Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

A variety of blood glucose monitoring devices, commonly known as blood glucose meters, are available in the market. These devices are tailored to cater to different types of diabetes, encompassing Type 1, Type 2, and gestational diabetes. The growth of the Blood Glucose Monitoring Devices Market can be attributed to several key factors, including the escalating prevalence of diabetes, technological advancements in monitoring and diagnostic tools, early diabetes detection, and the growing demand for continuous glucose monitoring devices.

Blood glucose meters are compact electronic devices specially designed for the analysis of blood samples obtained through a small prick using a lancet and lancing device. Subsequently, the blood sample is placed onto a disposable test strip, which is then inserted into the meter. The meter reads the glucose level in the blood through an electrochemical reaction between the test strip and the blood. These meters are battery-powered and compact enough to fit comfortably in the palm of one's hand. The blood sample flows through a tube within the device, and the glucose concentration is accurately determined, facilitating efficient and user-friendly glucose monitoring.

Key Market Drivers

High Prevalence of Diabetes

Diabetes is a chronic disease that occurs when the pancreas does not produce enough insulin or cannot effectively use it to regulate body sugar levels. This imbalance in blood glucose control can lead to various complications and health risks if not managed properly.According to the International Diabetes Federation, it is estimated that in 2021, there were approximately 537 million people worldwide living with diabetes. This number is projected to increase to 643 million by 2030 and a staggering 783 million by 2045. The significant growth in the diabetic population is primarily attributed to the rising prevalence of sedentary lifestyles, poor dietary habits, and decreased physical activity. It is worth noting that the impact of diabetes is not evenly distributed across the globe. The prevalence of diabetes has risen more rapidly in low- and middle-income countries compared to high-income countries. This disparity can be attributed to various factors, including limited access to healthcare resources, inadequate education about diabetes management, and socioeconomic challenges.

Given these alarming statistics and trends, the demand for blood glucose monitoring devices is expected to surge in the coming years. These devices play a crucial role in helping individuals with diabetes monitor their blood sugar levels and make informed decisions about their treatment plans. They provide a convenient and efficient way to track glucose levels, thereby empowering individuals to manage their condition effectively and improve their overall quality of life. In conclusion, the increasing prevalence of diabetes, particularly in low- and middle-income countries, underscores the urgent need for effective management strategies and access to proper healthcare resources. The use of blood glucose monitoring devices is one of the key tools in managing diabetes and ensuring better health outcomes for individuals living with this chronic condition.

Increasing Geriatric Population

The increasing geriatric population is expected to have a significant impact on the demand for blood glucose monitoring devices. As the global population ages, the prevalence of diabetes, particularly Type 2 diabetes, is on the rise. The risk of developing diabetes increases with age. Elderly individuals are more prone to Type 2 diabetes due to factors like decreased insulin sensitivity and physical inactivity. As a result, a growing number of seniors require regular monitoring of their blood glucose levels.Advances in healthcare have led to longer lifespans, but with extended longevity often comes an increased risk of chronic conditions like diabetes. Seniors are living longer, and many require ongoing diabetes management, necessitating regular blood glucose monitoring. Preventive healthcare measures are crucial in managing diabetes among the elderly. Regular monitoring allows for early detection of abnormal blood glucose levels, enabling healthcare providers to intervene promptly with lifestyle modifications or medication adjustments. Diabetes is a global health concern, affecting people of all ages. As the worldwide prevalence of diabetes continues to grow, the elderly population remains a substantial portion of those affected, contributing to the demand for blood glucose monitoring devices on a global scale.

Growth in Obesity Rates

The growing prevalence of obesity is anticipated to have a substantial impact on the demand for blood glucose monitoring devices. Obesity is a well-established risk factor for the development of Type 2 diabetes, a condition characterized by impaired insulin function and elevated blood glucose levels. Obesity is closely linked to the development of Type 2 diabetes. Excess body fat, particularly around the abdomen, can lead to insulin resistance, where the body's cells do not respond effectively to insulin. This insulin resistance often progresses to diabetes, necessitating regular blood glucose monitoring to manage the condition. Monitoring blood glucose levels is crucial for the early detection of diabetes in individuals with obesity-related risk factors. Regular monitoring allows healthcare providers to intervene promptly with lifestyle modifications or medications to prevent or manage diabetes effectively.Obesity management often involves lifestyle modifications, such as dietary changes and increased physical activity. Blood glucose monitoring devices provide individuals with real-time feedback on how their choices impact their blood glucose levels, motivating healthier behaviors. Blood glucose monitoring devices are becoming more user-friendly and accessible, empowering individuals with obesity and diabetes to actively participate in their healthcare. These devices enable patients to make informed decisions about their daily routines and medication management.

