manage the data requirements of hyperscale data centers and metropolitan networks. These transceivers can process more data per second, improving network performance and enabling greater capacity in the same physical infrastructure. As data rates continue to increase, optical transceivers are evolving to meet these requirements, offering higher performance while maintaining energy efficiency and reducing latency.In hyperscale data centers, which serve the vast data needs of cloud giants like Amazon, Google, and Microsoft, high-speed optical transceivers have become essential for efficient network management. With these facilities processing unprecedented data volumes, 400G and 800G transceivers allow data center operators to optimize space and power usage while meeting growing traffic demands. These high-capacity transceivers support dense wave division multiplexing (DWDM) and coarse wave division multiplexing (CWDM) technologies, which allow multiple data channels to share the same fiber, significantly increasing capacity without additional infrastructure. As data centers strive to keep pace with demand while controlling operational costs, high-speed transceivers have become critical in supporting the scaling of infrastructure necessary to handle exponential data growth.

Moreover, advancements in coherent optical technology are enabling even faster data transmission over long distances, further shaping the high-speed transceiver market. Coherent optical technology allows transceivers to process complex signals with greater spectral efficiency, which is particularly valuable for long-haul and metro networks that connect data centers, cities, and even continents. By increasing the amount of data that can be transmitted over a single wavelength, coherent optics make it possible to achieve 400G and higher speeds over extensive distances without the need for regeneration or amplification, which reduces costs and enhances network efficiency. This capability is crucial for telecommunications providers upgrading their backbone networks to support higher bandwidth requirements, and as coherent optical technology advances, it is likely to spur continued growth and innovation within the optical transceiver market.

What Role Do Optical Transceivers Play in 5G and Beyond?

Optical transceivers are integral to the successful deployment of 5G networks and are expected to play an even more critical role as 6G development advances. As mobile networks transition to 5G, there is an unprecedented demand for backhaul infrastructure that can handle high data rates and provide low-latency connections between base stations and the core network. Optical transceivers, especially those capable of high-speed data transmission over long distances, provide the robust and reliable connectivity required to support 5G's high bandwidth and ultra-reliable low latency characteristics. In 5G networks, transceivers are widely used to connect various network segments, including the radio access network (RAN), transport network, and core network, enabling seamless data transfer that is crucial for high-speed applications such as augmented reality (AR), virtual reality (VR), and real-time IoT services.Furthermore, the small cell architecture in 5G networks, which involves a dense network of base stations to provide localized, high-capacity coverage, relies heavily on optical transceivers for inter-cell connectivity. Small cells are essential for achieving the high data rates and coverage density required by 5G, but they also demand extensive fiber infrastructure to connect each cell back to the core network. Optical transceivers facilitate this connectivity, enabling data to be transmitted efficiently across numerous small cells without signal degradation. As mobile networks expand their 5G footprint, especially in urban and suburban areas, the demand for optical transceivers will continue to rise, driven by the need for a high-capacity, low-latency backhaul network that supports a growing array of 5G-enabled devices and applications.

Looking toward the future, optical transceivers will be critical in enabling the infrastructure required for 6G networks, which promise even higher data rates, faster speeds, and wider coverage than 5G. 6G is anticipated to support advanced applications such as holographic communication, digital twins, and pervasive AI, which will necessitate massive bandwidth and ultra-low latency. Optical transceivers are expected to evolve to handle terabit-per-second data rates, supporting next-generation infrastructure with coherent optical technology, wavelength division multiplexing, and potentially even quantum communication capabilities. As 5G continues to expand and the vision for 6G takes shape, optical transceivers will remain at the heart of wireless network evolution, supporting the high-speed, high-capacity networks of the future.

What Is Fueling the Growth in the Optical Transceiver Market?

The growth in the optical transceiver market is driven by several key factors, including the expansion of data centers, the roll-out of 5G networks, and the shift toward higher data rates in telecommunications and enterprise networks. The demand for cloud services and streaming content has led to an explosion in data center construction worldwide, particularly hyperscale facilities that require extensive, high-speed connectivity to manage massive data flows. Optical transceivers are indispensable in these environments, enabling data centers to meet escalating demands while maintaining energy efficiency and cost control. As data centers continue to expand, driven by cloud computing and edge infrastructure, the market for optical transceivers that can support high-capacity, low-latency data transfer will continue to grow.The ongoing global deployment of 5G networks is another significant driver for optical transceivers, which provide the crucial high-speed backhaul connections necessary to support 5G's data-intensive applications. Optical transceivers enable 5G networks to achieve the required speed and reliability for real-time applications like remote healthcare, autonomous vehicles, and smart city infrastructure. Small cell deployments, an essential part of 5G architecture, further increase the need for fiber-connected transceivers to facilitate communication across densely packed network nodes. As 5G roll-outs progress and the demand for faster, more reliable mobile networks intensifies, optical transceivers will play an integral role in meeting these requirements, sustaining market growth.

The trend toward higher data rates, particularly the adoption of 400G and 800G transceivers, is also propelling the optical transceiver market forward. Telecommunications providers and data centers are upgrading their networks to support these high data rates to manage the growing traffic generated by AI, IoT, and other bandwidth-heavy applications. The adoption of coherent optical technology, which enables efficient data transmission over long distances, is further driving demand as it reduces network costs while enhancing performance. With organizations moving toward more advanced, high-capacity networks, the demand for optical transceivers capable of supporting these higher data rates is expected to increase steadily, underscoring their importance in the ongoing expansion of global communication networks.

Report Scope

The report analyzes the Optical Transceivers market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Fiber Type (Single-Mode, Multimode); Data Rate (Less than 10 Gbps, 10 Gbps to 40 Gbps, 41 Gbps to 100 Gbps, More than 100 Gbps); Application (Data Center, Telecommunication, Enterprise).

- Geographic Regions/Countries:World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Single-Mode Optical Transceivers segment, which is expected to reach US$15.4 Billion by 2030 with a CAGR of a 11.3%. The Multimode Optical Transceivers segment is also set to grow at 18.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $3.4 Billion in 2024, and China, forecasted to grow at an impressive 18.6% CAGR to reach $7.3 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Optical Transceivers Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Optical Transceivers Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Optical Transceivers Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Accelink, Applied Optoelectronics, Ciena, Cisco, FIT Hong Teng Limited and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 18 companies featured in this Optical Transceivers market report include:

- Accelink

- Applied Optoelectronics

- Ciena

- Cisco

- FIT Hong Teng Limited

- Fujitsu Optical Components

- Hisense Broadband

- II-VI Incorporated

- Innolight

- Intel

- Lumentum

- Mellanox

- NEC

- NeoPhotonics

- Perle Systems

- Reflex Photonics

- Smartoptics

- Solid Optics

- Source Photonics

- Sumitomo Electric Industries Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Accelink

- Applied Optoelectronics

- Ciena

- Cisco

- FIT Hong Teng Limited

- Fujitsu Optical Components

- Hisense Broadband

- II-VI Incorporated

- Innolight

- Intel

- Lumentum

- Mellanox

- NEC

- NeoPhotonics

- Perle Systems

- Reflex Photonics

- Smartoptics

- Solid Optics

- Source Photonics

- Sumitomo Electric Industries Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 351 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 13.3 Billion |

| Forecasted Market Value ( USD | $ 30.1 Billion |

| Compound Annual Growth Rate | 14.6% |

| Regions Covered | Global |