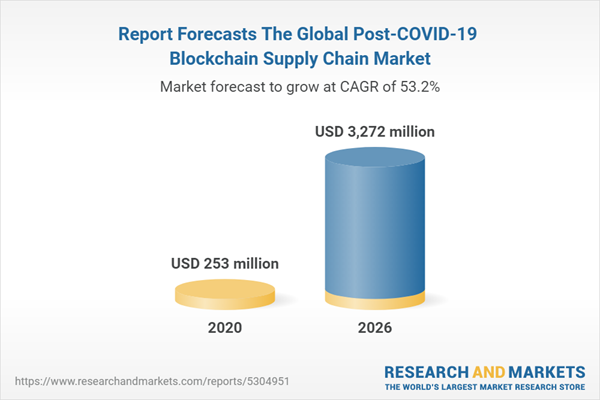

The report forecasts the global post-COVID-19 blockchain supply chain market to grow from USD 253 million in 2020 to USD 3,272 million by 2026, at a Compound Annual Growth Rate (CAGR) of 53.2% during 2020-2026. The major growth drivers for the market include increasing popularity of blockchain technology in retail and SCM and growing need for supply chain transparency. However, uncertain regulatory status and standards may restrain the market growth.

Among type, hybrid and consortium segment to grow at the highest CAGR during the forecast period

A permissioned blockchain provides a hybrid solution between the low trust offered by public blockchains and the single, highly trusted entity model of private blockchains. The advantage of the hybrid blockchain combines a permissioned that is a private blockchain with a public blockchain, and companies are able to secure background transactions with business partners, while also sharing product information with consumers on an open ledger.

The advantage of access control leading to increase as well as strengthened security has helped hybrid blockchain to increasingly become popular among enterprises and is being implemented by companies, such as Maersk. The use cases of hybrid blockchain in supply chain are increasing among industry verticals, such as eCommerce. Hence is expected to grow at the highest CAGR.

Large enterprises segment to hold a larger market size during the forecast period

The reduction in infrastructure costs, improvement in business functioning, and sustainability in the intense competition are the key factors that are projected to drive the adoption of blockchain supply chain in large organizations. The investments done by large enterprises in advanced technologies for increasing productivity and efficiency of the company is also a key factor that is projected to drive the adoption of blockchain supply chain in large enterprises.

Asia-Pacific (APAC) to grow at the highest CAGR during the forecast period

Due to the presence of more middle-class societies, APAC has more varied customer demands. Approximately 70% of the world’s container traffic passes through ports in APAC. Moreover, most APAC businesses reach their markets through complex supply chains that include many intermediaries, such as trading partners and a variety of different paths to market. Supply chains in APAC are often significantly more difficult to manage as compared to other regions of the world. To reduce these complexities, the adoption of blockchain supply chain in the region is increasing.

China, India, Australia, and Singapore are witnessing growth in the number of startups in cryptocurrency and blockchain technology. Hence, organizations have started joining various conferences to brainstorm and understand the value of blockchain. The increased shift of APAC enterprises toward leaner and agile supply chains with end-to-end visibility by the adoption of the latest technologies is also one of the biggest drivers of blockchain supply chain software and services in the region.

Research Coverage

The report segments the global blockchain supply chain market by offering, type, provider, application, end user, and region. The offering segment comprises platform and services. The type segment comprises public, private, and hybrid and consortium. The provider segment comprises application providers, middleware providers and infrastructure providers. The blockchain supply chain market by application includes Asset Tracking, Counterfeit Detection, Payment and Settlement, Smart Contracts, Risk and Compliance Management, and others (Inventory Control and Reward Management). By end user, blockchain supply chain market includes FMCG, Retail and eCommerce, Healthcare, Manufacturing, Transportation and Logistics, Oil, Gas and Mining, and Others (Construction, Agriculture, and Automobile). The report covers the blockchain supply chain market with respect to 5 major regions, namely, North America, Europe, Asia-Pacific (APAC), the Middle East and Africa (MEA) and Latin America.

The report includes the study of the key players offering blockchain supply chain solutions and services. It profiles major vendors in the global blockchain supply chain market, including IBM (US), Microsoft (US), SAP SE (Germany), Amazon Web Services (AWS) (US), Oracle (US), Huawei (China), Guardtime (Estonia), Tibco Software (US), Bitfury (Netherlands), Interbit (Canada), Auxesis (India), Vechain Foundation (China), Chainvine (UK), Digital Treasury Corporation (DTCO) (China), Datex Corporation (US), OpenXcell (US), Algorythmix (India) etc.

Breakup of Primary Interviews

- By Company: Tier I: 35%, Tier II: 45%, and Tier III: 20%

- By Designation: C-Level Executives: 35%, Directors: 25%, and Others: 40%

- By Region: North America: 45%, Europe: 20%, APAC: 30%, and Rest of World: 5%

The report would help the market leaders and new entrants in the global blockchain supply chain market in the following ways:

- The report segments the market into various subsegments. Hence it covers the market comprehensively. It provides the closest approximations of the revenue numbers for the overall market and its subsegments. The market numbers are split further across applications and regions.

- It helps in understanding the overall growth of the market. It also provides information about key market drivers, restraints, challenges, and opportunities.

- It helps stakeholders in understanding their competitors better and gaining more insights to strengthen their positions in the market. The study also presents the positioning of the key players based on their product offerings and business strategies.