Technological Advancements

Technological advancements are poised to revolutionize the field of blood glucose monitoring, significantly boosting the demand for these devices. These innovations are enhancing the accuracy, convenience, and connectivity of blood glucose monitors, making them more user-friendly and effective. The development of CGM systems allows for real-time monitoring of blood glucose levels. These wearable devices provide continuous data, enabling individuals with diabetes and healthcare providers to make immediate treatment decisions. The demand for CGM devices is on the rise due to their ability to improve glycemic control and reduce the risk of hypoglycemia and hyperglycemia.Researchers are making significant progress in developing non-invasive glucose monitoring technologies, such as optical sensors and smart contact lenses. These approaches eliminate the need for fingerstick tests and offer more comfortable monitoring options, which can lead to increased patient compliance and demand. AI and machine learning algorithms are being applied to blood glucose data analysis. These technologies can predict blood glucose trends, detect patterns, and provide personalized insights, empowering individuals with diabetes to make proactive decisions about their health.

Key Market Challenges

High-Cost Nature and Complications for Monitoring Devices

The glucose monitoring device, while effective in managing diabetes, can pose certain challenges. Firstly, the cost of the device can be a barrier for some individuals, making it inaccessible to those who need it the most. Additionally, the process of monitoring glucose levels can be painful, causing discomfort for patients. Another concern is the accuracy of the results, as diabetes care devices may not always provide reliable readings. Furthermore, insurance coverage for diabetes-related expenses is often limited, leaving many hospitals and healthcare centers unable to fully support patients in managing their condition. This lack of coverage or qualifications for coverage has become a growing issue in the healthcare industry. These factors, together, act as barriers to the growth of the market for glucose monitoring devices.Moreover, several complications are associated with the use of these devices, further hindering market growth. Disruptive alerts and lost signals can lead to data gaps, making it challenging to accurately interpret glucose readings. Additionally, some patients may experience skin irritation or adhesive issues due to prolonged use of the devices. These complications add to the overall hindrance faced by the market.

Stringent Regulatory Framework

The Blood Glucose Monitoring (BGM) Devices Market growth is being challenged by a robust regulatory framework. The market faces significant hurdles due to stringent regulations imposed by regulatory bodies such as the US FDA and the European Union's European Medicines Agency (EMA) on medical devices, including blood glucose meters. These regulations necessitate extensive clinical trials and studies to ensure product safety and efficacy, leading to time-consuming and expensive processes that can delay new product launches.Compliance with strict guidelines for accuracy and reliability of blood glucose meters is a demanding and resource-intensive task for manufacturers. Moreover, regulatory changes can have adverse effects on the market. The stringent regulatory framework poses a significant challenge to the market, impacting innovation, increasing costs, and causing delays in new product launches, ultimately impeding market growth during the forecast period.

Key Market Trends

Smart Watch-Based Apps

Smartwatch-based applications are a significant trend that is influencing the growth of the Blood Glucose Monitoring (BGM) Devices Market. Within the market, there is an increasing inclination towards utilizing smartwatch-based applications for monitoring blood glucose levels. In recent years, smartwatches have gained popularity due to their ability to track various activities such as heart rate, sleep patterns, physical activity, and other health metrics. These applications utilize Continuous Glucose Monitoring (CGM) sensors to measure glucose levels in the user's interstitial fluid. The collected data is then transferred to the smartwatch, enabling users to view their glucose levels and monitor their progress over time.One of the notable advantages of smartwatch-based blood glucose monitoring applications is their convenience and discretion. Users can monitor their glucose levels without the need for carrying a separate device or performing finger pricks to obtain blood samples. This convenience empowers individuals with diabetes to effectively manage their condition and achieve optimal blood sugar control. Consequently, users can take proactive measures to regulate their glucose levels, such as making dietary adjustments or adhering to medication. The overall trend towards smartwatch-based blood glucose monitoring applications is expected to continue as wearable technology becomes more prevalent and individuals seek convenient and effective methods to manage their health during the forecast period.

