In the above-mentioned situation, the utilization of automated material handling equipment is extensively across manufacturing & warehouse units with an aim to decrease downtime & labor costs, combine the manufacturing, transportation, & distribution efficiently, and produce an early & high return on investments. Moreover, the material handling industry is revolutionized by the integration of emerging technologies such as Artificial Intelligence, SLAM (simultaneous localization and mapping), & the Internet of Things and simultaneously, these technologies have created a latest trends & advancement for the industry.

The market has witnessed uncertainty due to the outbreak of the COVID-19 pandemic, resulting in the closure of manufacturing facilities & disturbance in the supply chain environment. As the virus continues to haunt the world, the financial institutions is expected to also block the current or future investment for the future development of infrastructure.

Reduced labor cost, improved workflow and better production quality of a process are some of the features provided by the automated material handling systems. In order to cut down costs, procure superior quality products, & save time, AMH equipment is widely integrated by the automotive, electronics, chemical, healthcare, food & beverage, and aviation industries. With the increasing automation trends among the several manufacturing industries, the global automated material handling equipment is expected to observe a gradual growth rate.

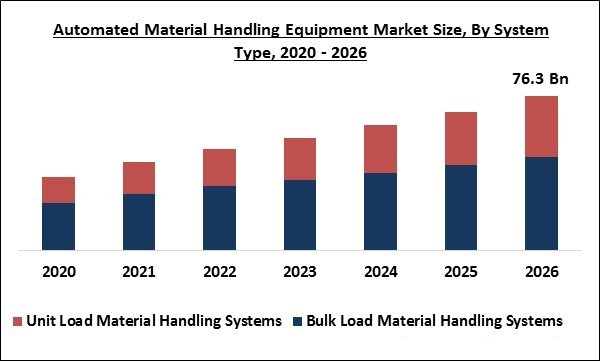

System Type Outlook

Based on System Type, the market is segmented into Bulk Load Material Handling Systems and Unit Load Material Handling Systems. The unit load material handling systems market is expected to exhibit a major growth rate during the forecast period. Various industries adopt these systems extensively as they are low-cost, and can manage multiple products at the same time, hence decreasing the number of trips, the time needed for loading & unloading, and the cost of handling. The unit load material handling systems segment is expected to be propelled by the rising demand for automated material handling equipment in the e-commerce industry.

Products Outlook

Based on Products, the market is segmented into Robots, Conveyors & Sortation Systems, Automated Guided Vehicle (AGV), Warehouse Management System (WMS), Cranes and Automated Storage and Retrieval System (ASRS). In 2019, the robots segment acquired the highest share of the global automated material handling equipment market. By adopting robots, it becomes easier to considerably enhance the productivity & efficiency of manufacturing & warehouse facilities. Robots help in lowering down the labor costs, give protection to workers against injuries, and offer a massive return on investment. These benefits are supporting the demand for robots in manufacturing & warehousing facilities.

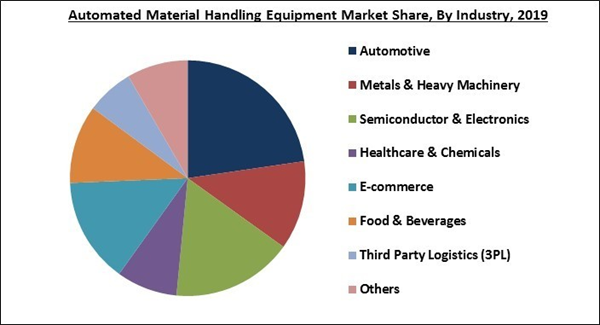

Industry Outlook

Based on Industry, the market is segmented into Automotive, Metals & Heavy Machinery, Semiconductor & Electronics, Healthcare & Chemicals, E-commerce, Food & Beverages, Third Party Logistics (3PL) and Others. The 3PL segment is expected to exhibit a promising growth rate during the forecast period. The adoption of AMH equipment in the 3PL industry is driven by various aspects like rising outsourcing of logistics & transportation operations, the requirement for effective order management, and globalization of supply chain networks. The COVID-19 caused the lockdown across the globe & this has boosted the online retail industry, and the e-commerce industry witnessed the potential for 3PL. This aspect is expected to boost the demand for AMH equipment in the 3PL industry during the forecast period.

