Increase in urbanization and infrastructure development.

Urbanization and infrastructure development drive the global n-butanol market. Infrastructural expansion to facilitate economic development in the countries creates immense demand for paints and coatings, thereby providing opportunities enough for n-butanol to drive the industry. Construction is one of the leading sectors in the global economy. In developed regions, construction adds up to 5% of GDP and in developing regions, it is as high as 8%. According to the U.S. Census, in 2019, construction activities accounted for an expenditure of USD 1.30 trillion. In the coming two decades, the expenses on infrastructure are going to surge sharply, as the global annual spending is pegged at USD 3.7 trillion by 2040.The areas with the most significant infrastructure investment gaps are South America and Africa, which have tremendous potential for the future. In Asian countries such as Hong Kong, Taiwan, and Korea construction has been used as a means of fueling their economies to join the world's economy mainstream. Malaysia and China are also resorting to highly massive infrastructure projects to become full participants in the global economy. India's construction sector ranks as the third biggest amongst the larger economic sectors of the country and the second largest employment generator, after agriculture. It is expected to add up to 12 - 15% of the GDP by 2025.

The total investment in dwellings within the European Union accounted for 5.6% of GDP in 2021. The percentage of Member States was different: between 7.6% in Cyprus and 7.2% in Germany and Finland, at a lower level than that for the European Union as a whole, reached only 1.3% in Greece, 2.1% in Ireland, 2.2% in Latvia and 2.3% in Poland. It reflects construction's critical role in stability and growth in the region. A significant increase in construction activity, particularly in the developing regions, has created a demand for high-quality coatings for residential as well as commercial projects, resulting in increased consumption of n-butanol-based products.

Based on grade, the industrial segment has the largest market share during the forecast period, in terms of value.

Industrial segment the largest share of the market in n-butanol for the forecast period, mainly due to its wide application in varied industries. Such a demand of n-butanol as the solvent and chemical intermediate in manufacture of coatings, adhesives, and plastic would provide this segment to emerge at the corner. This flexibility in the molecule makes n-butanol valuable in the manufacturing process for butyl acrylate and butyl acetate which are widely used in paints and coatings.Another area of great importance is the paints and coatings industry. As high-performance coatings form part now of residential buildings and also of commercial ones, then the rise in the construction field also supports this demand more because industries demand finishes to be equally hard-wearing and aesthetically pleasing. Also, n-butanol is widely used to manufacture plasticizers and direct solvents, a point that contributes highly to its market presence.

Growing concerns over sustainability and low environmental footprint in industries have progressively led to an uptrend in the adoption of bio-based n-butanol. The growth of the industrial segment benefits from the uptrend trend in adoption besides being in line with the world's adaptation of greener production processes. In general, the leading status of the industrial segment adequately represents n-butanol's importance to manufacturing applications and its capabilities to meet dynamic market needs.

Based on application, the direct solvent segment has the second largest market share during the forecast period, in terms of value.

The direct solvent segment is the second largest in terms of market share in the forecast period, with significant application usage. This segment will generate huge revenues due to wide n-butanol usage as a direct solvent, which is valued for good solvency properties and compatibility with most resins and binders. Such properties have made it an essential product in the manufacture of paints, coatings, emulsions, lacquers, and inks.Its higher evaporation rate and less toxicity than the conventional solvents make this product more attractive in industrial as well as consumer markets. The increasing demand for quality coatings in construction and automobile industries is showing a positive movement in both sectors as they look for efficient solvents that can bring about minimum restrictions on stiff environmental regulations for high performance. Prospects with leading industries on a shift toward sustainable practices and high-performance materials will make the direct solvent market for n-butanol explode enormously in the near future.

Based on end-use industry, paints and coatings has the largest market share during the forecast period, in terms of value.

The paints and coatings industry is the biggest end-use sector that fuels the growth of the n-butanol market, primarily due to its excellent solvent properties as well as compatibility with many different resin compositions, n-Butanol is widely used in paint and coating formulations since it increases flow and lowers the viscosity. Thus, it prevents other problems like cobwebbing related to application. It is, therefore, a preferred solvent for industrial as well as consumer-grade coatings.The increasing demand for n-butanol in paints and coatings continues to gain further momentum from growth in the construction and automotive sectors, where high-performance coatings are needed. An increase in urbanization and infrastructural initiatives spurred the growth, particularly in the rapidly growing regions durable and attractive coatings spur substantial consumption of n-butanol.

Based on region, Asia Pacific is the largest market for n-butanol in 2023, in terms of value.

