Global Heparin Market - Key Trends and Drivers Summarized

Is Heparin the Essential Blood Thinner in Modern Medicine?

Heparin is a critical anticoagulant, widely used in modern medicine to prevent and treat blood clots. But why is it so essential? Heparin works by inhibiting clotting factors in the blood, particularly thrombin and Factor Xa, which play crucial roles in the formation of clots. This makes it an indispensable drug in a variety of medical settings, including surgeries, dialysis, and the management of cardiovascular conditions like deep vein thrombosis (DVT), pulmonary embolism (PE), and atrial fibrillation. By preventing clot formation, heparin reduces the risk of potentially life-threatening events such as strokes and heart attacks.Heparin is available in two primary forms: unfractionated heparin (UFH) and low molecular weight heparin (LMWH). UFH is typically used in hospital settings where close monitoring is required, while LMWH, with its more predictable effects and longer half-life, is often preferred for outpatient use. This versatility allows heparin to be used in a wide range of clinical scenarios, from acute interventions in emergency care to long-term management of chronic conditions. As one of the oldest and most trusted anticoagulants, heparin continues to be a cornerstone in the prevention and treatment of thrombotic disorders across the globe.

How Has Technology Advanced Heparin Use and Safety?

Technological advancements have significantly enhanced the use and safety of heparin, improving its delivery, monitoring, and reducing potential side effects. One of the key innovations is the development of low molecular weight heparin (LMWH), which has transformed how heparin is administered and managed. LMWH offers a more predictable anticoagulant effect compared to unfractionated heparin, allowing it to be administered in fixed doses without the need for constant laboratory monitoring. This convenience has made LMWH the preferred choice for many conditions, particularly in outpatient settings, where frequent blood tests would be impractical. Moreover, LMWH has a lower risk of heparin-induced thrombocytopenia (HIT), a potentially dangerous immune reaction that can occur with standard heparin therapy.Another significant advancement is the use of automated infusion pumps and dosing algorithms in hospital settings for administering unfractionated heparin. These devices allow for precise control of the drug's infusion rate, ensuring that patients receive the correct dosage based on their individual needs. Combined with real-time monitoring of coagulation levels using laboratory tests like the activated partial thromboplastin time (aPTT), these innovations help reduce the risks of bleeding or clotting complications. Additionally, point-of-care devices now enable rapid testing of aPTT and anti-Xa levels, allowing clinicians to adjust heparin dosing more effectively and promptly.

Efforts to reduce the risks of contamination and dosing errors have also advanced heparin safety. In the past, contamination in heparin production led to serious adverse events, prompting regulators and manufacturers to tighten production standards and improve testing protocols. These changes, including the adoption of rigorous purification processes and stringent quality control measures, have made heparin safer and more reliable. Furthermore, the use of pre-filled syringes and single-use vials has reduced dosing errors and minimized the risk of contamination during administration. These technological improvements have enhanced both the safety and efficacy of heparin, ensuring that it remains a trusted anticoagulant in medical practice.

Why Is Heparin Essential for Managing Cardiovascular and Thrombotic Conditions?

Heparin is essential for managing cardiovascular and thrombotic conditions because it provides fast and effective anticoagulation, preventing the formation of dangerous blood clots. In conditions like deep vein thrombosis (DVT) and pulmonary embolism (PE), where blood clots can obstruct veins or arteries, immediate anticoagulation with heparin is often required to prevent the clot from growing or traveling to critical areas like the lungs or brain. Heparin's ability to quickly inhibit clotting factors makes it an ideal choice in these acute settings, where timely intervention can mean the difference between life and death.In addition to treating existing clots, heparin is crucial for preventing clot formation during high-risk situations, such as surgery, prolonged immobilization, and medical procedures like dialysis. For patients undergoing major surgeries, heparin is administered to reduce the risk of postoperative blood clots, which can form due to reduced mobility or tissue trauma during the procedure. In dialysis patients, heparin prevents clots from forming in the dialysis machine, ensuring that the procedure runs smoothly and that the patient receives adequate filtration of blood. It is also widely used in patients with atrial fibrillation, a condition that increases the risk of blood clots forming in the heart and potentially causing a stroke.

Heparin's role in cardiology is equally significant, particularly in the management of acute coronary syndromes (ACS), such as unstable angina and myocardial infarction (heart attack). During a heart attack, clot formation in the coronary arteries can block blood flow to the heart, leading to severe damage. Heparin is often administered in these emergency situations to prevent further clot formation while patients undergo procedures like angioplasty or thrombolysis to restore blood flow. Its rapid action, combined with its ability to be reversed with protamine sulfate in case of bleeding complications, makes heparin a critical tool in cardiovascular care. Overall, heparin's ability to prevent and treat clots across a wide range of clinical scenarios makes it indispensable for managing cardiovascular and thrombotic disorders.