Table of Contents

1 Introduction

1.1 Introduction to COVID-19

1.2 COVID-19 Health Assessment

Figure 1 COVID-19: Global Propagation

Figure 2 COVID-19 Propagation: Select Countries

1.3 COVID-19 Economic Assessment

Figure 3 Revised Gross Domestic Product Forecasts for Select G20 Countries in 2020

1.3.1 COVID-19 Economic Impact - Scenario Assessment

Figure 4 Criteria Impacting Global Economy

Figure 5 Scenarios in Terms of Recovery of Global Economy

1.4 Study Objectives

1.4.1 Market Definition

1.4.2 Inclusions and Exclusions

1.5 Market Scope

1.5.1 Market Segmentation

1.5.2 Years Considered for the Study

1.6 Currency Considered

Table 1 United States Dollar Exchange Rate, 2014-2020

1.7 Stakeholders

1.8 Summary of Changes

2 Research Methodology

2.1 Research Data

Figure 6 Blockchain Supply Chain Market: Research Design

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakup of Primary Profiles

2.1.2.2 Key Industry Insights

2.2 Market Breakup and Data Triangulation

2.3 Market Size Estimation

Figure 7 Market Size Estimation Methodology - Approach 1 (Supply Side): Revenue from the Platform/Services of Vendors

Figure 8 Market Size Estimation Methodology: Illustrative Example of Amazon Web Services

Figure 9 Market Size Estimation Methodology - Approach 2, Bottom Up (Supply Side): Collective Revenue from Platform and Services

Figure 10 Market Size Estimation Methodology - Approach 3, Top Down (Demand Side)

2.4 Market Forecast

Table 2 Factor Analysis

2.5 Company Evaluation Matrix Methodology

Figure 11 Company Evaluation Matrix: Criteria Weightage

2.6 Startup/SME Evaluation Matrix Methodology

Figure 12 Startup/SME Evaluation Matrix: Criteria Weightage

2.7 Assumptions for the Study

2.8 Limitations of the Study

3 Executive Summary

Figure 13 Global Blockchain Supply Chain Market to Witness High Growth During the Forecast Period

Figure 14 Leading Segments in the Market in 2020

Figure 15 Market: Regional Snapshot

4 Premium Insights

4.1 Attractive Opportunities in the Blockchain Supply Chain Market

Figure 16 High Adoption of the Blockchain Technology Across Application Areas to Provide Significant Opportunities for Market Growth

4.2 Market, by Type and Provider

Figure 17 Private Blockchain Segment and Application Segment to Hold the Highest Market Shares in 2020

4.3 Market, by Region

Figure 18 Asia-Pacific to Grow at the Highest CAGR During the Forecast Period

4.4 Market: Investment Scenario

Figure 19 Asia-Pacific to Emerge as the Best Market for Investments Over the Next Five Years

5 Market Overview and Industry Trends

5.1 Introduction

5.2 Market Dynamics

Figure 20 Drivers, Restraints, Opportunities, and Challenges: Blockchain Supply Chain Market

5.2.1 Drivers

5.2.1.1 Increasing Popularity of Blockchain Technology in Retail and SCM

5.2.1.2 Growing Need for Supply Chain Transparency

5.2.1.3 Rising Demand for Enhanced Security of Supply Chain Transactions

5.2.2 Restraints

5.2.2.1 Uncertain Regulatory Status and Standards

5.2.3 Opportunities

5.2.3.1 Growing Need for Automating Supply Chain Activities and Eliminating Middlemen

5.2.3.2 Rising Government Initiatives

5.2.4 Challenges

5.2.4.1 Managing the Increasing Data Volume

5.2.4.2 Lack of the Technical Knowledge

5.2.4.3 Shortage of Supply and Demand Shocks During COVID-19 Outbreak

5.3 COVID-19 Driven Market Dynamics

5.3.1 Drivers and Opportunities

5.3.2 Restraints and Challenges

5.3.3 Cumulative Growth Analysis

Table 3 COVID-19 Impact: Blockchain Supply Chain Market

5.4 Value Chain Analysis

Figure 21 Value Chain: Market

5.5 Ecosystem: Market

Figure 22 Ecosystem: Market

Table 4 Role of Companies in Ecosystem

5.6 Average Selling Price/Pricing Model of Blockchain Supply Chain Players 2019-2020

Figure 23 2019-2020 Average Selling Price Model of Market

5.7 Blockchain Technology Analysis

5.7.1 Blockchain Supply Chain Market: Top Trends

5.7.1.1 Integration of Blockchain Technology with the Internet of Things

5.7.1.2 Smart Contracts

5.8 Use Cases

5.8.1 to Check the Authenticity, Provenance, and Origin of Products by Tracking the Global Flow of Goods, by BigchainDB

5.8.2 Use Case 2: To Reduce the Wastage of Food by Improving Food Safety and Traceability, and to Help Its Online and Offline Consumers Across the Globe, by IBM

5.8.3 Use Case 3: To Leverage Innovative Technologies such as Blockchain, AI and IoT to Transform Supply Chain Operations in the Shipping Industry, by Oracle