Increasing Strategic Developments

Increasing strategic developments, such as collaborations, play a pivotal role in driving market growth. A recent example of this is the collaboration between Roche and Eli Lilly and Company in 2021. Their joint efforts are focused on enhancing the management of insulin pen therapy, a critical aspect of diabetes care. This collaboration underscores Roche's commitment to creating an open ecosystem that integrates its solutions, partner devices, and services across the entire continuum of care in diabetes. by leveraging this comprehensive approach, Roche is not only addressing the immediate needs of patients but also facilitating long-term market growth in the healthcare industry.Segmental Insights

Product Type Insights

Based on the product type, the market is divided into two categories: self-monitoring glucose devices and continuous glucose monitoring devices. Among these, the continuous glucose monitoring devices segment is projected to exhibit the highest compound annual growth rate (CAGR) during the forecast period. This remarkable growth can be primarily attributed to the increasing adoption of minimally invasive procedures, which offer patients a more convenient and accurate way of monitoring their glucose levels. With the continuous glucose monitoring devices segment gaining traction, it is expected to play a significant role in shaping the future of glucose monitoring technology.End User Insights

Based on the end user segment, the home care segment is projected to experience significant growth during the forecast period. One of the key factors driving this growth is the revolutionary approach of self-monitoring of blood glucose, which has transformed home-based glucose monitoring. Self-monitoring blood glucose (SMBG) is widely adopted worldwide as the preferred method for short-term glucose monitoring. It allows individuals, with or without diabetes, to conveniently measure their blood sugar levels in the comfort of their own homes. This approach empowers patients to closely monitor the effects of their treatment, including diet, insulin, exercise, and stress management, leading to better management of their overall health and well-being.Regional Insights

North America is projected to be the largest contributor to the growth of the global blood glucose monitoring devices market during the forecast period. Technavio's analysts have comprehensively explained the regional trends and drivers shaping the market in this period.The market in this region is expected to exhibit steady growth, driven by factors such as the increasing prevalence of diabetes, growing awareness of the significance of blood glucose monitoring, and technological advancements leading to further developments. Key players in this market include Abbott Laboratories, Roche Diagnostics, LifeScan, Dexcom, and others. The United States stands as the leading sales market for blood glucose meters in North America, experiencing significant growth primarily due to the rising prevalence of obesity and diabetes. Consequently, the demand for blood glucose monitoring devices and services in the region has witnessed a substantial increase.

Key Market Players

- Roche Holding AG

- Dexcom Inc.

- Medtronic PLC

- Arkray Inc.

- Ascensia Diabetes Care

- Agamatrix Inc.

- Bionime Corporation

- Acon Laboratories Inc.

- Medisana AG

- Rossmax International Ltd.

Report Scope

In this report, the Global Blood Glucose Monitoring Devices Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Blood Glucose Monitoring Devices Market, by Product Type:

- Self-Monitoring Glucose Devices

- Continuous Glucose Monitoring Devices

Blood Glucose Monitoring Devices Market, by Application:

- Type 1 Diabetes

- Type 2 Diabetes

- Gestational Diabetes

Blood Glucose Monitoring Devices Market, by End User:

- Home Care Settings

- Hospital

- Others

Blood Glucose Monitoring Devices Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Blood Glucose Monitoring Devices Market.Available Customizations

The following customization option is available based on your specific needs: Detailed analysis and profiling of additional market players (up to five).This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Roche Holding AG

- Dexcom Inc.

- Medtronic PLC

- Arkray Inc.

- Ascensia Diabetes Care

- Agamatrix Inc.

- Bionime Corporation

- Acon Laboratories Inc.

- Medisana AG

- Rossmax International Ltd.

Table Information

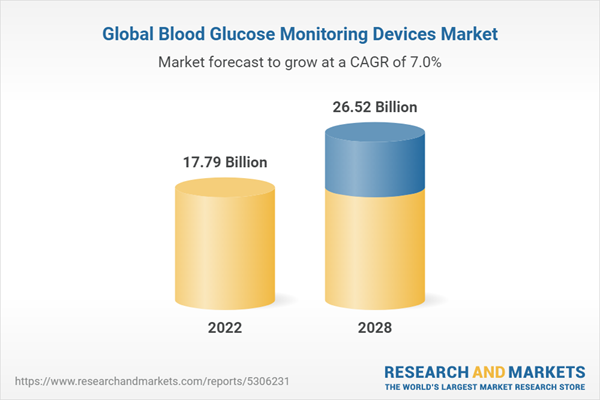

| Report Attribute | Details |

|---|---|

| No. of Pages | 174 |

| Published | October 2023 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 17.79 Billion |

| Forecasted Market Value ( USD | $ 26.52 Billion |

| Compound Annual Growth Rate | 7.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |