India has emerged as a manufacturing hub. The 'Make in India' campaign places India on the world map as a manufacturing centre and gives global recognition to the Indian economy. India's manufacturing sector has the potential to cross US$ 1 trillion by 2025; also, according to the Indian Brand Equity Foundation, India is projected to rank among the top three growing economies and manufacturing destinations in the world. India's astonishing growth would drive the deployment of thermal insulation in heavy industry, oil & gas industry, and power generation industry. Further, the government of India is focused on enhancing the country's electrification rate coupled with technological advancements, which is also likely to increase the demand of thermal insulation during the forecast period. Moreover, the thermal insulation is used for high efficiency in the varying temperature of the industries. Further, rise in number of pharmaceutical industries in India is posing significant business opportunities for the thermal insulation market players to increase their respective customer base and expand their presence in the country. These factors are expected to propel the growth of the thermal insulation market during the forecast period. Due to the COVID-19 outbreak, since the first quarter of 2020, India imposed lockdown restrictions to control the spread of novel coronavirus that causes COVID-19. Such restrictions restricted the movement of materials and people, and the disrupted the supply chain in the thermal insulation industry. Moreover, amid the COVID-19 outbreak, new construction activities in the country are restricted due to lockdown. Therefore, there is a decline in the use of insulation material. Insulation in old buildings, as per new local government rules and regulations, is also on hold owing to the lack of material and labor. According to Credit Rating Information Services of India Limited (CRISIL), the growth of Indian construction industry is declined by 12–16% in the current fiscal year because of the COVID-19 outbreak. According to the same agency, major players in the construction sector are expected to witness a 13 to 17% drop in revenue in fiscal year 2021 as there is decline in the construction activities.

The India thermal insulation market is segmented on the basis of material type and industry vertical. Based on material type, the market is segmented into fiber glass, plastic foam, stone wool, calcium silicate, cellular glass, and others. The stone wool segment dominated the market in 2020. In terms of industry vertical, the India thermal insulation market is segmented into oil and gas, chemical, aerospace and defense, automotive, pharmaceutical, and others. The chemical segment is a crucial industry for thermal insulations market.

The use of Polyurethane (PU) foam is an effective and advanced method for the thermal insulation of buildings. It is applied on the building by spraying, to reach even in the smallest gaps. It offers the damage-resistant and permanent insulation for house to improve living comfort and lower heating bills of building. The most significant advantages and disadvantages of other insulation methods substantiate that the PU foam is one of the most-effective methods to retain heat inside a building. The PU foam insulation is described by a high efficiency and short application time. The government legislation coupled with rising awareness about the advantages of thermal insulation is boosting the demand for insulation products. A few key players operating in the India thermal insulation market are Armacell India Pvt. Ltd., BASF SE, Imerys, Lloyd Insulations (India) Limited, Minwool Rock Fibres Limited, Neo Thermal Insulation (India) Pvt. Ltd., Owens Corning, Saint-Gobain, Supreme Petrochem Ltd, and Thermocareindia.

The overall India thermal insulation market size has been derived using both primary and secondary sources. To begin the research process, exhaustive secondary research has been conducted using internal and external sources to obtain qualitative and quantitative information related to the market. The process also serves the purpose of obtaining an overview and forecast for the India thermal insulation market with regard to all the segments. Also, primary interviews were conducted with industry participants and commentators to validate data as well as to gain more analytical insights into the topic. The participants of this process include industry experts such as VPs, business development managers, market intelligence managers, and national sales managers, along with external consultants such as valuation experts, research analysts, and key opinion leaders, specializing in the India thermal insulation market.

Reasons to Buy

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players and segments in the India thermal insulation market.

- Highlights key business priorities in order to assist companies to realign their business strategies.

- The key findings and recommendations highlight crucial progressive industry trends in the India thermal insulation market, thereby allowing players across the value chain to develop effective long-term strategies.

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets.

