In the last two decades, the telecommunication sector has been thrived & massive investment was put into the development of these fiber-optic networks. That period witnessed the installation of fiber networks combined with rail lines & highways (i.e., long-haul network type). In a similar fashion, a long-distance of local or regional network (such as metro network type) was installed across big cities & population centers. With the advent of new century, the telecom industry has observed a huge collapse, and these high-cost fiber network frameworks were traded at a moderate cost by telecom vendors to prevent bankruptcy.

Telecom service vendors are now purchasing the existing dark fiber & also aim to develop their own, due to the rising demand for mobile data & the advent of 5G services. The growth of the market is expected to witness various growth avenues by various aspects like growing bandwidth demand of handheld equipment, user audience & essential transmission to HD video quality for cable operators.

Regulatory bodies of developed countries like the U.S., U.K., China, Germany, and Japan are putting substantial investment in security framework at national levels. Rising awareness among the quickly emerging countries in order to bolster their presence & hold at the international level. This aspect is compelling governments to put high investment in emerging technologies, mainly in fiber networks that is expected to improve the telecommunication industry framework with superior security features.

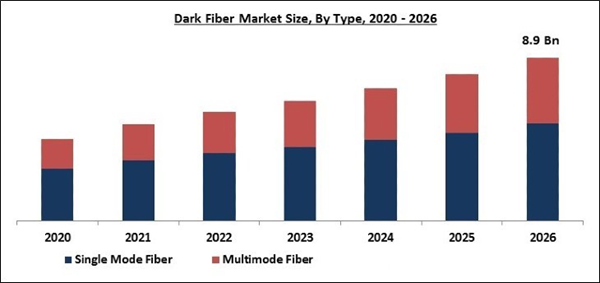

Type Outlook

Based on Type, the market is segmented into Single Mode Fiber and Multimode Fiber. The single-mode fiber segment is expected to garner the major revenue share as compared to the multimode fiber segment. The increasing installation of single-mode dark fibers for 5G/LTE networks across different regions is responsible for this massive revenue share of this segment. Besides, single dark fibers provide a low level of signal losses in comparison to the multimode dark fibers. A major factor that boosts the development of the single-mode fiber segment is the increasing demand for high-speed & high bandwidth internet connectivity.

Material Outlook

Based on Material, the market is segmented into Glass and Plastic. The Glass market dominated the Global Dark Fiber Market by Material 2019, growing at a CAGR of 11.4 % during the forecast period. The Plastic market is expected to witness a CAGR of 14% during (2020 - 2026).

Network Type Outlook

Based on Network Type, the market is segmented into Long Haul and Metro. The long haul segment is expected to exhibit a promising growth rate in comparison to the metro segment during the forecast period. The massive demand for high-speed internet connectivity is responsible for the high growth of this segment. Long-haul dark fibers provide safety & reliability while carrying a massive load of data.

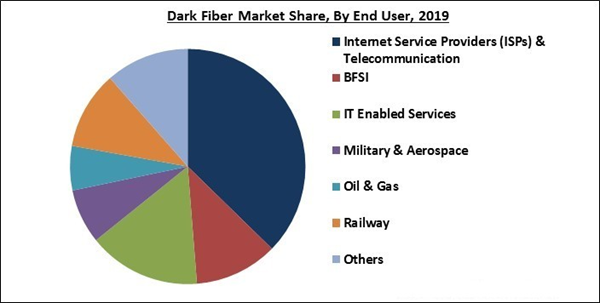

End User Outlook

Based on End User, the market is segmented into Internet Service Providers (ISPs) & Telecommunication, BFSI, IT Enabled Services, Military & Aerospace, Oil & Gas, Railway and Others. Medical and Military & Aerospace application segments is expected to display a promising growth rate due to the rising installation of optic technology devices. The segment is expected to witness bright prospects due to the severe norms & regulations formulated by regulatory bodies & medical associations, thereby fuelling the growth of the overall market.

Regional Outlook

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. The Asia Pacific emerged as a leading region in terms of market growth. This is due to the various technological developments & wide installation of the technology in IT & telecommunication and administrative sector. The regional growth is accelerated by the massive penetration of Dark fiber technology in the manufacturing industry and enhancing the IT & telecom industry across the region. In addition, the demand for dark data fiber in the regional market is expected to be increased by the rising utilization of fiber networks in the medical industry, particularly in countries like India, China, and Japan.

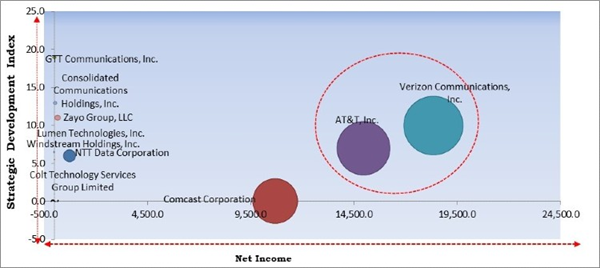

The major strategies followed by the market participants are Partnerships. Based on the Analysis presented in the Cardinal matrix; AT&T, Inc. and Verizon Communications, Inc. are the forerunners in the Dark Fiber Market. Companies such as GTT Communications, Inc., Consolidated Communications Holdings, Inc., Zayo Group, LLC, Lumen Technologies, Inc. are some of the key innovators in the market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include AT&T, Inc. AT&T Intellectual Property), Verizon Communications, Inc., NTT Data Corporation, Comcast Corporation, Consolidated Communications Holdings, Inc., Colt Technology Services Group Limited, Windstream Holdings, Inc., Zayo Group, LLC (EQT Partners Digital Colony), GTT Communications, Inc. (Mercator Partners, LLC), and Lumen Technologies, Inc.

Recent strategies deployed in Dark Fiber Market

Partnerships, Collaborations, and Agreements:

Nov-2020: Colt Technology came into partnership with Atman, the leader of the Polish data center market and telecommunications operator. The partnership focused on providing customers and telecommunications partners the possibility of setting up connections at the Atman data centers. By using the expertise of Colt and Atman, businesses in Central and Eastern Europe (CEE) could streamline and boost their digital transformation through agile, on-demand, and high bandwidth services.

Sep-2020: CenturyLink signed a contract with the Defense Information Systems Agency. Under this contract, the companies is expected to continue to operate and maintain dark fiber and other similar commercial facilities in support of the Department of Defense. The company also performed work at different locations within the continental U.S.

Aug-2020: Consolidated Communications came into partnership with the state of New Hampshire and local towns. The partnership aimed to expand and improve broadband services across the state. The company received grants from the state’s Connecting New Hampshire Emergency Broadband Expansion Program to make high-speed, fiber-to-the-premises Internet networks to homes and businesses in Springfield, Danbury, and Mason. Additionally, the company also got a separate grant to upgrade prevailing Internet services in the town of Errol.

Aug-2020: Windstream came into collaboration with Everstream, the business-only fiber network. Under this collaboration, the companies announced the operational turn-up of long-haul 400 Gigabit Ethernet (GbE) Wavelength Services, marking one of the industry-first deployments for a business-optimized service provider. The deployment included the combined technologies provided by Infinera’s Groove (GX) Series compact modular platforms and Juniper’s PTX Series transport routers.

Jun-2020: Windstream came into agreement with Infinera, a global supplier of innovative networking solutions. Both the companies completed a live network trial that successfully achieved 800 gigabits per second (800G) single-wavelength transmission over 730 kilometers (km) around Windstream’s long-haul network between San Diego and Phoenix.

Feb-2020: Windstream signed an agreement with Sparkle, the first international service provider in Italy. Under this agreement, Windstream provides wave connectivity to Sparkle. This connectivity from Sparkle’s PoP in El Paso takes place through the Equinix LA1 International Business Exchange (IBX) data center in Los Angeles.

Jan-2020: Zayo Group partnered with Denver Public Schools (DPS). Under this partnership, Zayo completed the implementation of a dark fiber private network around its district. This high-capacity fiber network spans more than 600 route miles of fiber that included more than 50 route miles of new build to reach 132 schools. The dark fiber network delivers DPS with improved capacity, increased reliability, and a more cost-effective solution.

Acquisition and Mergers:

Mar-2020: Zayo Group agreed to acquire Intelligent Fiber Network (IFN), provider of fiber transport, internet connectivity, and carrier-grade colocation services. Following the acquisition, IFN is expected to bring Zayo another unique and deep regional fiber network and a dedicated local team that excels in serving its customer base.

Dec-2019 GTT Communications took over KPN International, a division of KPN N.V. headquartered in the Netherlands. Following the acquisition, KPN added more than 400 strategic enterprise and carrier clients. GTT is expected to have been the preferred international network supplier for various hundred additional clients retained by KPN.

May-2018: GTT Communications completed the acquisition of Interoute, operator of one of Europe’s largest independent fiber networks. In this acquisition, the enhanced scale, expanded network footprint, and award-winning product capabilities strengthen their position as a global leader in cloud networking.

Feb-2018: AT&T completed the acquisition of FiberTower Corporation, a provider of facilities-based backhaul services to wireless carriers. The acquisition helped the company to get a millimeter wave spectrum that is expected to put to work to begin the rollout of mobile 5G services.

Dec-2017: Verizon acquired fiber-optic network assets serving the Chicago market from WideOpenWest. The acquisition of these fiber assets was a part of the company's strategy to strengthen its network capabilities and prepare for the future. It also helped in expanding their network densification with fiber and small cells, improving their 4G LTE network and laying the groundwork for 5G.

Nov-2017: CenturyLink acquired Level 3 Communications, American multinational telecommunications, and Internet service Provider Company. The acquisition focused on providing customers a broad range of high-quality technology solutions over a safer and reliable fiber-rich network.

Sep-2017: GTT Communications took over Global Capacity, a provider of networking services connecting enterprises to high-value cloud and business destinations. This acquisition aimed to grow the customer base of GTT by adding marquee clients in the healthcare, application service provider, and retail and carrier markets. The addition of highly complementary recurring revenue streams boosted GTT’s SD-WAN service with various access options that included an extensive on-net Ethernet over Copper infrastructure.

Jul-2017: Consolidated Communications acquired FairPoint Communications, a communications provider of high-speed Internet access. Under this acquisition, FairPoint added 22,000 fiber route miles to the Consolidated Communications fiber network, without any overlapping markets. The integrated network spans 24 states and more than 36,000 fiber route miles, helping Consolidated Communications to be the ninth largest fiber provider in the U.S. Consolidated Communication’s on-net buildings grow to 8,800 and fiber-connected towers total 2,600.

Product Launches and Product Expansions:

Apr-2019: Consolidated Communications completed a Fiber-to-the-Premises (FTTP) broadband network and the launch of a TV service in Ghent, New York, located in Columbia County, southeastern New York. The 1 Gig fiber network is prepared and ready to provide an incredible TV experience to the customers and has the potential to not only change the quality of their lives but improve its enjoyment by expanded programming delivered on superior broadband technology.

Scope of the Study

Market Segmentation:

By Type

- Single Mode Fiber

- Multimode Fiber

By Material

- Glass

- Plastic

By Network Type

- Long Haul

- Metro

By End User

- Internet Service Providers (ISPs) & Telecommunication

- BFSI

- IT Enabled Services

- Military & Aerospace

- Oil & Gas

- Railway

- Others

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Companies Profiled

- AT&T, Inc. (AT&T Intellectual Property)

- Verizon Communications, Inc.

- NTT Data Corporation

- Comcast Corporation

- Consolidated Communications Holdings, Inc.

- Colt Technology Services Group Limited

- Windstream Holdings, Inc.

- Zayo Group, LLC (EQT Partners Digital Colony)

- GTT Communications, Inc. (Mercator Partners, LLC)

- Lumen Technologies, Inc.

Unique Offerings from the Publisher

- Exhaustive coverage

- Highest number of market tables and figures

- Subscription based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- AT&T, Inc. (AT&T Intellectual Property)

- Verizon Communications, Inc.

- NTT Data Corporation

- Comcast Corporation

- Consolidated Communications Holdings, Inc.

- Colt Technology Services Group Limited

- Windstream Holdings, Inc.

- Zayo Group, LLC (EQT Partners Digital Colony)

- GTT Communications, Inc. (Mercator Partners, LLC)

- Lumen Technologies, Inc.