Speak directly to the analyst to clarify any post sales queries you may have.

A strategic introduction framing how rental operators, contractors, and asset managers can navigate evolving demand drivers and operational priorities in construction equipment rental

The construction equipment rental sector functions as a vital intermediary between manufacturers and project owners, enabling capital discipline, schedule flexibility, and access to specialized machinery without the long-term ownership burden. In recent years, contractors and asset managers have increasingly prioritized variable-capital models to align equipment availability with project phasing and cash-flow constraints, raising the strategic importance of rental partners in delivering just-in-time capacity.As owners confront tightening project schedules, workforce shortages, and higher expectations for environmental stewardship, rental operators are evolving from transactional suppliers into solution providers that combine fleet availability with telematics, maintenance, and financing services. This transition is driven both by end-user demand for turnkey capabilities and by operators’ need to maximize utilization while reducing total cost of ownership across heterogeneous asset classes.

Consequently, rental firms are recalibrating procurement, service delivery, and commercial models to balance durability, emissions compliance, and technological readiness. By integrating digital asset management, preventative maintenance regimes, and flexible rental terms, forward-looking operators position themselves to capture share across diversified applications ranging from high-intensity infrastructure projects to short-duration commercial fit-outs. In short, the rental channel is no longer merely an equipment source; it is a strategic enabler of project execution and productivity gains for the construction ecosystem

How electrification, digitalization, automation, and resilient supply strategies are collectively reshaping fleet economics and service models in equipment rental

The construction equipment rental landscape is undergoing a series of transformative shifts that are redefining competitive advantage and capital allocation. Electrification of powertrains, accelerated by local emissions standards and customer sustainability commitments, is reshaping fleet replacement cycles and aftermarket servicing requirements. At the same time, telematics and Internet of Things integrations are delivering real-time utilization, fuel and energy consumption metrics, and predictive maintenance triggers, enabling data-driven decisions that lift utilization and reduce downtime.Automation and autonomy are moving from pilot projects to operational deployments in controlled environments, creating pathways to address labor constraints and improve site safety. Rental models are also evolving: short-term and on-demand rental offerings are expanding alongside subscription and rent-to-own frameworks that align payment profiles with project cash flows. These shifts are coupled with a growing emphasis on circular economy principles, where refurbishment, component reuse, and end-of-life remanufacturing reduce lifecycle costs and environmental impact.

Finally, supply-chain resilience has become a strategic imperative. Firms that proactively diversify suppliers, invest in inventory buffers for critical components, and explore nearshoring options are better positioned to absorb geopolitical shocks and tariff-induced cost volatility. In combination, these transformative forces are compelling stakeholders across the value chain to rethink asset strategy, service delivery, and partnership models to remain competitive

Assessing the cumulative operational, procurement, and strategic consequences of United States tariff measures on rental operators and equipment supply choices in 2025

The tariff policy environment in the United States during 2025 introduced a set of cumulative effects that materially influenced procurement, fleet composition, and commercial strategy across the rental sector. When duties raise the landed cost of imported machinery and critical components, operators face immediate pressure on capex budgets and must reassess sourcing strategies to preserve margin and competitive pricing. In response, many firms increased emphasis on supplier diversification, looking to balance imports with domestically produced alternatives or parts inventories held closer to point of use.Tariff-induced cost pressures also influenced the timing of procurement decisions and the composition of replacement cycles. Organizations prolonged service lives through enhanced maintenance programs and parts cannibalization where feasible, while others accelerated purchases prior to tariff implementation to avoid price escalation. These dynamics heightened demand for used and refurbished equipment as cost-conscious customers sought lower-cost access to capacity, shifting utilization patterns within rental fleets.

Moreover, tariffs catalyzed discussions around localization and strategic partnerships with domestic manufacturers and component suppliers. Rental companies evaluated joint-service agreements and preferred-supplier arrangements to secure priority allocations and predictable lead times. Financing structures adapted as well, with operators leveraging lease and rent-to-own arrangements to soften immediate capital outlays. Across the ecosystem, the cumulative impact of tariffs emphasized the need for agile procurement practices, more sophisticated inventory management, and a proactive commercial stance to safeguard service levels and profitability amid rising input costs

A comprehensive segmentation roadmap that links equipment families, powertrains, operational modes, rental tenors, and end-use applications to fleet and service strategies

A robust segmentation lens clarifies where demand is concentrated and how rental operators should allocate resources across asset classes, usage horizons, and customer needs. Equipment type segmentation encompasses aerial work platforms that include boom lifts and scissor lifts; concrete and road construction machinery such as concrete mixers, concrete pavers, and concrete pumps; earth moving machinery including backhoes, bulldozers, excavators, and skid steer loaders; earth-compacting equipment like plate tampers, pneumatic rollers, and road rollers; and material handling machinery that covers cranes and telehandlers. Each asset family has distinct utilization rhythms, maintenance profiles, and operator training requirements, shaping fleet mix and aftermarket support investments.Rental duration is another critical axis, divided between long-term arrangements-annually or monthly-and short-term commitments on a daily or weekly basis. Long-term duration clients prioritize predictable availability, contractual maintenance, and optimized total cost, whereas short-term customers value immediate deployment, flexible pickup and drop-off, and rapid onboarding. Power source segmentation distinguishes diesel, electric, gasoline, and hybrid units, with electricity and hybridization drawing interest from customers targeting emissions reductions and lower site-level noise.

