Global Small Molecule Drug Discovery Market - Key Trends and Drivers Summarized

Why Is Small Molecule Drug Discovery Crucial for Modern Medicine?

Small molecule drug discovery is at the core of modern medicine as it focuses on developing therapeutics that can modulate specific biological pathways and targets to treat a wide range of diseases. Small molecules, typically low molecular weight compounds, have the advantage of being easily absorbed, distributed, metabolized, and excreted in the human body, making them ideal candidates for oral administration. These drugs play a crucial role in treating complex conditions such as cancer, cardiovascular diseases, neurological disorders, and infectious diseases. The growing emphasis on targeted therapies, personalized medicine, and the development of novel small molecule drugs for rare diseases and unmet medical needs is driving the demand for small molecule drug discovery.How Are Technological Advancements Transforming Small Molecule Drug Discovery?

Technological advancements are transforming small molecule drug discovery by enhancing the efficiency, speed, and accuracy of the drug development process. The integration of high-throughput screening (HTS), computational drug design, and AI-driven predictive modeling is enabling researchers to identify potential drug candidates with high precision. The use of big data analytics and machine learning algorithms is revolutionizing the discovery process by analyzing large datasets and predicting drug-target interactions, toxicity, and efficacy. The emergence of fragment-based drug discovery (FBDD) and structure-based drug design (SBDD) approaches is allowing for the identification of high-affinity compounds that can be optimized into potent therapeutics. These innovations are reducing the time, cost, and risk associated with drug development, fostering collaboration between pharmaceutical companies, research institutes, and contract research organizations (CROs).Which Market Segments Are Driving the Adoption of Small Molecule Drug Discovery?

Therapeutic areas include oncology, neurology, immunology, cardiovascular, infectious diseases, and metabolic disorders, with oncology holding the largest market share due to the high prevalence of cancer and the demand for targeted therapies. Technologies encompass high-throughput screening, computational drug design, bioinformatics, and combinatorial chemistry, with high-throughput screening leading the market owing to its efficiency in screening large compound libraries. End-users include pharmaceutical and biotechnology companies, academic and research institutions, and CROs, with pharmaceutical companies being the primary adopters due to their focus on developing first-in-class and best-in-class therapeutics. Geographically, North America and Europe are the largest markets for small molecule drug discovery due to advanced healthcare infrastructure and significant R&D investments, while Asia-Pacific is emerging as a high-growth region driven by increasing healthcare expenditure and expanding biopharmaceutical industry.What Are the Key Drivers of Growth in the Small Molecule Drug Discovery Market?

The growth in the small molecule drug discovery market is driven by several factors, including the rising focus on targeted therapies and personalized medicine, advancements in high-throughput screening, AI-based drug design, and computational drug discovery techniques. The increasing collaborations between pharmaceutical companies, research institutes, and CROs are driving market adoption for oncology, neurology, and immunology research. The growing demand for oral, small molecule therapeutics with improved bioavailability, safety, and efficacy profiles is expanding the market reach among diverse therapeutic areas. The surge in pipeline molecules, the expiration of key biologic patents, and the development of small molecule drug-drug conjugates (SMDCs) are creating new opportunities for market growth. Additionally, the rising investments in R&D for innovative drug discovery platforms, the adoption of fast-track and orphan drug designations, and the expansion of outsourcing drug discovery activities are further supporting market expansion.Report Scope

The report analyzes the Small Molecule Drug Discovery market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Therapeutic Area (Oncology Therapeutic Area, Central Nervous Systems Therapeutic Area, Cardiovascular Therapeutic Area, Metabolic Disorders Therapeutic Area, Respiratory Therapeutic Area, Other Therapeutic Areas); Process (Target ID / Validation Process, Lead Identification Process, Lead Optimization Process, Hit Generation & Selection Process); End-Use (Pharmaceutical Companies End-Use, Biotechnology Companies End-Use, Contract Research Organizations (CROs) End-use, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Oncology Therapeutic Area segment, which is expected to reach US$38.9 Billion by 2030 with a CAGR of 9.8%. The Central Nervous Systems Therapeutic Area segment is also set to grow at 9.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $20.5 Billion in 2024, and China, forecasted to grow at an impressive 10% CAGR to reach $14.9 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Small Molecule Drug Discovery Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Small Molecule Drug Discovery Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Small Molecule Drug Discovery Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AstraZeneca PLC, Boehringer Ingelheim International GmbH, Bristol-Myers Squibb Company, Gilead Sciences, Inc., GlaxoSmithKline PLC and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 61 companies featured in this Small Molecule Drug Discovery market report include:

- AstraZeneca PLC

- Boehringer Ingelheim International GmbH

- Bristol-Myers Squibb Company

- Gilead Sciences, Inc.

- GlaxoSmithKline PLC

- Johnson & Johnson

- Merck & Co., Inc.

- Pfizer, Inc.

- Teva Pharmaceutical Industries Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AstraZeneca PLC

- Boehringer Ingelheim International GmbH

- Bristol-Myers Squibb Company

- Gilead Sciences, Inc.

- GlaxoSmithKline PLC

- Johnson & Johnson

- Merck & Co., Inc.

- Pfizer, Inc.

- Teva Pharmaceutical Industries Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 376 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

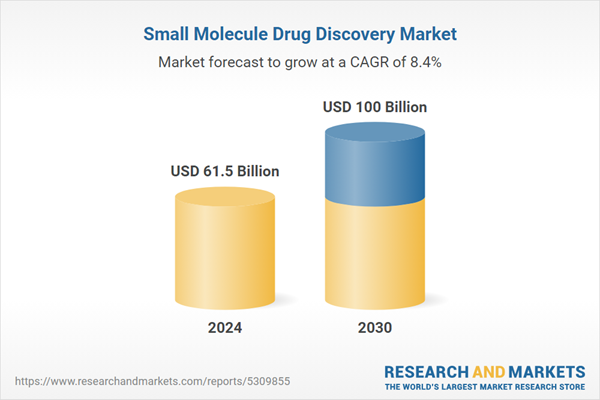

| Estimated Market Value ( USD | $ 61.5 Billion |

| Forecasted Market Value ( USD | $ 100 Billion |

| Compound Annual Growth Rate | 8.4% |

| Regions Covered | Global |