Regional Outlook

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. North America and Europe is expected to showcase a considerable growth rate during the forecast period. This is due to a surge in sales via e-commerce channels, rising demand for durable & non-durable goods ultimately forcing manufacturing companies to deploy extensive assembly lines & material handling equipment. The Middle East & Africa and Latin America is expected to exhibit a gradual growth rate due to the high penetration of the e-commerce & retail industry in these regions, high amount of foreign direct investments from online retailers to establish warehouse units to fulfil the untapped market.

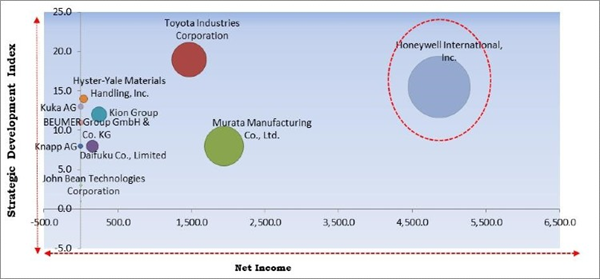

The major strategies followed by the market participants are Partnerships. Based on the Analysis presented in the Cardinal matrix; Honeywell International, Inc. is the major forerunner in the Automated Material Handling Equipment Market. Companies such as Toyota Industries Corporation, Hyster-Yale Materials Handling, Inc., Kion Group, Murata Manufacturing Co., Ltd., and Kuka AG are some of the key innovators in the market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Daifuku Co., Limited, Kion Group, Knapp AG, Toyota Industries Corporation, Honeywell International, Inc., Hyster-Yale Materials Handling, Inc., Kuka AG, BEUMER Group GmbH & Co. KG, Murata Manufacturing Co., Ltd., and John Bean Technologies Corporation.

Recent strategies deployed in Automated Material Handling Equipment Market

Partnerships, Collaborations, and Agreements:

Dec-2020: Hyster-Yale Group signed an agreement with Capacity Trucks, a global leader in ports, warehouse operations, and intermodal facilities. In this agreement, the companies aimed to address the growing demand for environmentally sustainable terminal tractor solutions in port, terminal and distribution center markets. The companies re-developed electric and hydrogen-powered terminal tractors with automation-ready potentialities.

Aug-2020: Kion Group came into partnership with Quicktron, a Chinese manufacturer of autonomous mobile robots (AMR) based in Shanghai. The partnership was signed on distributing Quicktron products through the global sales and service networks of the Kion brands Linde Material Handling, STILL, and Dematic. The partnership is expected to expand Kion Group’s global product offering of automated warehouse solutions.

Aug-2020: Swisslog teamed up with Mai Dubai, a leading Dubai-based bottled drinking water company. Following the collaboration, Swisslog installed and implemented a new fully-automated and retrieval solution for Mai Dubai.

Jul-2020: BEUMER Group announced its collaboration with Royal Mail to design the technology for the latter company's new fully automated parcel super-hub in Warrington. Following the collaboration, BEUMER Group is expected to provide the technology to Royal Mail for achieving the desired levels of parcel sortation.

Jun-2020: Murata Machinery collaborated with Steel products and equipment maker, Prestar Resources Bhd. Under this collaboration, the latter company aims to supply the Automated Storage and Retrieval System (ASRS) Racking System for the former company.

May-2020: Bastian Solutions, a Toyota Advanced Logistics company, extended its collaboration with AutoStore, the manufacturer of an automated storage and retrieval system. This expansion supported both Bastian Solutions and AutoStore’s growing global presence and provided end-users with additional partners to support international projects

Mar-2020: Swisslog, a division of Kuka collaborated with IKEA Supply (Malaysia) Sdn. Bhd. Under this collaboration, Swisslog received a further order from IKEA Supply. The Swiss logistics automation specialist is embedding the largest distribution centers in the Asia Pacific region with the SynQ warehouse management system.