5.8.4 Use Case 4: Blockchain Helps RCS Global Trace Responsibly Produced Raw Materials, by IBM

5.9 Revenue Shift - YC/YCC Shift for Market

Figure 24 YC/YCC Shift: Blockchain Supply Chain Market

5.10 Patent Analysis

Figure 25 Blockchain Patent Applications Per Year

Figure 26 Top Blockchain Application Areas

Table 5 Blockchain Supply Chain Patent Analysis

5.11 Porter's Five Forces Analysis

Table 6 Porters 5 Forces Impact on the Market

Figure 27 Porter's Five Forces Analysis: Market

5.11.1 Threat from New Entrants

5.11.2 Threat of Substitutes

5.11.3 Bargaining Power of Suppliers

5.11.4 Bargaining Power of Buyers

5.11.5 Intensity of Competition Rivalry

6 Blockchain Supply Chain Market, by Offering

6.1 Introduction

6.1.1 Offering: Market Drivers

6.1.2 Offering: COVID-19 Impact

Figure 28 Platform Segment to Hold a Significant Market Size During the Forecast Period

Table 7 Market Size, by Offering, 2014-2019 (USD Million)

Table 8 Market Size, by Offering, 2019-2026 (USD Million)

6.2 Platform

Table 9 Platform: Market Size, by Region, 2014-2019 (USD Million)

Table 10 Platform: Market Size in Software, by Region, 2019-2026 (USD Million)

6.3 Services

Figure 29 Deployment and Integration Segment to Hold the Largest Market Size During the Forecast Period

Table 11 Services: Blockchain Supply Chain Market Size, by Region, 2014-2019 (USD Million)

Table 12 Services: Market Size, by Region, 2019-2026 (USD Million)

Table 13 Services: Market Size, by Type, 2014-2019 (USD Million)

Table 14 Services: Market Size, by Type, 2019 -2026 (USD Million)

6.3.1 Technology Advisory and Consulting

Table 15 Technology Advisory and Consulting Market Size, by Region, 2014-2019 (USD Million)

Table 16 Technology Advisory and Consulting Market Size, by Region, 2019-2026 (USD Million)

6.3.2 Deployment and Integration

Table 17 Deployment and Integration Market Size, by Region, 2014-2019 (USD Million)

Table 18 Deployment and Integration Market Size, by Region, 2019-2026 (USD Million)

6.3.3 Support and Maintenance

Table 19 Support and Maintenance Market Size, by Region, 2014-2019 (USD Million)

Table 20 Support and Maintenance Market Size, by Region, 2019-2026 (USD Million)

7 Blockchain Supply Chain Market, by Type

7.1 Introduction

7.1.1 Type: Market Drivers

7.1.2 Type: COVID-19 Impact

Figure 30 Hybrid and Consortium Segment to Hold the Largest Market Size During the Forecast Period

Table 21 Market Size, by Type, 2014-2019 (USD Million)

Table 22 Market Size, by Type, 2019-2026 (USD Million)

7.2 Public

Table 23 Public: Market Size, by Region, 2014-2019 (USD Million)

Table 24 Public: Market Size, by Region, 2019-2026 (USD Million)

7.3 Private

Table 25 Private:Market Size, by Region, 2014-2019 (USD Million)

Table 26 Private: Market Size, by Region, 2019-2026 (USD Million)

7.4 Hybrid and Consortium

Table 27 Hybrid and Consortium: Market Size, by Region, 2014-2019 (USD Million)

Table 28 Hybrid and Consortium: Market Size, by Region, 2019-2026 (USD Million)

8 Blockchain Supply Chain Market, by Provider

8.1 Introduction

8.1.1 Provider: Market Drivers

8.1.2 Provider: COVID-19 Impact

Figure 31 Application Provider Segment to Hold the Largest Market Size During the Forecast Period

Table 29 Market Size, by Provider Type, 2014-2019 (USD Million)

Table 30 Market Size, by Provider Type, 2019-2026 (USD Million)

8.2 Application Providers

Table 31 Application Providers: Market Size, by Region, 2014-2019 (USD Million)

Table 32 Application Providers: Market Size, by Region, 2019-2026 (USD Million)

8.3 Middleware Providers

Table 33 Middleware Providers: Market Size, by Region, 2014-2019 (USD Million)

Table 34 Middleware Providers: Market Size, by Region, 2019-2026 (USD Million)

8.4 Infrastructure Providers

Table 35 Infrastructure Providers: Market Size, by Region, 2014-2019 (USD Million)

Table 36 Infrastructure Providers: Market Size, by Region, 2019-2026 (USD Million)

9 Blockchain Supply Chain Market, by Application

9.1 Introduction

9.1.1 Application: Market Drivers

9.1.2 Application: COVID-19 Impact

Figure 32 Counterfeit Detection Segment to Hold the Largest Market Size During the Forecast Period

Table 37 Market Size, by Application, 2014-2019 (USD Million)

Table 38 Market Size, by Application, - 2019-2026 (USD Million)

9.2 Asset Tracking

Table 39 Asset Tracking: Market Size, by Region, 2014-2019 (USD Million)

Table 40 Asset Tracking: Market Size, by Region, 2019-2026 (USD Million)

9.3 Counterfeit Detection

Table 41 Counterfeit Detection: Market Size, by Region, 2014-2019 (USD Million)

Table 42 Counterfeit Detection: Blockchain Supply Chain Market Size, by Region, 2019-2026 (USD Million)

9.4 Payment and Settlement

Table 43 Payment and Settlement: Market Size, by Region, 2014-2019 (USD Million)

