The outbreak of the COVID-19 pandemic in 2020 severely impacted the entire aviation industry. It has resulted in several aircraft operators filing for bankruptcy, which reduced the demand for aircraft and aircraft engines. Reducing future defense spending may also hamper future military aircraft procurement plans, as countries are more focused on enhancing healthcare infrastructure. The shutdown of industries in several countries in 2020 halted the manufacturing of components and materials and impacted the supply chain associated with aircraft and engine manufacturing. Although situations improved in 2021, the demand is expected to continue to remain lower than the pre-COVID-19 levels in the near future.

The substantial rise in passenger traffic and the imposition of new emission regulations led to a significant increase in demand for new-generation aircraft purchases over the last decade, before the pandemic. Aircraft manufacturers are developing new aircraft models in the commercial, military, and general aviation sectors, requiring newer engines with better performance and low weight. As a result, the emphasis on newer material technologies like composites is increasing.

With the major engine manufacturers emphasizing their own in-house composite material development capabilities, the dependency on outsourced materials is expected to reduce over the years.

Aeroengine Composites Market Trends

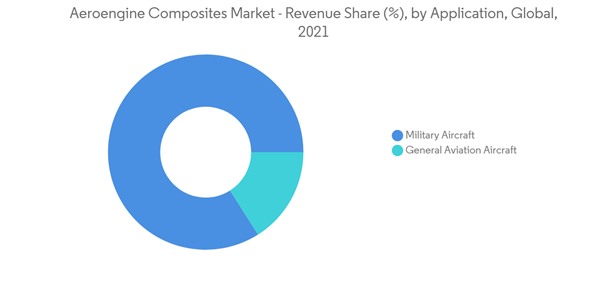

The Commercial Aircraft Segment Held the Highest Market Share in 2021

The commercial aircraft segment accounted for the highest market share in the aeroengine composites market in 2021. One of the main drivers for the market from the commercial sector is the demand for narrowbody aircraft. By the end of 2021, Airbus' aircraft order backlog stood at 7,082 aircraft, out of which over 88% were A220 and A320ceo/neo family narrowbody aircraft. Likewise, Boeing's year-end 2021 backlog was 4,250 aircraft, of which 3,414 were 737 family narrowbody jets. After two years of being grounded, the Boeing 737 Max has been cleared to return to the skies in several countries around the world in 2021, helping the growth of the overall narrowbody orders in 2021. Also, two new narrowbody aircraft models, the MC-21 and C919 aircraft, are expected to enter service in 2022. On the leap engines that power the A320 family of aircraft, along with the upcoming MC-21 and C919 aircraft, composite structures, including 3-D woven carbon fiber composite fan blades and fan cases, are used. Also, ceramic matrix composites (CMC) are used to build the turbine shrouds of the engine.Many developments regarding the use of composites in commercial aircraft engines are underway. For instance, GE is working on new composite blades for the GE9X. The new engine is the largest manufactured by General Electric Company and is designed exclusively for Boeing's 777X aircraft. The company has already received several orders and commitments for more than 700 GE9X engines from several airlines like Emirates, Qatar, Etihad, Lufthansa, Cathay Pacific, British Airways, and All Nippon Airways. With the deliveries of these aircraft being higher and the use of composites increasing on the commercial aircraft engines simultaneously, this trend is projected to continue, making the segment witness a healthy CAGR during the forecast period.

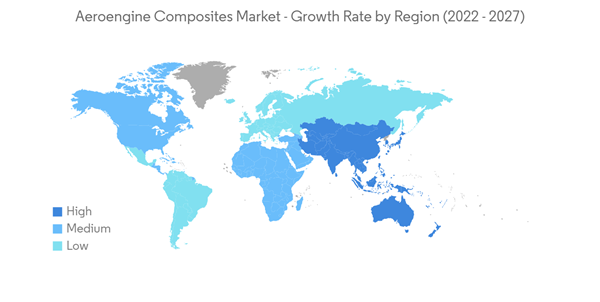

Asia-Pacific Expected to be the Fastest-growing Market for Aeroengine Composites During the Forecast Period

The Asia-Pacific region is now the fastest-growing market for aero-engine composites in terms of geography. This high growth rate is the increasing procurement of aircraft with engines that use these composites. In the commercial sector, more than one-third of the commercial aircraft deliveries of two aerospace giants, Airbus SE and The Boeing Company combined, are to the customers in Asia-Pacific. In May 2021, IndiGo, a major low-cost airline, announced that it selected CFM International 'LEAP-1A' engines to power its fleet of 310 new Airbus family of aircraft delivered from 2023. The aircraft belong to different categories, including A320neo, A321neo, and A321XLR. The agreement includes 620 new installed engines and associated spare engines and a long-term, multi-year service agreement. The Leap Engines used in the aircraft use a higher volume of composites than its predecessors.On the other hand, in November 2021, the Royal Australian Air Force (RAAF) received three new Lockheed Martin-built F-35A Lightning II aircraft, taking the total size of the fleet to 44. GKN and Meggit supply several composite components for the F-135 engines that power the F-35 aircraft. Likewise, many developments in terms of composites on the aircraft engines procured by the region are expected to make the Asia-Pacific region the fastest-growing market in the years to come.

Aeroengine Composites Industry Overview

GE Aviation, Safran SA, Solvay SA, Meggitt PLC, and Hexcel Corporation are some of the prominent players in the market. Among the engine manufacturers, Safran and GE Aviation generate the highest demand for the aero-engine composites, whereas other manufacturers like Rolls-Royce PLC and Pratt & Whitney (Raytheon Technologies Corporation) are expected to increase the volume of composite usage in their engine models in the years to come. Over the years, engine manufacturers have developed significant in-house composite manufacturing capacities. For instance, GE Aviation has its own composites manufacturing facilities and various joint ventures (like Nexcelle with Safran SA). This trend may affect the market revenues of the composite suppliers for the engine OEMs. The usage of composites is increasing in aircraft.The increase in the overall engine production rates means that the forecast period is showing considerable growth impetus for the aeroengine composite part manufacturers and their respective supply chains. Simultaneously, material suppliers will need to expand their raw materials output to stay in the competition, which is currently higher than ever before. The development of composites that can sustain high temperatures in the engine core will play a key role in the forecast period. Any improvement in this direction will greatly benefit composite manufacturers.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- GE Aviation

- Rolls-Royce PLC

- Safran SA

- General Dynamics Corporation

- GKN Aerospace

- FACC AG

- Meggitt PLC

- Hexcel Corporation

- Solvay SA

- Albany Engineered Composites Inc.

- Pratt & Whitney (Raytheon Technologies Corporation)