- Scrutinize in-depth India market trends and outlook coupled with the factors driving the market, as well as those hindering it.

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing and distribution

Table of Contents

1. Introduction1.1 Study Scope

1.2 Research Report Guidance

1.3 Market Segmentation

2. Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. India Thermal Insulation Market Landscape

4.1 Market Overview

4.2 PEST Analysis

4.2.1 India - PEST Analysis

4.3 Ecosystem Analysis

4.4 Expert Opinion

4.5 Premium Insights

4.5.1 Temperature Limits and Applications of Commonly used Insulation Materials

4.5.2 Insights on Perlite Insulation

4.5.3 Import and Export Statistics (Calcium Silicate and Perlite Based Insulation)

4.5.3.1 Import and Export Statistics of Calcium Silicate

4.5.3.1.1 Export Statistics

4.5.3.1.2 Import Statistics

4.5.3.2 Import and Export Statistics of Perlite Based Insulation

4.5.3.2.1 Import and Export Statistics of Cellulose

4.5.3.2.1.1 Export Statistics

4.5.3.2.1.2 Import Stats

4.5.3.2.2 Import and Export Stats of Aerogel

4.5.3.2.2.1 Export Stats

4.5.3.2.2.2 Import Stats

5. India Thermal Insulation Market - Key Market Dynamics

5.1 Market Drivers

5.1.1 Development of Green Buildings

5.1.2 Growing Number of Building Energy Codes

5.2 Market Restraints

5.2.1 Limited Penetration Among SMEs and Price Sensitivity Market

5.3 Opportunity

5.3.1 Rising Infrastructural Spending in India

5.4 Trends

5.4.1 Growing Adoption of Polyurethane Foam Insulation

5.5 Impact Analysis of Drivers and Restraints

6. Thermal Insulation - India Market Analysis

6.1 India Thermal Insulation Market Overview

6.2 India Thermal Insulation Market - Revenue, and Forecast to 2028 (INR Crore)

6.3 Market Positioning - India Market Players Ranking

7. India Thermal Insulation Market Analysis - By Material Type

7.1 Overview

7.2 India Thermal Insulation Market, By Material Type (2020 and 2028)

7.3 Fiber Glass

7.3.1 Overview

7.3.2 Fiber Glass: India Thermal Insulation Market - Revenue, and Forecast to 2028 (INR Crore)

7.4 Plastic Foam

7.4.1 Overview

7.4.2 Plastic Foam: India Thermal Insulation Market - Revenue, and Forecast to 2028 (INR Crore)

7.5 Stone Wool

7.5.1 Overview

7.5.2 Stone Wool: India Thermal Insulation Market - Revenue, and Forecast to 2028 (INR Crore)

7.6 Calcium Silicate

7.6.1 Overview

7.6.2 Calcium Silicate: India Thermal Insulation Market - Revenue, and Forecast to 2028 (INR Crore)

7.7 Cellular Glass

7.7.1 Overview

7.7.2 Cellular Glass: India Thermal Insulation Market - Revenue, and Forecast to 2028 (INR Crore)

7.8 Others

7.8.1 Overview

7.8.2 Others: India Thermal Insulation Market - Revenue, and Forecast to 2028 (INR Crore)

8. India Thermal Insulation Market Analysis - By Industry Vertical

8.1 Overview

8.2 India Thermal Insulation Market, By Industry Vertical (2020 and 2028)

8.3 Oil and Gas

8.3.1 Overview

8.3.2 Oil and Gas: India Thermal Insulation Market - Revenue, and Forecast to 2028 (INR Crore)

8.4 Chemical

8.4.1 Overview

8.4.2 Chemical: India Thermal Insulation Market - Revenue, and Forecast to 2028 (INR Crore)

8.5 Aerospace and Defense

