Plasma-Derived Coagulation Factor Concentrates is the fastest growing segment, North America is the largest regional market

Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

The increasing global prevalence of bleeding disorders represents a primary driver for the expansion of the bleeding disorders drugs market. Conditions such as hemophilia and von Willebrand disease affect a substantial patient population, creating an ongoing demand for effective therapeutic interventions. Enhanced diagnostic capabilities, alongside greater public and medical professional awareness, contribute to a higher rate of diagnosis, subsequently increasing the number of identified patients requiring treatment. This expanding patient base directly translates into a heightened need for existing and novel pharmaceutical products designed to manage these complex conditions.Key Market Challenges

The elevated cost of advanced therapies, particularly gene therapies and extended half-life products, significantly impedes the expansion of the global bleeding disorders drugs market. These high costs directly restrict patient access, especially in low-income regions where the economic burden of treatment is substantial. This limitation is compounded by less developed healthcare infrastructure and inadequate reimbursement policies prevalent in these areas, making it challenging for healthcare systems to procure and provide these expensive yet effective treatments.Key Market Trends

The shifting treatment paradigm towards gene therapies represents a significant transformation in the global bleeding disorders drugs market. These advanced therapies aim to offer potentially curative or long-lasting solutions, moving beyond the traditional need for frequent factor infusions. This shift dramatically alters disease management by providing sustained endogenous factor production, thereby enhancing patient quality of life and reducing the long-term treatment burden. According to the World Federation of Hemophilia's 2024 Annual Report, the organization formally began tracking these novel treatments by enrolling its first patient in the Gene Therapy Registry in 2024, signaling a concentrated effort by industrial associations to monitor their real-world impactKey Market Players Profiled:

- Bayer AG

- Grifols S.A.

- Pfizer Inc.

- Octapharma AG

- Ferring International Center S.A.

- Sanofi S.A.

- Baxter International Inc.

- F. Hoffmann-La Roche Ltd

- Takeda Pharmaceutical Company Limited

- Novo Nordisk A/S

Report Scope:

In this report, the Global Bleeding Disorders Drugs Market has been segmented into the following categories:By Drug Type:

- Plasma-derived Coagulation Factor Concentrates

- Recombinant Coagulation Factor Concentrates

- Desmopressin

- Antifibrinolytics

- Fibrin Sealants

- Others

By Disease Type:

- Hemophilia A

- Hemophilia B

- Von Willebrand Disease

- Others

By Distribution Channel:

- Hospital Pharmacies

- Retail Pharmacies

- Online

By End User:

- Hospitals

- Hemophilia Treatment Centers

- Research Institutes

- Others

By Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Bleeding Disorders Drugs Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The companies profiled in this Bleeding Disorders Drugs market report include:- Bayer AG

- Grifols S.A.

- Pfizer Inc.

- Octapharma AG

- Ferring International Center S.A.

- Sanofi S.A.

- Baxter International Inc.

- F. Hoffmann-La Roche Ltd

- Takeda Pharmaceutical Company Limited

- Novo Nordisk A/S

Table Information

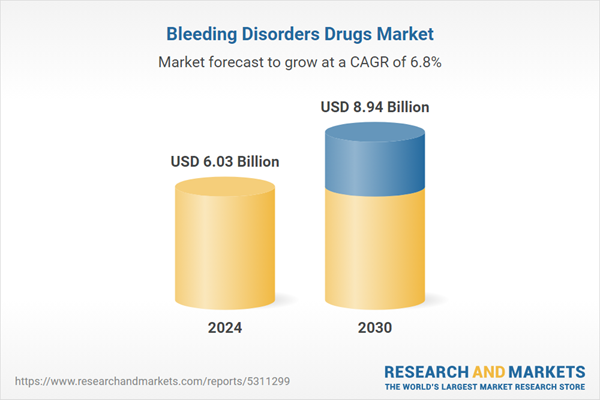

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | November 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 6.03 Billion |

| Forecasted Market Value ( USD | $ 8.94 Billion |

| Compound Annual Growth Rate | 6.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |