The growth of the Asia Pacific antacids market is attributed to the key driving factors such as the increasing launches of innovative products by market players and the rising incidence of obese population. However, the stringent regulatory norms and several challenges associated with gastrointestinal diseases hinder the market growth.

Many players operating in the Asia Pacific antacid market are developing and launching new products. The companies adopt strategies such as new products’ launches to expand their geographic presence and capacity to cater to many customers. For instance, in October 2020, Dr. Reddy's Laboratories (an Indian multinational pharmaceutical) launched an over-the-counter (OTC) generic drug - Famotidine tablets - to treat gastroesophageal reflux disease in the market.

Similarly, in May 2017, the consumer products division of Piramal Enterprises, headquartered in Mumbai, India, launched the paan-flavored (betel leaf flavor) variant of its antacid brand, Polycrol. With the pleasant taste, Polycrol offers quick relief from acidity. Furthermore, one of India's leading drug makers, Sun Pharmaceuticals Ltd launched Pepmelt (a mouth-melt granules format) in February 2016. This product is the company’s first consumer healthcare product. Additionally, in May 2017, GSK Consumer Healthcare (a leading global consumer healthcare company) launched “ENO Cooling” - driven by Fast Cooling Technology. The product quickly relieves from acidity and offers an instant cooling sensation. Therefore, the increasing launches of innovative products associated with antacids drive the growth of the Asia Pacific antacid market.

Countries in the Asia Pacific are facing challenges due to the rapidly increasing number of COVID-19 confirmed cases. The countries in the region expect the second wave of the outbreak due to the large-scale movements of people within the countries and internal travel. As a precautionary measure, the governments are imposing restrictions on human movements. The governments have preferred to continue to permit business operations and economic activities. Thus, the supply of the consumer health products such as antacids is less affected. For instance, India is among the largest hubs for pharmaceutical manufacturing. The country contributes to the majority shares of supplying generic and branded drugs across the world. The manufacturers are operating with full capacity. Thus, it is expected to maintain the gap between the demand and supply of the products in the associated markets. The outbreak has severely affected the tourism industry and imposed supply chain disruptions. Moreover, low-income countries face additional challenges due to the shortage of healthcare infrastructure. Restrictive measures have been put forth in South Korea, Malaysia, Singapore, the Philippines, and India to prevent transmission of the coronavirus that causes COVID-19.

Acidity is among the common side effects associated with the medications prescribed for COVID-19 and other chronic diseases. Thus, the demand for antacids is rising during the ongoing COVID-19 outbreak.

Based on dosage form, the Asia Pacific antacids market is segmented into tablet, liquid, and others. The tablet segment held the largest market share in 2019, whereas the liquid segment is anticipated to register the highest CAGR in the market during the forecast period.

The Asia Pacific antacids market, based on drug class, is segmented into proton pump inhibitors, H2 antagonist, and acid neutralizers. The proton pump inhibitors segment held the largest market share in 2019. Also, the same segment is anticipated to register the highest CAGR in the market during 2020-2027.

By distribution channel, the Asia Pacific antacids market is segmented into hospital pharmacy, retail pharmacy, and online pharmacy. The retail pharmacy segment held the largest market share in 2019, also the same segment is anticipated to register the highest CAGR in the market during the forecast period.

A few of the primary and secondary sources referred to while preparing the report on the Asia Pacific antacids market are National Center for Health Statistics (NCHS), the India Brand Equity Foundation (IBEF), and the Australian Self Medication Industry (ASMI).

Table of Contents

Companies Mentioned

- Bayer AG

- GlaxoSmithKline plc

- Takeda Pharmaceutical Company Limited

- Sun Pharmaceutical Industries Ltd

- Sanofi

- Boehringer Ingelheim International GmbH

- Dr. Reddy's Laboratories

- Pfizer Inc

- Reckitt Benckiser Group Plc

- Procter & Gamble

Table Information

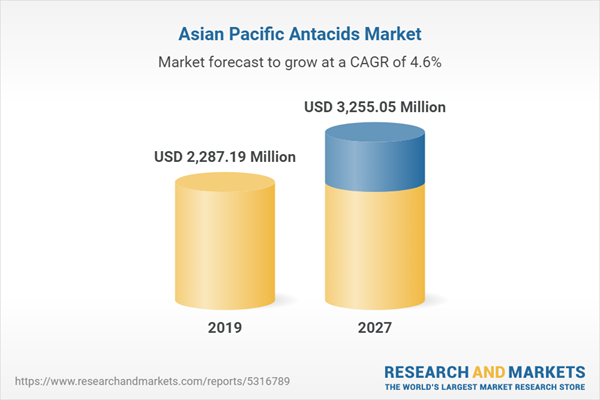

| Report Attribute | Details |

|---|---|

| No. of Pages | 150 |

| Published | April 2021 |

| Forecast Period | 2019 - 2027 |

| Estimated Market Value ( USD | $ 2287.19 Million |

| Forecasted Market Value ( USD | $ 3255.05 Million |

| Compound Annual Growth Rate | 4.6% |

| Regions Covered | Asia Pacific |

| No. of Companies Mentioned | 10 |