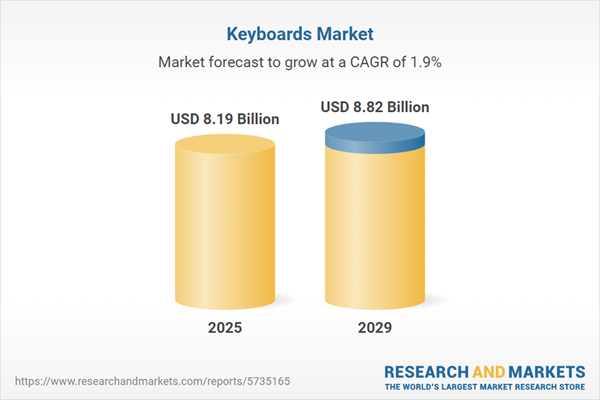

The keyboard market size is expected to see marginal growth in the next few years. It will grow to $8.82 billion in 2029 at a compound annual growth rate (CAGR) of 1.9%. The growth in the forecast period can be attributed to remote and flexible work trends, customization and personalization, rise of mechanical keyboards, integration with smart devices, focus on sustainability. Major trends in the forecast period include integration of touchpad and trackpoint, enhanced durability and build quality, smart and productivity features, sustainability and eco-friendly materials, integration with smart devices.

The increasing number of gamers utilizing keyboards for gaming is a significant factor contributing to the expansion of the keyboard market. For example, in September 2024, data released by Priori Data, a German app store data and analytics provider, indicated that the gaming community is expected to generate revenues of $282 billion by the end of 2024. As of 2024, there are approximately 3.32 billion active gamers worldwide, with Asia leading the market at 1.48 billion gamers, followed by Europe with 715 million players. Each year, the number of gamers continues to grow, and with the launch of new games, the demand for keyboards is anticipated to increase, further driving the keyboard market. Gaming keyboards are designed to accommodate quick, easy, and repetitive keystrokes, catering to gamers' needs. The full-size layout with 104 keys offers a wide range of input options, allowing players to map game functions across these easily accessible keys, which provides flexibility in controlling their gaming experience. Additionally, keyboards offer the functionality of macros, which are sequences of commands linked to a single input. Therefore, the growing number of gamers is expected to stimulate the growth of the keyboard market.

The keyboards market is expected to experience growth due to the rising number of information technology (IT) professionals. IT professionals play crucial roles within the IT industry, and keyboards are indispensable tools that enhance their productivity and facilitate effective communication. Keyboards serve as essential components for various IT tasks. According to the US Department of Labor Blog, overall employment in computer and information technology occupations is projected to grow at a rapid pace of 14.6% from 2021 to 2031, significantly outpacing the average growth rate for all occupations (5.3%). This projection underscores the increasing demand for IT professionals, which, in turn, contributes to the growth of the keyboards market.

A significant trend gaining momentum in the keyboards market is the continual growth of technological advances. Major companies in the keyboard industry are actively focused on introducing innovative keyboard technology solutions to meet the evolving needs of users. An illustrative example is the launch of an innovative product by 3Dconnexion, a Germany-based computer application company. In September 2023, 3Dconnexion unveiled the Keyboard Pro with Numpad. This cutting-edge keyboard is equipped with 12 programmable 3Dconnexion keys, offering stability and minimal resistance. The advanced scissor technology employed in the keyboard automatically recognizes active applications, providing users with access to app-specific commands. This feature not only saves time but also enhances user focus by streamlining interactions with various applications.

Major companies operating in the keyboards market are focusing on the development of mechanical keyboards to drive their revenues. A mechanical keyboard is a specialized type of computer keyboard that employs individual mechanical switches for each key, as opposed to the rubber dome or membrane found in traditional keyboards. An exemplary instance is the collaboration between OnePlus, a China-based consumer electronics company, and Keychron, a France-based keyboard manufacturer. In February 2023, they launched a mechanical keyboard designed for easy assembly, allowing users to customize and adjust each component, creating a personalized typing experience. The gasket-mounted design, coupled with hot-swap switches, contributes to enhancing the keyboard's overall typing experience and performance. This emphasis on technological innovation reflects a key trend in the keyboards market.

In May 2024, Higround, a US-based company specializing in gaming peripherals, teamed up with Minecraft to introduce an exclusive collection that celebrates gaming as a form of art. This collaboration showcases the creativity of Minecraft players through a range of uniquely designed peripherals, including the Summit 65, Basecamp 65, and Performance 65 keyboards. These products are adorned with designs inspired by Minecraft's iconic landscapes and characters, reflecting both the artistry of the game and Higround's dedication to quality in gaming accessories. Minecraft, developed by Mojang Studios, is a Sweden-based sandbox video game that allows players to build and explore virtual worlds constructed from blocks.