Aug-2019: Honeywell collaborated with Slate River Systems, Inc. (SRSI), a leading material handling systems integrator. Following the collaboration, SRSI joined Honeywell Intelligrated’s network of integration partners. The SRSI team employed Honeywell Intelligrated’s line of high-speed conveyor and sortation systems, automated storage and picking systems, and intelligent software as essential components of their optimized distribution center solutions. SRSI customers directly benefitted from the application of best-in-class systems and technologies.

Aug-2019: Murata Machinery came into partnership with Alert Innovation, Inc., a start-up, with a mission to re-invent retailing through robotics. Following the partnership, the companies were engaged in the development and commercialization of Alert Innovation's Alphabot material handling technology. Muratec has been adopting and selling the technology to support applications beyond Alert Innovation's focus on transforming grocery retail.

Jul-2019: Daifuku BCS signed an agreement with Arnott following which the former company aimed to develop a high capacity storage solution for the latter company. The storage formed part of Arnott’s existing manufacturing site in Huntington NSW. Arnott implemented Daifuku’s unit load ASRS cranes, sorting transfer vehicles and goods to person stations for mixed case picking.

Acquisition and Mergers:

Jan-2020: Toyota Forklift merged Toyota Industrial Equipment Manufacturing (TIEM) and Toyota Material Handling USA (TMHU) into a single unit. The single unit is named Toyota Material Handling, Inc. (TMH). Under this merger, Toyota's forklift manufacturing operations integrated with its sales, marketing, and distribution applications. The combination of TIEM and TMHU helped the company to modify, and building up the total requirements like customer experience. TMH enhanced the transmission of the information to and from their customers to offer intact their needs.

Apr-2019: Daifuku Co. completed the acquisition of Vega Conveyors & Automation Private Limited, a company engaged in consulting, designing, manufacturing, installation, and after-sales service of conveyors and other material handling equipment. The acquisition helped the company in expanding its footprint in India and other markets within Asia and Oceania by using its technology and expertise cultivated through global business development.

Nov-2018: Honeywell acquired Transnorm, a warehouse automation solutions provider. Transnorm became part of Honeywell Safety and Productivity Solutions (SPS). The acquisition complemented Honeywell Intelligrated business and broadened its warehouse automation solutions.

Jun-2018: Hyster-Yale Materials Handling completed its acquisition of 75 percent of Zhejiang Maximal Forklift from KNSN Pipe & Pile Company Limited. The company also renamed Zhejiang Maximal Forklift as Hyster-Yale Maximal Forklift (Zhejiang) Co., Ltd. The acquisition aimed to strengthen Hyster-Yale's utility and standard product portfolio by introducing a broad spectrum of products to the leading global materials handling business, and improve the company's position in the increasing global utility and standard market segments and also in the China market.

May-2018: Toyota Advanced Logistics North America (TALNA) completed the acquisition of Peach State Integrated Technologies, a strategic supply chain consulting, engineering, and material handling integration firm. The acquisition supported TALNA’s growth strategy while offering clients an expanded network of services and knowledgeable supply chain professionals. This acquisition enabled both companies to better serve their current and future customer base by maximizing and sharing knowledge and resources

Mar-2017: Toyota Industries acquired Vanderlande, a company specialized in process automation for luggage retrieval systems and warehouse operations. The acquisition helped the company in becoming the logistics supplier to warehouses worldwide, expanding Toyota’s reach from the equipment supplier to a full-service partner. It also expanded the division’s global reach by adding management and logistics support in Europe.

Product Launches and Product Expansions:

Nov-2020: Toyota Material Handling launched two automated guided vehicles (AGVs). Toyota Material Handling’s new Center-Controlled Rider Automated Forklift and Core Tow Tractor Automated Forklift modernizes the way customers handle their manufacturing, warehousing, and dispensation problems.