Operational mode segmentation separates autonomous systems from manual machines, with autonomy offering productivity gains in repeatable tasks and manual operations remaining prevalent in complex or variable jobsite contexts. Rental model segmentation spans equipment-only offerings, full-service contracts that bundle maintenance and transport, and rent-to-own structures that transition customers toward ownership over time. Finally, application segmentation spans commercial construction including office spaces and retail buildings, industrial construction across manufacturing plants and warehouses, infrastructure development covering bridge, road, and tunnel projects, and residential construction. Each application vertical demands tailored specifications, regulatory compliance knowledge, and service models, reinforcing the need for an integrated segmentation strategy that aligns fleet composition, contractual terms, and value-added services with end-user requirements

A nuanced regional assessment that identifies differentiated demand drivers, regulatory pressures, and service expectations across the Americas, EMEA, and Asia-Pacific markets

Regional dynamics exert a strong influence on demand patterns, equipment preferences, and service expectations, shaping where rental operators should focus investment and capability development. In the Americas, North America displays high rental penetration driven by sophisticated fleet-management practices, mature telematics adoption, and large-scale infrastructure and commercial projects, while parts of Latin America are characterized by opportunistic demand, strong price sensitivity, and growing appetite for flexible rental models as project financing evolves.Europe, Middle East & Africa present a mosaic of regulatory and commercial conditions. Western Europe is a leader in emissions regulation and electrification initiatives, prompting rental firms to accelerate low-emission fleet deployments and offer comprehensive compliance support. In the Middle East, rapid infrastructure programs and energy-related projects generate demand for high-capacity earth-moving and material handling equipment, while African markets show long-term growth potential tied to urbanization and road network expansion, albeit with challenges in logistics and local aftermarket capacity.

Asia-Pacific is defined by diverse trajectories across markets. Advanced markets emphasize digital integration and increasingly stringent environmental standards, encouraging uptake of electric and hybrid assets, whereas emerging markets continue to prioritize cost-effective diesel fleets and used equipment. Rapid urbanization, mass transit and infrastructure investments, and a robust manufacturing base drive pronounced demand for both short-term and long-term rentals. Collectively, these regional profiles necessitate differentiated commercial models, targeted inventory strategies, and localized service footprints to effectively capture opportunity across geographies

An authoritative view of competitive dynamics showing how scale, service integration, OEM partnerships, and technology differentiation shape market leadership outcomes

Competitive dynamics in the rental sector are shaped by the coexistence of global full-service operators, national and regional specialists, OEM financing and rental arms, and a growing roster of technology providers delivering telematics, marketplace platforms, and predictive maintenance solutions. Larger operators compete on scale, network density, and integrated services such as transport logistics and bundled maintenance, while smaller or niche players differentiate through local knowledge, rapid response, and specialized equipment fleets tailored to particular applications.Partnerships between rental firms and equipment manufacturers are increasingly common, enabling access to priority production slots, extended warranties, and co-developed electrification roadmaps. Technology vendors play a pivotal role by enabling utilization analytics, condition monitoring, and customer self-service interfaces that reduce administrative friction. Strategic M&A activity has been motivated by objectives to increase geographic reach, consolidate service networks, and broaden asset portfolios, while joint ventures and preferred-supplier agreements help manage supply-side volatility.

Key competitive levers include fleet modernization cadence, aftermarket service quality, pricing flexibility, and the ability to deliver sustainable solutions that meet client carbon targets. Firms that align commercial propositions with customer pain points-such as minimizing downtime, simplifying billing, and offering turnkey site solutions-tend to capture higher-value engagements. In sum, the ecosystem rewards operators that combine operational excellence with a clear technology and sustainability roadmap

Actionable strategic priorities for executives to align fleet modernization, digital services, commercial design, and supply resilience to capture sustainable growth

Industry leaders must adopt a multi-dimensional strategy to convert structural shifts into durable advantage. First, prioritize fleet electrification and hybridization where site emissions and noise constraints create commercial differentiation. Investing in electric assets should be paired with charging infrastructure planning, grid coordination, and training for electrified equipment maintenance. Second, expand telematics and predictive maintenance capabilities to boost uptime and create data-driven pricing models that reward efficient utilization rather than flat daily rates.Next, develop flexible commercial offerings that span daily on-demand rentals to long-term, full-service contracts and rent-to-own pathways. Tailored pricing and bundled service agreements can capture customers across the project lifecycle while improving retention. Strengthen supply-chain resilience by diversifying suppliers, securing strategic inventory for critical components, and exploring nearshoring arrangements for high-risk product lines. At the same time, invest in workforce development programs focused on maintenance of electrified and autonomous equipment, ensuring technicians can service advanced powertrains and digital control systems.