Major companies operating in the keyboards market include Apple Inc., Samsung Electronics Co. Ltd., Microsoft Corporation, Dell Technologies Inc., Lenovo Group Ltd., HP Inc., ASUSTeK Computer Inc., Logitech International SA, EpicGear, Corsair Components Inc., Razer Inc., Fellowes Brands LLC, Key Tronic Corporation, Riitek Corp., Targus Group International Inc., Rapoo Corporation, SteelSeries ApS, Filco Co. Ltd., Topre Corporation, Kinesis Corporation, Matias Corporation, Datadesk Technologies Inc., Fentek Industries Inc., WASD Keyboards, Azio Corporation, Huizhou Greetech Electronics Co. Ltd. - Greetech, Ducky Channel International Co. Ltd., Cooler Master Technology Co. Ltd., Das Keyboard Inc., HyperX, Mistel Keyboard, Nixeus Technology Inc., Wooting technologies.

The North America was the largest region in the keyboard market in 2024. North America is expected to be the fastest-growing region in the global keyboard market analysis report during the forecast period. The regions covered in the keyboards market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the keyboards market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

A keyboard is an input device that uses a set of keys or buttons to send data to a computer or other devices. It is primarily used for typing text, entering commands, and controlling the computer's functions.

Primary types of keyboards include the basic QWERTY keyboard, wired and wireless variants, ergonomic, vertical, compact, adjustable, split, mechanical keyboards, and others. The QWERTY keyboard is the standard English typewriter and computer keyboard. These keyboards are distributed through online and offline stores and are utilized across corporate, personal, and gaming applications.

The keyboard market research report is one of a series of new reports that provides keyboard market statistics, including keyboard industry global market size, regional shares, competitors with a keyboard market share, detailed keyboard market segments, market trends and opportunities, and any further data you may need to thrive in the keyboard industry. This keyboard market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The keyboard market consists of sales of keyboards, which are computer peripheral equipment used to add input functionality to a computer. Values in this market are factory gate values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Keyboards Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on keyboards market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for keyboards? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The keyboards market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Type: Basic Keyboard (QWERTY); Wired Keyboard; Wireless Keyboard; Ergonomic Keyboard; Vertical Keyboard; Compact keyboard; Adjustable keyboard; Split Keyboard; Mechanical Keyboard2) By Application: Corporate; Personal; Gaming

3) By Distribution Channel: Online Store; Offline Store

Subsegments:

1) By Basic Keyboard (QWERTY): Standard Layout Keyboards; Membrane Keyboards2) By Wired Keyboard: USB Keyboards; PS/2 Keyboards

3) By Wireless Keyboard: Bluetooth Keyboards; RF Wireless Keyboards

4) By Ergonomic Keyboard: Contoured Keyboards; Tented Keyboards

5) By Vertical Keyboards: Vertical Ergonomic Keyboards

6) By Compact Keyboard: Tenkeyless Keyboards; Mini Keyboards

7) By Adjustable Keyboard: Height-Adjustable Keyboards; Angle-Adjustable Keyboards

8) By Split Keyboard: Split Ergonomic Keyboards

9) By Mechanical Keyboard: Switch Type Mechanical Keyboards; Gaming Mechanical Keyboards

Key Companies Mentioned: Apple Inc.; Samsung Electronics Co. Ltd.; Microsoft Corporation; Dell Technologies Inc.; Lenovo Group Ltd.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Apple Inc.

- Samsung Electronics Co. Ltd.

- Microsoft Corporation

- Dell Technologies Inc.

- Lenovo Group Ltd.

- HP Inc.

- ASUSTeK Computer Inc.

- Logitech International SA

- EpicGear

- Corsair Components Inc.

- Razer Inc.

- Fellowes Brands LLC

- Key Tronic Corporation

- Riitek Corp.

- Targus Group International Inc.

- Rapoo Corporation

- SteelSeries ApS

- Filco Co. Ltd.

- Topre Corporation

- Kinesis Corporation

- Matias Corporation

- Datadesk Technologies Inc.

- Fentek Industries Inc.

- WASD Keyboards

- Azio Corporation

- Huizhou Greetech Electronics Co. Ltd. - Greetech

- Ducky Channel International Co. Ltd.

- Cooler Master Technology Co. Ltd.

- Das Keyboard Inc.

- HyperX

- Mistel Keyboard

- Nixeus Technology Inc.

- Wooting technologies

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 175 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 8.19 Billion |

| Forecasted Market Value ( USD | $ 8.82 Billion |

| Compound Annual Growth Rate | 1.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 33 |