Asia Pacific market is projected to reach around 30.9% share of the global total market share during 2024, estimated around USD 1.25 billion by 2024. The market is expected to grow with a compound annual growth rate of 4.6% during 2024-2034. The largest volume usage of n-butanol in North America is primarily because of its use as a solvent that enhances the flow and application properties of several paints and coatings. Increased construction activity, primarily in residences and commercial buildings, continues to drive demand for n-butanol, an essential ingredient in high-end paints and coatings applied in these buildings.The shale gas revolution across North America improved not only supply but also competitiveness for feedstocks in the production of chemicals, which, in the case of n-butanol, turned out to be low-cost. Such an edge enabled local producers to grow more and to satisfy the increasing demand in all sectors industrial, automotive, construction, and personal care. Overall, the North American n-butanol market is well-suited for growth due to the high level of industrialization, technology, and focus towards sustainability. Domestic and international players in this business will find tremendous opportunities in such an environment.

In the process of determining and verifying the market size for several segments and subsegments identified through secondary research, extensive primary interviews were conducted. A breakdown of the profiles of the primary interviewees are as follows:

- By Company Type: Tier 1 - 40%, Tier 2 - 30%, and Tier 3 - 30%

- By Designation: Manager Level - 20%, Director Level - 10%, and Others - 70%

- By Region: North America - 35%, Europe - 15%, Asia Pacific - 40%, Rest of the World - 10%

Research Coverage

This report segments the n-butanol market based on grade, distribution channel, feedstock, application, end-use industry, and region, and provides estimations for the overall value of the market across various regions. A detailed analysis of key industry players has been conducted to provide insights into their business overviews, products and services, key strategies, new product launches, expansions, and mergers and acquisitions associated with the n-butanol market.Key benefits of buying this report

This research report focuses on various levels of analysis, including industry analysis (industry trends), market ranking analysis of top players, and company profiles, which together provide an overall view of the competitive landscape, emerging and high-growth segments of the n-butanol market, high-growth regions, and market drivers, restraints, opportunities, and challenges.The report provides insights on the following pointers:

- Analysis of key drivers (Growing urbanization and infrastructure development), restraints (Fluctuating raw material prices and their scarcity in the future), opportunities (Emerging trends in bio-based n-butanol) and challenges (Stringent regulations and restrictions).

- Market Penetration: Comprehensive information on the n-butanol market offered by top players in the global n-butanol market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the n-butanol market.

- Market Development: Comprehensive information about lucrative emerging markets - the report analyzes the markets for n-butanol market across regions.

- Market Diversification: Exhaustive information about new products, untapped regions, and recent developments in the global n-butanol market

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the n-butanol market

Table of Contents

Companies Mentioned

- BASF

- Mitsubishi Chemical Group Corporation

- The Dow Chemical Company

- Kh Neochem Co. Ltd.

- Eastman Chemical Company

- Sasol Limited

- Oq Chemicals GmbH

- Petrochina Company Limited

- Sabic

- Petronas Chemicals Group Berhad

- Nacalai Tesque, Inc.

- Tokyo Chemical Industry Co. Ltd.

- Central Drug House

- The Chemical Company

- Wanhua

- Green Biologics Ltd

- Kr Chemicals

- Ineos Oxide

- Grupa Azoty

- Anhui Shuguang Chemical Group

- The Andhra Petrochemicals Limited

- Texmark Chemicals, Inc.

- Neuchem

- Shrine Chemicals

Table Information

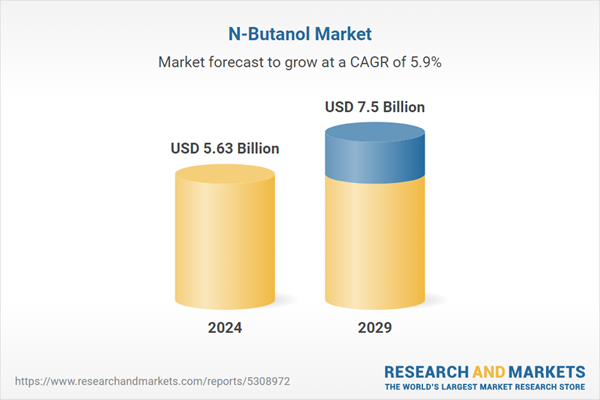

| Report Attribute | Details |

|---|---|

| No. of Pages | 257 |

| Published | October 2024 |

| Forecast Period | 2024 - 2029 |

| Estimated Market Value ( USD | $ 5.63 Billion |

| Forecasted Market Value ( USD | $ 7.5 Billion |

| Compound Annual Growth Rate | 5.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 24 |