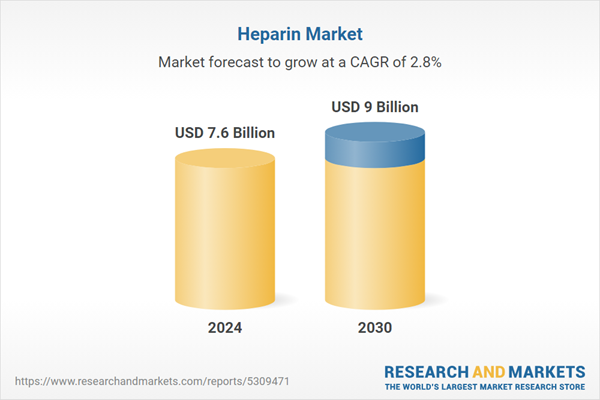

What Factors Are Driving the Growth of the Heparin Market?

The growth of the heparin market is driven by several key factors, including the rising incidence of cardiovascular diseases, technological advancements in drug formulation, and the increasing use of anticoagulants in surgical and critical care settings. One of the primary drivers is the global rise in cardiovascular diseases, such as heart attacks, strokes, and venous thromboembolism (VTE), which are leading causes of death and disability worldwide. As populations age and the prevalence of risk factors like obesity, diabetes, and hypertension increases, the demand for anticoagulant therapies like heparin continues to rise.Technological advancements in heparin formulations, particularly the development of low molecular weight heparin (LMWH), have also contributed to market growth. LMWH has become a preferred option for many conditions due to its ease of administration, predictable pharmacokinetics, and reduced risk of complications like heparin-induced thrombocytopenia (HIT). The availability of LMWH in pre-filled syringes and its suitability for outpatient care have made it an attractive choice for both healthcare providers and patients. These advancements have expanded the use of heparin in diverse clinical settings, from hospitals to home care.

The growing number of surgical procedures and the increased use of heparin in preventing blood clots during surgery are further driving the market. Heparin is routinely used as a prophylactic measure to prevent postoperative deep vein thrombosis (DVT) and pulmonary embolism (PE), particularly in orthopedic, cardiovascular, and general surgeries. As the number of surgeries performed globally continues to increase, so does the demand for heparin in preventing clot-related complications. Additionally, heparin is a critical component in extracorporeal procedures such as dialysis, where anticoagulation is necessary to prevent clot formation during the filtration process. The expansion of dialysis services, particularly in developing regions, is expected to boost the demand for heparin in these applications.

Lastly, the increasing focus on quality control and safety in heparin production, particularly in light of past contamination incidents, is contributing to market growth. Regulatory agencies and manufacturers have implemented stringent quality assurance measures to ensure the safety and purity of heparin products. These efforts, combined with the growing availability of biosynthetic and recombinant heparin, are enhancing the reliability of the drug and expanding its use across the healthcare system. With continued advancements in heparin formulations and the rising demand for anticoagulation in diverse medical scenarios, the heparin market is expected to experience steady growth in the coming years, cementing its role as a cornerstone of thrombosis prevention and cardiovascular care.

Report Scope

The report analyzes the Heparin market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Product Type (Low Molecular Weight Heparin (LMWH), Ultra-Low Molecular Weight Heparin (ULMWH), Unfractionated Heparin (UFH)); Source (Porcine, Bovine, Other Sources); Route of Administration (Subcutaneous, Intravenous).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Low Molecular Weight Heparin (LMWH) segment, which is expected to reach US$5.9 Billion by 2030 with a CAGR of 2.8%. The Ultra-Low Molecular Weight Heparin (ULMWH) segment is also set to grow at 3.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $2.1 Billion in 2024, and China, forecasted to grow at an impressive 4.5% CAGR to reach $1.8 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Heparin Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Heparin Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Heparin Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ATTWILL Vascular Technologies, Bristol-Myers Squibb Company, Corline Biomedical, Cosmo Pharmaceuticals, ExThera Medical Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 21 companies featured in this Heparin market report include:

- ATTWILL Vascular Technologies

- Bristol-Myers Squibb Company

- Corline Biomedical

- Cosmo Pharmaceuticals

- ExThera Medical Corporation

- Gland Pharma Ltd.

- GlaxoSmithKline PLC

- Hebei Changshan Biochemical Pharmaceutical

- Hepoligo

- IBEX Technologies, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ATTWILL Vascular Technologies

- Bristol-Myers Squibb Company

- Corline Biomedical

- Cosmo Pharmaceuticals

- ExThera Medical Corporation

- Gland Pharma Ltd.

- GlaxoSmithKline PLC

- Hebei Changshan Biochemical Pharmaceutical

- Hepoligo

- IBEX Technologies, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 184 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 7.6 Billion |

| Forecasted Market Value ( USD | $ 9 Billion |

| Compound Annual Growth Rate | 2.8% |

| Regions Covered | Global |