8.5.1 Overview

8.5.2 Aerospace and Defense: India Thermal Insulation Market - Revenue, and Forecast to 2028 (INR Crore)

8.6 Automotive

8.6.1 Overview

8.6.2 Automotive: India Thermal Insulation Market - Revenue, and Forecast to 2028 (INR Crore)

8.7 Pharmaceutical

8.7.1 Overview

8.7.2 Pharmaceutical: India Thermal Insulation Market - Revenue, and Forecast to 2028 (INR Crore)

8.8 Others

8.8.1 Overview

8.8.2 Others: India Thermal Insulation Market - Revenue, and Forecast to 2028 (INR Crore)

9. India Thermal Insulation Market- COVID-19 Impact Analysis

9.1 Overview

10. Industry Landscape

10.1 Market Initiative

10.2 Merger and Acquisition

10.3 New Development

11. Company Profiles

11.1 Neo Thermal Insulation (India) Pvt. Ltd.

11.1.1 Key Facts

11.1.2 Business Description

11.1.3 Products and Services

11.1.4 Financial Overview

11.1.5 SWOT Analysis

11.1.6 Key Developments

11.2 Owens Corning

11.2.1 Key Facts

11.2.2 Business Description

11.2.3 Products and Services

11.2.4 Financial Overview

11.2.5 SWOT Analysis

11.2.6 Key Developments

11.3 Supreme Petrochem Ltd

11.3.1 Key Facts

11.3.2 Business Description

11.3.3 Products and Services

11.3.4 Financial Overview

11.3.5 SWOT Analysis

11.3.6 Key Developments

11.4 Thermocareindia

11.4.1 Key Facts

11.4.2 Business Description

11.4.3 Products and Services

11.4.4 Financial Overview

11.4.5 SWOT Analysis

11.4.6 Key Developments

11.5 SAINT GOBAIN S.A.

11.5.1 Key Facts

11.5.2 Business Description

11.5.3 Products and Services

11.5.4 Financial Overview

11.5.5 SWOT Analysis

11.5.6 Key Developments

11.6 Armacell India Pvt. Ltd.

11.6.1 Key Facts

11.6.2 Business Description

11.6.3 Products and Services

11.6.4 Financial Overview

11.6.5 SWOT Analysis

11.6.6 Key Developments

11.7 BASF SE

11.7.1 Key Facts

11.7.2 Business Description

11.7.3 Products and Services

11.7.4 Financial Overview

11.7.5 SWOT Analysis

11.7.6 Key Developments

11.8 Imerys S.A.

11.8.1 Key Facts

11.8.2 Business Description

11.8.3 Products and Services

11.8.4 Financial Overview

11.8.5 SWOT Analysis

11.8.6 Key Developments

11.9 Lloyd Insulations (India) Limited

11.9.1 Key Facts

11.9.2 Business Description

11.9.3 Products and Services

11.9.4 Financial Overview

11.9.5 SWOT Analysis

11.9.6 Key Developments

11.10 Minwool Rock Fibres Limited

11.10.1 Key Facts

11.10.2 Business Description

11.10.3 Products and Services

11.10.4 Financial Overview

11.10.5 SWOT Analysis

11.10.6 Key Developments

11.11 Rockwool India Pvt. Ltd.

11.11.1 Key Facts

11.11.2 Business Description

11.11.3 Products and Services

11.11.4 Financial Overview

11.11.5 SWOT Analysis

11.11.6 Key Developments

12. Appendix

12.1 About the Publisher

12.2 Word Index

List of Tables

Table 1. India Thermal Insulation Market - Revenue, and Forecast to 2028 (INR Crore)

Table 2. List of Abbreviation

List of Figures

Figure 1. India Thermal Insulation Market Segmentation

Figure 2. India Thermal Insulation Market Overview

Figure 3. Stone Wool Material Type to Dominate the India Thermal Insulation Market

Figure 4. Chemical Industry Vertical to Dominate the India Thermal Insulation Market