Table 44 Payment and Settlement: Market Size, by Region, 2019-2026 (USD Million)

9.5 Smart Contracts

Table 45 Smart Contracts: Market Size, by Region, 2014-2019 (USD Million)

Table 46 Smart Contracts: Market Size, by Region, 2019-2026 (USD Million)

9.6 Risk and Compliance Management

Table 47 Risk and Compliance Management: Market Size, 2014-2019 (USD Million)

Table 48 Risk and Compliance Management: Market Size, by Region, 2019-2026 (USD Million)

9.7 Other Applications

Table 49 Other Applications: Market Size, by Region, 2014-2019 (USD Million)

Table 50 Other Applications: Market Size, by Region, 2019-2026 (USD Million)

10 Blockchain Supply Chain Market, by Organization Size

10.1 Introduction

Figure 33 Large Enterprises Segment to Hold a Larger Market Size During the Forecast Period

Table 51 Market Size, by Organization Size, 2014-2019 (USD Million)

Table 52 Market Size, by Organization Size, 2019-2026 (USD Million)

10.2 Small and Medium-Sized Enterprises

10.2.1 Small- and Medium-Sized Enterprises: Market Drivers

10.2.2 Small- and Medium-Sized Enterprises: COVID-19 Impact

Table 53 Small and Medium-Sized Enterprises: Market Size, by Region, 2014-2019 (USD Million)

Table 54 Small and Medium-Sized Enterprises: Market Size, by Region, 2019-2026 (USD Million)

10.3 Large Enterprises

10.3.1 Large Enterprises: Market Drivers

10.3.2 Large Enterprises: COVID-19 Impact

Table 55 Large Enterprises: Market Size, by Region, 2014-2019 (USD Million)

Table 56 Large Enterprises: Market Size, by Region, 2019-2026 (USD Million)

11 Blockchain Supply Chain Market Analysis, by End-user

11.1 Introduction

Table 57 Market Size, by End-user, 2014-2019 (USD Million)

Table 58 Market Size, by End-user, 2019-2026 (USD Million)

Figure 34 Retail and eCommerce End-user to Account for the Largest Market Size in 2020

11.2 Fast-Moving Consumer Goods

11.2.1 Fast-Moving Consumer Goods: Market Drivers

11.2.2 Fast-Moving Consumer Goods: COVID-19 Impact

Table 59 Fast-Moving Consumer Goods: Market Size, by Region, 2014-2019 (USD Million)

Table 60 Fast-Moving Consumer Goods: Market Size, by Region, 2019-2026 (USD Million)

11.3 Retail and eCommerce

11.3.1 Retail and eCommerce: Market Drivers

11.3.2 Retail and eCommerce: COVID-19 Impact

Table 61 Retail and eCommerce: Blockchain Supply Chain Market Size, by Region, 2014-2019 (USD Million)

Table 62 Retail and eCommerce: Market Size, by Region, 2019-2026 (USD Million)

11.4 Healthcare

11.4.1 Healthcare: Market Drivers

11.4.2 Healthcare: COVID-19 Impact

Table 63 Healthcare: Market Size, by Region, 2014-2019 (USD Million)

Table 64 Healthcare: Market Size, by Region, 2019-2026 (USD Million)

11.5 Manufacturing

11.5.1 Manufacturing: Market Drivers

11.5.2 Manufacturing: COVID-19 Impact

Table 65 Manufacturing: Market Size, by Region, 2014-2019 (USD Million)

Table 66 Manufacturing: Market Size, by Region, 2019-2026 (USD Million)

11.6 Transportation and Logistics

11.6.1 Transportation and Logistics: Blockchain Supply Chain Market Drivers

11.6.2 Transportation and Logistics: COVID-19 Impact

Table 67 Transportation and Logistics: Market Size, by Region, 2014-2019 (USD Million)

Table 68 Transportation and Logistics: Market Size, by Region, 2019-2026 (USD Million)

11.7 Oil, Mining, and Gas

11.7.1 Oil, Mining, and Gas: Market Drivers

11.7.2 Oil, Mining, and Gas: COVID-19 Impact

Table 69 Oil, Mining, and Gas: Market Size, by Region, 2014-2019 (USD Million)

Table 70 Oil, Mining, and Gas: Market Size, by Region, 2019-2026 (USD Million)

11.8 Other End-users

Table 71 Other End-users: Market Size, by Region, 2014-2019 (USD Million)

Table 72 Other End-users: Market Size, by Region, 2019-2026 (USD Million)

12 Blockchain Supply Chain Market, by Region

12.1 Introduction

Table 73 Market Size, by Region, 2014-2019 (USD Million)

Table 74 Market Size, by Region, 2019-2026 (USD Million)

12.2 North America

12.2.1 North America: Market Drivers

12.2.2 North America: COVID-19 Impact

12.2.3 North America: Regulations

Figure 35 North America: Market Snapshot

Table 75 North America: Blockchain Supply Chain Market Size, by Offering, 2014-2019 (USD Million)

Table 76 North America: Market Size, by Offering, 2019-2026 (USD Million)

Table 77 North America: Market Size, by Service, 2014-2019 (USD Million)

Table 78 North America: Market Size, by Service, 2019-2026 (USD Million)

Table 79 North America: Market Size, by Type, 2014-2019 (USD Million)

