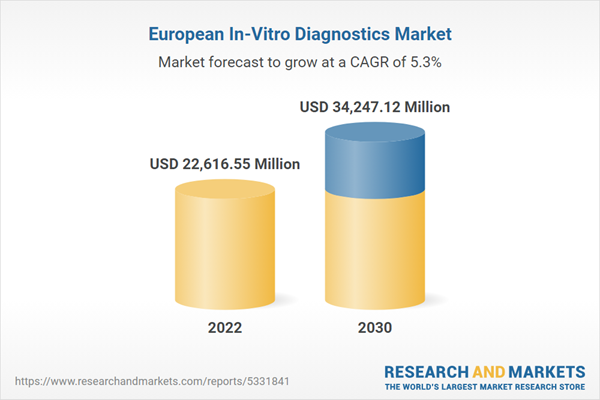

The Europe in-vitro diagnostics market is expected to grow from US$ 22,616.55 million in 2022 to US$ 34,247.12 million by 2030. It is estimated to grow at a CAGR of 5.3% from 2022 to 2030.

In June 2021, the British In Vitro Diagnostics Association (BIVDA) launched “The Digital Revolution” strategy to encourage breakthroughs in in-vitro diagnostics during the COVID-19 pandemic. In July 2022, BioGX announced the launch of a CE-marked, three-gene point-of-care (POC) multiplex COVID-19 test on its Pixel platform. Thus, the COVID-19 pandemic has benefitted the in-vitro diagnostics market due to the rising demand for point-of-care (POC) diagnostics and laboratory testing procedures.

The IVD market in Germany experienced an enormous rise in demand amid the COVID-19 pandemic. Comprehensive testing was a central component of the German government's health policy strategy to combat the pandemic and protect the population from infection. Companies based in Germany are proven innovators in developing molecular tests as well as high-tech instruments and consumables that are used in the bioanalysis of molecular information. Developments of in-vitro diagnostics through innovative product launches by companies with automation systems in labs boost the in-vitro diagnostics market in Germany.

Europ

Based on product & services, the Europe in-vitro diagnostics market is segmented into reagents & kits, instruments, and software & services. The reagents & kits segment held the largest share of the Europe in-vitro diagnostics market in 2022.

Based on technology, the Europe in-vitro diagnostics market is segmented into immunoassay/ immunochemistry, clinical chemistry, molecular diagnostics, microbiology, blood glucose self-monitoring, coagulation & hemostasis, hematology, urinalysis, and others. The immunoassay/ immunochemistry segment held the largest share of the Europe in-vitro diagnostics market in 2022.

Based on application, the Europe in-vitro diagnostics market is segmented into infectious diseases, diabetes, oncology, cardiology, autoimmune diseases, nephrology, and others. The infectious diseases segment held the largest share of the Europe in-vitro diagnostics market in 2022.

Based on end user, the Europe in-vitro diagnostics market is segmented into hospitals, laboratories, homecare, and others. The hospitals segment held the largest share of the Europe in-vitro diagnostics market in 2022.

Based on country, the Europe in-vitro diagnostics market is segmented int o Germany, France, UK, Italy, Spain, and the Rest of Europe. The Rest of Europe dominated the Europe in-vitro diagnostics market in 2022.

Abbott Laboratories, Becton Dickinson and Co, bioMerieux SA, Bio-Rad Laboratories Inc, Danaher Corp, F. Hoffmann-La Roche Ltd, Qiagen NV, Siemens AG, Sysmex Corp, and Thermo Fisher Scientific Inc are some of the leading companies operating in the Europe in-vitro diagnostics market.

Reasons to Buy

Rise in the Demand for In-Vitro Diagnostics During COVID-19 Pandemic Fuels Europe In-Vitro Diagnostics Market

IVDs that are used in the diagnosis of infectious diseases include immunoassays, and molecular assays. Diagnostics companies also focus on making rapid advancements in their offerings to manage COVID-19. Further, regulatory authorities introduced temporary amendments or modifications to their standards, which favored the launches of new IVDs during the pandemic. The demand for molecular diagnostics and immunoassays surged due to these government initiatives. Moreover, many companies expanded their product lines for IVD manufacturing.In June 2021, the British In Vitro Diagnostics Association (BIVDA) launched “The Digital Revolution” strategy to encourage breakthroughs in in-vitro diagnostics during the COVID-19 pandemic. In July 2022, BioGX announced the launch of a CE-marked, three-gene point-of-care (POC) multiplex COVID-19 test on its Pixel platform. Thus, the COVID-19 pandemic has benefitted the in-vitro diagnostics market due to the rising demand for point-of-care (POC) diagnostics and laboratory testing procedures.

Europe In-Vitro Diagnostics Market Overview

The Europe in-vitro diagnostics market has been segmented into Germany, France, UK, Italy, Spain, and the Rest of Europe. The market growth in this region is attributed to the rising awareness of the disease diagnosis, increasing ageing population, and technological advancements in in-vitro diagnostics thereby dominating the overall market growth. Germany accounts for the largest share of the in-vitro diagnostic (IVD) market in Europe. The German IVD industry is known for its innovation capabilities. Its IVD industry benefits from developments in molecular biology, miniaturization, and automation. The German "Industrie 4.0" project is undergoing digitalization, particularly in ICD, with "Lab 4.0" developed for data handling, cloud-based IT solutions, lab and production automation processes, and digital networking.The IVD market in Germany experienced an enormous rise in demand amid the COVID-19 pandemic. Comprehensive testing was a central component of the German government's health policy strategy to combat the pandemic and protect the population from infection. Companies based in Germany are proven innovators in developing molecular tests as well as high-tech instruments and consumables that are used in the bioanalysis of molecular information. Developments of in-vitro diagnostics through innovative product launches by companies with automation systems in labs boost the in-vitro diagnostics market in Germany.

Europ

e In-Vitro Diagnostics Market Revenue and Forecast to 2030 (US$ Million)

Europe In-Vitro Diagnostics Market Segmentation

The Europe in-vitro diagnostics market is segmented into product & services, technology, application, end user, and country.Based on product & services, the Europe in-vitro diagnostics market is segmented into reagents & kits, instruments, and software & services. The reagents & kits segment held the largest share of the Europe in-vitro diagnostics market in 2022.

Based on technology, the Europe in-vitro diagnostics market is segmented into immunoassay/ immunochemistry, clinical chemistry, molecular diagnostics, microbiology, blood glucose self-monitoring, coagulation & hemostasis, hematology, urinalysis, and others. The immunoassay/ immunochemistry segment held the largest share of the Europe in-vitro diagnostics market in 2022.

Based on application, the Europe in-vitro diagnostics market is segmented into infectious diseases, diabetes, oncology, cardiology, autoimmune diseases, nephrology, and others. The infectious diseases segment held the largest share of the Europe in-vitro diagnostics market in 2022.

Based on end user, the Europe in-vitro diagnostics market is segmented into hospitals, laboratories, homecare, and others. The hospitals segment held the largest share of the Europe in-vitro diagnostics market in 2022.

Based on country, the Europe in-vitro diagnostics market is segmented int o Germany, France, UK, Italy, Spain, and the Rest of Europe. The Rest of Europe dominated the Europe in-vitro diagnostics market in 2022.

Abbott Laboratories, Becton Dickinson and Co, bioMerieux SA, Bio-Rad Laboratories Inc, Danaher Corp, F. Hoffmann-La Roche Ltd, Qiagen NV, Siemens AG, Sysmex Corp, and Thermo Fisher Scientific Inc are some of the leading companies operating in the Europe in-vitro diagnostics market.

Reasons to Buy

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players, and segments in the Europe In-Vitro Diagnostics Market.

- Highlights key business priorities in order to assist companies to realign their business strategies.

- The key findings and recommendations highlight crucial progressive industry trends in the Europe In-Vitro Diagnostics Market, thereby allowing players across the value chain to develop effective long-term strategies.

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets.

- Scrutinize in-depth Europe market trends and outlook coupled with the factors driving the market, as well as those hindering it.

- Enhance the decision-making process by understanding the strategies that underpin security interest with respect to client products, segmentation, pricing and distribution.

Table of Contents

1. Introduction

2. Executive Summary

3. Research Methodology

4. Europe In-Vitro Diagnostics Market - Key Industry Dynamics

5. In-Vitro Diagnostics Market - Europe Market Analysis

6. Europe In-Vitro Diagnostics Market - Revenue and Forecast to 2030 - by Product and Services

7. Europe In-Vitro Diagnostics Market - Revenue and Forecast to 2030 - by Technology

8. Europe In-Vitro Diagnostics Market - Revenue and Forecast to 2030 - by Application

9. Europe In-Vitro Diagnostics Market - Revenue and Forecast to 2030 - by End User

10. Europe In-Vitro Diagnostics Market - Revenue and Forecast to 2030 - Country Analysis

11. Industry Landscape

12. Company Profiles

13. Appendix

List of Tables

List of Figures

Companies Mentioned

- Abbott Laboratories

- F. Hoffmann-La Roche Ltd

- Danaher Corp

- Siemens AG

- Sysmex Corp

- Thermo Fisher Scientific Inc

- Becton Dickinson and Co

- bioMerieux SA

- Bio-Rad Laboratories Inc

- Qiagen NV

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 124 |

| Published | January 2024 |

| Forecast Period | 2022 - 2030 |

| Estimated Market Value ( USD | $ 22616.55 Million |

| Forecasted Market Value ( USD | $ 34247.12 Million |

| Compound Annual Growth Rate | 5.3% |

| Regions Covered | Europe |

| No. of Companies Mentioned | 10 |