Oct-2020: Kuka introduced a new range of SCARA robots. The new KR SCARA jointed-arm robots are reliable assistants for industrial products that are better in applications like small parts assembly, materials handling, and inspection tasks.

Mar-2020: Swisslog Logistics launched ItemPiQ, the robotic single item picking solution. This solution is perfectly paired with AutoStore and delivers new levels of warehouse productivity. When integrated with the AutoStore robotic storage and retrieval system, the solution develops a fully automated goods-to-robot system designed to shorten both pick times and ROI.

Apr-2019: Knapp launched its latest OSR Shuttle Evo+. It is a flexible, scalable, and effective autonomous mobile robotic solution.

Apr-2019: Honeywell introduced a new automated robotic solution. The solution unloaded a variety of packages from truck trailers and shipping containers at distribution centers. The robotic unloader utilizes artificial intelligence to function fully autonomously inside of a trailer that remarkably minimizes the handbook effort needed to perform receiving docks for retail products and parcel distribution centers.

Apr-2019: JBT Corporation introduced a new dual-mode AGV to the market. This new AGV is developed in assistance with Hyster-Yale Materials Handling. Combining with Hyster-Yale on a dual-mode, double-deep pantograph reach truck, JBT demonstrated its automated guided vehicle effectiveness and its determination to deliver automation to customers across the globe. The dual-mode truck signals a direct response from JBT to trends in warehousing that increased the need for automation.

Geographical Expansions:

Sep-2020: Kion Group opened a factory at its site in Stříbro near the Czech city of Plzeň. The factory covers 25,500 square meters and is used for the manufacturing of conveyor belts, pouch sorting systems, and storage and retrieval equipment known as Multishuttle systems that ensure the smooth flow of goods in warehouses and distribution centers.

Nov-2019: Kion Group expanded its footprints by establishing a new plant in Pune, Maharashtra. This plant is India's largest production facility for intralogistics equipment. Diesel and electric forklifts and battery-powered lift trucks and reach trucks are manufactured in this ultra-modern plant on an area of around 25 hectares. The new plant is embedded with the three assembly lines consisting of a paint shop, parts warehouse, and an R&D center, where professionals analyze continuous changing needs and environment of the Indian markets and simultaneously develop products according to it.

Oct-2019: Honeywell opened a new center of excellence named after Honeywell Robotics. It is an advanced technology center of excellence focused on innovating and developing artificial intelligence, machine learning, computer vision, and advanced robotics for use across supply chains. Honeywell Robotics is expected to help shape the warehouse and distribution center of the future, particularly as companies look to automated solutions, software, and robotics to deliver increased speed, accuracy, and throughput in complex material handling environments.

Scope of the Study

Market Segmentation:

By System Type

- Bulk Load Material Handling Systems

- Unit Load Material Handling Systems

By Products

- Robots

- Conveyors & Sortation Systems

- Automated Guided Vehicle (AGV)

- Warehouse Management System (WMS)

- Cranes

- Automated Storage and Retrieval System (ASRS)

By Industry

- Automotive

- Metals & Heavy Machinery

- Semiconductor & Electronics

- Healthcare & Chemicals

- E-commerce

- Food & Beverages

- Third Party Logistics (3PL)

- Others

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Companies Profiled

- Daifuku Co., Limited

- Kion Group

- Knapp AG

- Toyota Industries Corporation

- Honeywell International, Inc.

- Hyster-Yale Materials Handling, Inc.

- Kuka AG

- BEUMER Group GmbH & Co. KG

- Murata Manufacturing Co., Ltd.

- John Bean Technologies Corporation

Unique Offerings from the Publisher

- Exhaustive coverage

- Highest number of market tables and figures

- Subscription based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- Daifuku Co., Limited

- Kion Group

- Knapp AG

- Toyota Industries Corporation

- Honeywell International, Inc.

- Hyster-Yale Materials Handling, Inc.

- Kuka AG

- BEUMER Group GmbH & Co. KG

- Murata Manufacturing Co., Ltd.

- John Bean Technologies Corporation