Global Diabetes Drugs Market - Key Trends and Drivers Summarized

What Are Diabetes Drugs and How Do They Transform Lives?

Diabetes drugs form a critical component of diabetes management, a disease that affects millions worldwide. These medications help manage blood sugar levels in patients with both type 1 and type 2 diabetes. Type 1 diabetes is typically managed with insulin therapy, which replaces the insulin the body is unable to produce. Type 2 diabetes treatment may involve a variety of drugs that work in different ways: some increase insulin secretion, others improve insulin sensitivity, and some decrease the absorption of sugar from the digestive system. Recent advancements have introduced drugs that mimic intestinal hormones to slow digestion and sugar absorption. Each medication is tailored to fit the patient's specific health profile, with the goal of maintaining blood glucose levels within a normal range, thus preventing the long-term complications of diabetes, such as heart disease, kidney damage, and vision loss.How Has Innovation Influenced the Development of Diabetes Medications?

Innovation in diabetes treatment has seen substantial growth over the past few decades, driven by a deeper understanding of the disease and its metabolic pathways. Modern drug development has introduced several new classes of medications, including GLP-1 receptor agonists and SGLT2 inhibitors, which have changed the diabetes treatment paradigm. GLP-1 receptor agonists, such as exenatide and liraglutide, enhance insulin secretion and suppress glucagon release in a glucose-dependent manner, offering benefits beyond glycemic control, such as weight loss and cardiovascular risk reduction. SGLT2 inhibitors reduce blood glucose by preventing the kidneys from reabsorbing glucose back into the blood. Moreover, the advent of biosimilars and improvements in insulin therapy, including faster-acting insulins and insulin analogs, provide more physiological and convenient treatment options, enhancing patient adherence and overall quality of life.What Role Does Personalized Medicine Play in Diabetes Care?

The shift towards personalized medicine in diabetes care is a game-changer, enhancing the efficacy and safety of treatment protocols. Personalized medicine in diabetes involves tailoring drug therapies based on an individual's genetic makeup, lifestyle, and specific health needs. This approach not only helps in selecting the most effective medication for each patient but also in determining the optimal dose and timing of administration to minimize side effects and maximize benefits. For instance, the choice between using a standard drug regimen versus newer agents may depend on factors such as a patient's cardiovascular health, kidney function, and potential for hypoglycemic episodes. Personalized medicine has been facilitated by advances in genetic testing and mobile health technologies, which allow for continuous monitoring of blood glucose levels and real-time data analysis. This personalization helps in predicting disease progression and in making more informed decisions regarding adjustments in therapy, thereby significantly improving patient outcomes.What Drives the Growing Market for Diabetes Drugs?

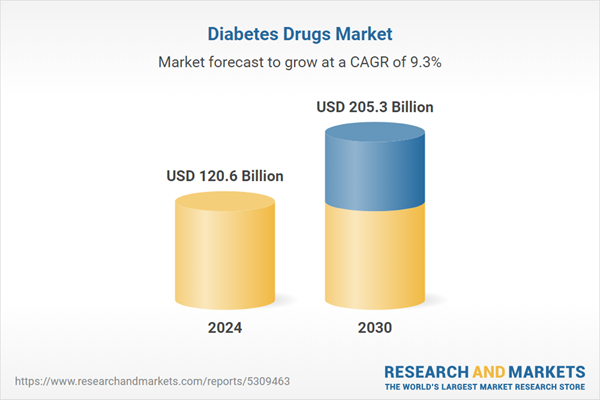

The growth in the diabetes drugs market is driven by several factors, including the rising global prevalence of diabetes due to increasing obesity rates, aging populations, and higher incidences of sedentary lifestyles. Advances in drug research and development, resulting in more efficacious and safer medications, also boost the market growth. Additionally, there is a growing awareness and better screening for diabetes, leading to earlier and increased diagnosis and treatment of the disease. Economic development and the expansion of healthcare infrastructure in emerging markets provide access to medical care for a larger portion of the population, further expanding the demand for diabetes medications. The increasing adoption of digital health solutions for disease management and the expansion of personalized medicine are also crucial factors contributing to the robust growth of this market. Together, these dynamics ensure sustained investment and innovation within the sector, responding to the urgent need for effective diabetes management solutions.Report Scope

The report analyzes the Diabetes Drugs market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Route of Administration (Oral, Insulin Syringe / Insulin Pen, Insulin Pump, Other Routes of Administration); Product (Insulin, Non-Insulin Drugs).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Oral Administration segment, which is expected to reach US$163.4 Billion by 2030 with a CAGR of 9.7%. The Insulin Syringe / Insulin Pen Administration segment is also set to grow at 7.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $31.1 Billion in 2024, and China, forecasted to grow at an impressive 12.4% CAGR to reach $46.8 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Diabetes Drugs Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Diabetes Drugs Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Diabetes Drugs Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AstraZeneca PLC, Bayer AG, Boehringer Ingelheim International GmbH, Eli Lilly and Company, GlaxoSmithKline PLC and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 46 companies featured in this Diabetes Drugs market report include:

- AstraZeneca PLC

- Bayer AG

- Boehringer Ingelheim International GmbH

- Eli Lilly and Company

- GlaxoSmithKline PLC

- Johnson & Johnson

- Merck & Co., Inc.

- Sanofi

- Takeda Pharmaceuticals Company Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AstraZeneca PLC

- Bayer AG

- Boehringer Ingelheim International GmbH

- Eli Lilly and Company

- GlaxoSmithKline PLC

- Johnson & Johnson

- Merck & Co., Inc.

- Sanofi

- Takeda Pharmaceuticals Company Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 196 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 120.6 Billion |

| Forecasted Market Value ( USD | $ 205.3 Billion |

| Compound Annual Growth Rate | 9.3% |

| Regions Covered | Global |