Global Generic Drugs Market - Key Trends & Drivers Summarized

Generic drugs play a pivotal role in the healthcare industry by providing cost-effective alternatives to brand-name medications. These drugs contain the same active ingredients, dosage form, strength, route of administration, and therapeutic effects as their branded counterparts, ensuring they are equally safe and effective. The production of generic drugs becomes possible after the patent protections on brand-name drugs expire, allowing other manufacturers to create and market the same medication at a lower price. The rigorous approval process for generics, overseen by regulatory bodies such as the U.S. Food and Drug Administration (FDA), ensures that these drugs meet stringent standards for quality, performance, and labeling.The widespread use of generic drugs has significant implications for both healthcare systems and patients. By offering more affordable options, generics help to reduce the overall cost of healthcare, making medications more accessible to a larger portion of the population. This affordability can lead to improved adherence to treatment regimens, as patients are less likely to skip doses or abandon treatment due to high costs. Moreover, the increased availability of generic drugs fosters competition in the pharmaceutical market, which can drive down prices even further. Hospitals, insurance companies, and government healthcare programs heavily rely on generic drugs to manage budgets and provide comprehensive care to patients.

The growth in the generic drugs market is driven by several factors. Firstly, the rising incidence of chronic diseases and an aging population increase the demand for various medications, many of which are available as generics. The expiration of patents on several high-revenue drugs opens the door for generic manufacturers to introduce cost-effective alternatives. Additionally, technological advancements in pharmaceutical manufacturing enhance the efficiency and cost-effectiveness of producing generic drugs. Regulatory initiatives aimed at speeding up the approval process for generics and biosimilars also play a crucial role in market expansion. Consumer behavior trends, such as increased trust in generic medications and a greater focus on reducing healthcare expenditures, further propel market growth. Lastly, emerging markets with growing healthcare needs and improving healthcare infrastructure present new opportunities for generic drug manufacturers. These factors collectively drive the robust growth and adoption of generic drugs globally.

Report Scope

The report analyzes the Generic Drugs market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Small-Molecule Generics, Biosimilars); Therapeutic Application (Cardiovascular, Central Nervous System (CNS), Dermatology, Oncology, Respiratory, Other Therapeutic Applications).

- Geographic Regions/Countries: World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Small-Molecule Generics segment, which is expected to reach US$538.8 Billion by 2030 with a CAGR of 4.8%. The Biosimilars segment is also set to grow at 16.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $138.7 Billion in 2024, and China, forecasted to grow at an impressive 8.1% CAGR to reach $126.8 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Generic Drugs Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Generic Drugs Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Generic Drugs Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Abbott Laboratories, Apotex Inc., ASKA Pharmaceutical Co., Ltd., Aspen Pharmacare Holdings Limited, AstraZeneca Plc and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 255 companies featured in this Generic Drugs market report include:

- Abbott Laboratories

- Apotex Inc.

- ASKA Pharmaceutical Co., Ltd.

- Aspen Pharmacare Holdings Limited

- AstraZeneca Plc

- Baxter International Inc.

- Dr. Reddy’s Laboratories Limited'

- Eli Lilly and Company

- Endo International plc

- F. Hoffmann-La Roche AG

- Fresenius Kabi AG

- GSK plc

- H. Lundbeck A/S

- Incepta Pharmaceuticals Ltd.

- Lupin Ltd.

- Novo Nordisk A/S

- Sandoz International GmbH

- Sanofi-Aventis U.S. LLC

- STADA Arzneimittel AG

- Sun Pharmaceutical Industries Limited

- Teva Pharmaceutical Industries Ltd.

- Viatris Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Abbott Laboratories

- Apotex Inc.

- ASKA Pharmaceutical Co., Ltd.

- Aspen Pharmacare Holdings Limited

- AstraZeneca Plc

- Baxter International Inc.

- Dr. Reddy’s Laboratories Limited'

- Eli Lilly and Company

- Endo International plc

- F. Hoffmann-La Roche AG

- Fresenius Kabi AG

- GSK plc

- H. Lundbeck A/S

- Incepta Pharmaceuticals Ltd.

- Lupin Ltd.

- Novo Nordisk A/S

- Sandoz International GmbH

- Sanofi-Aventis U.S. LLC

- STADA Arzneimittel AG

- Sun Pharmaceutical Industries Limited

- Teva Pharmaceutical Industries Ltd.

- Viatris Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 711 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

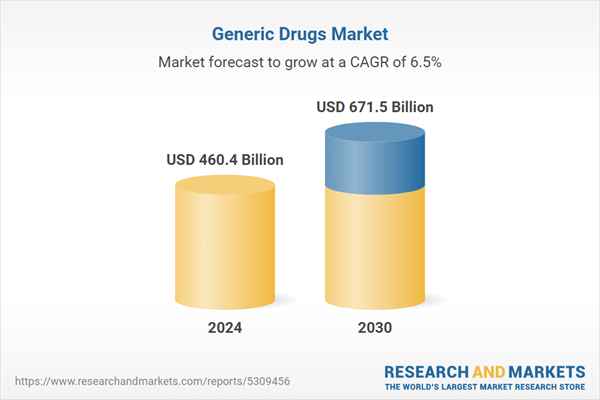

| Estimated Market Value ( USD | $ 460.4 Billion |

| Forecasted Market Value ( USD | $ 671.5 Billion |

| Compound Annual Growth Rate | 6.5% |

| Regions Covered | Global |