Table 80 North America: Market Size, by Type, 2019-2026 (USD Million)

Table 81 North America: Market Size, by Provider, 2014-2019 (USD Million)

Table 82 North America: Market Size, by Provider, 2019-2026 (USD Million)

Table 83 North America: Market Size, by Application, 2014-2019 (USD Million)

Table 84 North America: Market Size, by Application, 2019-2026 (USD Million)

Table 85 North America: Market Size, by Organization Size, 2014-2019 (USD Million)

Table 86 North America: Market Size, by Organization Size, 2019-2026 (USD Million)

Table 87 North America: Market Size, by End-user, 2014-2019 (USD Million)

Table 88 North America: Market Size, by End-user, 2019-2026 (USD Million)

Table 89 North America: Market Size, by Country, 2014-2019 (USD Million)

Table 90 North America: Market Size, by Country, 2019-2026 (USD Million)

12.2.4 United States

Table 91 United States: Blockchain Supply Chain Market Size, by Offering, 2014-2019 (USD Million)

Table 92 United States: Market Size, by Offering, 2019-2026 (USD Million)

Table 93 United States: Market Size, by Service, 2014-2019 (USD Million)

Table 94 United States: Market Size, by Service, 2019-2026 (USD Million)

Table 95 United States: Market Size, by Type, 2014-2019 (USD Million)

Table 96 United States: Market Size, by Type, 2019-2026 (USD Million)

Table 97 United States: Market Size, by Provider, 2014-2019 (USD Million)

Table 98 United States: Market Size, by Provider, 2019-2026 (USD Million)

Table 99 United States: Market Size, by Application, 2014-2019 (USD Million)

Table 100 United States: Market Size, by Application, 2019-2026 (USD Million)

Table 101 United States: Market Size, by Organization Size, 2014-2019 (USD Million)

Table 102 United States: Market Size, by Organization Size, 2019-2026 (USD Million)

Table 103 United States: Market Size, by End-user, 2014-2019 (USD Million)

Table 104 United States: Market Size, by End-user, 2019-2026 (USD Million)

12.2.5 Canada

12.3 Europe

12.3.1 Europe: Blockchain Supply Chain Market Drivers

12.3.2 Europe: COVID-19 Impact

12.3.3 Europe: Tariffs and Regulations

Table 105 Europe: Market Size, by Offering, 2014-2019 (USD Million)

Table 106 Europe: Market Size, by Offering, 2019-2026 (USD Million)

Table 107 Europe: Market Size, by Service, 2014-2019 (USD Million)

Table 108 Europe: Market Size, by Service, 2019-2026 (USD Million)

Table 109 Europe: Market Size, by Type, 2014-2019 (USD Million)

Table 110 Europe: Market Size, by Type, 2019-2026 (USD Million)

Table 111 Europe: Market Size, by Provider, 2014-2019 (USD Million)

Table 112 Europe: Market Size, by Provider, 2019-2026 (USD Million)

Table 113 Europe: Market Size, by Application, 2014-2019 (USD Million)

Table 114 Europe: Market Size, by Application, 2019-2026 (USD Million)

Table 115 Europe: Market Size, by Organization Size, 2014-2019 (USD Million)

Table 116 Europe: Market Size, by Organization Size, 2019-2026 (USD Million)

Table 117 Europe: Market Size, by End-user, 2014-2019 (USD Million)

Table 118 Europe: Market Size, by End-user, 2019-2026 (USD Million)

Table 119 Europe: Market Size, by Country, 2014-2019 (USD Million)

Table 120 Europe: Market Size, by Country, 2019-2026 (USD Million)

12.3.4 United Kingdom

Table 121 United Kingdom: Blockchain Supply Chain Market Size, by Offering, 2014-2019 (USD Million)

Table 122 United Kingdom: Market Size, by Offering, 2019-2026 (USD Million)

Table 123 United Kingdom: Market Size, by Service, 2014-2019 (USD Million)

Table 124 United Kingdom: Market Size, by Service, 2019-2026 (USD Million)

Table 125 United Kingdom: Market Size, by Type, 2014-2019 (USD Million)

Table 126 United Kingdom: Market Size, by Type, 2019-2026 (USD Million)

Table 127 United Kingdom: Market Size, by Provider, 2014-2019 (USD Million)

Table 128 United Kingdom: Market Size, by Provider, 2019-2026 (USD Million)

Table 129 United Kingdom: Market Size, by Application, 2014-2019 (USD Million)

Table 130 United Kingdom: Market Size, by Application, 2019-2026 (USD Million)

Table 131 United Kingdom: Market Size, by Organization Size, 2014-2019 (USD Million)

Table 132 United Kingdom: Market Size, by Organization Size, 2019-2026 (USD Million)

Table 133 United Kingdom: Market Size, by End-user, 2014-2019 (USD Million)

Table 134 United Kingdom: Market Size, by End-user, 2019-2026 (USD Million)

12.3.5 Germany

12.3.6 Rest of Europe

12.4 Asia-Pacific

12.4.1 Asia-Pacific: Blockchain Supply Chain Market Drivers

12.4.2 Asia-Pacific: COVID-19 Impact

12.4.3 Asia-Pacific: Regulations

Figure 36 Asia-Pacific: Market Snapshot

Table 135 Asia-Pacific: Market Size, by Offering, 2014-2019 (USD Million)

