Global Opioids Market - Key Trends & Drivers Summarized

How Has the Opioid Market Evolved Amid Growing Concerns Over Addiction and Regulation?

The global opioids market has been at the center of significant scrutiny and change in recent years due to rising concerns over opioid addiction, abuse, and the corresponding public health crisis. Opioids, a class of drugs that includes prescription painkillers like oxycodone, morphine, and hydrocodone, as well as illicit drugs like heroin, have been widely used for pain management. However, the over-prescription and misuse of these drugs have led to widespread addiction and a global opioid epidemic, particularly in North America. As a result, regulatory authorities worldwide have introduced stricter guidelines on opioid prescriptions, leading to a decline in the use of these drugs for chronic pain. The pharmaceutical industry has also responded by developing abuse-deterrent formulations (ADFs) designed to reduce the potential for misuse. Additionally, the focus is shifting towards non-opioid alternatives for pain management, driving research into new therapies and pain relief methods that minimize the risk of addiction.What Trends Are Influencing the Opioid Market Today?

Several key trends are shaping the opioid market, reflecting the growing emphasis on reducing opioid-related harm and the development of safer alternatives for pain management. One of the most significant trends is the increasing regulation of opioid prescriptions, particularly in the United States, where the opioid crisis has been most severe. Healthcare providers are now being encouraged to explore non-opioid treatments and to use opioids only as a last resort for managing pain. This trend has led to a decline in opioid prescriptions in many developed markets. Another important trend is the development of abuse-deterrent formulations (ADFs), which are designed to make it more difficult to misuse prescription opioids. These ADFs are gaining traction as pharmaceutical companies and regulators seek to address the issue of opioid abuse while still providing effective pain relief for patients with legitimate medical needs. Additionally, there is growing interest in alternative pain management therapies, including non-opioid drugs, physical therapy, and behavioral interventions, as the medical community looks for ways to manage pain without the risks associated with opioids.How Is Technology and Research Shaping the Future of Opioids?

Technology and research are playing a key role in shaping the future of the opioid market, with significant efforts being made to develop safer pain management options and reduce the potential for misuse. Pharmaceutical companies are focusing on the development of abuse-deterrent formulations (ADFs) that are resistant to tampering, making it more difficult for individuals to crush, snort, or inject the drugs. These ADFs are designed to maintain the therapeutic benefits of opioids while minimizing the potential for abuse. Advances in drug delivery systems, such as extended-release formulations, are also helping to provide consistent pain relief with lower doses, reducing the risk of dependence. Research into non-opioid painkillers, such as cannabinoids, gabapentinoids, and nerve blockers, is gaining momentum, offering promising alternatives to traditional opioids. Additionally, digital health technologies, including pain management apps and telemedicine, are providing new ways for patients to manage chronic pain without relying on opioids, offering a more holistic approach to pain management.What Is Driving the Growth in the Opioid Market?

The growth in the opioid market is driven by several factors, including the ongoing need for effective pain management, particularly in cases of acute and postoperative pain. While there is a growing emphasis on reducing opioid use due to addiction concerns, opioids remain an important option for managing severe pain, such as that experienced by cancer patients or individuals recovering from major surgery. The development of abuse-deterrent formulations (ADFs) is driving growth in the prescription opioid market, as these formulations offer a safer alternative to traditional opioids. However, regulatory pressures and increased scrutiny are causing a shift towards non-opioid pain management options, limiting the growth potential in some regions. The aging population, particularly in developed markets, is also contributing to the demand for pain management solutions, as older adults are more likely to experience chronic pain conditions. Additionally, the expansion of healthcare access in emerging markets is supporting growth in opioid demand for pain management, though regulatory frameworks in these regions are becoming more stringent to prevent abuse.Report Scope

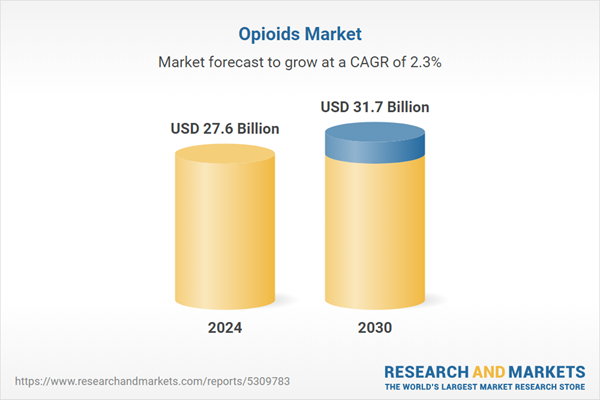

The report analyzes the Opioids market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Segment (Extended-Release / Long-Acting, Immediate-Release / Short-Acting); End-Use (Pain Relief, Anesthesia, Cough Suppression, Diarrhea Suppression, Deaddiction).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Extended-Release / Long-Acting segment, which is expected to reach US$18.7 Billion by 2030 with a CAGR of 2.9%. The Immediate-Release / Short-Acting segment is also set to grow at 1.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $7.5 Billion in 2024, and China, forecasted to grow at an impressive 3.7% CAGR to reach $6 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Opioids Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Opioids Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Opioids Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Egalet Corporation, Janssen Pharmaceuticals, Inc., Pfizer, Inc., Purdue Pharma LP, Sanofi and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 31 companies featured in this Opioids market report include:

- Egalet Corporation

- Janssen Pharmaceuticals, Inc.

- Pfizer, Inc.

- Purdue Pharma LP

- Sanofi

- Sun Pharmaceutical Industries Ltd.

- West-Ward Pharmaceuticals Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Egalet Corporation

- Janssen Pharmaceuticals, Inc.

- Pfizer, Inc.

- Purdue Pharma LP

- Sanofi

- Sun Pharmaceutical Industries Ltd.

- West-Ward Pharmaceuticals Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 189 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 27.6 Billion |

| Forecasted Market Value ( USD | $ 31.7 Billion |

| Compound Annual Growth Rate | 2.3% |

| Regions Covered | Global |