Figure 5. India - PEST Analysis

Figure 6. India Thermal Insulation Market - Ecosystem Analysis

Figure 7. Expert Opinion

Figure 8. World Production of Perlite (In 000, Tonnes)

Figure 9. World Reserves of Perlite (In 000, Tonnes)

Figure 10. Total Value of Imports by Destination Port (%)- Year 2016

Figure 11. India thermal insulation market Impact Analysis of Drivers and Restraints

Figure 12. India: Thermal Insulation Market - Revenue and Forecast to 2028 (INR Crore)

Figure 13. India Thermal Insulation Market Revenue Share, by Material Type (2020 and 2028)

Figure 14. Fiber Glass: India Thermal Insulation Market - Revenue, and Forecast to 2028 (INR Crore)

Figure 15. Plastic Foam: India Thermal Insulation Market - Revenue, and Forecast to 2028 (INR Crore)

Figure 16. Stone Wool: India Thermal Insulation Market - Revenue, and Forecast to 2028 (INR Crore)

Figure 17. Calcium Silicate: India Thermal Insulation Market - Revenue, and Forecast to 2028 (INR Crore)

Figure 18. Cellular Glass: India Thermal Insulation Market - Revenue, and Forecast to 2028 (INR Crore)

Figure 19. Others: India Thermal Insulation Market - Revenue, and Forecast to 2028 (INR Crore)

Figure 20. India Thermal Insulation Market Revenue Share, by Industry Vertical (2020 and 2028)

Figure 21. Oil and Gas: India Thermal Insulation Market - Revenue, and Forecast to 2028 (INR Crore)

Figure 22. Chemical: India Thermal Insulation Market - Revenue, and Forecast to 2028 (INR Crore)

Figure 23. Aerospace and Defense: India Thermal Insulation Market - Revenue, and Forecast to 2028 (INR Crore)

Figure 24. Automotive: India Thermal Insulation Market - Revenue, and Forecast to 2028 (INR Crore)

Figure 25. Pharmaceutical: India Thermal Insulation Market - Revenue, and Forecast to 2028 (INR Crore)

Figure 26. Others: India Thermal Insulation Market - Revenue, and Forecast to 2028 (INR Crore)

Figure 27. Impact of COVID-19 Pandemic on India Thermal Insulation Market

Companies Mentioned

- Armacell India Pvt. Ltd.

- BASF SE

- Imerys

- Lloyd Insulations (India) Limited

- Minwool Rock Fibres Limited

- Neo Thermal Insulation (India) Pvt. Ltd.

- Owens Corning

- Saint-Gobain

- Supreme Petrochem Ltd

- Thermocareindia

- ROCKWOOL INDIA PVT. LTD.

Table Information

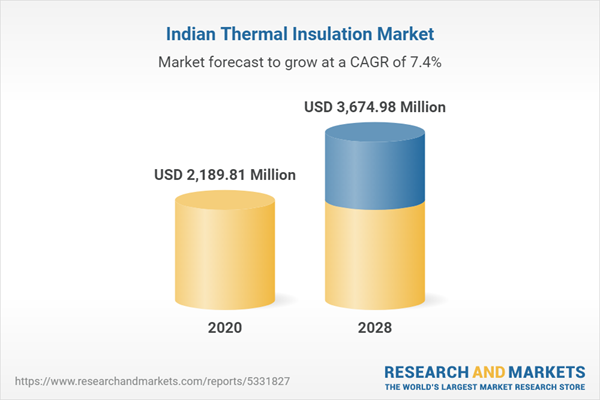

| Report Attribute | Details |

|---|---|

| Published | April 2021 |

| Forecast Period | 2020 - 2028 |

| Estimated Market Value ( USD | $ 2189.81 Million |

| Forecasted Market Value ( USD | $ 3674.98 Million |

| Compound Annual Growth Rate | 7.4% |

| Regions Covered | India |

| No. of Companies Mentioned | 11 |