Table 136 Asia-Pacific: Market Size, by Offering, 2019-2026 (USD Million)

Table 137 Asia-Pacific: Market Size, by Service, 2014-2019 (USD Million)

Table 138 Asia-Pacific: Market Size, by Service, 2019-2026 (USD Million)

Table 139 Asia-Pacific: Market Size, by Type, 2014-2019 (USD Million)

Table 140 Asia-Pacific: Market Size, by Type, 2019-2026 (USD Million)

Table 141 Asia-Pacific: Market Size, by Provider, 2014-2019 (USD Million)

Table 142 Asia-Pacific: Market Size, by Provider, 2019-2026 (USD Million)

Table 143 Asia-Pacific: Market Size, by Application, 2014-2019 (USD Million)

Table 144 Asia-Pacific: Market Size, by Application, 2019-2026 (USD Million)

Table 145 Asia-Pacific: Market Size, by Organization Size, 2014-2019 (USD Million)

Table 146 Asia-Pacific: Market Size, by Organization Size, 2019-2026 (USD Million)

Table 147 Asia-Pacific: Market Size, by End-user, 2014-2019 (USD Million)

Table 148 Asia-Pacific: Market Size, by End-user, 2019-2026 (USD Million)

Table 149 Asia-Pacific: Market Size, by Country, 2014-2019 (USD Million)

Table 150 Asia-Pacific: Market Size, by Country, 2019-2026 (USD Million)

12.4.4 China

Table 151 China: Blockchain Supply Chain Market Size, by Offering, 2014-2019 (USD Million)

Table 152 China: Market Size, by Offering, 2019-2026 (USD Million)

Table 153 China: Market Size, by Service, 2014-2019 (USD Million)

Table 154 China: Market Size, by Service, 2019-2026 (USD Million)

Table 155 China: Market Size, by Type, 2014-2019 (USD Million)

Table 156 China: Market Size, by Type, 2019-2026 (USD Million)

Table 157 China: Market Size, by Provider, 2014-2019 (USD Million)

Table 158 China: Market Size, by Provider, 2019-2026 (USD Million)

Table 159 China: Market Size, by Application, 2014-2019 (USD Million)

Table 160 China: Market Size, by Application, 2019-2026 (USD Million)

Table 161 China: Market Size, by Organization Size, 2014-2019 (USD Million)

Table 162 China: Market Size, by Organization Size, 2019-2026 (USD Million)

Table 163 China: Market Size, by End-user, 2014-2019 (USD Million)

Table 164 China: Market Size, by End-user, 2019-2026 (USD Million)

12.4.5 Japan

12.4.6 India

12.4.7 Rest of Asia-Pacific

12.5 Middle East and Africa

12.5.1 Middle East and Africa: Blockchain Supply Chain Market Drivers

12.5.2 Middle East and Africa: COVID-19 Impact

12.5.3 Middle East and Africa: Regulations

Table 165 Middle East and Africa: Market Size, by Offering, 2014-2019 (USD Million)

Table 166 Middle East and Africa: Market Size, by Offering, 2019-2026 (USD Million)

Table 167 Middle East and Africa: Market Size, by Service, 2014-2019 (USD Million)

Table 168 Middle East and Africa: Market Size, by Service, 2019-2026 (USD Million)

Table 169 Middle East and Africa: Market Size, by Type, 2014-2019 (USD Million)

Table 170 Middle East and Africa: Market Size, by Type, 2019-2026 (USD Million)

Table 171 Middle East and Africa: Market Size, by Provider, 2014-2019 (USD Million)

Table 172 Middle East and Africa: Market Size, by Provider, 2019-2026 (USD Million)

Table 173 Middle East and Africa: Market Size, by Application, 2014-2019 (USD Million)

Table 174 Middle East and Africa: Blockchain Supply Chain Market Size, by Application, 2019-2026 (USD Million)

Table 175 Middle East and Africa: Market Size, by Organization Size, 2014-2019 (USD Million)

Table 176 Middle East and Africa: Market Size, by Organization Size, 2019-2026 (USD Million)

Table 177 Middle East and Africa: Market Size, by End-user, 2014-2019 (USD Million)

Table 178 Middle East and Africa: Market Size, by End-user, 2019-2026 (USD Million)

Table 179 Middle East and Africa: Market Size, by Subregion, 2014-2019 (USD Million)

Table 180 Middle East and Africa: Market Size, by Subregion, 2019-2026 (USD Million)

12.5.4 Middle East

Table 181 Middle East: Blockchain Supply Chain Market Size, by Offering, 2014-2019 (USD Million)

Table 182 Middle East: Market Size, by Offering, 2019-2026 (USD Million)

Table 183 Middle East: Market Size, by Service, 2014-2019 (USD Million)

Table 184 Middle East: Market Size, by Service, 2019-2026 (USD Million)

Table 185 Middle East: Market Size, by Type, 2014-2019 (USD Million)

Table 186 Middle East: Market Size, by Type, 2019-2026 (USD Million)

Table 187 Middle East: Market Size, by Provider, 2014-2019 (USD Million)

Table 188 Middle East: Market Size, by Provider, 2019-2026 (USD Million)

Table 189 Middle East: Market Size, by Application, 2014-2019 (USD Million)

Table 190 Middle East: Market Size, by Application, 2019-2026 (USD Million)

Table 191 Middle East: Market Size, by Organization Size, 2014-2019 (USD Million)

Table 192 Middle East: Market Size, by Organization Size, 2019-2026 (USD Million)

Table 193 Middle East: Market Size, by End-user, 2014-2019 (USD Million)

Table 194 Middle East: Market Size, by End-user, 2019-2026 (USD Million)

12.5.5 Africa

12.6 Latin America

12.6.1 Latin America: Blockchain Supply Chain Market Drivers

12.6.2 Latin America: COVID-19 Impact

12.6.3 Latin America: Regulations

Table 195 Latin America: Market Size, by Offering, 2014-2019 (USD Million)

Table 196 Latin America: Market Size, by Offering, 2019-2026 (USD Million)

Table 197 Latin America: Market Size, by Service, 2014-2019 (USD Million)

Table 198 Latin America: Market Size, by Service, 2019-2026 (USD Million)

Table 199 Latin America: Market Size, by Type, 2014-2019 (USD Million)

Table 200 Latin America: Market Size, by Type, 2019-2026 (USD Million)

Table 201 Latin America: Market Size, by Provider, 2014-2019 (USD Million)

Table 202 Latin America: Market Size, by Provider, 2019-2026 (USD Million)

Table 203 Latin America: Market Size, by Application, 2014-2019 (USD Million)

Table 204 Latin America: Market Size, by Application, 2019-2026 (USD Million)

Table 205 Latin America: Market Size, by Organization Size, 2014-2019 (USD Million)

Table 206 Latin America: Market Size, by Organization Size, 2019-2026 (USD Million)

Table 207 Latin America: Market Size, by End-user, 2014-2019 (USD Million)

Table 208 Latin America: Market Size, by End-user, 2019-2026 (USD Million)

Table 209 Latin America: Market Size, by Country, 2014-2019 (USD Million)

Table 210 Latin America: Market Size, by Country, 2019-2026 (USD Million)

12.6.4 Brazil

Table 211 Brazil: Blockchain Supply Chain Market Size, by Offering, 2014-2019 (USD Million)

Table 212 Brazil: Market Size, by Offering, 2019-2026 (USD Million)

Table 213 Brazil: Market Size, by Service, 2014-2019 (USD Million)

Table 214 Brazil: Market Size, by Service, 2019-2026 (USD Million)

Table 215 Brazil: Market Size, by Type, 2014-2019 (USD Million)

Table 216 Brazil: Market Size, by Type, 2019-2026 (USD Million)

Table 217 Brazil: Market Size, by Provider, 2014-2019 (USD Million)

Table 218 Brazil: Market Size, by Provider, 2019-2026 (USD Million)

Table 219 Brazil: Market Size, by Application, 2014-2019 (USD Million)

Table 220 Brazil: Market Size, by Application, 2019-2026 (USD Million)

Table 221 Brazil: Market Size, by Organization Size, 2014-2019 (USD Million)

Table 222 Brazil: Market Size, by Organization Size, 2019-2026 (USD Million)

Table 223 Brazil: Market Size, by End-user, 2014-2019 (USD Million)

Table 224 Brazil: Market Size, by End-user, 2019-2026 (USD Million)

12.6.5 Mexico

12.6.6 Rest of Latin America

13 Competitive Landscape

13.1 Introduction

13.2 Market Evaluation Framework

Figure 37 Blockchain Supply Chain: Market Evaluation Framework

13.3 Revenue Analysis of Leading Players

Figure 38 Blockchain Supply Chain Market: Revenue Analysis

13.4 Market Share Analysis of Top Market Players

Table 225 Market: Degree of Competition

13.5 Historical Revenue Analysis

Figure 39 Revenue Analysis of Top Five Market Players

13.6 Ranking of Key Players in the Market, 2020

Figure 40 Key Players Ranking, 2020

13.7 Company Evaluation Matrix

13.7.1 Company Evaluation Matrix Definitions and Methodology

Table 226 Evaluation Criteria

Table 227 Company Product Footprint

13.7.2 Star

13.7.3 Pervasive

13.7.4 Emerging Leaders

13.7.5 Participants

Figure 41 Blockchain Supply Chain Market (Global), Company Evaluation Matrix, 2020

13.8 Strength of Product Portfolio

Figure 42 Product Portfolio Analysis of Top Players in the Market

13.9 Business Strategy Excellence

Figure 43 Business Strategy Excellence of Top Players in the Market

13.10 Startup/SME Evaluation Matrix, 2020

13.10.1 Progressive Companies

13.10.2 Responsive Companies

13.10.3 Dynamic Companies

13.10.4 Starting Blocks

Figure 44 Blockchain Supply Chain Market (Global), Company Evaluation Matrix, 2020

14 Company Profiles

(Business Overview, Solutions & Services, Key Insights, Recent Developments, Response to COVID-19, Analyst's View)*

14.1 Major Players

14.1.1 IBM

Table 228 IBM: Business Overview

Figure 45 IBM: Company Snapshot

Table 229 IBM: Solutions Offered

Table 230 IBM: Market: Product Launches

Table 231 IBM: Market: Deals

14.1.2 Microsoft

Figure 46 Microsoft: Company Snapshot

Table 232 Microsoft: Business Overview

Table 233 Microsoft: Solutions Offered:

Table 234 Microsoft: Blockchain Supply Chain Market: Product Launches

Table 235 Microsoft: Market: Deals

14.1.3 SAP SE

Table 236 SAP: Business Overview

Figure 47 SAP SE: Company Snapshot

Table 237 SAP: Solutions and Services Offered

Table 238 SAP: Market: Deals

14.1.4 Amazon Web Services

Table 239 AWS: Business Overview

Figure 48 Amazon Web Services: Company Snapshot

Table 240 AWS: Solutions and Services Offered

14.1.5 Oracle

Table 241 Oracle: Business Overview

Figure 49 Oracle: Company Snapshot

Table 242 Oracle: Services Offered

Table 243 Oracle: Blockchain Supply Chain Market: Product Launches

Table 244 Oracle: Market: Deals

Table 245 Oracle: Market: Others

14.1.6 Huawei

Table 246 Huawei: Business Overview

Figure 50 Huawei: Company Snapshot

Table 247 Huawei: Services Offered

Table 248 Huawei: Market: Product Launches

14.1.7 Guardtime

Table 249 Guardtime: Business Overview

Table 250 Guardtime: Solutions and Services Offered

Table 251 Guardtime: Blockchain Supply Chain Market: Product Launches

Table 252 Guardtime: Market: Deals

14.1.8 Tibco Software

Table 253 Tibco Software: Business Overview

Table 254 Tibco Software: Solutions Offered

14.1.9 Bitfury

Table 255 Bitfury: Business Overview

Table 256 Bitfury: Solutions Offered

Table 257 Bitfury: Market: Product Launches

Table 258 Bitfury: Market: Deals

Table 259 Bitfury: Blockchain Supply Chain Market: Others

14.1.10 Interbit

Table 260 Interbit: Business Overview

Table 261 Interbit: Solutions and Services Offered

Table 262 Interbit: Market: Product Launches

14.1.11 Auxesis Group

14.1.12 Vechain Foundation

14.1.13 Chainvine

14.1.14 Digital Treasury Corporation

14.1.15 Datex Corporation

14.1.16 OpenXcell

14.1.17 Algorythmix

14.1.18 Blockverify

14.1.19 Applied Blockchain

*Details on Business Overview, Solutions & Services, Key Insights, Recent Developments, Response to COVID-19, Analyst's View Might Not be Captured in Case of Unlisted Companies

14.2 Right to Win

Table 263 Right to Win

14.3 Startup Company Profiles

14.3.1 Transchain

14.3.2 Omnichain

14.3.3 Ownest

14.3.4 Traceparency

14.3.5 Peerledger

14.3.6 Oaro

14.3.7 Recordskeeper

15 Adjacent/Related Markets

15.1 Introduction

15.2 Healthcare Supply Chain Management Market

15.2.1 Market Definition

Table 264 Healthcare Supply Chain Management Market, by End-user, 2018-2025 (USD Million)

Table 265 Healthcare Supply Chain Management Market for Manufacturers, by Region, 2018-2025 (USD Million)

Table 266 Healthcare Supply Chain Management Market for Distributors,By Region, 2018-2025 (USD Million)

Table 267 Healthcare Supply Chain Management Market for Providers, by Region, 2018-2025 (USD Million)

15.3 Supply Chain Analytics Market

15.3.1 Market Definition

Table 268 Services: Supply Chain Analytics Market Size, by Region, 2014-2019 (USD Million)

Table 269 Services: Supply Chain Analytics Market Size, by Region, 2019-2025 (USD Million)

Table 270 Supply Chain Analytics Market Size, by Service, 2014-2019 (USD Million)

Table 271 Supply Chain Analytics Market Size, by Service, 2019-2025 (USD Million)

Table 272 Managed Services Market Size, by Region, 2014-2019 (USD Million)

Table 273 Managed Services Market Size, by Region, 2019-2025 (USD Million)

Table 274 Supply Chain Analytics Market Size, by Professional Service, 2014-2019 (USD Million)

Table 275 Supply Chain Analytics Market Size, by Professional Service, 2019-2025 (USD Million)

15.4 Cloud Supply Chain Management Market

15.4.1 Market Definition

Table 276 Cloud Supply Chain Management Market Size, by Organization Size, 2014-2021 (USD Million)

Table 277 Small and Medium Enterprises: Cloud Supply Chain Management Market Size, by Region, 2014-2021 (USD Million)

Table 278 Large Enterprises: Cloud Supply Chain Management Market Size, by Region, 2014-2021 (USD Million)

16 Appendix

16.1 Discussion Guide

16.2 Knowledge Store: The Subscription Portal

16.3 Available Customizations

Companies Mentioned

- Algorythmix

- Amazon Web Services (AWS)

- Applied Blockchain

- Auxesis Group

- BigchainDB

- Bitfury

- Blockverify

- Chainvine

- Datex Corporation

- Digital Treasury Corporation

- Guardtime

- Huawei

- IBM

- Interbit

- Maersk

- Microsoft

- Oaro

- Omnichain

- OpenXcell

- Oracle

- Ownest

- Peerledger

- Recordskeeper

- SAP SE

- Tibco Software

- Traceparency

- Transchain

- Vechain Foundation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 262 |

| Published | March 2021 |

| Forecast Period | 2020 - 2026 |

| Estimated Market Value ( USD | $ 253 million |

| Forecasted Market Value ( USD | $ 3272 million |

| Compound Annual Growth Rate | 53.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 28 |