Speak directly to the analyst to clarify any post sales queries you may have.

In-depth Analysis and Data-driven Insights on the Impact of COVID-19 Included in this Global Building Integrated Photovoltaics Market Report

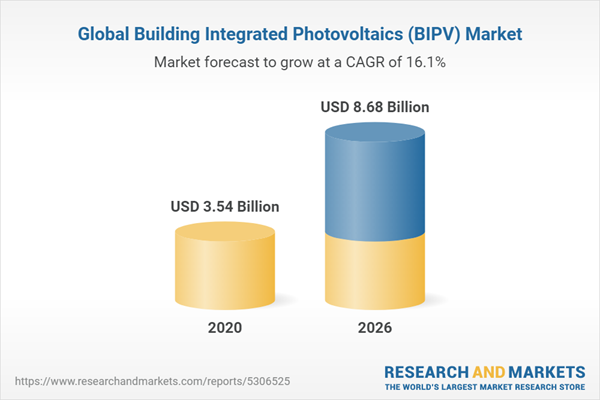

The global building integrated photovoltaics market by revenue is expected to grow at a CAGR of over 16% during the period 2021-2026.

The global market has observed a rapid growth in Europe, North America, and parts of APAC in recent years. With the improvement in infrastructure, lux residential complexes, commercial office spaces, airports, and hospitals, the demand for sustainable energy products, including BIPV, is growing. The market has historically been concentrated in the US and Europe and accounted for the highest installations; however, emerging economies are currently contributing toward the BIPV demand significantly. The application of BIPV products in the residential sector is expected to increase with the growth in awareness and increase in disposable incomes in developing regions. Along with the rising demand for new installations, the market in developed regions is witnessing an increased demand from retrofit projects.

The following factors are likely to contribute to the growth of the building integrated photovoltaics market during the forecast period:

- Growth of Zero Energy Buildings

- Development of Next-Gen BIPV Products

- Popularity of Smart Homes

- Preference for Non-conventional Energy Sources

The study considers the present scenario of the building integrated photovoltaics market and its market dynamics for the period 2020-2026. It covers a detailed overview of several market growth enablers, restraints, and trends. The report offers both the demand and supply aspects of the market. It profiles and examines leading companies and other prominent ones operating in the market.

Global Building Integrated Photovoltaics Market Segmentation

The global building integrated photovoltaics market research report includes a detailed segmentation by technology, application, end-users, geography. Crystalline silicon BIPV products dominated the building integrated photovoltaics market share of over 73% in 2020. Monocrystalline and polycrystalline modules witnessed high application in roofs. However, the growth in thin-film technologies is expected to capture a major share of first-generation silicon cells during the forecast period. The thin-film segment is expected to pose an absolute growth of 192% during the forecast period with the rise in preference for foil-based flexible modules. Crystalline-silicon products are ideal for residential buildings due to high efficiency coefficients. As residential buildings have space constraints, crystalline silicon PV products become the most preferred material choice for buildings, especially for roofs.

In 2020, BIPV roof products dominated the market with a share of over 63% due to innovations in crystalline technology. The customized portfolio for shingles and flexible thin-film foils is accelerating the demand for residential rooftops. Transparent solar modules could be the next major opportunity in the market. They usually consist of transparent crystalline modules and can be used as a window glazing in sunspaces and have the feasibility to be integrated with roofs. However, the steep increase in the demand for BIPV roof products is challenged due to the lack of standardization in photovoltaic tiles. The roof products have high potential in western economies due to slanting roof designs. The application of thin-film BIPV and façade, on the other hand, is higher in APAC and MEA regions, where the roof design is relatively flat.

With the implementation of solar power panels in building codes becoming compulsory, commercial buildings are expected to integrate PV systems in the building envelope. The adoption of BIPV products in commercial buildings offers dual benefits - acting as a structurally sound outer layer of the building and reducing power expenses as they can generate electricity for self-consumption. The commercial segment was the largest end-user that is expected to pose an absolute growth of 149% during the forecast period. The growth in flexible working spaces and increased importance of zero-energy practices could boost the usage of commercial BIPV products.