Finally, embed sustainability into procurement and reporting practices to meet client expectations and regulatory requirements. Establish clear metrics for fleet emissions, energy consumption, and lifecycle refurbishment to demonstrate progress and support green procurement discussions. By combining technology adoption, flexible commercial design, supply-chain agility, and workforce readiness, leaders can improve margins, reduce operational risk, and deliver more compelling value propositions to customers

A rigorous, mixed-methods research approach combining stakeholder interviews, technical analysis, and scenario modeling to validate strategic insights and recommendations

The research underpinning this analysis combined qualitative and quantitative approaches to ensure findings are robust, validated, and actionable. Primary research included interviews with fleet managers, rental operators, OEM representatives, and procurement executives across a range of project types and geographies. These discussions provided ground-level insight into utilization patterns, maintenance pain points, and commercial preferences that guided interpretation of secondary data.Secondary research drew on industry reports, regulatory publications, technical standards, and supplier product specifications to map technology trajectories and operational benchmarks. Equipment lifecycle and total cost considerations were evaluated through case studies and maintenance record analysis, while tariff impacts and supply-chain shifts were assessed using customs and trade policy documentation alongside industry commentaries. Data triangulation ensured consistency between interview findings and documented trends.

Analytical techniques included scenario analysis to explore alternative procurement and regulatory outcomes, fleet utilization modeling to identify leverage points for uptime improvements, and segmentation analysis to align offerings with customer needs. Validation steps included peer review with independent industry experts and iterative refinement based on client feedback. Together, these methods produced a structured, evidence-based perspective on strategic imperatives for the construction equipment rental sector

A concise conclusion synthesizing why fleet modernization, digital services, and procurement agility will determine competitive success in the evolving rental landscape

The construction equipment rental industry stands at an inflection point defined by accelerating technology adoption, rising environmental expectations, and a more volatile trade environment. Operators that respond with purposeful fleet strategies, invest in digital enablers, and shore up supply-chain resilience will be better positioned to meet diverse client needs and protect margins. The interplay between short-term flexibility and long-term service commitments underscores the need for hybrid commercial models that accommodate project variability while securing recurring revenue streams.Sustainability considerations and electrification are no longer optional; they drive procurement decisions and can unlock new customer segments, particularly in urban and regulated markets. Likewise, data and analytics are fundamental to improving utilization, reducing costs, and developing differentiated pricing models. The cumulative effects of tariff shifts and geopolitical uncertainty require proactive procurement playbooks, including supplier diversification and strategic inventory management, to maintain service continuity.

In conclusion, success in the coming cycle will depend on the ability to integrate fleet modernization, digital service delivery, and commercial innovation into a coherent strategy. Firms that move decisively to align capabilities with evolving customer expectations will capture disproportionate value and become trusted partners in efficient, sustainable project delivery

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

18. China Construction Equipment Rental Market

Companies Mentioned

The key companies profiled in this Construction Equipment Rental market report include:- AB Volvo

- ABC Infra Equipment PVT. LTD.

- AKTIO Holdings Corporation

- Ashtead Group PLC

- Boels Verhuur B.V.

- Caterpillar Inc.

- Custom Truck One Source, Inc.

- Doggett Equipment Services Group

- Emeco Holdings Limited

- Finning International Inc.

- Gemini Equipment And Rentals Private Limited

- Herc Holdings Inc.

- Hitachi, Ltd.

- Industrial Supplies Development Co. Ltd.

- ITOCHU Corporation

- Kanamoto Co., Ltd.

- Kiloutou Group

- Liebherr-International AG

- LOXAM GROUP

- Maxim Crane Works, L.P.

- Nishio Rent All Co., Ltd.

- Sanghvi Movers Limited

- Sarens Bestuur NV

- Speedy Hire PLC

- Sumitomo Corporation

- TAIYOKENKI RENTAL CO.,LTD.

- TVH Equipment NV

- United Rentals, Inc.

- Zahid Group

Table Information

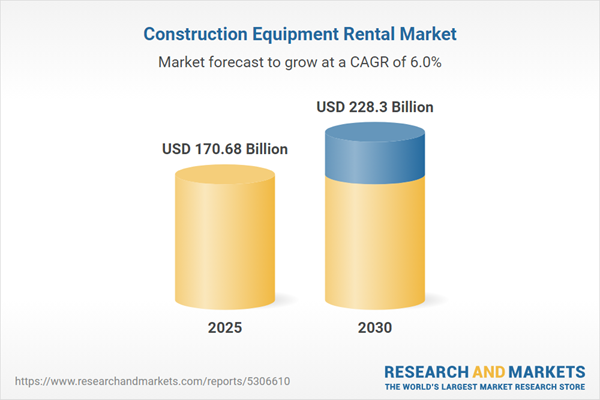

| Report Attribute | Details |

|---|---|

| No. of Pages | 187 |

| Published | January 2026 |

| Forecast Period | 2025 - 2030 |

| Estimated Market Value ( USD | $ 170.68 Billion |

| Forecasted Market Value ( USD | $ 228.3 Billion |

| Compound Annual Growth Rate | 5.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 30 |