Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Growing Real Estate Market and Property Ownership

One of the primary drivers of the India Loan Against Property (LAP) market is the rapid growth in the real estate sector, coupled with the increasing rate of property ownership across the country. As India's economy continues to expand, urbanization is rising, leading to a steady demand for both residential and commercial properties. According to the National Housing Bank, the Indian real estate market is expected to grow at a compound annual growth rate (CAGR) of 9.2% from 2020 to 2025.With more individuals and businesses acquiring real estate, there has been a corresponding increase in the number of property owners looking to leverage their assets to access funds. LAP allows borrowers to unlock the value of their properties by using them as collateral for loans, and this flexibility has become especially attractive in a growing economy. The increased availability of properties, combined with a surge in property values over the past decade, has provided a solid foundation for the LAP market to expand, offering consumers an effective way to raise capital for personal or business-related financial needs.

Increased Demand for Credit and Financing Solutions

Another key driver of the India Loan Against Property market is the growing demand for credit and various financing solutions among individuals and businesses. With rising living costs, increasing education and healthcare expenses, and the need for businesses to expand and maintain operations, there is a heightened demand for financing options that provide quick access to funds. Loan Against Property has become an appealing option because it offers larger loan amounts and lower interest rates compared to unsecured loans like personal loans or credit cards. In addition, the loan tenure is often more flexible, providing better financial relief for borrowers.As the number of small and medium-sized enterprises (SMEs) grows and individuals seek to fund large expenses, LAP has emerged as an ideal solution. According to data from the Reserve Bank of India (RBI), the demand for loans in India is expected to increase significantly due to the growing middle-class population and an increasing number of people seeking financial support for various purposes. As these demands rise, LAP products have gained popularity for their ability to offer competitive loan-to-value ratios, easy access, and lower-risk lending options for financial institutions.

Attractive Interest Rates and Repayment Flexibility

The relatively lower interest rates and flexible repayment options are crucial factors that contribute to the growth of the Loan Against Property market in India. Since LAP is secured by a property, financial institutions generally offer more favorable interest rates compared to unsecured loans. The reduced risk for lenders translates into lower costs for borrowers, making LAP an affordable borrowing option for many. Typically, the interest rates for LAP range between 9% and 15%, depending on factors such as the borrower's creditworthiness, property valuation, and tenure.Moreover, the flexible repayment terms, which can extend up to 15 or even 20 years, provide borrowers with significant relief and make the loans easier to service. This flexibility in loan structure has expanded the appeal of LAPs to a broader audience, including individuals seeking to fund large personal expenses such as weddings, education, home renovation, or medical emergencies, as well as businesses in need of working capital or expansion financing. The ease of availing LAPs with minimal documentation further adds to their growing popularity, especially in the digital age where online applications have made the loan process more streamlined and accessible.

Digitalization and the Rise of Non-Banking Financial Companies (NBFCs)

The digital transformation in India's financial sector has significantly bolstered the Loan Against Property market, making the lending process faster, more transparent, and accessible to a broader range of customers. The rise of Non-Banking Financial Companies (NBFCs) has further played a pivotal role in driving growth in the LAP sector. These financial institutions have emerged as strong competitors to traditional banks, offering innovative and flexible loan products, including LAP. According to the Finance Ministry's data, NBFCs account for over 13% of the total credit market in India, and their share is steadily increasing.These companies have adopted digital platforms that enable borrowers to apply for LAP online, reducing the time and paperwork involved in securing loans. Digital technology also helps in expediting property verification, valuation, and approval processes, making LAP a convenient option for tech-savvy customers. Furthermore, the rise of alternative data points used in underwriting, such as digital payment histories and transaction patterns, has made it easier for individuals with limited formal credit histories to access LAPs. This development is particularly significant in India's underserved rural and semi-urban areas, where access to formal financial services has historically been limited. The growing availability of digital platforms and the aggressive push by NBFCs to reach untapped markets have contributed to the rapid expansion of the Loan Against Property market, offering borrowers more options and greater flexibility.

Key Market Challenges

High Property Valuation and Market Volatility

One of the major challenges facing the Loan Against Property (LAP) market in India is the volatility and unpredictability of property valuations. Real estate prices, especially in metropolitan and tier-1 cities, have seen significant fluctuations in recent years. While properties are typically considered a stable asset, their valuation can be influenced by various external factors such as government policies, economic conditions, and changes in demand and supply dynamics. A sudden dip in property prices can lead to loan-to-value (LTV) ratios becoming unfavorable for both lenders and borrowers, potentially leading to financial instability.Financial institutions may become more cautious, reducing the amount they are willing to lend, or imposing stricter eligibility criteria, making it harder for borrowers to access funds. Additionally, borrowers may struggle with repayment if property values fall, leading to an increase in defaults. This challenge can be more acute in certain regions where real estate bubbles are more likely to form, leaving both borrowers and lenders vulnerable to significant financial losses. Therefore, the cyclical nature of real estate prices and market volatility remains a critical challenge for the growth of the LAP market.