Technology

- Thin-Films

- Crystalline Silicon

- Others

Application

- Roof

- Façade and Window

End-user

- Commercial

- Residential

- Others

Insights by Geography

The Europe BIPV market is expected to grow at a CAGR of over 14% during the forecast period. As solar energy is the cheapest source of electricity in Nordics, the momentum for PV is growing in the region. The growth of BIPV has been steady and optimistic in countries such as Norway, Sweden despite the absence of special subsidies and wide policies. The BIPV system as a building envelope material is economically feasible in Norway that is driving the adoption. Homeowners in the Netherlands have shown keen interest in PV modules. Europe is one of the largest markets in terms of installed PV capacities and annual installations across the world. Institutions and industries in Europe are increasingly adopting eco-friendly or green technology to reduce carbon footprints from buildings. Buildings have become exceedingly complex with the incorporation of smart technology. While the beneficial economic factors that are capable to drive the demand for BIPV installation in Europe, there are certain policies and regulations that could hamper the demand for BIPV installation. Reduction in incentives and subsidies and decrease or removal of feed-in-tariff rates can adversely affect market growth in the region.

By Geography

- North America

- US

- Canada

- Europe

- UK

- Germany

- France

- Spain

- Italy

- APAC

- China

- Japan

- South Korea

- Australia

- Latin America

- Brazil

- Chile

- Middle East & Africa

- Saudi Arabia

- UAE

Insights by Vendors

The global building integrated photovoltaics market is observing a flurry of activities, with new entrants queuing up to entry it. However, high initial capital investments hamper the entry of new players as development and commercialization of high-efficiency BIPV modules technology remain a capital-intensive affair. As the building integrated photovoltaics (BIPV) market grows with the growing adoption of solar energy in residential and commercial buildings, it is expected that vendors invest in enhancing their product portfolio during the forecast period. The incorporation of recyclability in manufacturing processes can enhance the significance of vendors in terms of sustainability and eco-friendliness. With solar energy witnessing traction, the potential for reducing energy costs is significantly high.

Prominent Vendors

- First Solar

- Yingli Solar

- Solar Frontier K.K

- Hanwha Solar

- Hanergy Holding Group

Other Prominent Vendors

- Solarcentury

- Sharp Corporation

- REC Solar Holdings AS

- Panasonic

- Wuxi Suntech Power Co.

- Canadian Solar

- KYOCERA Corporation

- Onyx Solar Group

- SunPower

- Jinko Solar

- Tesla

- Heliatek

- BIPVco

- Visaka Industries

- NanoPV Solar

- Tractile

- ISSOL

- ertex Solar

- Nippon Sheet Glass

- BISOL

- ViaSolis

- Topsun Energy

- Polysolar

Key Questions Answered

1. How is smart home automation growth affecting the BIPV market growth?

2. What are the major sustainable practices followed by building integrated photovoltaics manufacturers?

3. What is the market size and growth rate of the BIPV market during the period 2021-2026?

4. Which segment is likely to emerge as the largest revenue-generator during the forecast period?

5. Which regions are expected to dominate the BIPV market shares during the forecast period?

6. What are the market restraints impacting the building integrated photovoltaics market growth?

Table of Contents

1 Research Methodology2 Research Objectives3 Research Process

Companies Mentioned

- First Solar

- Yingli Solar

- Solar Frontier K.K

- Hanwha Solar

- Hanergy Holding Group

- Solarcentury

- Sharp Corporation

- REC Solar Holdings AS

- Panasonic

- Wuxi Suntech Power Co.

- Canadian Solar

- KYOCERA Corporation

- Onyx Solar Group

- SunPower

- Jinko Solar

- Tesla

- Heliatek

- BIPVco

- Visaka Industries

- NanoPV Solar

- Tractile

- ISSOL

- ertex Solar

- Nippon Sheet Glass

- BISOL

- ViaSolis

- Topsun Energy

- Polysolar

Methodology

Our research comprises a mix of primary and secondary research. The secondary research sources that are typically referred to include, but are not limited to, company websites, annual reports, financial reports, company pipeline charts, broker reports, investor presentations and SEC filings, journals and conferences, internal proprietary databases, news articles, press releases, and webcasts specific to the companies operating in any given market.

Primary research involves email interactions with the industry participants across major geographies. The participants who typically take part in such a process include, but are not limited to, CEOs, VPs, business development managers, market intelligence managers, and national sales managers. We primarily rely on internal research work and internal databases that we have populated over the years. We cross-verify our secondary research findings with the primary respondents participating in the study.

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| Published | March 2021 |

| Forecast Period | 2020 - 2026 |

| Estimated Market Value ( USD | $ 3.54 Billion |

| Forecasted Market Value ( USD | $ 8.68 Billion |

| Compound Annual Growth Rate | 16.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 28 |