With the advent of Covid-19, Hardwood flooring was the segment with the largest percentage rise in market sales value of US floor covering with LVT flooring leading the market sales volume. Import of floor covering in the United States observed a sharp increase during the pandemic with a steady decline in the export value of US floor covering. Luxury Vinyl tiles and Rigid floor covering were the largest import in the region with inflation and Shortage of labor supply impacting the sales of floor covering during the pandemic.

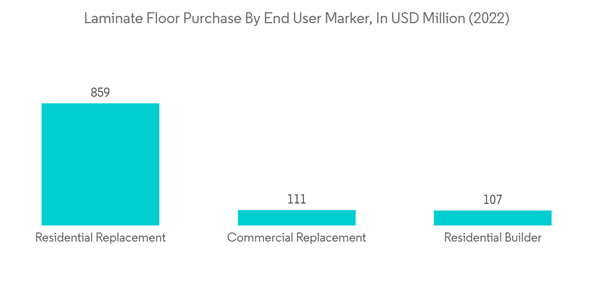

Residential Builder, Manufacturing Housing, Commercial Construction, and Transportation equipment are among the segment having a major share in floor covering of the region with residential replacement having the largest share of laminated sales existing at (70%). As the real estate sector is recovering from covid impact commercial Wood, Carpets & Rugs and Commercial flooring will be leading the market.

North America Laminate Flooring Market Trends

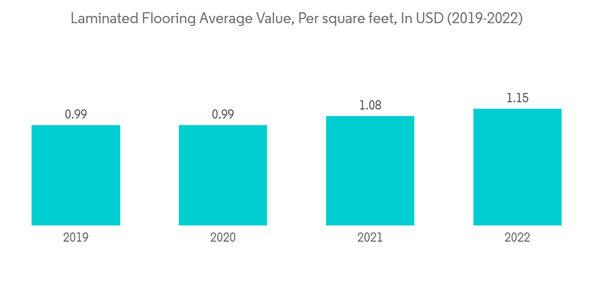

Increase In Use Of Laminated Floor Covering

In terms of the purchase of laminated flooring by the end-use market, residential replacement is having the largest share of demand at USD 859 Million (79.8%) followed by commercial replacement and residential builder. Shortage in the supply of laminated floor covering with an increased container cost and delay is deterring the suppliers from accessing the whole market, which is expected to rise in the future as supply chain disruptions will ease.Laminated floor covering faces competition from luxury Vinyl tyles in terms of market revenue. Over a period consumers and the flooring industry observed that LVT is a plastic product while laminate flooring is generally made from real wood fibers. This is leading to a shift away from LVT creating a positive externality for sales of laminated floor covering.

Rising Construction increasing demand for Laminate Flooring

The commercial application dominates the laminate flooring market in North America. Laminate flooring is extensively used in the commercial sector, as it is cost-effective, requires low maintenance, and can withstand high traffic. On account of the high demand for laminate flooring from five-star hotels, showrooms, retail outlets, and corporate offices, the demand for laminate flooring in the commercial sector has increased significantly.Post Covid sales value and volume of laminated floor covering observed an increase which was declining for two years prior to Covid with the largest sales done through floor covering stores and contractors. Healthcare, senior living, and education are among the segments observing a sharp growth in engineered commercial flooring which was able to maintain strong deliveries and quality. Combined with this mergers and acquisitions of firms during the pandemic allowed the manufacturers to grow their commercial business

North America Laminate Flooring Industry Overview

The report covers major international players operating in the North American laminate flooring market. In terms of market share, brand names have a very small influence on the sales of laminated floors and are majorly affected by salespersons. However, with technological advancement and product innovation, mid-size to smaller companies are increasing their market presence by securing new contracts and tapping new markets. Among the players existing in North America, Laminated flooring are Mohawk, Shaw, Mannington mills, Formica, Pego, and others.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Armstrong Flooring Inc.

- Shaw Industries

- Tarkett

- Mohawk Industries

- Mannington Mills

- Formica Group

- Beaulieu

- Richmond

- Floorcraft

- Pergo