Lack of Awareness and Financial Literacy

Despite the growth of the Loan Against Property market, a significant portion of the population remains unaware of this financing option, particularly in rural and semi-urban areas. Financial literacy continues to be a barrier to many individuals and small businesses who could benefit from LAP but do not understand how it works or how to access it. According to a report by the National Center for Financial Education (NCFE), a large segment of India's population still lacks basic knowledge about personal finance, loan products, and credit ratings, which hampers their ability to make informed decisions about securing loans.Without adequate awareness, borrowers may be reluctant to pledge their properties as collateral, fearing the risk of losing their asset in case of default. Moreover, the complexities of the loan application process, such as property verification, documentation requirements, and interest rate structures, may deter potential borrowers who are not well-versed in financial matters. As a result, many consumers may opt for unsecured loans or other alternative financing options that are easier to access but come with higher interest rates or less favorable terms. This lack of awareness and financial literacy restricts the overall growth potential of the LAP market in India and limits its reach, particularly in rural areas where there is a large unbanked population.

Stringent Regulatory and Compliance Issues

The regulatory environment surrounding loans against property in India can be complex and subject to change, which presents a significant challenge for both lenders and borrowers. Banks and Non-Banking Financial Companies (NBFCs) offering LAP products must adhere to stringent regulations and compliance requirements, which can often vary across states and regions. These regulations cover a wide range of aspects, including property documentation, loan terms, interest rates, and foreclosure procedures. For lenders, the time-consuming process of verifying property documents, conducting due diligence, and ensuring the legal validity of the collateral can increase operational costs and delay loan disbursals.For borrowers, compliance with regulatory requirements can create barriers to obtaining loans, as certain legal and financial criteria must be met before they can access funding. Additionally, the introduction of new regulations or changes in existing laws - such as changes in stamp duty, tax reforms, or loan recovery procedures - can impact both lenders’ ability to offer competitive terms and borrowers’ willingness to take out loans. Moreover, strict norms regarding the classification of non-performing assets (NPAs) and asset recoveries can create hesitation among financial institutions, especially in an environment where defaults or delays in repayment are common. These regulatory challenges contribute to the complexity and uncertainty in the LAP market, making it a less attractive option for both lenders and borrowers.

Key Market Trends

Shift Towards Digital and Online Platforms

A significant trend in the India Loan Against Property (LAP) market is the growing reliance on digital platforms for loan applications, processing, and approvals. With the advent of fintech companies, non-banking financial companies (NBFCs), and traditional banks leveraging technology, borrowers now have greater access to LAP products without the need to physically visit a bank or financial institution. Online loan application processes, automated property valuations, and e-KYC (Know Your Customer) verification have streamlined the LAP experience, making it faster and more efficient. In FY24, digital loans in India surged by 49% in value, reaching ₹1.46 trillion in disbursements, highlighting rapid adoption of fintech platforms.This trend is especially evident in urban areas where digital literacy is high and consumers prefer the convenience of applying for loans online. The rise of mobile applications for loan processing further complements this trend, as more consumers opt for on-the-go services. Digitalization has not only improved customer experience but has also allowed financial institutions to reduce operational costs and increase their reach to underserved markets. This trend is expected to continue, with more players entering the market and offering tech-driven solutions to make the loan application process seamless. With the continued rise of digital payments and e-commerce, the demand for digital loan services, including LAPs, is poised to grow, leading to greater penetration of these products in the market.

Increased Focus on Credit Risk Assessment and Data Analytics

As competition in the LAP market intensifies, financial institutions are increasingly focusing on improving credit risk assessment techniques to enhance their underwriting processes. Traditional methods of evaluating loan eligibility, such as credit scores and income verification, are now being supplemented by more advanced data analytics tools. Lenders are utilizing big data, machine learning algorithms, and artificial intelligence (AI) to analyze a borrower’s creditworthiness by assessing a wider array of factors, including digital footprints, social media activity, and alternative data sources.This trend has made it easier for individuals with limited or no formal credit history, particularly those in rural areas or informal sectors, to gain access to LAPs. For example, lending institutions are incorporating mobile phone usage patterns, online payment behaviors, and e-commerce transaction histories into their assessments. This move towards data-driven lending not only helps mitigate the risk of defaults but also allows lenders to offer personalized loan terms tailored to each borrower’s specific financial situation. By leveraging advanced analytics and data modeling, financial institutions are reducing the risk of non-performing assets (NPAs) and increasing loan approval rates for a broader customer base, expanding the reach of LAP products.

Growth of Secured Business Loans and SME Financing

Another prominent trend in the India Loan Against Property market is the rising demand for secured business loans, particularly among small and medium-sized enterprises (SMEs). SMEs form the backbone of India’s economy, contributing significantly to employment and GDP. However, access to traditional credit sources has often been a challenge for this segment, as they are typically not able to meet the stringent criteria for unsecured loans. LAPs provide an alternative financing option for SMEs, allowing them to leverage their properties to access capital for business growth, working capital, equipment purchases, and operational expenses.This trend has gained momentum with the government’s initiatives to promote entrepreneurship and the growing recognition of SMEs as a key driver of economic growth. Furthermore, financial institutions have started offering LAP products tailored specifically to meet the needs of SMEs, with features such as customized loan tenures, lower interest rates, and flexible repayment terms. The increase in the number of digital lending platforms focusing on SME financing has further facilitated this trend. As more SMEs seek affordable financing options to expand and thrive in a competitive market, LAPs have become an essential tool for their growth, and this trend is expected to continue in the coming years.

Emergence of Hybrid Loan Products and Refinancing Options

The India Loan Against Property market has also seen the emergence of hybrid loan products and refinancing options designed to offer borrowers more flexibility and convenience. Hybrid loan products combine features of traditional loans with other financial products to cater to the evolving needs of customers. For instance, some lenders now offer a combination of LAP and overdraft facilities, where borrowers can use their property as collateral to obtain a line of credit, providing them with both flexibility and access to immediate funds. This hybrid model has gained popularity among borrowers who need working capital and require the ability to access funds as and when required, rather than receiving a lump sum amount upfront.In addition to hybrid products, refinancing of existing LAPs has become increasingly common, with many borrowers opting to refinance their loans to secure better terms, lower interest rates, or higher loan amounts. Lenders have responded to this demand by offering refinancing options that allow borrowers to enhance their liquidity without the need to sell or liquidate assets. As interest rates remain competitive, refinancing provides an attractive opportunity for borrowers to restructure their debt, extend repayment periods, and reduce monthly installments. The rise in hybrid loan products and refinancing options reflects the market’s move towards offering more tailored solutions to meet the diverse financial needs of individuals and businesses, making LAP a more versatile product in the broader credit market.

Segmental Insights

Property Type Insights

The Commercial Property segment was the fastest-growing in India’s Loan Against Property (LAP) market. This growth is driven by the increasing demand for office spaces, retail outlets, and industrial properties in urban areas and tier-1 cities like Mumbai, Bengaluru, and Delhi. As businesses and start-ups continue to expand, property owners are leveraging their commercial assets to secure loans for business expansion, working capital, and other financial needs. The appreciation of commercial real estate values also allows borrowers to access larger loan amounts, making it an attractive and rapidly growing segment within the LAP market.Regional Insights

South India was the dominating region in India’s Loan Against Property (LAP) market, with cities like Bengaluru, Chennai, Hyderabad, and Kochi driving significant growth. This is attributed to the region’s rapid urbanization, booming IT and manufacturing sectors, and a high concentration of commercial and residential properties. The increasing disposable incomes and growing middle class further fuel the demand for LAP products in these states. Additionally, South India has a well-developed financial infrastructure, which, along with higher financial literacy, contributes to a robust LAP market. As a result, the South remains a key player in India’s LAP landscape.Key Market Players

- HDFC Bank Ltd.

- ICICI Bank Limited

- LIC Housing Finance Limited

- PNB Housing Finance Limited

- State Bank of India Limited

- South Indian Bank Limited

- Indian Bank Limited

- Federal Bank Limited

- Yes Bank Limited

- Axis Bank Limited

Report Scope:

In this report, the India Loan Against Property Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:India Loan Against Property Market, By Property Type:

- Self-Occupied Residential Property

- Rented Residential Property

- Commercial Property

- Self-Owned Plot

India Loan Against Property Market, By Interest Rate:

- Fixed Rate

- Floating Rate

India Loan Against Property Market, By Tenure:

- Upto 5 Years

- 6-10 Years

- 11-24 Years

- 25-30 Years

India Loan Against Property Market, By Region:

- North

- South

- East

- West

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the India Loan Against Property Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- HDFC Bank Ltd.

- ICICI Bank Limited

- LIC Housing Finance Limited

- PNB Housing Finance Limited

- State Bank of India Limited

- South Indian Bank Limited

- Indian Bank Limited

- Federal Bank Limited

- Yes Bank Limited

- Axis Bank Limited

Table Information

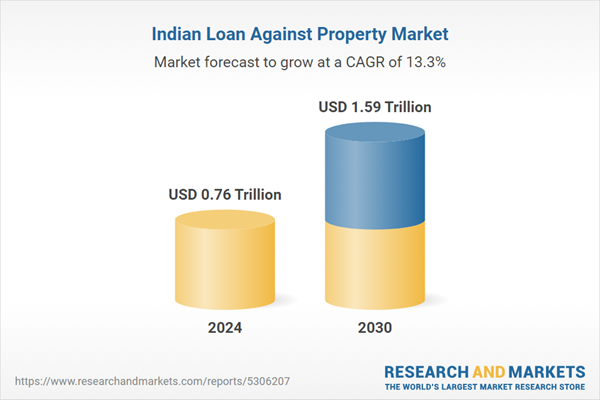

| Report Attribute | Details |

|---|---|

| No. of Pages | 85 |

| Published | February 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 0.76 Trillion |

| Forecasted Market Value ( USD | $ 1.59 Trillion |

| Compound Annual Growth Rate | 13.2% |

| Regions Covered | India |

| No. of Companies Mentioned | 10 |